Market Overview

The Qatar Hybrid Aircraft Market is projected to grow significantly due to technological advancements, environmental regulations, and increased government investment in green aviation. The market size is influenced by Qatar’s commitment to sustainability and reducing carbon emissions in its aviation sector. The hybrid aircraft market size is expected to reach approximately USD ~ million by 2024, with growth propelled by innovation in hybrid propulsion systems, energy storage technologies, and the country’s growing interest in sustainable transport solutions for the aviation industry. Key factors like the rising cost of fuel and the push for cleaner aviation alternatives drive the demand for hybrid aircraft.

Qatar, along with other major players like the UAE and Saudi Arabia, dominates the hybrid aircraft market in the Gulf region. Qatar’s dominance stems from its strategic positioning as an aviation hub, alongside government policies incentivizing technological advancements and sustainability. The country’s state-of-the-art aviation infrastructure, supported by its national airline, Qatar Airways, positions it as a leader in adopting new aviation technologies, including hybrid propulsion systems. Additionally, the nation’s forward-thinking regulatory framework, which supports low-carbon innovations, further cements Qatar’s position at the forefront of hybrid aircraft development in the region.

Market Segmentation

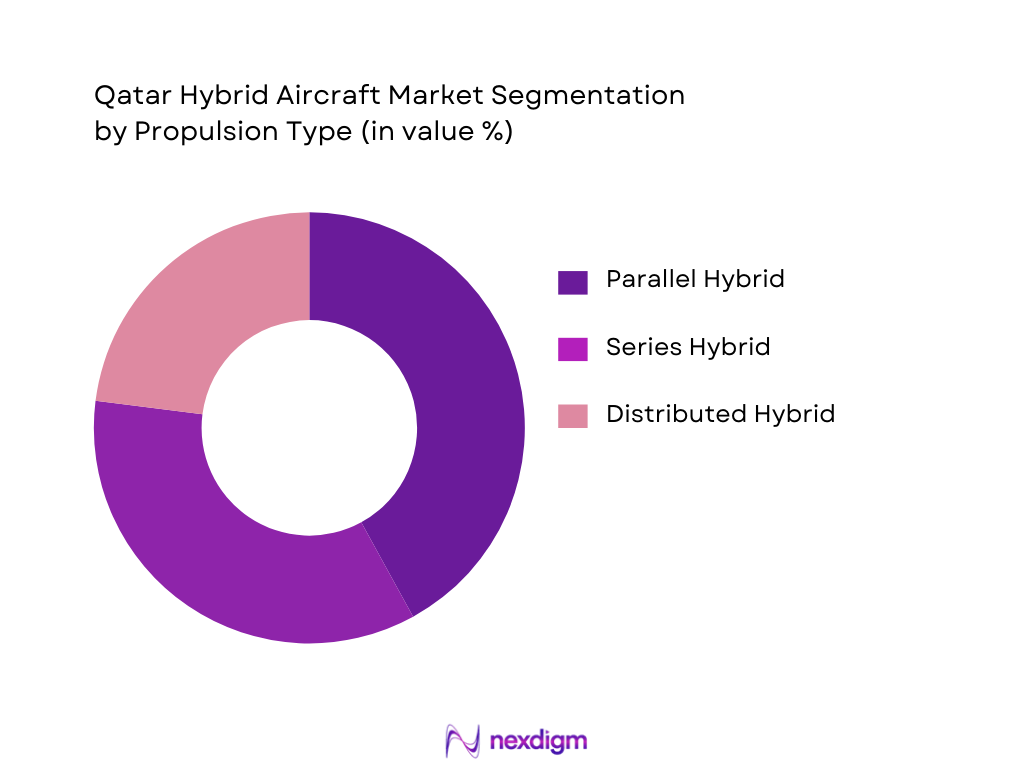

By Propulsion Type

The Qatar Hybrid Aircraft Market is segmented by propulsion type into parallel hybrid, series hybrid, and distributed hybrid systems. Among these, parallel hybrid propulsion systems are leading the market. This dominance is driven by their ability to combine traditional combustion engines with electric motors, making them more adaptable to existing aircraft designs. Parallel systems are highly attractive to operators looking for cost-effective retrofitting options and those aiming to reduce fuel consumption without undergoing full system overhauls. The relatively lower costs and ease of integration have helped parallel hybrid systems secure the largest market share , with significant adoption among commercial regional aircraft.

