Market Overview

The Qatar Helicopter Ice Protection Systems market is valued at USD ~ million in 2023, driven by the growing need for advanced safety systems in both military and civil aviation sectors. Qatar’s harsh weather conditions, particularly in high-altitude areas, necessitate reliable ice protection solutions for helicopter fleets. The market is fueled by technological advancements, including more energy-efficient de-icing systems and enhanced performance of anti-icing solutions. Moreover, rising investments in defense infrastructure further contribute to the demand for these systems, particularly in the military sector.

Qatar’s aviation sector, especially in Doha, plays a central role in the demand for helicopter ice protection systems. The nation’s strategic geographical location, combined with its investment in cutting-edge aerospace technologies, positions it as a dominant player in this market. Qatar’s military and civil aviation sectors are heavily reliant on advanced ice protection systems for their operations. The capital city, Doha, is at the forefront due to its concentration of defense and aerospace facilities, as well as the regional importance of its air transport infrastructure.

Market Segmentation

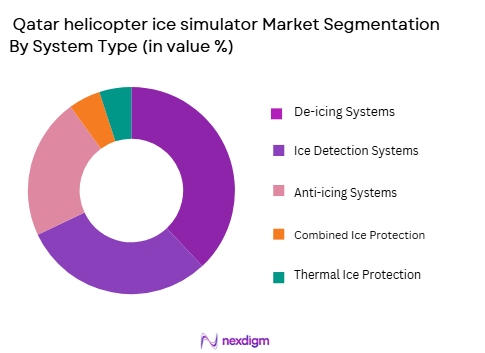

By System Type

The Qatar Helicopter Ice Protection Systems market is segmented by system type into ice detection systems, de-icing systems, anti-icing systems, combined ice protection systems, and thermal ice protection system De-icing systems dominate the Qatar market for helicopter ice protection. This is primarily due to their effectiveness in removing accumulated ice during flight, which is critical for maintaining the safety of helicopters operating in high-altitude and cold environments. De-icing systems are essential for both military and civilian applications, particularly in challenging conditions, and they have been the preferred solution due to their reliability and established technological base. The widespread use of these systems across various platforms ensures their leading position in the market.

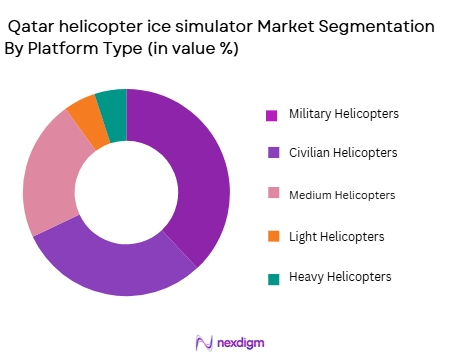

By Platform Type

The market is segmented by platform type into light helicopters, medium helicopters, heavy helicopters, civilian helicopters, and military helicopters. Military helicopters lead the market in Qatar, driven by the country’s significant defense investments and strategic location. The military relies heavily on advanced helicopters for defense and security operations, often in high-altitude and extreme weather conditions. These helicopters require reliable ice protection systems to ensure operational efficiency, especially during missions in harsh climates. Qatar’s military focus and the increasing modernization of its fleet further contribute to the dominance of this segment.

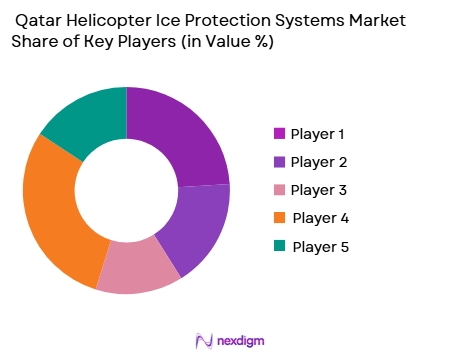

Competitive Landscape

The Qatar Helicopter Ice Protection Systems market is concentrated around a few key players, both global and regional, who dominate through innovation, technology, and strategic partnerships.The market for helicopter ice protection systems in Qatar is dominated by major players such as Honeywell Aerospace, Collins Aerospace, and Safran, along with several regional firms. These companies offer advanced solutions that meet the high-performance requirements of military and civilian helicopters operating in challenging environments. The consolidation of these key players highlights their significant influence on the market, with their products widely adopted across military and commercial aviation sectors.

| Company | Establishment Year | Headquarters | Ice Protection Systems Offered | Major End-Users | Technology Adoption | Regional Presence | Market Strategy | Strategic Partnerships |

| Honeywell Aerospace | 1906 | USA | Anti-icing, De-icing, Thermal | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | De-icing, Ice Detection | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | Thermal Protection, De-icing | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | De-icing, Ice Protection | ~ | ~ | ~ | ~ | ~ |

| UTC Aerospace Systems | 2012 | USA | Anti-icing, De-icing | ~ | ~ | ~ | ~ | ~ |

Qatar Helicopter Ice Protection Systems Market Analysis

Growth Drivers

Increased Demand for Safety and Reliability:

The growing emphasis on safety and reliability in aviation, especially in regions with extreme weather conditions, is driving the demand for helicopter ice protection systems. These systems are crucial to ensure that helicopters can operate safely in freezing environments, preventing accidents caused by ice build-up on critical components such as rotors and engines.

