Market Overview

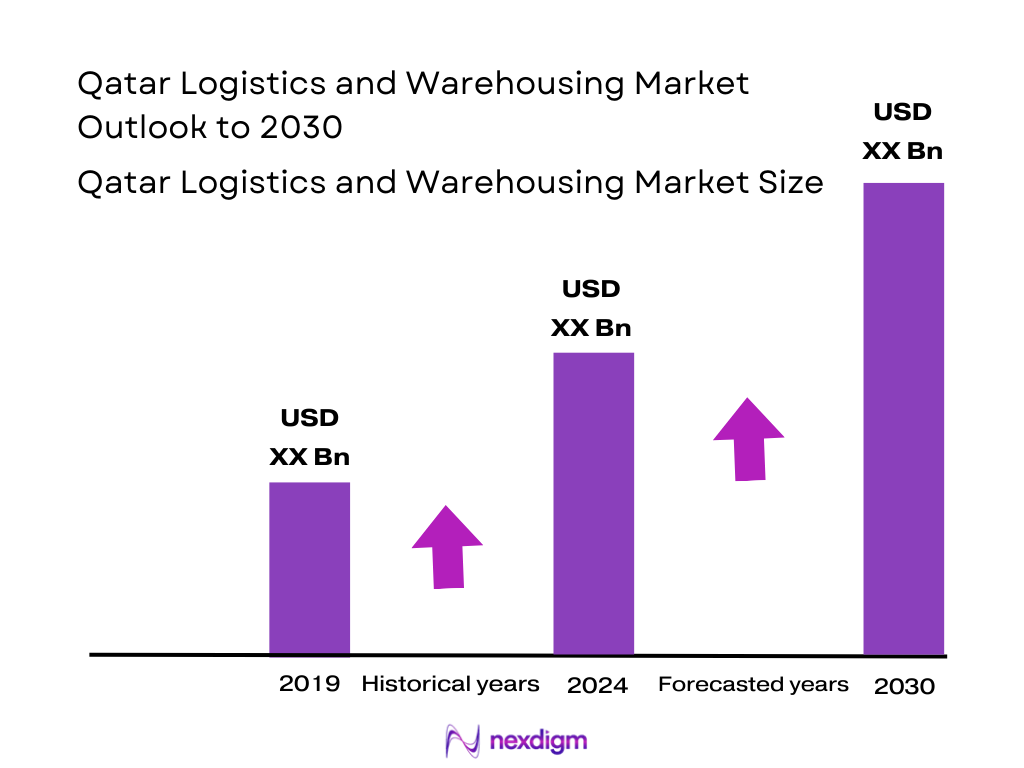

The Qatar freight and logistics market is valued at USD 9.53 billion in 2024. This reflects robust throughput across sea port TEUs, air cargo volumes, and warehousing capacity. Growth in 2023 stemmed from rapid expansion of Hamad Port handling over 1.4 million TEUs and rising freight volumes linked to infrastructure development and increasing e‑commerce and energy exports. These factors also drove warehousing demand and CEP volumes, consolidating market size in 2024.

Logistics activity is heavily concentrated in Doha and Greater Doha metro area, anchored by Hamad Port, Hamad International Airport, and free‑zone facilities at Ras Bufontas and Um Al‑Houl. Doha’s dominance is due to its deep‑water port capacity, strategic location at the Asia‑Europe‑Africa trade corridor, and world‑class cargo infrastructure. Secondary hubs like Umm Salal and Bu Fasseela Warehousing Park support industrial customers through lower‑cost logistics land and warehouse capacity.

Based on Nexdigm, the market is forecasted to grow at a CAGR of ~5.9% between 2024 and 2030, reaching approximately USD 13.49 billion by 2030.