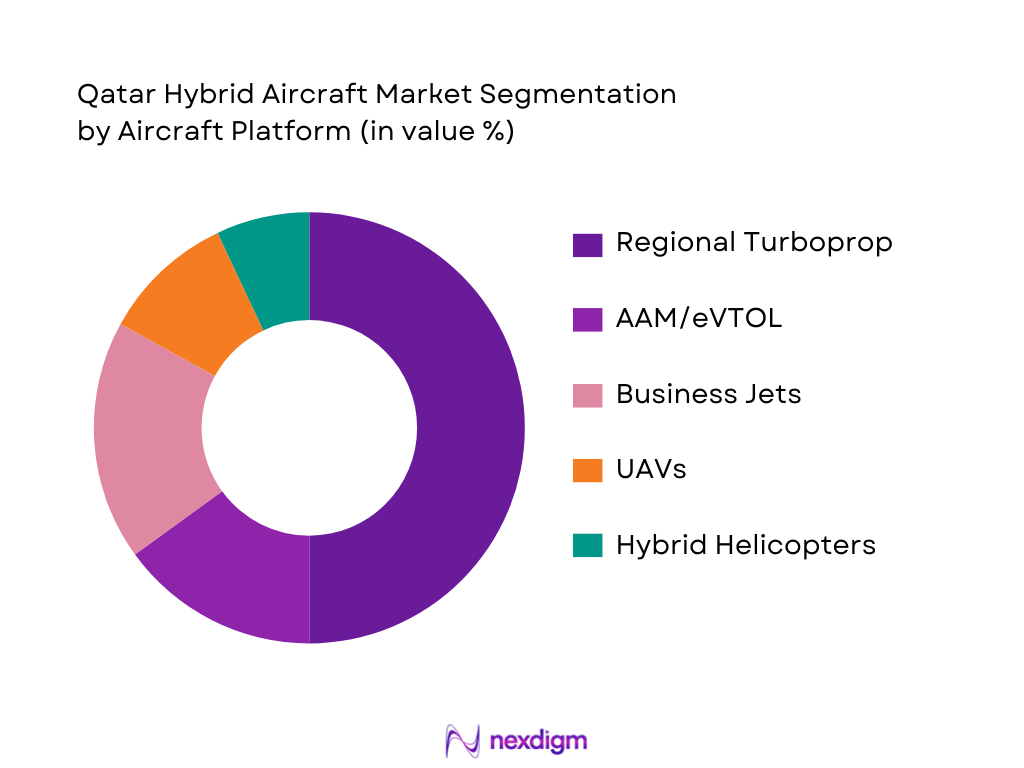

By Aircraft Platform

In terms of aircraft platforms, regional turboprop and commuter aircraft dominate the Qatar Hybrid Aircraft Market. These aircraft benefit from hybrid systems’ ability to reduce operating costs, particularly for shorter regional routes. The efficiency and cost-effectiveness of hybrid propulsion systems, especially in aircraft that service smaller airports or regional hubs, make them highly suitable for Qatar’s aviation infrastructure. Additionally, the shift towards hybrid propulsion aligns with Qatar’s goals of reducing aviation-related carbon emissions while maintaining operational efficiency. Consequently, regional turboprops and commuter aircraft are projected to maintain the highest market share.

Competitive Landscape

The Qatar Hybrid Aircraft Market is highly competitive, with several global and regional players vying for market share. Major players include aircraft manufacturers, engine developers, and technology providers, all focusing on hybrid propulsion systems and energy storage solutions. Companies like Airbus, Boeing, and Embraer, along with regional players such as Qatar Airways and other GCC-based companies, are at the forefront of driving innovation in hybrid aircraft technologies. The market is characterized by high research and development investment, with a focus on improving fuel efficiency and reducing environmental impact.

