Market Overview

As of 2024, the Qatar infrastructure construction market is valued at USD 65.7 billion, with a growing CAGR of 10.2% from 2024 to 2030, reflecting a robust development trajectory fueled by substantial government investments and a burgeoning population. Infrastructure development in Qatar is primarily driven by the need to host large-scale events, such as the FIFA World Cup, alongside continuous urbanization efforts to accommodate the increasing demand for residential, commercial, and industrial facilities.

Dominating cities in the Qatar Infrastructure Construction market include Doha and Lusail, which serve as the economic and cultural hubs. Doha, as the capital, attracts considerable investment due to its strategic location and established infrastructure. Lusail is developed as a smart city aimed at enhancing urban living standards, thus attracting numerous projects focused on sustainability and modernization, leading to its rising prominence in the construction sector.

Market Segmentation

By Project Type

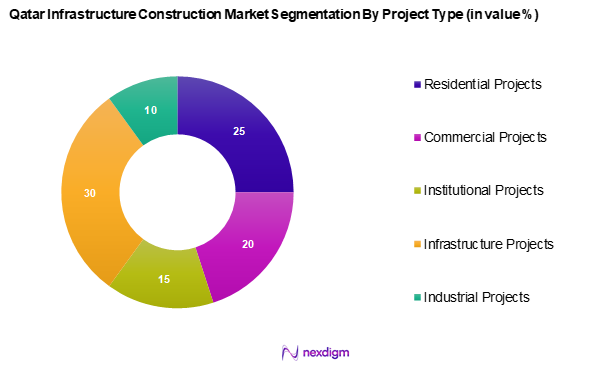

The Qatar infrastructure construction market is segmented into residential projects, commercial projects, institutional projects, infrastructure projects, and industrial projects. Notably, infrastructure projects currently dominate the market due to significant governmental spending on roads, transportation, and utilities that support diverse urban initiatives. Projects like the Doha Metro and the new Hamad International Airport have attracted substantial investments, driving growth in this segment, as they are pivotal for bolstering connectivity and accommodating the country’s future economic expansion.

By Construction Material

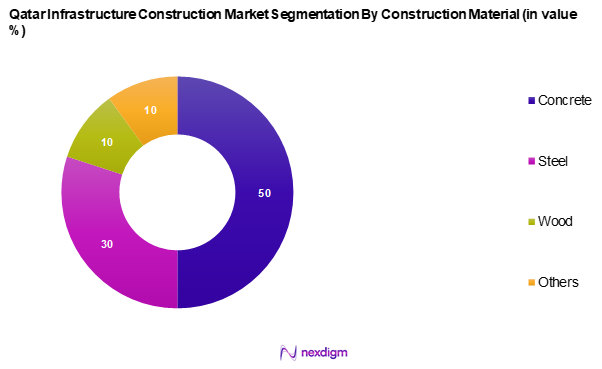

The Qatar infrastructure construction market is segmented into concrete, steel, wood, and others. Concrete leads this sector as the dominant construction material, reflecting its critical role in infrastructure projects due to characteristics such as durability, availability, and cost-effectiveness. The increasing focus on sustainable construction methods has further enhanced the use of concrete, especially in environmentally friendly initiatives such as precast concrete technology that minimizes waste and optimizes energy use during construction.

Competitive Landscape

The Qatar Infrastructure Construction market is dominated by several key players who play a critical role in shaping the industry landscape. Major companies include Qatari Diar, Qatar Engineering and Construction Company, Galfar Al Misnad, and Gulf Contracting Company. Their strong market position is attributed to their extensive portfolios and reputable track records in executing large-scale infrastructure projects.

| Company | Establishment Year | Headquarters | No. of Projects | Revenue

(USD Mn) |

Major Clients | Market Position |

| Qatari Diar | 2005 | Doha, Qatar | – | – | – | – |

| Qatar Engineering and Construction | 1975 | Doha, Qatar | – | – | – | – |

| Galfar Al Misnad | 1995 | Doha, Qatar | – | – | – | – |

| Gulf Contracting Company | 1976 | Doha, Qatar | – | – | – | – |

| Redco Construction – Almana | 1998 | Doha, Qatar | – | – | – | – |

Qatar Infrastructure Construction Market Analysis

Growth Drivers

Rising Population and Urbanization

Qatar’s population has witnessed significant growth, with an estimated increase from 2.7 million in 2022 to 2.9 million in 2025. This escalating population encourages urban expansion and housing development. Urbanization rates in Qatar are projected to rise, with around 99% of the population expected to reside in urban areas by 2025. The country’s ongoing efforts to ensure infrastructure supports housing and urban development are echoed in government strategies such as the Qatar National Vision 2030. This vision aims to boost livability through sustainable urban environments, which requires substantial infrastructure investments.

Government Investments in Mega Projects

The Qatari government has allocated an ambitious budget exceeding QAR 210 billion (USD 57.69 billion) towards infrastructure projects as part of its National Development Strategy 2030. Major projects include the expansion of the Doha Metro and the development of the Lusail City. According to the Ministry of Finance, these projects are expected to create approximately 45,000 jobs from 2022 to 2025, significantly bolstering the construction sector. Moreover, the FIFA World Cup 2022 acted as a catalyst for massive investment in sports and transport infrastructure, laying a solid foundation for future growth.

Market Challenges

Regulatory Restrictions

In Qatar, regulatory challenges significantly impact the construction sector. The country has stringent building codes that ensure safety and sustainability. According to the Qatar Ministry of Municipality, compliance with over 300 regulatory requirements can lead to delays, with an average project delay of 12 months reported in recent years. These regulations can deter foreign investments. Navigating the complex permitting process, which involves multiple agencies and detailed compliance documentation, remains a challenge for developers seeking to promote efficient project completion.