Market Segmentation

By Service Type

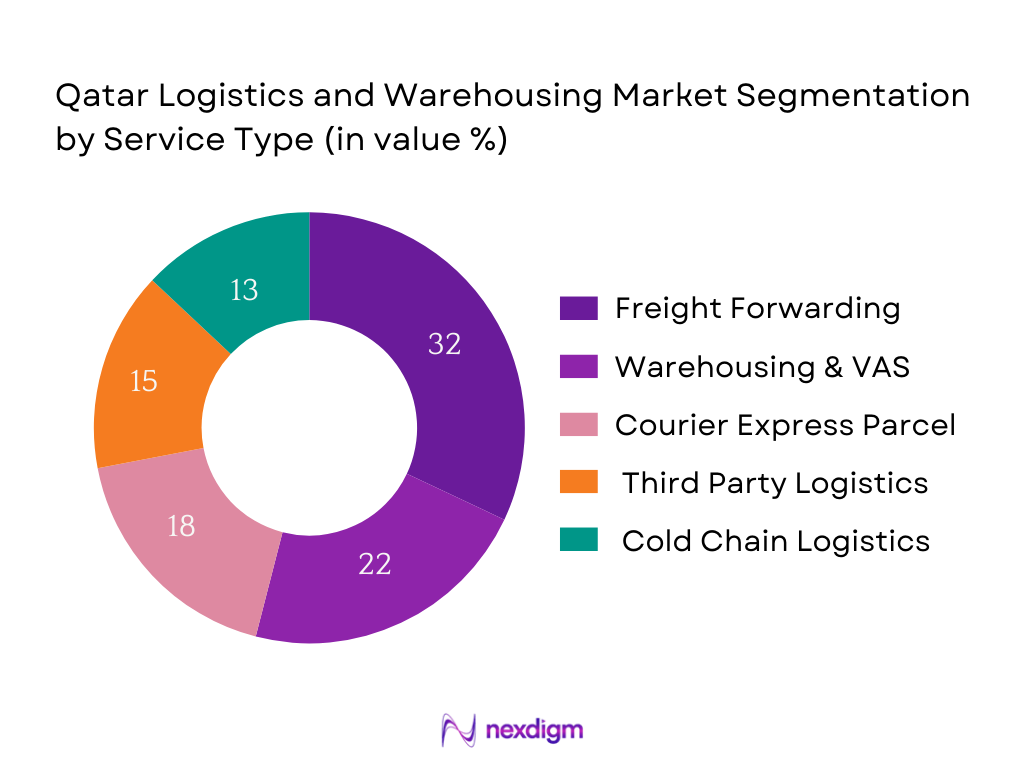

The Qatar logistics market is segmented into Freight Forwarding, Warehousing & Value Added Services (VAS), Courier Express Parcel (CEP), Third Party Logistics (3PL) Integrated Services, and Cold Chain Logistics. Freight Forwarding holds the largest share due to high sea and air cargo volumes driven by Qatar’s LNG exports and imports of over 3,500 product lines from 122 countries. Hamad Port processed over 1.54 million TEUs in 2021, with 557,464 TEUs in transshipment alone in 2023, making freight forwarding the backbone of trade logistics.