The competitive landscape reflects a trend towards consolidation and strategic alliances among aircraft manufacturers, energy storage developers, and infrastructure providers. This cooperation enables the development of hybrid aircraft systems that meet both the environmental standards and operational requirements of the region’s diverse aviation needs.

| Company | Establishment Year | Headquarters | Technology Focus | Market Share | Innovation/Tech R&D | Regional Collaboration |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ |

| ZeroAvia | 2020 | USA | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | USA | ~ | ~ | ~ | ~ |

Qatar Hybrid Aircraft Market Analysis

Growth Drivers

Sustainability Regulation Impact (ICAO Net Zero Targets, Qatar Environmental Policy)

Sustainability regulation is a major growth driver in the Qatar Hybrid Aircraft Market due to rigorous emissions reduction goals set by global and national aviation bodies. The International Civil Aviation Organization (ICAO) has established aspirational goals for carbon neutral growth and improved fuel efficiency, shaping airline and OEM strategies toward cleaner propulsion systems. In addition, Qatar’s national environmental policy emphasizes reducing carbon emissions across all sectors, including aviation, prompting airlines and government stakeholders to explore hybrid propulsion solutions that align with sustainability objectives and international commitments. This regulatory pressure supports investment in hybrid aircraft technologies and encourages adoption by carriers aiming for compliance and competitive advantage in an increasingly eco‑focused aerospace landscape.

Fuel Price Volatility and Lifecycle Cost Optimization

Fuel price volatility continues to influence airline operating costs globally, making hybrid aircraft technology more attractive. Traditional aircraft incur high fuel expenses, and fluctuations in global oil prices can significantly impact profitability. Hybrid aircraft, by integrating electric and conventional propulsion systems, help airlines achieve lower fuel consumption and reduced lifecycle operating costs. This economic incentive is pushing carriers and fleet planners to consider hybrid platforms that deliver cost savings through improved fuel efficiency and lower maintenance costs compared to conventional engines. Operators seeking long‑term financial predictability and resilience against fuel market volatility find hybrid aircraft a strategic approach to optimize lifecycle costs while maintaining performance and operational flexibility.

Market Challenges

Certification Barriers for Hybrid Propulsion

Certification remains one of the most significant challenges in the hybrid aircraft market. Regulatory bodies such as the Qatar Civil Aviation Authority (QCAA), along with ICAO and EASA/FAA frameworks, require rigorous safety validation and type certification for new propulsion technologies, which often lack precedent in existing standards. Hybrid propulsion systems combine electric motors with traditional engines, introducing complex integration, power management, and redundancy requirements that certification authorities scrutinize closely. This leads to lengthier approval timelines and higher compliance costs for manufacturers. The absence of established test protocols for hybrid propulsion further complicates the process, slowing commercialization and deployment. These barriers require coordinated efforts between regulators, OEMs, and industry consortia to develop certification pathways tailored to hybrid aircraft systems.

Infrastructure Adequacy (Charging, Hydrogen Refueling)

Infrastructure adequacy poses a significant market challenge, particularly for hybrid aircraft that rely on advanced charging facilities or hydrogen refueling systems. Airports and aviation hubs in Qatar and the broader Gulf region currently lack widespread electrification and hydrogen supply networks capable of supporting regular hybrid aircraft operations. Developing this infrastructure involves substantial capital investment in grid enhancements, high‑capacity charging stations, and safe hydrogen storage/dispensing facilities. Without such support systems, hybrid aircraft cannot achieve optimal utilization or operational reliability, deterring airlines from committing to large‑scale adoption. Moreover, coordination between aviation authorities, energy suppliers, and airport operators is necessary to align infrastructure development with hybrid aircraft deployment timelines to avoid bottlenecks in service readiness.

Opportunities

Adoption in GCC Air Travel Corridors

The GCC region presents a compelling opportunity for hybrid aircraft adoption, particularly across regional air travel corridors connecting major cities such as Doha, Dubai, Riyadh, and Abu Dhabi. These routes typically involve short‑to‑medium range flights where hybrid propulsion’s efficiency gains and lower fuel dependency offer tangible operational benefits. Furthermore, GCC nations are actively pursuing diversification away from oil‑centric economies toward technology and sustainable aviation sectors. Investments in green aviation initiatives, coupled with high passenger traffic on regional air routes, make hybrid aircraft an attractive solution for carriers seeking lower emissions and reduced fuel costs. Collaborative regulatory frameworks and planned harmonization of regional airspace could accelerate the deployment of hybrid aircraft services, enhancing connectivity while supporting broader environmental goals. This convergence of regional demand and policy alignment positions the GCC as a catalyst region for hybrid aviation uptake.

