Market Overview

The Qatar In-Flight Entertainment and Connectivity (IFE&C) market is experiencing significant growth, driven by the increasing demand for improved passenger experiences and the need for seamless connectivity during flights. As of 2025, the market size is expected to be valued at approximately USD ~ million. This market is primarily driven by advancements in satellite communication technologies, growing investments in airline digitalization, and the rising preference for high-speed, high-quality entertainment systems. Additionally, the push towards offering more personalized in-flight experiences is accelerating market adoption, with major airlines integrating advanced IFE&C systems to meet passenger expectations.

Qatar, and the broader Middle East region, is at the forefront of the IFE&C market. Qatar Airways, as a flagship airline, has led the charge in adopting cutting-edge IFE&C systems, positioning the country as a dominant player. The nation’s strong aviation infrastructure, coupled with its strategic location as a global hub for connecting flights, provides an ideal environment for expanding in-flight connectivity services. Moreover, cities like Doha, which is the country’s economic and aviation center, play a significant role in this market’s development due to their continuous investments in airline modernization and airport upgrades.

Market Segmentation

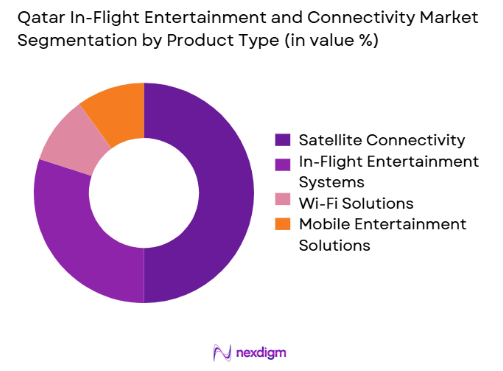

By Product Type

The Qatar IFE&C market is segmented by product type into satellite connectivity, in-flight entertainment systems, Wi-Fi solutions, and mobile entertainment services. In-flight entertainment systems are expected to dominate the market in 2025, primarily due to their widespread implementation across major airlines operating in the region, such as Qatar Airways. These systems offer passengers a range of entertainment options, including movies, music, games, and live TV, contributing to an enhanced travel experience. The popularity of these systems is also bolstered by the increasing demand for personalized and immersive in-flight experiences. The implementation of seat-back screens and the ability to connect passengers with the internet further boost the adoption of these solutions, providing Qatar with a competitive edge in the IFE&C space.

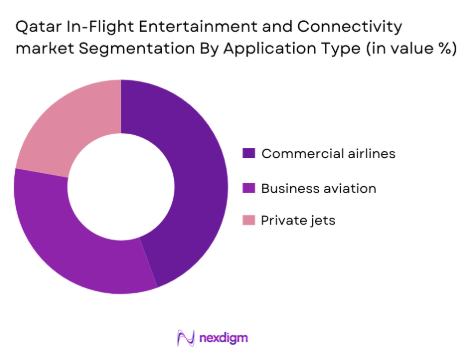

By Application

The IFE&C market in Qatar is segmented by application into commercial airlines, business aviation, and private jets. Among these segments, commercial airlines dominate the market share in 2024, with Qatar Airways leading the charge in providing superior IFE&C systems. Commercial airlines benefit from the larger passenger base and greater demand for high-speed internet connectivity and entertainment options. As one of the world’s leading carriers, Qatar Airways continuously upgrades its fleet with the latest IFE&C technologies, making commercial aviation the largest contributor to the market’s growth. This trend is expected to continue with the increasing demand for high-quality, seamless connectivity solutions on long-haul flights.

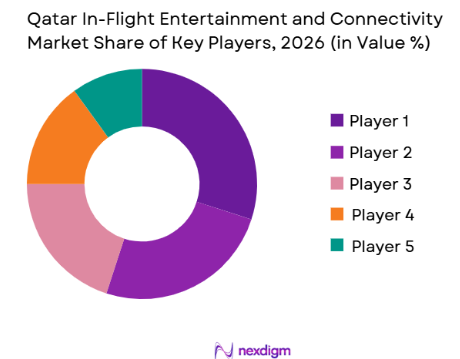

Competitive Landscape

The Qatar In-Flight Entertainment and Connectivity market is characterized by the presence of several key players, both regional and global, including aircraft manufacturers, satellite connectivity providers, and content service providers. The market is dominated by major players like Qatar Airways, Inmarsat, and Thales Group, which offer comprehensive IFE&C solutions for the aviation industry. These companies are continuously innovating and expanding their service offerings to meet the increasing demand for high-speed connectivity and personalized entertainment options in-flight. The competition is intensifying as airlines strive to differentiate themselves through advanced IFE&C systems that enhance the overall passenger experience.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Product Portfolio | Revenue (2024) | Technology Focus |

| Qatar Airways | 1993 | Doha, Qatar | ~ | ~ | ~ | ~ |

| Inmarsat | 1979 | London, UK | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Gogo Inc. | 1991 | Broomfield, USA | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | California, USA | ~ | ~ | ~ | ~ |