Skilled Labor Shortage

The labor market in Qatar faces a substantial skills gap, with an estimated shortfall of over 40,000 skilled workers in the construction sector as of 2023. This shortage has prompted employers to import labor, driving costs and affecting project timelines. The Qatar Chamber of Commerce identified that around 30% of construction projects are experiencing delays due to insufficient skilled workers, particularly in specialized construction trades.

Opportunities

Sustainability Trends

Sustainability is emerging as a vital driver in Qatar’s construction sector, with the government emphasizing green building practices. In 2023, approximately 20% of new buildings were certified under the Qatar Sustainability Building Standard (QSBS). Additionally, investments in renewable energy projects are on the rise, with QAR 10 billion allocated for green projects by 2025. The construction industry stands to gain significantly from these sustainability initiatives, as they enhance energy efficiency and reduce operational costs while meeting international environmental standards, thus creating opportunities for local companies involved in sustainable construction technologies.

Smart City Initiatives

The Smart Qatar initiative (TASMU) is set to revolutionize urban living through intelligent infrastructure solutions. The government plans to invest QAR 1.5 billion in smart city technologies by 2025, focusing on enhanced connectivity and urban services. In 2023, about 15% of urban areas are equipped with smart infrastructure systems, which include smart traffic management and energy-efficient buildings. These developments create opportunities for tech firms and construction companies to collaborate, enhancing operational efficiencies and improving the quality of urban life in Qatar.

Future Outlook

Over the next five years, the Qatar Infrastructure Construction market is expected to experience significant growth driven by strategic government initiatives, particularly in preparation for future mega-events. The continued influx of foreign investments focused on infrastructure expansion and smart city developments will further enhance market dynamics. Additionally, increasing emphasis on sustainable construction practices and technological advancements will likely contribute to transforming the construction landscape significantly.

Major Players

- Qatari Diar

- Qatar Engineering and Construction Company

- Galfar Al Misnad

- Gulf Contracting Company

- Redco Construction – Almana

- MIDMAC Contracting

- Al Jaber Group

- Arab Engineering Bureau

- Dar Al Handasah

- KEO International Consultants

- AECOM

- Bechtel

- LafargeHolcim

- Qatar National Cement Company

- Qatar Building Company

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Ministry of Municipality and Environment)

- Real estate developers

- Construction material suppliers

- Urban planning consultants

- Public infrastructure authorities

- Project management firms

- Major contractors and subcontractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar Infrastructure Construction market. This step utilizes extensive desk research and a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as demand trends, pricing mechanisms, and regulatory impacts.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Qatar Infrastructure Construction market is compiled and analyzed. This includes assessing market penetration, the ratio of construction project types, and resultant revenue generation for different segments. Furthermore, an evaluation of project completion timelines and investment sources will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed during the initial analysis will be validated through consultations with industry experts representing a diverse array of companies in the construction sector. These interviews will provide valuable insights into operational dynamics, financial performance, and strategic directions, thereby refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves collaborative engagement with construction project stakeholders to acquire detailed insights into project execution, material preferences, and market demand. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring the analysis encompasses comprehensive, accurate, and validated insights into the Qatar Infrastructure Construction market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Remote Data Collection Techniques, Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Population and Urbanization

Government Investments in Mega Projects - Market Challenges

Regulatory Restrictions

Skilled Labor Shortage - Opportunities

Sustainability Trends

Smart City Initiatives - Trends

Digital Twin Technology Adoption

Prefabricated Construction Methods - Government Regulation

Building Codes and Standards

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Project Cost, 2019-2024

- By Project Type

Residential Projects

– Apartments

– Villas

– Gated Communities

– Worker Housing Compounds

Commercial Projects

– Office Towers

– Shopping Malls

– Hotels and Resorts

– Mixed-Use Developments

Institutional Projects

– Schools and Universities

– Hospitals and Clinics

– Government Buildings

– Religious Institutions

Infrastructure Projects

– Roads and Highways

– Metro and Rail Networks

– Airports and Ports

– Water Supply and Sewerage

Industrial Projects

– Warehouses and Logistics Parks

– Manufacturing Plants

– Oil & Gas Facilities

– Power Generation and Desalination Plants - By Construction Material

Concrete

– Precast Concrete

– Ready-Mix Concrete

– Reinforced Concrete

Steel

– Structural Steel Frames

– Steel Rebars

– Steel Cladding

Wood

– Timber Frames

– Engineered Wood

– Plywood and Composite Boards

Others

– Glass

– Bricks and Blocks

– Sustainable and Recycled Materials - By Region

Doha

Al Rayyan

Lusail

Al Wakrah

Umm Salal

Al Khor - By Contracting Type

Fixed Price

– Lump Sum Contracts

– Turnkey Projects

Cost Plus

– Cost Plus Fixed Fee

– Cost Plus Incentive Fee

Time and Material

– Hourly Rate Contracts

– Unit Price Contracts - By End User Sector

Government

– Ministries and Municipalities

– Infrastructure Authorities (Ashghal, etc.)

Private Sector

– Real Estate Developers

– Industrial Park Operators

Public-Private Partnerships (PPP)

– Transport Infrastructure Projects

– Healthcare and Education PPPs

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Project Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue Sources, Distribution Channels, Technological Investment, Project Management Approaches)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Qatari Diar

Qatar Engineering and Construction Company

Galfar Al Misnad

Gulf Contracting Company

Redco Construction – Almana

MIDMAC Contracting

Al Jaber Group

Arab Engineering Bureau

Dar Al Handasah

KEO International Consultants

AECOM

Bechtel

LafargeHolcim

- Demand Analysis

- Budget Allocation Trends

- Regulatory Compliance Needs

- Key Decision Factors

- Buyer Persona Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Project Cost, 2025-2030