Advanced Air Mobility Corridors (Doha Urban Mobility)

Advanced Air Mobility (AAM) corridors represent a high‑value opportunity for hybrid aircraft technologies, especially in urban centers like Doha where congestion and demand for efficient transit solutions are increasing. Hybrid propulsion, encompassing both hybrid‑electric and distributed propulsion systems, is particularly suitable for advanced air mobility vehicles such as eVTOLs, enabling quieter and more sustainable short‑haul flights within metropolitan areas. Establishing designated AAM corridors for passenger and cargo operations could unlock new mobility services and offer scalable transit alternatives that complement existing infrastructure. Investments in vertiports, airspace management systems, and regulatory frameworks tailored for AAM operations will further support hybrid aircraft integration. As urban air mobility transitions from concept to commercial reality, hybrid aircraft technologies are poised to play a pivotal role in creating seamless, low‑emission urban and regional transit networks.

Future Outlook

Over the next 5 years, the Qatar Hybrid Aircraft Market is expected to show significant growth driven by continuous government support, advancements in hybrid propulsion technology, and increasing consumer demand for eco-friendly aviation solutions. With Qatar’s commitment to reducing aviation emissions and its ongoing infrastructural development, the market is poised for substantial growth. Innovations in battery technology and fuel efficiency will also contribute to the widespread adoption of hybrid aircraft. Qatar’s strategic location as an aviation hub in the Middle East will continue to fuel the growth of hybrid aircraft in the region, supporting both domestic and international aviation operations.

Major Players

- Airbus SE

- Embraer S.A.

- Boeing

- ZeroAvia

- Honeywell Aerospace

- Safran S.A.

- Rolls-Royce

- Textron Aviation

- VoltAero

- Heart Aerospace

- General Electric Aviation

- Electric Aviation Group Ltd.

- Pipistrel

- XTI Aircraft

- Avidyne Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aviation manufacturers and OEMs

- Airline operators and airport authorities

- Aviation maintenance, repair, and overhaul (MRO) service providers

- Electric and hybrid battery system developers

- Fuel and energy providers (Hydrogen, Electric Charging)

- Aircraft leasing companies

Research Methodology

Step 1: Identification of Key Variables

The research starts by mapping the ecosystem of stakeholders in the Qatar Hybrid Aircraft Market. This involves identifying key manufacturers, airlines, regulatory bodies, and technology providers. A mix of secondary and primary data sources helps define the critical variables that influence the market dynamics.

Step 2: Market Analysis and Construction

We analyze historical data on hybrid aircraft adoption, including market penetration, fleet size, and operational cost efficiency. A combination of interviews with industry experts and secondary data from aviation reports will help to refine the accuracy of market size and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses will be validated through direct consultations with hybrid aircraft manufacturers, airline executives, and aviation technology experts. This expert feedback will be gathered through structured interviews and questionnaires to ensure the data reflects real-time developments.

Step 4: Research Synthesis and Final Output

The final phase involves cross-verification of the collected data through direct engagement with aircraft manufacturers, airline operators, and regulatory authorities. This will ensure that the report is both comprehensive and accurate, including all key insights into the market’s current status and future growth trajectories.

- Executive Summary

- Research Methodology (Market Definition and Hybrid Propulsion Scope (Parallel, Series, Distributed Hybrid), Assumptions and Market Boundaries (Certification, Operations, Infrastructure), Abbreviations and Units, Primary Research and Expert Validation Protocol, Secondary Data Sources and Regional Aviation Data Used, Limitations and Data Confidence Levels)

- Definition and Hybrid Aircraft Market Scope

- Qatar Aviation Ecosystem Snapshot (Airports, Carriers, Regulatory Bodies)