Qatar In-Flight Entertainment and Connectivity Market Analysis

Growth Drivers

Increasing Demand for Seamless Connectivity

The increasing demand for seamless connectivity during air travel is one of the significant drivers for the Qatar IFE&C market. As of 2024, global internet traffic reached ~ zettabytes, and the Middle East region alone witnessed a ~% increase in internet users from 2024 to 2025. This surge in internet consumption has driven passengers to demand reliable and continuous in-flight connectivity. Qatar, as a prominent aviation hub, benefits from this trend, with travelers expecting uninterrupted high-speed internet for both personal and professional use. According to the World Bank’s 2024 data, Qatar’s internet penetration rate was ~%, reflecting the growing dependency on high-speed connectivity in all aspects of daily life.

Expansion of Airline Networks and In-Flight Service Offerings

Qatar’s aviation sector is expanding rapidly, as demonstrated by the continuous fleet upgrades and the increasing number of global destinations. In 2024, Qatar Airways reached a milestone by expanding to more than ~ destinations worldwide, up from ~in 2024. This growth is closely linked to the rising demand for sophisticated in-flight services, including enhanced entertainment and connectivity solutions. The Gulf Cooperation Council (GCC) region, which includes Qatar, is witnessing a boom in airline expansion, with the International Air Transport Association (IATA) forecasting an ~% increase in air traffic within the Middle East region over the next two years. This expansion in routes and services amplifies the need for advanced IFE&C systems to cater to a diverse passenger base.

Market Challenges

High Infrastructure and Maintenance Costs

The high infrastructure and maintenance costs associated with in-flight entertainment and connectivity systems represent a significant challenge in the Qatar market. According to the International Civil Aviation Organization (ICAO), the cost of upgrading in-flight communication systems and maintaining satellite connectivity for a single aircraft can reach up to USD ~million annually. Additionally, infrastructure such as satellites, data centers, and network management platforms, which are critical to maintaining these systems, demand substantial capital investment. With Qatar Airways operating a fleet of over ~aircraft, the cumulative expenditure for maintaining IFE&C systems across its fleet is substantial. These high operational costs place pressure on airlines to balance service quality with profitability.

Regulatory Hurdles and Airspace Limitations

Airspace limitations and regulatory hurdles are additional challenges faced by the Qatar IFE&C market. Qatar’s geographical location as a transit hub often leads to its airspace being subject to complex international aviation regulations. The International Telecommunications Union (ITU) governs satellite communications, and its stringent regulations limit the bandwidth and frequencies available for in-flight connectivity. As of 2024, the ITU allocated specific frequency bands for aviation communications, which has led to competition for airwaves, especially in high-demand flight corridors. Moreover, the Gulf region has faced airspace restrictions during periods of geopolitical tension, which can affect connectivity services in certain regions. Airlines must navigate these regulations while maintaining high service standards for passengers.

Opportunities

Rise of 5G Connectivity and its Integration in Aircraft

The introduction of 5G technology offers substantial opportunities for the Qatar IFE&C market. The Middle East, including Qatar, is expected to see an accelerated rollout of 5G networks. In 2024, Qatar’s 5G adoption rate was at ~%, with the government planning to increase nationwide 5G coverage to over ~% by the end of 2026. This rise in 5G infrastructure presents a prime opportunity for the aviation industry to integrate 5G connectivity into aircraft. With 5G offering faster speeds and lower latency compared to 4G networks, it could revolutionize in-flight entertainment by providing passengers with seamless streaming, real-time gaming, and more interactive content. Qatar Airways has already begun testing 5G-enabled aircraft systems in partnership with major satellite and telecom companies, making the integration of 5G connectivity a potential game-changer for the region’s aviation sector.

Increased Investment in Sustainable Aviation Practices

The growing emphasis on sustainability in aviation presents another key opportunity for the IFE&C market in Qatar. Qatar has made significant investments in sustainable aviation technologies as part of its commitment to the United Nations Sustainable Development Goals (SDGs). In 2024, Qatar Airways announced plans to reduce its carbon emissions by ~% by 2030, with a significant portion of this strategy focused on investing in more efficient in-flight technologies. Airlines are increasingly adopting fuel-efficient aircraft and sustainable practices, and in-flight connectivity is no exception. Sustainable solutions for IFE&C, such as energy-efficient servers for entertainment systems and the integration of renewable energy sources for satellite communication, are expected to gain momentum. This trend towards sustainability provides growth opportunities for suppliers offering eco-friendly IFE&C solutions.

