Market Overview

The Qatar heavy lift helicopter market is valued at USD ~ billion based on recent assessments. This market is largely driven by increasing demand from sectors such as defense, construction, oil, and gas, where heavy lift helicopters are crucial for transporting large equipment and personnel. The government’s investments in infrastructure and defense, along with the rising need for offshore and remote area operations, have accelerated the growth in this sector. Additionally, technological advancements, such as enhanced payload capacities and the development of electric hybrid models, further contribute to the market’s expansion.

The market is dominated by countries such as Qatar and the UAE due to their large-scale defense projects and thriving construction industries. These countries, with their strategic location in the Middle East and substantial investments in energy, defense, and infrastructure, are the major drivers of demand for heavy lift helicopters. The Middle East’s focus on modernization of its military and infrastructure, alongside government-backed defense spending, makes these nations key players in the market.

Market Segmentation

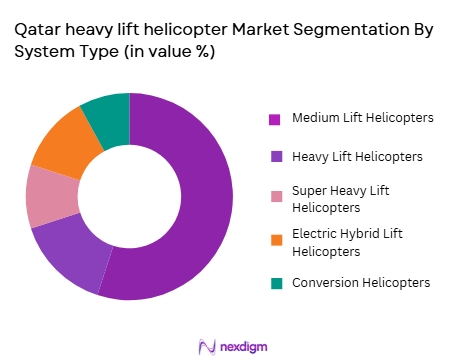

By System Type:

The Qatar heavy lift helicopter market is segmented by system type into medium lift helicopters, heavy lift helicopters, super heavy lift helicopters, electric hybrid lift helicopters, and conversion helicopters. The heavy lift helicopter segment is currently dominating the market share. This is primarily due to the robust demand from the defense sector and large-scale construction projects that require these helicopters for transporting oversized cargo, heavy machinery, and critical infrastructure components. Additionally, this segment is benefitting from technological advancements, such as improved fuel efficiency and payload capacity, which enhance the performance of these helicopters in challenging environments.

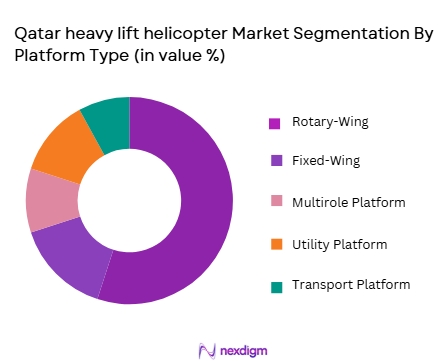

By Platform Type:

The market is segmented by platform type into rotary-wing, fixed-wing, multirole platform, utility platform, and transport platform. Among these, rotary-wing platforms dominate the market due to their versatility in various applications such as military operations, offshore oil rig supply, and disaster relief efforts. Rotary-wing helicopters can perform vertical take-offs and landings, allowing them to access difficult terrains, which is particularly important in the Middle Eastern region with its vast desert landscapes and offshore operations. This platform type is essential for lifting and transporting heavy equipment in a variety of environments, further solidifying its market dominance.

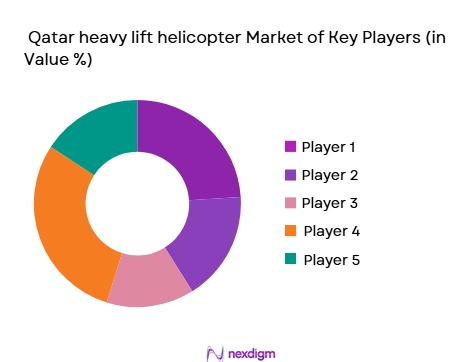

Competitive Landscape

The Qatar heavy lift helicopter market is dominated by a few major players, including both global giants and specialized regional manufacturers. This consolidation reflects the significant technological advancements required to manufacture these sophisticated machines, as well as the high capital and regulatory barriers to entry. Companies such as Airbus Helicopters, Sikorsky Aircraft, and Boeing are leaders in the market, known for their strong brand presence, extensive service networks, and commitment to innovation in helicopter design.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Airbus Helicopters | 1965 | Marignane, France | ~ | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | Stratford, USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

| MD Helicopters | 1966 | Mesa, USA | ~ | ~ | ~ | ~ | ~ |

Qatar heavy lift helicopter Market Analysis

Growth Drivers

Government Investments in Infrastructure and Defense

Government-backed initiatives in Qatar, along with regional defense spending, are driving the demand for heavy lift helicopters. Investments in defense modernization and large-scale infrastructure projects, including construction, oil exploration, and emergency services, create a continuous need for specialized helicopters capable of lifting heavy equipment and personnel to challenging locations.

Technological Advancements in Helicopter Systems

Advancements in helicopter technology, such as hybrid-electric propulsion systems, lighter composite materials, and enhanced lift capacities, are contributing to the growth of the heavy lift helicopter market. These innovations improve operational efficiency and reduce costs, making heavy lift helicopters more attractive for a wider range of industries, including oil and gas, defense, and construction.

Market Challenges

High Operational and Maintenance Costs

The cost of procuring and maintaining heavy lift helicopters is a significant challenge. These helicopters require specialized components, highly skilled personnel, and regular servicing, all of which contribute to high operating costs. This limits their accessibility for smaller companies and increases the financial burden on organizations that rely on these helicopters for operations.

