Market Overview

The Qatar helicopter simulator market is valued at approximately USD ~million, with growth being driven by the increasing demand for advanced training systems and simulation technology. This market is primarily fueled by the need for enhanced safety measures, cost-efficient pilot training solutions, and the rapid advancement of aviation technology. As aviation authorities and defense sectors continue to prioritize training, there is a rising need for realistic flight simulation systems. The market’s demand is also influenced by government and defense sector investments in Qatar’s military capabilities, which continues to propel the market forward.

Qatar is home to several key players and a strong aviation presence, particularly in cities like Doha, which is known for its aerospace industry initiatives and is an aviation hub in the region. The country’s strategic geographic location also boosts its dominance in the helicopter simulation market, offering a strategic base for both military and commercial aviation training. Qatar’s ongoing infrastructure development and focus on defense training have further solidified its position as a market leader in the region.

Market Segmentation

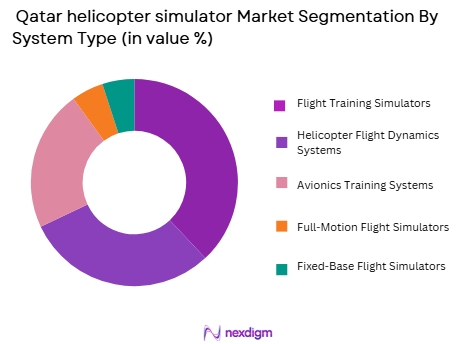

By System Type

The Qatar helicopter simulator market is segmented by system type into flight training simulators, helicopter flight dynamics systems, avionics training systems, full-motion flight simulators, and fixed-base flight simulators. Flight training simulators dominate the market share in Qatar. This is primarily due to their critical role in pilot training, providing a cost-effective solution that minimizes the need for actual flight hours. The growing demand for highly accurate, realistic training environments for pilots, especially in the military sector, has made flight training simulators a fundamental component in the development of aviation personnel. This demand is driven by both military and civilian aviation authorities prioritizing safety, training efficiency, and technology-driven solutions.

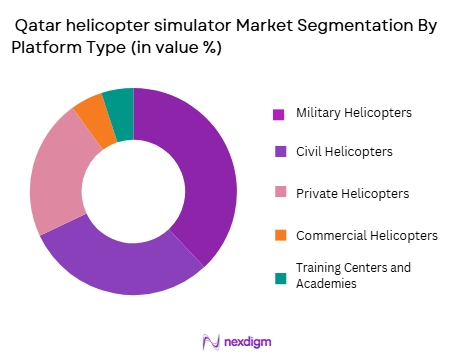

By Platform Type

The market is also segmented by platform type into civil helicopters, military helicopters, private helicopters, commercial helicopters, and training centers and academies. Military helicopters dominate the market share in Qatar. This is largely due to the country’s emphasis on strengthening its defense capabilities and investing heavily in advanced military training. Qatar’s government initiatives and its strategic partnerships with global defense manufacturers have fostered an increased demand for simulation technologies tailored for military helicopters. As military operations become more sophisticated, the need for high-quality, realistic flight training systems grows, contributing to the dominance of military helicopter simulators.

Competitive Landscape

The Qatar helicopter simulator market is dominated by a few major players, each contributing significantly to the growth and technological advancements in the field. Key players include multinational corporations that provide cutting-edge simulation systems for both military and civilian aviation sectors. These companies not only supply simulators but also offer after-sales support, training services, and maintenance, which has helped them establish long-lasting relationships with both private and government clients. The strong consolidation of global players such as CAE Inc., FlightSafety International, and L3Harris Technologies ensures that a few large entities control the majority of the market, while local companies and regional suppliers also play a critical role in market dynamics.

Competitive Landscape Table

| Company Name | Establishment Year | Headquarters | Market Focus | Product Range | Strategic Partnerships | Military Involvement |

| CAE Inc. | 1947 | Montreal, Canada | ~ | ~ | ~ | ~ |

| FlightSafety International | 1995 | New York, USA | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2007 | Melbourne, USA | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ |

| Meggitt | 1947 | UK | ~ | ~ | ~ | ~ |

Qatar helicopter simulator Market Analysis

Growth Drivers

Government Investment in Aviation & Defense:

Qatar’s ongoing investments in defense and aviation technologies fuel the growth of the helicopter simulator market. The Qatari government has allocated substantial resources to modernize its military and civil aviation sectors, including investments in training infrastructure and advanced simulation systems. This focus on upgrading defense training capabilities directly contributes to the growing demand for high-quality helicopter simulators.

Technological Advancements in Simulation Systems:

Continuous advancements in simulation technology, such as the integration of virtual reality (VR) and augmented reality (AR), enhance the realism and efficiency of training systems. These innovations make helicopter simulators more attractive for both military and civilian aviation sectors, driving market growth.