Technological Advancements in Ice Protection Systems:

Continuous innovation in ice protection technologies, such as de-icing and anti-icing systems, is contributing to the market’s growth. The development of more efficient, lightweight, and energy-efficient systems enhances the performance and cost-effectiveness of ice protection systems, driving adoption in both military and civil aviation sectors.

Market Challenges

High Initial Costs and Maintenance Requirements:

The high initial investment required for advanced ice protection systems can be a significant barrier for helicopter operators, especially in regions with lower demand or where extreme weather is less frequent. Additionally, the ongoing maintenance and operational costs associated with these systems can deter adoption among small and mid-sized operators.

Regulatory Compliance and Certification Delays:

Navigating complex regulatory frameworks for the certification of ice protection systems, both regionally and internationally, can delay product launches and market entry. Stringent certification requirements often lead to extended development cycles, slowing down the commercialization of advanced systems.

Opportunities

Expansion of Helicopter Fleet in Cold Climate Regions:

With the increasing deployment of helicopters in cold climate regions, particularly in northern latitudes and mountainous areas, there is a growing opportunity for ice protection system providers. The rising use of helicopters for search-and-rescue missions, oil and gas exploration, and passenger transport in these regions will significantly drive demand.

Integration with Advanced Avionics and Automation Systems:

The integration of ice protection systems with advanced avionics and automation systems offers an opportunity to enhance the overall performance and operational efficiency of helicopters. By combining these systems, operators can achieve better monitoring and control, ensuring optimal ice protection without compromising on flight performance or safety.

Future Outlook

Over the next ~to ~ years, the Qatar Helicopter Ice Protection Systems market is expected to witness significant growth. This growth is driven by increasing investments in both defense and civil aviation, with a strong focus on upgrading existing fleets and adopting advanced technology solutions. As the demand for reliable helicopter operations in harsh weather conditions continues to rise, the market for ice protection systems is set to expand. The integration of smart technologies and innovations in system design will also contribute to this growth, offering enhanced performance and efficiency.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Safran

- Raytheon Technologies

- UTC Aerospace Systems

- Airbus

- Boeing

- General Electric

- Thales Group

- Northrop Grumman

- Rockwell Collins

- Esterline Technologies

- L3 Technologies

- Garmin Ltd.

- BAE Systems

Key Target Audience

- Military and Defense Agencies

- Civil Aviation Authorities

- Commercial Helicopter Operators

- Helicopter Manufacturers

- Search and Rescue Operators

- Law Enforcement Agencies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key drivers and variables impacting the Qatar Helicopter Ice Protection Systems market. This includes analyzing technological trends, customer demands, and regulatory frameworks. Desk research, along with the use of proprietary databases, helps construct an ecosystem map of stakeholders involved in the market.

Step 2: Market Analysis and Construction

In this phase, historical data is gathered to understand the market dynamics of the Qatar Helicopter Ice Protection Systems market. This includes studying the growth of helicopter fleets, the adoption of ice protection technologies, and revenue generation from various systems, which form the basis for future forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth trends, technology adoption, and regulatory impact are validated through consultations with industry experts, including manufacturers, suppliers, and end-users. These insights help refine the market model and ensure that assumptions are well-grounded in real-world practices.

Step 4: Research Synthesis and Final Output

In the final phase, the data from expert consultations, historical market trends, and proprietary research is synthesized. This step involves engaging with key stakeholders, including manufacturers, to verify data and ensure the accuracy of the market analysis. The result is a comprehensive and validated market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for advanced safety systems in aviation

Growing need for reliable air transportation in challenging weather conditions

Technological advancements in ice protection systems - Market Challenges

High installation and maintenance costs

Regulatory hurdles and certification complexities

Lack of awareness and adoption in some regions - Market Opportunities

Rising air travel in the Middle East

Integration of smart technologies in ice protection systems

Expansion of military helicopter fleets in the region - Trends

Integration of AI and machine learning in ice detection

Shift towards more energy-efficient de-icing systems

Focus on improving durability and lifespan of ice protection systems - Government regulations

Certification requirements from civil aviation authorities

Regulation of system safety and performance standards

Environmental regulations affecting system design - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Ice Detection Systems

De-icing Systems

Anti-icing Systems

Combined Ice Protection Systems

Thermal Ice Protection Systems - By Platform Type (In Value%)

Light Helicopters

Medium Helicopters

Heavy Helicopters

Civilian Helicopters

Military Helicopters - By Fitment Type (In Value%)

Line-fit

Retrofit

Aftermarket Fitment

Custom Fitment

OEM Fitment - By EndUser Segment (In Value%)

Military

Commercial Aviation

Private Operators

Search and Rescue Operations

Law Enforcement - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

OEMs and Distributors

Military Procurement

Third-party Suppliers

- Cross Comparison Parameters (Market Share, System Complexity, Platform Type, Procurement Channel, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Boeing

Honeywell Aerospace

Daimler AG

UTC Aerospace Systems

Safran

Rockwell Collins

Esterline Technologies

GE Aviation

Northrop Grumman

Thales Group

Collins Aerospace

Garrett Motion

L3 Technologies

Raytheon Technologies

- Military operators seeking advanced ice protection for heavy-duty missions

- Civil aviation operators prioritizing passenger safety in adverse weather conditions

- Search and rescue teams needing reliable de-icing systems

- Private operators focusing on maintenance and cost efficiency

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035