Regulatory and Certification Barriers

Heavy lift helicopters are subject to stringent regulatory and certification requirements, both for operation and safety standards. These regulations, set by aviation authorities like the Qatar Civil Aviation Authority, can delay the procurement process and complicate operations, especially in international markets where different certification requirements may apply.

Opportunities

Expanding Oil and Gas Exploration in Remote Areas

As demand for oil and gas continues to grow, especially in offshore and remote areas of the Middle East, heavy lift helicopters are essential for transporting equipment and personnel to these locations. The expansion of oil exploration projects presents a significant opportunity for the heavy lift helicopter market to grow, especially in regions like Qatar and its neighboring countries.

Rise in Helicopter Leasing Models

Leasing options are becoming more popular as companies seek to lower capital expenditures. Helicopter leasing allows operators to access the latest models and technologies without the need for outright purchases. This shift is providing new opportunities for the heavy lift helicopter market, allowing smaller companies to access these critical resources for their operations without the upfront financial burden.

Future Outlook

Over the next five years, the Qatar heavy lift helicopter market is expected to experience steady growth, driven by government-backed investments in defense, infrastructure, and offshore oil exploration. The market will also benefit from technological advancements such as hybrid-electric propulsion systems, which could lower operational costs. Increasing demand from sectors like defense and construction will further fuel this growth, while the rise of leasing models as an alternative to full ownership will make these helicopters more accessible.

Major Players

- Bell Helicopter

- Sikorsky Aircraft

- Airbus Helicopters

- Lockheed Martin

- Boeing

- Leonardo

- Russian Helicopters

- MD Helicopters

- Guimbal Helicopters

- Kawasaki Heavy Industries

- China National Aviation Corporation

- Enstrom Helicopter Corporation

- NH Industries

- Aérospatiale

- Kawasaki Heavy Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Helicopter service providers

- Defense contractors

- Construction and engineering firms

- Offshore oil and gas companies

- Helicopter leasing companies

- Aviation training institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key factors influencing the Qatar heavy lift helicopter market, including technological advancements, regional defense needs, and infrastructure development. Data is gathered from reputable secondary sources such as industry reports and databases, complemented by expert interviews to define critical market variables.

Step 2: Market Analysis and Construction

This step involves analyzing historical market data and evaluating the current demand for various types of heavy lift helicopters in Qatar. This includes the assessment of market penetration, regional growth trends, and emerging demands in key sectors such as defense and construction.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are refined and validated through in-depth consultations with industry experts. This step includes interviews with helicopter manufacturers, operators, and stakeholders in defense and construction sectors. Expert opinions provide valuable insights to confirm the accuracy of the gathered data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all collected data and insights to create a comprehensive analysis of the Qatar heavy lift helicopter market. This includes verifying data through direct engagement with key market players to ensure the reliability of the findings and produce actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for military and defense operations in Qatar

Increasing infrastructure and construction projects requiring heavy lifting

Growing oil and gas exploration and development in the region - Market Challenges

High cost of procurement and maintenance of heavy lift helicopters

Shortage of skilled workforce for heavy lift helicopter operations

Regulatory hurdles in acquiring and certifying heavy lift helicopters - Market Opportunities

Government investments in defense and infrastructure boosting helicopter procurement

Increased use of helicopters for emergency services in remote areas

Development of electric hybrid helicopters for cost-effective and eco-friendly operations - Trends

Rising adoption of autonomous flight systems in heavy lift helicopters

Integration of advanced materials for weight reduction and increased payload capacity

Expansion of leasing models as an alternative to full ownership - Government regulations

Strict safety and operational certifications for heavy lift helicopters

Emphasis on environmental regulations to reduce emissions

Government-driven initiatives for defense procurement and heavy lift projects - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Medium lift helicopters

Heavy lift helicopters

Super heavy lift helicopters

Electric hybrid lift helicopters

Conversion helicopters - By Platform Type (In Value%)

Rotary-wing

Fixed-wing

Multirole platform

Utility platform

Transport platform - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Custom-fit

Refurbished

Upgrade and retrofitting - By EndUser Segment (In Value%)

Defense & Military

Aerospace & Aviation

Construction & Heavy Machinery

Oil & Gas

Emergency Medical Services (EMS) - By Procurement Channel (In Value%)

Direct Purchase

Government Tenders

OEM Agreements

Leasing

Aftermarket Service Providers

- Cross Comparison Parameters(Market value, Installed units, System complexity tier, Procurement channels, Regional demand)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bell Helicopter

Sikorsky Aircraft

Airbus Helicopters

Lockheed Martin

Boeing

Leonardo

Russian Helicopters

MD Helicopters

Guimbal Helicopters

Kawasaki Heavy Industries

China National Aviation Corporation

Enstrom Helicopter Corporation

NH Industries

Aérospatiale

Kawasaki Heavy Industries

- Increased demand from defense and military end-users in Qatar

- Growing commercial applications for heavy lift helicopters in construction

- Focus on helicopter fleets for offshore oil and gas operations

- Emerging use of helicopters in disaster response and EMS

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035