Market Overview

The Qatar Helicopter Services market is valued at USD ~million in 2024, driven by the increasing demand for offshore oil and gas operations, emergency medical services (EMS), and government-backed defense projects. The market has experienced steady growth, bolstered by ongoing investments in military and civilian aviation infrastructure. This growth is propelled by Qatar’s strategic location and high demand for advanced air mobility services. Additionally, advancements in helicopter technology, such as enhanced fuel efficiency and automation, are further contributing to the market’s expansion.

Qatar is a dominant player in the Gulf region for helicopter services, primarily due to its wealth from oil and gas reserves, strategic location, and robust defense sector. Cities like Doha, the capital, play a pivotal role as hubs for helicopter services, particularly in sectors such as offshore oil drilling, search and rescue operations, and defense. Qatar’s government investments in state-of-the-art aviation infrastructure and technology, along with partnerships with leading helicopter manufacturers, ensure its position as a key player in the regional market.

Market Segmentation

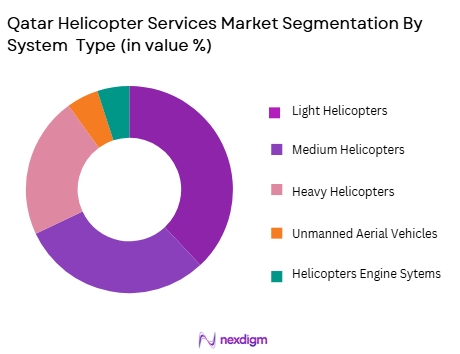

By System Type

The Qatar Helicopter Services market is segmented by system type into light helicopters, medium helicopters, heavy helicopters, unmanned aerial vehicles (UAVs), and helicopter engine systems. The medium helicopter segment is particularly dominant, owing to its versatility and wide usage across multiple industries such as offshore oil exploration, military, and emergency medical services. These helicopters offer a balance between capacity, range, and cost, making them ideal for operations in the region’s challenging environments.

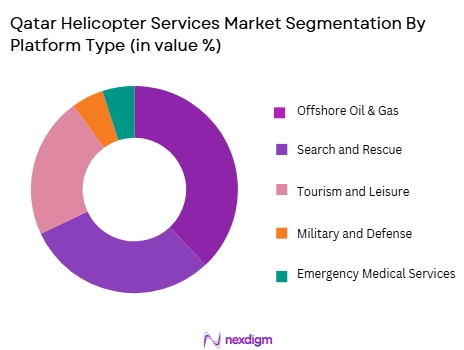

By Platform Type

The market is segmented by platform type into offshore oil and gas, search and rescue, tourism and leisure, military and defense, and emergency medical services (EMS). The offshore oil and gas platform type dominates the market due to Qatar’s large hydrocarbon industry, which requires extensive support services for oil rigs and platforms. Helicopters play a vital role in transporting personnel and equipment to offshore sites, thus driving the growth of this segment. This segment is expected to continue its dominance, supported by Qatar’s oil and gas reserves and its commitment to expanding energy production.

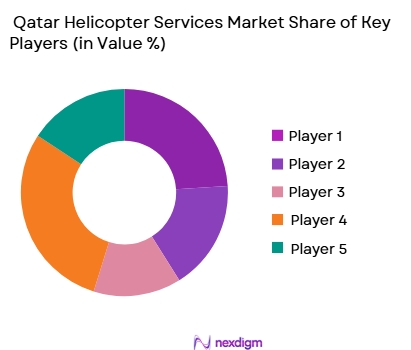

Competitive Landscape

The Qatar Helicopter Services market is dominated by a few major players, including well-established companies like Gulf Helicopters, Airbus Helicopters, and Sikorsky Aircraft. These companies have strong operational bases in Qatar and serve various sectors, including oil and gas, defense, and EMS. Their extensive experience, advanced fleet, and strong customer relationships give them a competitive edge.

| Company | Establishment Year | Headquarters | Fleet Size | Revenue | Market Segments | Key Partnerships |

| Gulf Helicopters | 1970 | Doha, Qatar | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1994 | Toulouse, France | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | Stratford, USA | ~ | ~ | ~ | ~ |

| HeliQwest | 2004 | Doha, Qatar | ~ | ~ | ~ | ~ |

| McAlpine Helicopters | 1980 | Doha, Qatar | ~ | ~ | ~ | ~ |

Qatar Helicopter Services Market Analysis

Growth Drivers

Increasing Demand for Air Travel and Tourism:

Qatar’s burgeoning tourism industry, particularly with major international events like the FIFA World Cup 2022, has spurred a growing demand for private and luxury helicopter services. This growth is driven by the need for faster, more convenient air travel, especially for high-net-worth individuals and corporate clients. Qatar’s world-class infrastructure and status as a global business hub further increase the demand for helicopter services, boosting the sector’s prospects.

Government Investments in Infrastructure:

The Qatari government has been making substantial investments in transportation infrastructure, including the development of heliports and expansion of airports. These initiatives enhance the accessibility and operational capacity for helicopter services, driving growth in both passenger and cargo transport. Strategic urban planning and transport diversification are key contributors to this growth.

Market Challenges:

Regulatory Hurdles:

The helicopter services market in Qatar faces challenges related to stringent regulatory requirements governing airspace usage, safety protocols, and flight permissions. While the government is supportive of the aviation industry, delays in licensing and complex regulations can impact the speed at which companies can expand operations. Additionally, international standards must be adhered to, which adds complexity to local operations and limits flexibility.

High Operational Costs:

Operating helicopters in Qatar is capital and maintenance intensive. High fuel costs, along with expensive insurance premiums and specialized maintenance requirements, contribute to the overall operational expenses of helicopter services. These high costs can limit the affordability and profitability of such services, restricting their appeal to a niche market.

