Market Overview

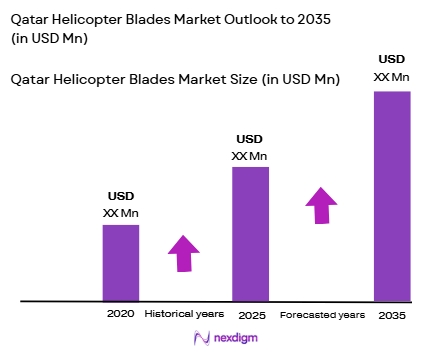

The Qatar helicopter blades market is valued at approximately USD ~million, driven by an increasing demand for helicopter services in both military and civilian sectors. The rapid expansion of defense budgets, as well as the growing civilian aviation sector, particularly for VIP transport and emergency services, are pivotal to market growth. The development of advanced materials and technology in blade design is also a crucial factor fueling market expansion. This sector’s growth is further propelled by technological advancements and the regional increase in the demand for modern rotorcraft, which require high-performance blades. The market is expected to continue expanding, driven by both local government investments and the adoption of advanced helicopter systems.

Qatar is at the forefront of the helicopter blades market, with its significant investments in defense and civil aviation. The country’s strategic location, growing military presence, and heavy reliance on helicopter transport for both defense and commercial use contribute to its dominance. The capital, Doha, is a central hub for military and civilian aviation activities, benefiting from the country’s well-developed infrastructure and high government spending on defense and tourism. Additionally, neighboring Gulf countries such as the UAE and Saudi Arabia also contribute indirectly to the demand for advanced helicopter systems and their components, including blades, due to shared geopolitical interests and aviation needs.

Market Segmentation

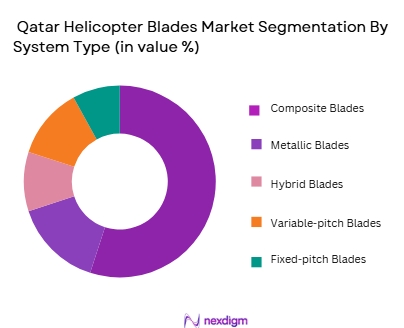

By System Type

The Qatar helicopter blades market is segmented by system type into composite blades, metallic blades, hybrid blades, variable-pitch blades, and fixed-pitch blades. Among these, composite blades have seen a significant rise in market share. This is due to their lightweight properties, which enhance fuel efficiency and performance, especially in military and high-end civilian helicopters. Composite materials like carbon fiber and fiberglass offer superior strength-to-weight ratios, making them the preferred choice for modern helicopters. These blades also have a longer lifespan and are more resistant to corrosion, which is vital in Qatar’s harsh environmental conditions.

By Platform Type

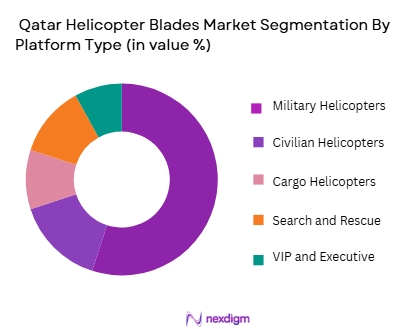

The platform type segment includes military helicopters, civilian helicopters, cargo helicopters, search and rescue helicopters, and VIP/executive helicopters. The military helicopter segment holds the largest share, driven by Qatar’s heavy investments in defense technology. The demand for advanced military rotorcraft is increasing due to regional security concerns and ongoing modernization of military fleets. The country’s commitment to strengthening its defense infrastructure has led to consistent demand for helicopter blades suited for tactical operations. Moreover, Qatar’s geographical position further solidifies the need for military helicopters, ensuring the continued growth of this segment in the market.

Competitive Landscape

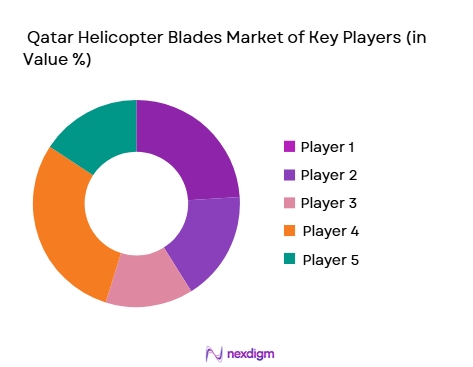

The Qatar helicopter blades market is dominated by a few major players, which include both global helicopter blade manufacturers and regional companies. These players have established strong positions in the market due to their technological capabilities and long-term relationships with the defense sector. The industry sees intense competition among key companies, with many striving to innovate in terms of material science, blade efficiency, and durability to meet the demands of the region’s harsh operating environments.