By Freight Forwarding

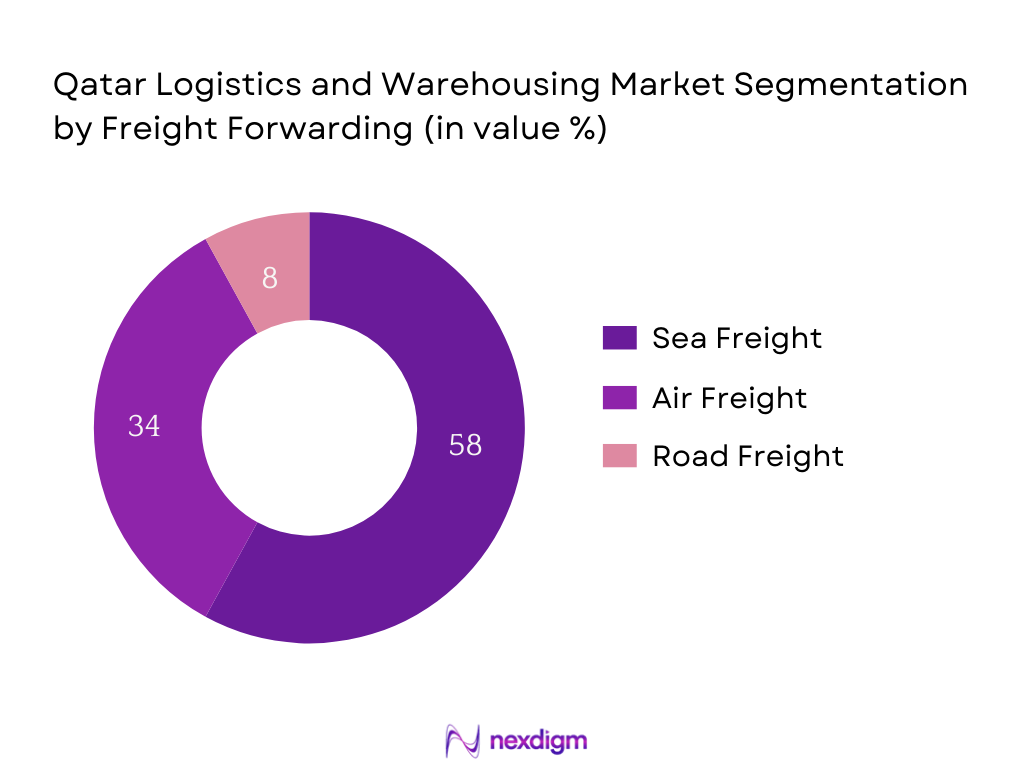

The segment covers sea, air, and road forwarding. Sea Freight dominates due to Hamad Port’s ability to handle 7.8 million tonnes annually and its role in LNG exports. Air freight, supported by Hamad International Airport’s cargo capacity exceeding 2 million tonnes per year, serves high-value goods such as pharma, electronics, and perishables. Road freight remains smaller, serving GCC cross-border trade through Abu Samra.