Opportunities:

Helicopter Tourism and Scenic Flights:

The growing interest in adventure and leisure tourism presents an opportunity for the helicopter services market. Offering unique experiences such as scenic flights over Qatar’s coastline, desert landscapes, and iconic landmarks can attract affluent tourists. With Qatar’s emphasis on diversifying its tourism offerings, helicopter tourism is a promising market segment with high growth potential.

Expanding Corporate and Medical Transport Services:

As Qatar’s business environment becomes more globalized and the demand for rapid corporate transport increases, the helicopter services market stands to benefit from offering tailored corporate transportation solutions. Additionally, the increasing demand for medical evacuation and air ambulance services provides a strong opportunity for growth. These services are particularly critical for remote areas and large construction projects where speed and efficiency are paramount.

Future Outlook

The Qatar Helicopter Services market is poised for substantial growth over the next decade. Driven by sustained investments in the defense sector, the growing need for offshore oil and gas operations, and the expansion of emergency medical services, the market is expected to exhibit a steady rise. Innovations in helicopter technology, including autonomous flight systems and more efficient fuel usage, will contribute to this growth. The market is projected to grow at a forecasted CAGR of ~ from 2026 to 2035, supported by continued infrastructure development and technological advancements.

Major Players

- Gulf Helicopters

- Airbus Helicopters

- Sikorsky Aircraft

- HeliQwest

- McAlpine Helicopters

- Leonardo Helicopters

- Bell Helicopter

- Russian Helicopters

- Kawasaki Heavy Industries

- AgustaWestland

- Turkish Aerospace Industries

- Vector Aerospace

- Enstrom Helicopter Corporation

- Rotortrade

- Viking Air

Key Target Audience

- Aviation companies

- Oil and gas companies

- Government agencies

- Emergency medical service providers

- Tourism and leisure companies

- Investments and venture capitalist firms

- Aerospace and defense contractors

- Helicopter service providers

Research Methodology

Step 1: Identification of Key Variables

In this step, key variables that influence the Qatar Helicopter Services market, such as technological advancements, regulatory frameworks, and consumer demand, are identified. This phase uses secondary and primary research sources, including industry reports and expert consultations, to map the ecosystem.

Step 2: Market Analysis and Construction

This phase involves analyzing historical market data, such as fleet sizes, service types, and revenue generation, to construct a clear market map. The data helps understand the penetration of helicopter services in various sectors and provides insight into trends that will shape the future of the market.

Step 3: Hypothesis Validation and Expert Consultation

After developing hypotheses based on initial data analysis, industry experts will be consulted to validate these findings. Experts from helicopter operators, government agencies, and aviation manufacturers will provide insights into market dynamics and emerging trends.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the findings into actionable insights. Detailed engagement with key market players is conducted to gather primary data on fleet performance, customer preferences, and future trends. This data is used to create a comprehensive and validated market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for helicopter services in offshore oil and gas operations

Government investments in military and defense helicopter fleets

Rising adoption of helicopters for emergency medical services (EMS) - Market Challenges

High operational costs and fuel expenses

Regulatory hurdles in obtaining flight permits and certifications

Limited availability of advanced helicopter technology - Market Opportunities

Expansion of helicopter tourism services in Qatar

Potential growth in the medical transport and EMS sectors

Technological advancements in unmanned aerial vehicles (UAVs) for helicopter operations - Trends

Integration of AI and automation in helicopter flight control systems

Growing focus on sustainability with fuel-efficient and eco-friendly helicopter designs

Increasing partnerships between private operators and government agencies for public services - Government regulations

Strict aviation safety and certification standards by Qatar Civil Aviation Authority

Environmental regulations encouraging the adoption of greener helicopters

Regulations around the use of UAVs for specific commercial applications - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Light Helicopters

Medium Helicopters

Heavy Helicopters

Unmanned Aerial Vehicles (UAVs)

Helicopter Engine Systems - By Platform Type (In Value%)

Offshore Oil & Gas

Search and Rescue

Tourism and Leisure

Military and Defense

Emergency Medical Services (EMS) - By Fitment Type (In Value%)

New Fitments

Upgrades and Retrofitting

Component Replacement

Customization Services

Maintenance, Repair, and Overhaul (MRO) - By EndUser Segment (In Value%)

Oil & Gas Industry

Government and Defense Agencies

Aviation and Tourism Companies

Medical Service Providers

Private Operators - By Procurement Channel (In Value%)

Direct Sales

Distributors and Dealers

Online Channels

OEM (Original Equipment Manufacturer) Partnerships

Government Procurement

- Cross Comparison Parameters (Fleet Size & Composition, Market Share & Growth Rate, Annual Revenue & Profitability, Service Type Portfolio, Geographic Coverage, Customer Base & Contracts, Safety & Compliance Records, Pricing Structure & Yield per Flight, Operational Efficiency Metrics, After‑Sales & MRO Capabilities, Strategic Partnerships & Alliances)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Qatar Airways

Airbus Helicopters

Bell Helicopter

Sikorsky Aircraft

Leonardo Helicopters

AgustaWestland

HeliQwest

McAlpine Helicopters

Kuwait Helicopters

Hala Group

Rotary Wings Qatar

Vinci Helicopter Services

Qatar Helicopter Services

Gulf Helicopters

Falcon Aviation

- Oil & Gas companies focusing on offshore drilling and platform support

- Government agencies increasing reliance on helicopters for defense and surveillance

- Tourism companies investing in sightseeing helicopter tours

- Private helicopter owners seeking more customization and luxury options

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035