Market Overview

The Qatar helicopter engines market is valued at approximately USD ~million, driven by the country’s expanding defense sector and the growth of the civil aviation market. The increase in government defense spending and modernization of Qatar’s military fleet are major factors propelling the demand for advanced helicopter engines. Additionally, the growing demand for helicopters in commercial sectors such as tourism and emergency services further supports market growth. Technological advancements in engine efficiency and performance have also contributed to the market’s expansion, making helicopters more affordable and operationally viable.

Qatar is at the center of the helicopter engines market in the Middle East due to its strong defense spending and its strategic position as a regional hub for air transport. The capital, Doha, is the key driver of market activity, as it is home to several military and commercial aviation operations. Qatar’s defense procurement strategies, which focus on state-of-the-art military technology, continue to drive demand for helicopter engines. The country’s investment in aviation infrastructure and its expanding tourism sector also contribute significantly to the market’s dominance.

Market Segmentation

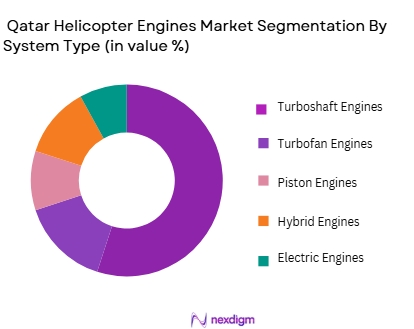

By System Type

The Qatar helicopter engines market is segmented by system type into turboshaft engines, turboshaft engines, piston engines, hybrid engines, and electric engines. Turboshaft engines dominate the market, primarily due to their widespread use in both military and commercial helicopters. These engines are favored for their efficiency, durability, and ability to operate in a variety of conditions. The growth of the military sector, where turboshaft engines are critical for attack and transport helicopters, continues to drive the dominance of this segment. Additionally, advances in turbine technology are making turboshaft engines more fuel-efficient, further boosting their demand.

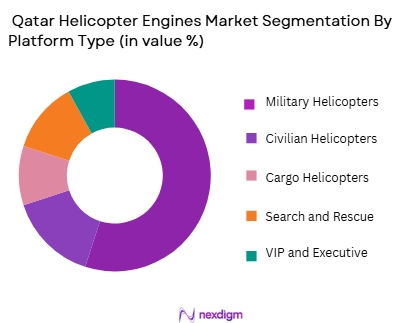

By Platform Type

The platform type segment includes military helicopters, civilian helicopters, cargo helicopters, search and rescue helicopters, and VIP/executive helicopters. Military helicopters hold the dominant share in the market due to Qatar’s substantial investments in defense and security. These helicopters are equipped with advanced engines designed for demanding military operations. The growth of defense spending, particularly in helicopter fleets for combat, surveillance, and transportation, has cemented military helicopters as the leading platform type. The strategic importance of Qatar’s military capabilities in the region further drives the high demand for military-grade helicopter engines.

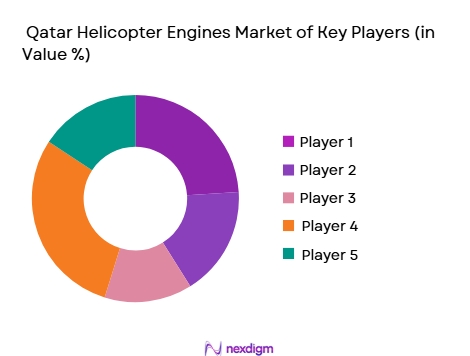

Competitive Landscape

The Qatar helicopter engines market is highly competitive, with a mix of international aerospace giants and regional players providing advanced helicopter engines. These companies offer a range of products tailored for military and civilian helicopter applications, focusing on engine efficiency, reliability, and performance. As the market continues to grow, the competition among key players is intensifying, with companies investing heavily in R&D to develop next-generation engine technologies such as hybrid and electric engines.