Major Players

| Company | Establishment Year | Headquarters | Products | R&D Investment | Manufacturing Capacity | Market Focus |

| Airbus Helicopters | 1997 | France | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | USA | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 2000 | Italy | ~ | ~ | ~ | ~ |

| Safran Helicopter Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Kaman Aerospace | 1945 | USA | ~ | ~ | ~ | ~ |

Qatar Helicopter Blades Market Analysis

Growth Drivers

Expansion of Offshore Oil & Gas and Utility Operations

In Qatar, the offshore energy sector is a major economic pillar, and helicopters play a crucial role in transporting personnel, conducting inspections, and supporting logistics across oil, gas, and maritime operations. This drives demand for reliable, high‑performance helicopter blades that can endure frequent use, saltwater exposure, and long‑distance flights. As Qatar continues investing in energy infrastructure and sustainability initiatives, operators will prioritize rotorcraft reliability and durability. The need to modernize existing fleets and maintain peak operational efficiency fosters recurring demand for advanced composite blades and tailored maintenance services up to 2035, supporting market growth.

Military Modernization & Government Aviation Expansion

Qatar’s government has been modernizing its defense and state aviation assets, including helicopter fleets used for border security, emergency services, and VIP transport. Advanced helicopter blades — designed with composite materials for superior strength, reduced weight, and improved aerodynamics — are critical for enhancing performance and fuel efficiency in both military and civil rotorcraft. As defense procurement cycles incorporate newer platforms and upgraded avionics, the helicopter blades sub‑market benefits from increased OEM orders and aftermarket replacements. Strategic defense partnerships and long‑term contracts further solidify this growth trend in the coming decade.

Market Challenges

High Cost and Technical Complexity of Advanced Blades

Helicopter blades, especially composite designs used in modern rotorcraft, are expensive to develop, certify, manufacture, and maintain. High‑performance materials like carbon fiber or advanced alloys require specialized facilities and expertise, which can raise costs for operators and suppliers. For Qatar, where some aviation maintenance activities are still developing domestically, reliance on imports or foreign MRO (maintenance, repair, overhaul) partners can increase lead times and costs. Ensuring quality control and certification compliance with international aviation standards (e.g., EASA/FAA) adds complexity, potentially limiting rapid fleet upgrades and local market scaling.

Limited Local Manufacturing & Skilled Workforce

Currently, Qatar’s aerospace manufacturing base is limited in comparison to larger global hubs. Producing or refurbishing rotorcraft blades requires precision engineering, specialized tooling, and a highly skilled workforce trained in composite fabrication and aerospace quality systems. The shortage of such capabilities locally means operators often depend on overseas manufacturers and service providers for blade supply and maintenance, which can introduce logistical delays, higher expenses, and vulnerability to supply chain disruptions. Building this capacity domestically will require targeted investment, training programs, and incentives to attract expertise and MRO partners.

Opportunities

Development of Local MRO & Composite Fabrication Centers

There’s a strong opportunity for Qatar to develop local maintenance, repair and overhaul (MRO) facilities focused on helicopter blade inspection, repair, and refurbishment. Establishing specialized composite fabrication centers can reduce dependence on imports, cut turnaround times, and create skilled jobs. Partnerships with established global OEMs or technical training alliances can accelerate knowledge transfer and certification readiness. Local MRO infrastructure that meets international safety standards can attract regional business from neighboring countries, positioning Qatar as a Gulf hub for rotorcraft blade services, especially for energy, defense, and EMS operators.

Adoption of Advanced Materials and Smart Monitoring

The helicopter blades market can benefit from innovation in materials science and digital health monitoring. Qatar’s focus on smart infrastructure and innovation incentives aligns with adopting lightweight composite materials that improve fatigue resistance and fuel efficiency. Embedding sensors and predictive health‑monitoring technologies in blades offers operators real‑time performance data, enabling condition‑based maintenance, reduced unscheduled downtime, and better lifecycle management. Suppliers that offer integrated solutions — combining materials, analytics, and service — can capture higher value in both civil and defense segments, fostering long‑term market resilience and technological leadership by 2035.