- Global Hybrid Aircraft Technology Evolution and Innovation Drivers

- Qatar Transport & Sustainability Imperatives Impacting Adoption

- Macro‑Economic and GDP Per Capita Influence on Aviation Modernization

- Growth Drivers

Sustainability Regulation Impact (ICAO Net Zero Targets, Qatar Environmental Policy)

Fuel Price Volatility and Lifecycle Cost Optimization

Airport Slot & Regional Connectivity Prioritization

Hybrid‑Enabled Lower Noise Profiles for Urban Operations

Local Innovation Funding and Public‑Private Collaboration Incentives

- Market Challenges

Certification Barriers for Hybrid Propulsion

Infrastructure Adequacy (Charging, Hydrogen Refueling)

Battery Energy Density & Thermal Management Constraints

- Opportunities

Adoption in GCC Air Travel Corridors

Advanced Air Mobility Corridors (Doha Urban Mobility)

Strategic Partnerships (Airlines × OEMs × Tech Providers)

- Market Trends

Collaborative R&D Platforms in Middle East Aviation

Digital Twin & Predictive Maintenance Integration in Hybrid Fleets

- Government Regulations & Policies

Aviation Emission Mandates

Safety Standards for Hybrid Propulsion Certification

- SWOT Analysis

- Stakeholder Ecosystem – Qatar (Air Navigation Service Providers, MROs, OEMs, Regulators)

- Porter’s Five Forces (Supply Influence, Buyer Bargaining, Technology Barriers)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Aircraft Propulsion Type (In Value %)

Parallel Hybrid Propulsion (Internal Combustion + Electric)

Series Hybrid Propulsion

Distributed Electric Hybrid Systems

Hydrogen‑Hybrid Systems - By Aircraft Platform (In Value %)

Regional Turboprop & Commuter Aircraft

Advanced Air Mobility (AAM/eVTOL for Urban Air Traffic)

Business Jets & Corporate Transport

Unmanned Hybrid UAV Platforms

Hybrid Helicopters (SAR/Offshore Operations) - By Energy Storage & Power Source (In Value %)

Lithium‑Ion Battery Systems

Solid‑State Batteries

Hydrogen Fuel Cell Hybrid

Supercapacitors + Battery Hybrid

On‑board Power Management Systems - By Operational Range (In Value %)

Short Range (<500 km)

Medium Range (500–1000 km)

Extended Range (>1000 km) - By Segment Use Case (In Value %)

Passenger Regional Transport

Cargo & Logistics

Offshore Energy Support (Oil & Gas, Platforms)

Defense & Border Surveillance

Emergency & Medical Evacuation

- Market Share of Major Players in Qatar

- Cross‑Comparison Parameters (Company Overview, Strategic Roadmap, Technology Depth (Battery/Propulsion Platforms), Certification Status, Supply Chain Integrations, Partnership Ecosystem, Production Footprint, R&D Intensity, After‑Sales Support Network, Deployment in Qatar/Middle East, Pricing Strategy, Revenue by Segment, Order Backlog, Key IP Holdings, System Integration Capabilities)

- Competitor Analysis

Airbus SE (Hybrid Programs – CityAirbus/Near‑Regional Concepts)

Embraer S.A. (Hybrid/Distributed Propulsion Initiatives)

Boeing (Prototypes, EcoDemonstrator Hybrid Trials)

ZeroAvia (Hydrogen Hybrid Power Systems)

Ampaire, Inc. (Regional Hybrid Aircraft)

Heart Aerospace AB (Regional Hybrid Turboprop Solutions)

Textron Aviation (Hybrid Retrofit Pathways)

VoltAero SAS (Hybrid Airframes)

Pipistrel d.o.o. (Electric + Hybrid Small Platforms)

XTI Aircraft Company (Hybrid Transport Concepts)

Honeywell Aerospace (Hybrid Power Management)

Safran S.A. (Hybrid Engines & Electric Drives)

Rolls‑Royce (Hybrid Propulsion Tests)

General Electric (Hybrid Aviation Tech Units)

Electric Aviation Group Ltd. (Hybrid Electric Platforms)

- Market Demand and Utilization (Commercial, Cargo, Defense)

- Adoption Drivers by User Type (Airlines, Charter Operators)

- Budget Allocation Trends for Hybrid Fleet Acquisition

- Decision‑Making Criteria

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035