Major Players

| Company | Establishment Year | Headquarters | Products | R&D Investment | Manufacturing Capacity | Market Focus |

| GE Aviation | 1917 | USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | USA | ~ | ~ | ~ | ~ |

| Safran Helicopter Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1942 | USA | ~ | ~ | ~ | ~ |

Qatar Helicopter Engines Market Analysis

Growth Drivers

Increasing Demand from Helicopter Operations Across Key Sectors

The Qatar Helicopter Engines market is driven by robust demand for helicopters in sectors such as oil & gas, tourism, public safety, and VIP transport, which in turn fuels the need for reliable, high‑performance engines. The energy industry’s offshore operations especially rely on helicopters for personnel movement and logistics, creating recurrent engine procurement and maintenance needs. Additionally, the growth of tourism and luxury travel services in Qatar supports more charter flights and aerial sightseeing, further boosting demand. As operators seek engines that deliver higher reliability and performance under varied conditions, the overall engines segment expands towards 2035.

Technological Advancements and Focus on Efficiency

The helicopter engines market globally is evolving with technological innovations focused on fuel efficiency, emission reduction, and enhanced operational performance. Engine manufacturers are delivering advanced turbine and turboshaft systems that reduce environmental impact while increasing reliability and power output — attributes valued by Qatar’s operators given rising performance expectations and sustainability goals. Moreover, maintenance, repair, and overhaul (MRO) service models, including data‑driven lifecycle support agreements, are gaining traction, enabling better engine uptime and predictability. These factors help modernize existing fleets and stimulate repeat purchases and upgrades, accelerating market growth through 2035.

Market Challenges

Limited Local Technical Expertise and Skilled Workforce

A key challenge in the Qatar helicopter engines market is the shortage of locally skilled maintenance technicians and engineers qualified to service advanced helicopter powerplants. This scarcity can lead to longer turnaround times, operational inefficiencies, and higher costs due to reliance on foreign specialists or overseas MRO providers. Engine servicing demands rigorous expertise, especially for complex turbine and turboshaft systems, and without sustained investment in training and certification domestically, maintenance bottlenecks could slow fleet operations and increase downtime, affecting service reliability and operator planning.

Regulatory Compliance and Certification Complexity

Helicopter engines must meet stringent airworthiness and safety certification standards set by aviation authorities. In Qatar, compliance with national and international regulatory frameworks (including performance, emissions, and safety rules) adds time and cost to engine procurement and maintenance cycles. Navigating these regulations can be particularly challenging for emerging local service providers, requiring extensive documentation, testing, and demonstration of compliance. Additionally, evolving environmental standards and certification requirements may necessitate costly engine upgrades or retrofits, creating barriers that can inhibit rapid market expansion.

Opportunities

Expansion of Local MRO Capabilities & Foreign Partnerships

The Qatar helicopter engines market has significant scope to grow through the development of local Maintenance, Repair, and Overhaul (MRO) hubs that can service helicopters and their engines domestically. Establishing highly capable facilities — potentially in partnership with global OEMs or certified international providers — would reduce reliance on overseas support, lower operational costs, and attract regional business. Qatar’s strategic position in the Middle East and its advanced aviation ecosystem make it a natural candidate for such investment, particularly as Gulf operators seek more localized technical support for engine life‑cycle services.

Adoption of Next‑Generation Engine Technologies

There’s growing market opportunity in next‑generation engine technologies that prioritize fuel efficiency, lower emissions, and reduced noise, aligning with broader sustainability goals and regulatory trends. Engine OEMs are developing advanced turboshaft and hybrid systems that improve performance while lowering life‑cycle costs for operators. Qatar’s continued investments in air transport infrastructure and modernization of helicopter fleets open the door for these advanced engines to replace older models. Moreover, data‑driven engine health monitoring and predictive maintenance services can attract operators focused on maximizing uptime and reducing unplanned maintenance, creating high‑value revenue streams.