By Warehousing

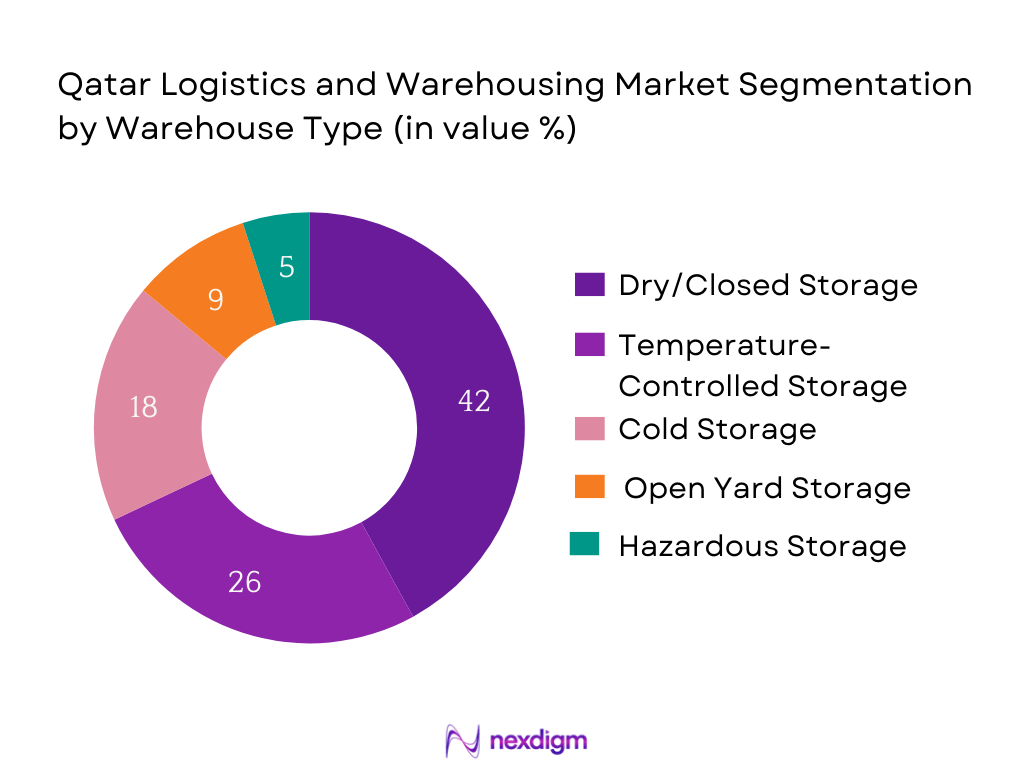

Covers storage facilities segmented by type and functional specification. Dry/Closed Storage leads the Qatar warehousing market, driven by the high volume of non-perishable imports such as construction materials, electronics, and general retail goods. Qatar imported goods from 122 countries across more than 3,500 HS-6 categories in 2022, most of which require dry storage conditions. Large inland hubs such as Umm Salal Logistics Park and Bu Fasseela handle the bulk of these goods due to their proximity to Doha’s retail and industrial zones, customs-bonded status, and access to Hamad Port via major road corridors.

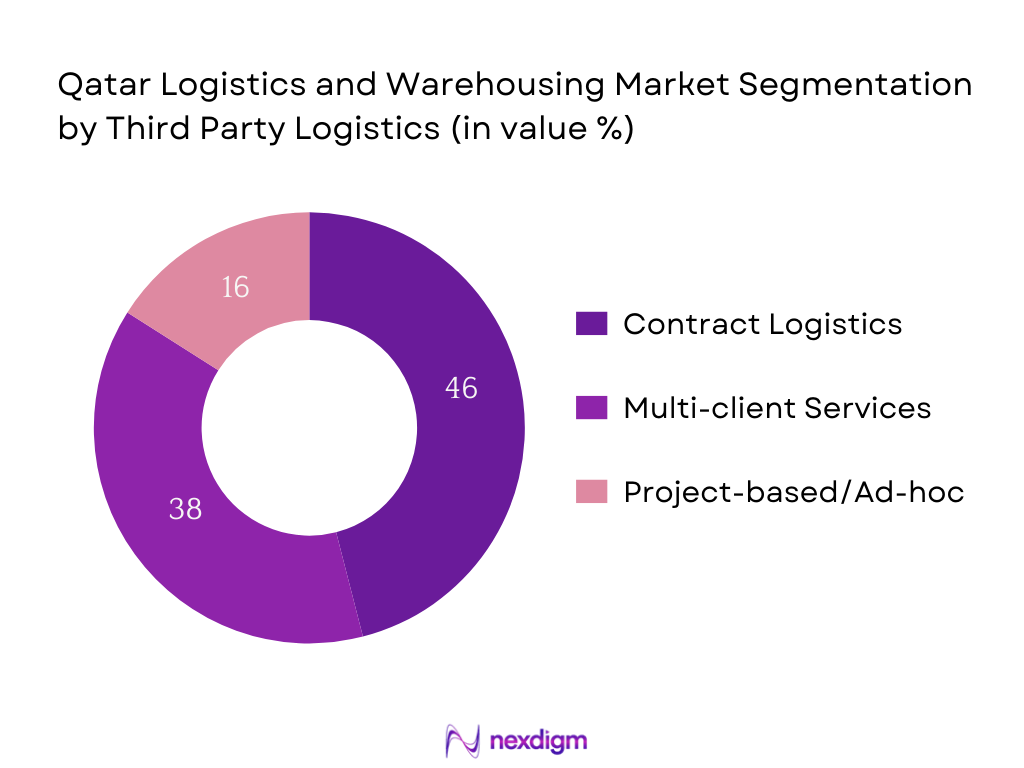

By 3PL (Third Party Logistics)

Covers outsourced logistics contracts across different service scopes. Dedicated contract logistics leads as large players like GWC, DHL, and Milaha serve energy, retail, and industrial sectors with multi-year contracts. Energy & LNG remains the largest 3PL client vertical, leveraging integrated inbound, storage, and export services linked to Ras Laffan’s LNG facilities.

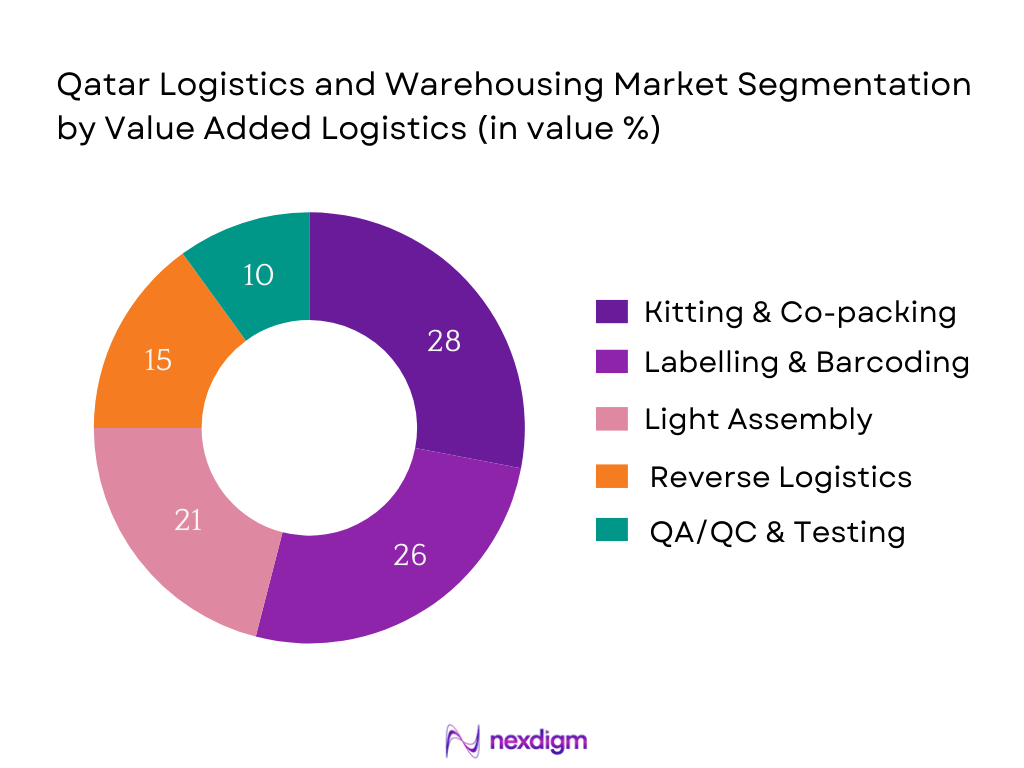

By Value Added Services (VAS)

Includes kitting, labelling, packaging, and customization. Kitting & Co-packing leads as Qatar’s FMCG and retail sectors demand tailored product packaging and promotional bundling. Growing e-commerce and seasonal campaigns increase throughput in these VAS cells, especially in free-zone facilities where customs clearance is streamlined.

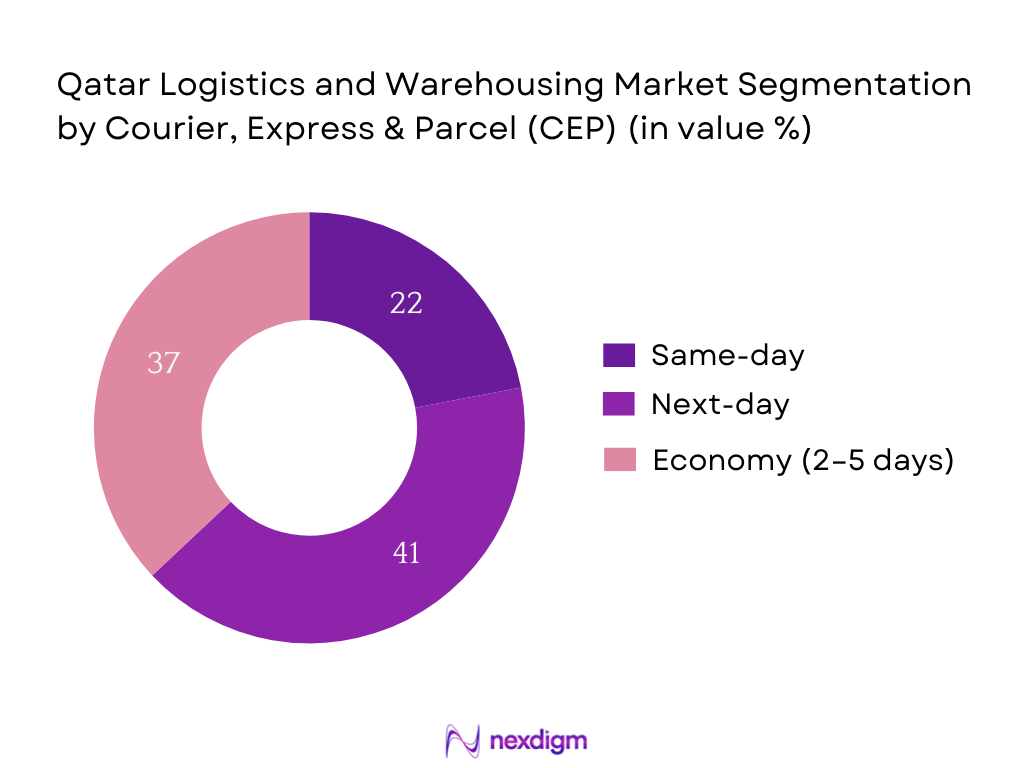

By Courier Express Parcel (CEP)

Covers domestic and cross-border express delivery. Next-day delivery dominates due to high service-level expectations in Doha and Greater Doha, where over 80% of the population resides (World Bank – Qatar Population). Major operators such as Qatar Post, Aramex, and DHL use central sortation hubs to achieve rapid turnaround, while same-day is growing in premium retail and urgent B2B deliveries.

Competitive Landscape

The market is consolidated around several major logistics names. The Qatar freight and logistics sector is led by a blend of national players—such as Gulf Warehousing Company (GWC), Qatar Airways Cargo, Nakilat, and Milaha—and global carriers including DHL, FedEx, Maersk, Aramex, and GAC. These companies exert strong control over transport, warehousing, and parcel services, driven by scale, infrastructure partnerships, and integrated service offerings.

| Company | Est. Year | HQ Location | Warehousing Capacity (m²) | Ports/Free‑Zone Reach | Automation & Tech Adoption | Client Vertical Focus | Pricing Model | Recent Strategic Moves |

| Gulf Warehousing Company (GWC) | 1955 | Doha | – | – | – | – | – | – |

| Qatar Airways Cargo | 1990s | Doha | – | – | – | – | – | – |

| Milaha (Qatar Navigation) | 1957 | Doha | – | – | – | – | – | – |

| Nakilat | 2004 | Doha | – | – | – | – | – | – |

| DHL Qatar | 1969 | Doha | – | – | – | – | – | – |

Qatar Logistics & Warehousing Market Analysis

Growth Drivers

Strategic GCC Location and Global Trade Connectivity

Qatar’s strategic geography lies at the intersection of Asia‑Europe‑Africa maritime corridors, enabling Hamad Port to handle approximately 1.54 million TEUs in 2021—up from 1.41 million in 2020. In 2023, transshipment through Hamad Port reached 557,464 TEUs, representing 43 percent of total throughput. These figures underscore Qatar’s pivotal role as a logistics hub. Its global connectivity is boosted by air cargo routes via Hamad International Airport and by sea freight volumes serving more than 129 export partners and 122 import partners, as recorded by WITS for 2022 data.

Infrastructure Investments

Hamad Port, operational from late 2016, has capacity to handle up to 7.8 million tonnes annually as per Port Authority records. In 2022, it processed 520,324 freight tonnes of bulk and 983,033 freight tonnes of break-bulk cargo, per shipping news sources. Concurrently, Hamad International Airport expanded cargo terminals post‑2022 to boost capacity, and Qatar’s Free Zones Authority has launched logistics zones in Ras Bufontas and Umm Salal, offering customs‑facilitated facilities. Together, these infrastructure assets underpin rapid scaling of warehousing and freight handling volumes in the market.

Market Challenges

Limited Land Availability and High Warehousing Rents

Qatar covers just 11,586 km², with nearly 80% of population in Doha, placing constraints on land allocation for logistics parks. Despite infrastructure expansion, inner‑city warehousing rents remain elevated, making operational costs high for logistics operators. Inland logistics zones such as Umm Salal and Bu Fasseela offer options, but available land remains limited. This restricts large footprint cold‑storage and automated facility scale‑up, impacting capacity expansion and cost competitiveness.

Complex Regulatory and Customs Procedures

Qatar’s average applied customs tariff is 3.71 percent, with MFN average at 4.23 percent as reported by WITS—reflecting complexity in import processing. Customs clearance involves multiple agencies and lacks full single‑window implementation. The World Bank Logistics Performance Index 2022 indicates median port dwell time globally of over 1.04 days; Qatar faces similar clearance complexities. These regulatory frictions delay throughput and raise transaction costs along the logistics chain.

Opportunities

Development of Automated and Vertical Warehousing

As of 2022, Qatar’s population reached 3.10 million, and import volumes spanned over 3,500 product lines, fueling demand for space‑efficient warehousing solutions. Automated racking, robotics, and vertical stacking can unlock capacity within limited urban land. Logistics operators in Qatar’s free zones are investing in vertical cold‑chain warehouses to optimize m² usage. Adoption of WMS, robotics and IoT aligns with global best practices reflected in World Bank LPI indicators, offering efficiency improvements and scalable operations even without expanding footprint.

Expansion of Inland Logistics Parks

To alleviate land constraints near Doha, new inland logistics parks at Umm Salal and Bu Fasseela are designated as logistics node zones with customs infrastructure and bonded warehouse facilities. These parks support overflow from Hamad Port and Ras Laffan export terminals. Current statistics show 557,464 TEUs transshipment in 2023 via Hamad Port alone, highlighting throughput pressures. Inland logistics parks provide immediate land access, easing bottlenecks and lowering warehousing rents while improving connectivity to road networks inland.

Future Outlook

Over the 2024–2030 horizon, the Qatar freight, logistics & warehousing market is projected to expand steadily supported by infrastructure investments, continued diversification beyond hydrocarbons, and the increasing footprint of e‑commerce and industrial sectors. Strategic development of inland logistics parks, expansion of free‑zone capabilities, and accelerated automation in warehousing and transport services will drive further growth. The growing internationalization of logistics providers and partnerships with global players will consolidate Qatar’s role as a regional hub.

Major Players

- Gulf Warehousing Company (GWC)

- Qatar Airways Cargo

- Nakilat

- Milaha (Qatar Navigation)

- DHL Qatar

- FedEx Qatar

- Aramex Qatar

- Maersk Qatar

- GAC Qatar

- DSV Qatar

- Kuehne + Nagel Qatar

- Ali Bin Ali Holding Logistics

- Bin Yousef Cargo

- Seven Seas Freight

- Qatar Post

Key Target Audience

- Logistics and supply‑chain investment firms

- Investments and venture capitalist firms

- Government and regulatory bodies (Qatar Free Zones Authority, Ashghal, Ministry of Transport)

- Large industrial importers and exporters in energy and construction

- Retail and e‑commerce platform operators

- Cold‑chain warehouse developers

- Air cargo terminal operators

- Port infrastructure investors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map covering ports (Hamad, Ras Laffan), airports, logistics parks, CEP providers, and service providers. It draws on secondary data from proprietary databases, government releases, and annual reports to define market structure variables and define scope.

Step 2: Market Analysis and Construction

This stage compiles historical data from 2018 to 2023 on freight volumes (TEUs, air cargo tonnes), warehousing capacity and utilization, and CEP shipments, enabling bottom‑up modeling of revenue and transaction volumes across segments.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses around growth drivers are tested through structured interviews (CATI) with industry stakeholders—forwarders, warehousing operators, port authorities, CEP firms—to validate pricing, tariffs, utilization rates and service practices.

Step 4: Research Synthesis and Final Output

The final phase integrates company‑level data (capacity, tech adoption, vertical focus) from major operators and overlays with forecast models to deliver forecasts, competitive benchmarking, and strategic recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Developments (Port, Airport, Free Zones)

- Business Cycle (Peak and Off‑Peak Logistics Seasons)

- Supply Chain and Value Chain Analysis (Sea, Air, Land, CEP, 3PL, VAS)

- By Value (USD Billion), 2019-2024

- By Volume (Freight Tonnage, TEUs, