Market Overview

The Qatar heliport market is valued at USD ~ million, supported by a growing demand for air transport, especially in offshore oil and gas operations and air ambulance services. The market is driven by infrastructure development in key sectors such as tourism, oil, and gas, where rapid transportation solutions are crucial. Additionally, the government’s efforts to develop aviation infrastructure, including expanding heliports, play a pivotal role in fostering market growth. Furthermore, Qatar’s strategic location for tourism and its wealth from natural resources continue to fuel demand for heliports.

Qatar is the dominant player in the Middle Eastern heliport market due to its high economic growth driven by natural gas and oil revenues. Doha, the capital, stands out as a major hub for heliport development due to its infrastructure investments, including the Hamad International Airport, and its proximity to offshore oil platforms. The country’s continued investments in tourism and medical services further strengthen its market dominance. This is further bolstered by the nation’s favorable regulatory environment and commitment to expanding its aviation infrastructure.

Market Segmentation

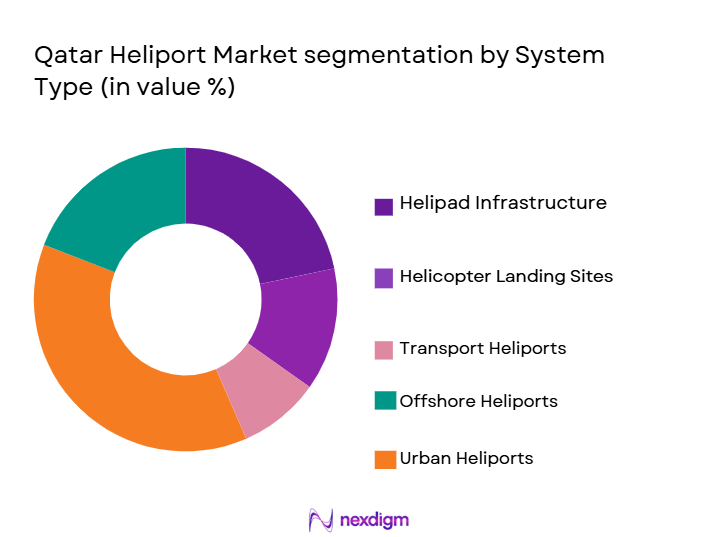

By System Type

The Qatar heliport market is segmented by system type into helipad infrastructure, helicopter landing sites, transport heliports, offshore heliports, and urban heliports. Offshore heliports dominate the market share due to Qatar’s robust oil and gas industry, where fast, reliable transportation to offshore rigs is vital. These heliports facilitate the transportation of personnel and supplies to and from offshore sites, significantly reducing travel time compared to traditional methods. Their demand is further fueled by Qatar’s economic reliance on oil and gas exports, making offshore heliports critical for efficient operational flow.

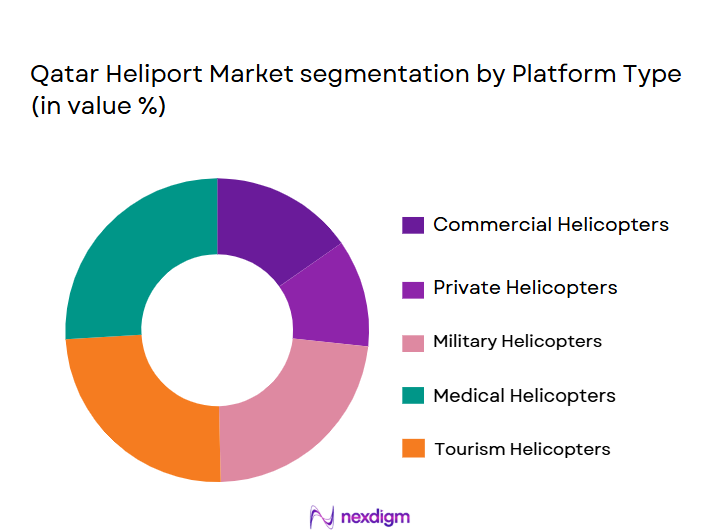

By Platform Type

The market is segmented into commercial helicopters, private helicopters, military helicopters, medical helicopters, and tourism helicopters. Medical helicopters have emerged as the dominant segment due to the increasing demand for air ambulance services. Qatar’s healthcare sector is growing rapidly, and the government prioritizes emergency medical services, enhancing the need for medical heliports. These helicopters are essential for quickly transporting patients from remote areas, such as oil fields or offshore platforms, to major hospitals, thereby improving health outcomes in critical situations.

Competitive Landscape

The Qatar heliport market is dominated by a few key players who lead both the infrastructure development and helicopter services sectors. Companies such as Qatar Airways and local providers like Qatar Helicopters and Falcon Aviation are key contributors to the market, with robust service offerings. These players are driving competition by enhancing their fleet capabilities and expanding their heliport infrastructure to meet the growing demand for faster and more reliable air transportation services.

| Company Name | Year Established | Headquarters | Major Service Type | Fleet Size | Annual Revenue | Strategic Initiatives | Regulatory Compliance | Technological Innovation | Safety Standards | Partnerships | Government Contracts |

| Qatar Helicopters | 2000 | Doha, Qatar | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Falcon Aviation | 2006 | Doha, Qatar | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Qatar Airways | 1993 | Doha, Qatar | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Al Hodaifi Group | 1998 | Doha, Qatar | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1974 | Toulouse, France | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar heliport Market Analysis

Growth Drivers

Increasing Demand for Air Travel and Aircraft Modernization

The growing air traffic in Singapore, a regional aviation hub, is driving the demand for advanced aircraft sensors. Singapore Airlines, one of the major carriers in Asia, continues to modernize its fleet to maintain competitive advantage, investing in next-generation aircraft with enhanced sensor technologies. The increasing need for high safety standards and improved operational efficiency in aviation has further accelerated the adoption of advanced sensors in aircraft systems. With the expansion of airports and regional connections, the demand for precise aircraft monitoring and data analytics is expected to continue its upward trend.

Technological Advancements in Sensor Systems

The rapid advancements in sensor technologies, including improved aircraft health monitoring and predictive maintenance systems, are contributing to market growth. New sensors capable of monitoring various parameters such as engine performance, fuel efficiency, and environmental conditions are enabling more efficient and reliable operations. Singapore’s strong aerospace sector is pushing the development of smart sensor systems that can enhance the safety, performance, and overall efficiency of aircraft, particularly in areas like predictive maintenance, real-time diagnostics, and automated systems.

Market Challenges

High Costs of Advanced Aircraft Sensors

The high costs associated with the research, development, and implementation of advanced aircraft sensor systems present a significant challenge to market growth. While these sensors provide critical data for improving operational efficiency and safety, their expensive installation and maintenance costs may deter smaller operators from adopting them. Aircraft manufacturers and service providers are required to allocate substantial budgets for sensor integration, which can sometimes limit the speed of adoption across the broader industry in Singapore, especially for legacy aircraft.

Regulatory Compliance and Integration Complexity

The regulatory landscape surrounding aircraft sensor systems can be complex and time-consuming. Aircraft sensors must comply with stringent aviation regulations set by authorities like the Civil Aviation Authority of Singapore (CAAS), which can result in lengthy certification processes. The integration of new sensor technologies with existing aircraft systems is often a technical challenge, as it requires ensuring compatibility with multiple components, meeting safety standards, and achieving regulatory approval. These complexities can delay the deployment of new sensor technologies and increase costs for manufacturers and operators.

Opportunities

Growth of Smart Airports and Automation

Singapore’s push toward becoming a global leader in aviation and airport automation presents a significant opportunity for the aircraft sensor market. The government’s investments in smart airport initiatives, such as the use of sensors for real-time baggage tracking, passenger flow management, and environmental monitoring, offer avenues for growth. As Singapore’s aviation infrastructure continues to modernize, there will be an increasing need for advanced sensors that integrate seamlessly with these automated systems, particularly for aircraft fleet management, operational monitoring, and predictive analytics.

Expanding Defense and Military Aircraft Sector

Singapore’s strategic position in Southeast Asia and its focus on strengthening defense capabilities offer significant opportunities for the aircraft sensor market in the military and defense sectors. The country’s defense budget continues to grow, with investments in advanced military aircraft equipped with state-of-the-art sensor systems. These sensors play a crucial role in enhancing aircraft capabilities such as surveillance, targeting, and navigation. The growing demand for advanced sensors in defense applications presents a major opportunity for market players to innovate and expand their product offerings tailored to military and defense aircraft.

Future Outlook

Over the next ~ years, the Qatar heliport market is expected to experience significant growth. This will be driven by ongoing infrastructure projects in the oil and gas sector, along with growing demand for rapid transportation in emergency medical services. With increasing government investments in transportation infrastructure and a booming tourism industry, Qatar’s heliport infrastructure is poised for further expansion, particularly with urban heliports and medical services playing a central role in market growth.

Major Players

- Qatar Helicopters

- Falcon Aviation

- Qatar Airways

- Al Hodaifi Group

- Airbus Helicopters

- Lockheed Martin

- Bell Helicopter

- Babcock International

- Sikorsky Aircraft

- Daher Aerospace

- Leonardo Helicopters

- HeliQatar

- Global Heliports

- Daher Aviation

- Aviation Canada

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Civil Aviation Authority of Qatar)

- Oil and Gas Companies

- Healthcare Institutions (Hospitals, Air Ambulance Providers)

- Tour Operators and Tourism Providers

- Military and Defense Agencies (Qatar Armed Forces)

- Helicopter Manufacturing Companies

- Aviation and Transportation Infrastructure Developers

Research Methodology

Step 1: Identification of Key Variables

The first step involves gathering and identifying key factors affecting the Qatar heliport market. Secondary research will be used extensively to understand trends and regulations that drive the industry, as well as technological innovations shaping the market.

Step 2: Market Analysis and Construction

Historical data on market trends, growth rates, and segmentation will be compiled to understand the dynamics of the market. This includes evaluating service providers and their offerings, along with assessing the penetration of heliport infrastructure.

Step 3: Hypothesis Validation and Expert Consultation

This phase involves validating hypotheses through expert consultations and interviews with key stakeholders in the aviation industry, including policymakers, service providers, and technology suppliers. This will provide practical insights into the market and confirm data accuracy.

Step 4: Research Synthesis and Final Output

The final research phase will integrate insights gathered through expert consultations, market surveys, and secondary research to provide an accurate, validated market forecast. This will include identifying key growth drivers and mapping market trends to ensure an exhaustive analysis.

- Executive Summary

- Qatar Heliport Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for helicopter air ambulance services

Expansion of the oil and gas sector requiring offshore heliports

Rising tourism activities and tourism-driven demand for helicopter services - Market Challenges

High installation and maintenance costs for heliports

Stringent regulations and certifications for aviation infrastructure

Limited availability of suitable land for heliport construction - Market Opportunities

Growth in urban air mobility initiatives

Strategic collaborations between private and government sectors

Technological advancements in heliport safety and automation - Trends

Increased use of drones and vertical takeoff and landing (VTOL) aircraft

Adoption of modular heliport designs

Integration of heliports with smart city infrastructure

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Helipad Infrastructure

Helicopter Landing Sites

Transport Heliports

Offshore Heliports

Urban Heliports - By Platform Type (In Value%)

Commercial Helicopters

Private Helicopters

Military Helicopters

Medical Helicopters

Tourism Helicopters - By Fitment Type (In Value%)

Helipad Conversion

New Heliport Installations

Retrofit Systems

Emergency Landing Zones

Temporary Heliports - By End-user Segment (In Value%)

Aviation Industry

Medical Services

Offshore Oil & Gas

Tourism Sector

Government and Military - By Procurement Channel (In Value%)

Direct Procurement

Distributor Networks

Government Contracts

Online Retail

Service Contracts

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Technological Advancements, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Infrastructure Investments, Regulatory Approvals, Pricing Models) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Qatar Helicopters

Qatar Airways

Falcon Aviation

HeliQatar

Doha Aviation Services

Al Hodaifi Group

Global Heliports

Daher Aerospace

Babcock International

Airbus Helicopters

Lockheed Martin

Bell Helicopter

KBR

HELIOS Systems

Sikorsky Aircraft

- Medical service providers focusing on rapid emergency response

- Oil and gas companies enhancing offshore operations with heliports

- Tourism companies integrating heliport services for sightseeing tours

- Government entities investing in heliport infrastructure for military and defense operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035