Future Outlook

Over the next decade, the Qatar helicopter engines market is expected to experience steady growth driven by continued defense spending, technological advancements in engine efficiency, and the expansion of helicopter-based services in the civilian sector. The demand for hybrid and electric engines is also expected to rise as the industry moves toward more sustainable and fuel-efficient technologies. Qatar’s ongoing military modernization efforts, combined with its growing commercial aviation sector, will continue to be key drivers for the market, ensuring long-term demand for high-performance helicopter engines.

Major Players

- GE Aviation

- Rolls-Royce

- Pratt & Whitney

- Safran Helicopter Engines

- Honeywell Aerospace

- Turbomeca

- Kaman Aerospace

- MTU Aero Engines

- L-3 Communications

- Lockheed Martin

- Sikorsky Aircraft

- Airbus Helicopters

- Leonardo Helicopters

- UTC Aerospace Systems

- Turbomeca

Key Target Audience

- Military Agencies

- Civil Aviation Authorities

- Defense Contractors

- Aerospace Manufacturers

- Investments and Venture Capitalist Firms

- Aircraft Maintenance Providers

- Government and Regulatory Bodies

- Private Sector Helicopter Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key variables affecting the Qatar helicopter engines market, such as defense budgets, technological advancements, and the demand for both military and civilian helicopters. Secondary research through industry reports, governmental publications, and aviation data will help gather the necessary information to identify and define these variables.

Step 2: Market Analysis and Construction

In this phase, historical data and market reports will be compiled and analyzed to assess market penetration, revenue generation, and growth trends. Key performance indicators like market size and technological trends will be the focus of this analysis to build an accurate representation of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts, including engineers, manufacturers, and military procurement officials. These consultations will provide valuable operational and market insights to refine the initial hypotheses and assumptions made during earlier phases of research.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing data collected from secondary research and expert consultations. Insights into market dynamics, including technological developments and key driver identification, will be incorporated into the final report, ensuring comprehensive and reliable market analysis for the Qatar helicopter engines market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased military spending and modernization of defense capabilities

Expansion of civilian aviation sector and helicopter-based services

Advancements in engine technologies improving efficiency and reducing costs - Market Challenges

High maintenance and operational costs of advanced helicopter engines

Dependency on foreign suppliers for critical engine components

Regulatory challenges related to safety and certification standards - Market Opportunities

Rising demand for hybrid and electric engines in helicopters

Emerging markets in the Middle East and North Africa driving demand for helicopters

Opportunities in the aftermarket engine service sector due to increasing fleet age - Trends

Increased focus on fuel efficiency and low-emission engines

Technological advancements in engine noise reduction

Integration of artificial intelligence and digital monitoring systems in engines - Government regulations

Aviation safety standards and regulations for engine performance

Certification requirements for new engine technologies

Environmental regulations on emissions and fuel efficiency - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Turboshaft Engines

Turbofan Engines

Piston Engines

Hybrid Engines

Electric Engines - By Platform Type (In Value%)

Military Helicopters

Civilian Helicopters

Cargo Helicopters

Search and Rescue Helicopters

VIP and Executive Helicopters - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Refurbishment Fitment

Upgraded Fitment

Custom Fitment - By EndUser Segment (In Value%)

Military

Commercial Airlines

Private Sector

Search and Rescue Agencies

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Through OEMs

Third-Party Distributors

Government Contracts

Aftermarket Suppliers

- Cross Comparison Parameters (Market Share, Competitive Pricing, Technological Innovation, Customer Service, Brand Reputation,)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus Helicopters

GE Aviation

Rolls-Royce

Pratt & Whitney

Safran Helicopter Engines

Honeywell Aerospace

Turbomeca

Sikorsky Aircraft

L-3 Communications

Kaman Aerospace

Daimler AG

MTU Aero Engines

Lockheed Martin

Turbomeca

Helicopter Services

- Increasing demand from Qatar’s defense sector for advanced helicopter engines

- Expansion of commercial and tourism helicopter services in Qatar

- Qatar’s focus on emergency services and search-and-rescue capabilities

- Growth in private sector helicopter usage for executive and VIP transport

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035