Future Outlook

Over the next several years, the Qatar IFE&C market is expected to show significant growth driven by advancements in satellite and air-to-ground communication technologies, increasing demand for seamless passenger connectivity, and enhanced in-flight entertainment experiences. Qatar Airways and other major carriers in the region are expected to continue investing in next-generation IFE&C systems, enabling better internet access and more interactive services. Additionally, the government’s initiatives to position Qatar as a hub for high-tech aviation services will further fuel the market’s growth, ensuring the country’s leadership in the global IFE&C space.

Major Players

- Qatar Airways

- Inmarsat

- Thales Group

- Gogo Inc.

- Panasonic Avionics

- Viasat Inc.

- Honeywell Aerospace

- Global Eagle Entertainment

- Collins Aerospace

- Satcom Direct

- SITAONAIR

- L3 Technologies

- Intelsat

- SES Networks

- Boeing

Key Target Audience

- Investments and Venture Capitalist Firms

- Airline Operators

- Aircraft Manufacturers

- Satellite Connectivity Providers

- Aviation Regulatory Bodies

- Government and Regulatory Bodies

- Airport Authorities

- Airline Equipment Suppliers

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we identified key variables affecting the IFE&C market in Qatar, including technological advancements, airline investments, and regulatory requirements. This step involved comprehensive desk research, using databases from aviation and telecommunications industries to gather accurate market data.

Step 2: Market Analysis and Construction

We conducted a thorough analysis of historical market data, including data on the adoption of IFE systems by airlines, and the technological capabilities of satellite communication providers. This phase also involved assessing the ratio of airlines adopting IFE&C solutions and evaluating the resulting revenue growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated by interviewing industry experts, including executives from major airlines and technology providers. These consultations helped refine the market data and provided insights into the operational and financial aspects of the market, allowing for a more accurate forecast.

Step 4: Research Synthesis and Final Output

The final research synthesis involved cross-referencing data from bottom-up market analysis with insights from industry stakeholders. By directly engaging with airlines and service providers, we verified key findings and ensured the accuracy of the final output.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle and Economic Influence on IFE&C

- Supply Chain and Value Chain Analysis

- Key Drivers of IFE&C Adoption

- Technological Advancements Shaping the IFE&C Market in Qatar

- Growth Drivers

Increasing Demand for Seamless Connectivity

Expansion of Airline Networks and In-Flight Service Offerings

Technological Advancements in Airborne Connectivity Solutions

Demand for Passenger-Centric, Personalized Entertainment

Growth in Middle Eastern Aviation Sector - Market Challenges

High Infrastructure and Maintenance Costs

Regulatory Hurdles and Airspace Limitations

Data Security and Privacy Concerns

Limited Coverage in Remote/Long-Haul Flights - Opportunities

Rise of 5G Connectivity and its Integration in Aircraft

Increased Investment in Sustainable Aviation Practices

Expansion of Smart Airports and Ground Services

Growing Demand for Interactive, Immersive In-Flight Entertainment - Trends

Passenger Engagement and Interactive Content Trends

Adoption of Green and Sustainable IFE Systems

Convergence of IFE with Internet of Things (IoT) Technology

Shift Toward More Affordable and Accessible Connectivity Solutions

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Product Type (In Value %)

Satellite Connectivity

Wi-Fi Solutions

In-Flight Entertainment Systems

Real-Time Communication

Mobile Entertainment Solutions - By Application (In Value %)

Commercial Airlines

Business Aviation

Charter and Private Jets

Military and Defense

Airports and Ground Services - By Service Provider (In Value %)

Network Service Providers

Content and Software Providers

In-Flight Connectivity Hardware Providers

Airlines with Integrated Solutions

Third-party Integration Service Providers - By Region (In Value %)

Middle East

North America

Europe

Asia Pacific

Africa - By Technology (In Value %)

Satellite Communication

Air-to-Ground Communication

5G and Next-Gen Connectivity

Virtual and Augmented Reality for Entertainment

Hybrid Connectivity Solutions

- Market Share of Major Players (By Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plants, Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis

- Porter’s Five Forces

- Detailed Profiles

Qatar Airways

Emirates Airlines

Etihad Airways

Turkish Airlines

Inmarsat

Gogo Inc.

Panasonic Avionics Corporation

Thales Group

Viasat Inc.

Honeywell Aerospace

Global Eagle Entertainment

Collins Aerospace

Satcom Direct

SITAONAIR

L3 Technologies

- Airlines’ Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements for IFE&C Adoption

- Passenger Needs, Desires, and Pain Points

- Decision-Making Process in Airline Adoption of IFE&C Solutions

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035