Future Outlook

Over the next decade, the Qatar helicopter blades market is expected to show steady growth. The expansion of both military and civilian helicopter fleets will drive the demand for advanced rotor blades, particularly those made from composite materials. Qatar’s continued investment in defense and infrastructure development will support this demand, along with the increased adoption of rotorcraft in commercial sectors such as tourism and air ambulance services. Additionally, technological innovations such as the development of quieter and more efficient helicopter blades will further propel the market.

Major Players

- Airbus Helicopters

- Bell Helicopter

- Leonardo Helicopters

- Safran Helicopter Engines

- Kaman Aerospace

- Sikorsky Aircraft

- MH Industries

- DART Aerospace

- Rotorcraft Support

- HELOS

- GE Aviation

- Honeywell Aerospace

- 13 L-3 Communications

- Helicopter Services

- Aero Industries

Key Target Audience

- Military Agencies (e.g., Qatar Armed Forces)

- Commercial Helicopter Operators

- Government Agencies (e.g., Qatar Civil Aviation Authority)

- Defense Contractors

- Aerospace Manufacturers

- Investments and Venture Capitalist Firms

- Aircraft Maintenance Providers

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that affect the Qatar helicopter blades market. This includes technological advancements, defense budgets, and the demand for civilian helicopter services. Secondary research through reputable industry reports and government publications will form the foundation for this identification.

Step 2: Market Analysis and Construction

In this phase, historical data and market reports will be analyzed to assess the overall market size and segmentation. We will also evaluate factors like technological advancements and the expansion of military and civilian aviation to construct a detailed market landscape.

Step 3: Hypothesis Validation and Expert Consultation

A series of expert interviews will be conducted with industry practitioners to validate market assumptions. These interviews will provide direct insights into market trends and the outlook for helicopter blades in Qatar, ensuring the data’s accuracy.

Step 4: Research Synthesis and Final Output

The final phase of research will synthesize all data gathered from secondary sources and expert consultations. The output will include a comprehensive analysis of the Qatar helicopter blades market, ensuring all variables and market drivers are accounted for.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for military and defense helicopters in the region

Technological advancements in helicopter blade manufacturing

Expansion of civil aviation sector and tourism in Qatar - Market Challenges

High maintenance and operational costs of helicopter blades

Lack of skilled workforce for advanced manufacturing techniques

Volatility in raw material prices for blade manufacturing - Market Opportunities

Emerging demand for lightweight composite materials in helicopter blades

Growing market for retrofit and aftermarket blade solutions

Increase in government defense budgets boosting helicopter procurements - Trends

Shift towards environmentally friendly and energy-efficient helicopter blades

Automation and robotics integration in manufacturing processes

Custom blade solutions to meet specific helicopter requirements - Government regulations

Strict aviation safety regulations in the Middle East

Certification standards for new composite materials

Compliance with environmental regulations for noise reduction - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Composite Blades

Metallic Blades

Hybrid Blades

Variable-pitch Blades

Fixed-pitch Blades - By Platform Type (In Value%)

Military Helicopters

Civilian Helicopters

Cargo Helicopters

Search and Rescue Helicopters

VIP and Executive Helicopters - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Refurbishment Fitment

Upgraded Fitment

Custom Fitment - By EndUser Segment (In Value%)

Military

Commercial Airlines

Private Sector

Search and Rescue Agencies

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Through OEMs

Third-Party Distributors

Government Contracts

Aftermarket Suppliers

- Cross Comparison Parameters (Market Share, Competitive Pricing, Technological Innovation, Customer Service, Brand Reputation, Market Size & Growth, Demand Drivers, Supply & Production Factors, Technology & Product Characteristics)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus Helicopters

Bell Helicopter

Sikorsky Aircraft

Leonardo Helicopters

MH Industries

Safran Helicopter Engines

Kaman Aerospace

Rotorcraft Support

HELIOS

DART Aerospace

GE Aviation

Honeywell Aerospace

L-3 Communications

Helicopter Services

Aero Industries

- Growing demand from Qatar’s military sector for advanced helicopter blades

- Increasing need for civilian helicopter blades in emergency services

- Qatar’s strategic location boosting demand for military-grade helicopters

- Rapid expansion of the tourism industry increasing civilian helicopter usage

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035