Market Challenges

High Initial Costs of Simulation Systems:

The significant upfront investment required for high-fidelity helicopter simulators remains a challenge. Many potential buyers, particularly small operators or new training facilities, find the cost prohibitive. The need for continuous updates and maintenance further adds to the financial burden, limiting broader adoption.

Skilled Operator Shortage:

While demand for helicopter simulators rises, there is a shortage of highly skilled operators capable of managing advanced simulation systems. This lack of qualified personnel hampers the efficiency of training programs and limits the potential market for advanced simulation technologies.

Opportunities

Growing Demand for Military Training Simulators:

With the increasing focus on defense capabilities, Qatar’s military is seeking advanced simulation tools to train its personnel. This creates an opportunity for simulation providers to tailor their systems to meet specific military training needs, driving demand for specialized simulators in the region.

Expansion of Civil Aviation & Training Centers:

As Qatar continues to expand its aviation infrastructure, including new airports and training centers, there is a rising need for high-quality helicopter simulators for civil aviation training. This growth in the aviation sector offers an opportunity to develop and deploy more simulation systems catering to commercial airlines, pilot schools, and training academies.

Future Outlook

Over the next decade, the Qatar helicopter simulator market is expected to see substantial growth due to continuous technological advancements, increased demand for military training, and ongoing infrastructure development in the aviation sector. The expanding role of defense and security agencies in the region, along with Qatar’s strategic investments in aerospace and aviation technologies, will continue to drive the demand for advanced simulation systems. With the increasing reliance on high-fidelity simulation for pilot training, the market is projected to exhibit significant growth, particularly in the military aviation sector.

Major Players

- CAE Inc.

- FlightSafety International

- L3Harris Technologies

- Thales Group

- Meggitt

- Indra Sistemas

- Rockwell Collins

- SimitriX

- Alsim

- TRU Simulation + Training

- Saab AB

- Textron Inc.

- Collins Aerospace

- Honeywell International

- Boeing

Key Target Audience

- Aviation Authorities

- Government and Defense Agencies

- Airlines and Aviation Operators

- Commercial Aviation Training Centers

- Military Defense Contractors

- Aviation Simulation System Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying all the key variables influencing the Qatar helicopter simulator market, including key trends, technology adoption rates, and major stakeholders. Secondary research and primary data sources are used to understand the dynamics of the sector.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the Qatar helicopter simulator market is compiled, including information on simulator demand, customer behavior, and technological advancements. A thorough analysis is conducted to understand market penetration and service offerings.

Step 3: Hypothesis Validation and Expert Consultation

To validate initial market hypotheses, expert consultations are conducted with industry practitioners and stakeholders in the aviation sector. This helps refine and corroborate insights gathered from secondary research.

Step 4: Research Synthesis and Final Output

The final research phase involves synthesizing the gathered data and consulting with key manufacturers in the simulation market. Insights from the bottom-up approach are used to validate the final outputs, ensuring the reliability of the analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- Growth Drivers

Increasing demand for flight training simulators in defense

Government investments in aviation and defense sectors

Rising need for cost-effective pilot training solutions - Market Challenges

High initial investment cost for simulator systems

Lack of skilled operators for advanced simulators

Limited availability of maintenance and service infrastructure - Market Opportunities

Integration of virtual reality (VR) and augmented reality (AR) into simulators

Growing demand for military training simulators

Expansion of training facilities in the Middle East region - Trends

Shift towards hybrid simulation systems combining hardware and software

Increased adoption of cloud-based simulation platforms

Demand for real-time training and performance tracking systems - Government regulations

Helicopter certification standards by Qatar Civil Aviation Authority (QCAA)

Defense industry regulations and certifications

Data security and privacy standards for training simulators - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Flight training simulators

Helicopter flight dynamics systems

Avionics training systems

Full-motion flight simulators

Fixed-base flight simulators - By Platform Type (In Value%)

Civil helicopters

Military helicopters

Private helicopters

Commercial helicopters

Training centers and academies - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket systems

Retrofit systems

Hybrid systems

Simulator system upgrades - By EndUser Segment (In Value%)

Military and defense

Aviation training schools

Commercial operators

Government and law enforcement

Private operators - By Procurement Channel (In Value%)

Direct purchase from OEMs

Third-party suppliers

Government contracts

Industry partnerships

Online platforms and distributors

- Cross Comparison Parameters (Market Share, System Complexity, Training Effectiveness, Cost per Flight Hour, End-user Segments, Regulatory Compliance, Geographic Penetration, Market Segment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

CAE Inc.

FlightSafety International

L3Harris Technologies

Thales Group

Indra Sistemas

Rockwell Collins

SimitriX

Meggitt

Alsim

TRU Simulation + Training

Saab AB

Textron Inc.

Collins Aerospace

Honeywell International

Boeing

- Growing demand for advanced helicopter training in military sectors

- Rising adoption of simulators in commercial aviation training

- Increasing focus on safety and accident prevention in aviation

- Expansion of specialized training programs for private operators

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035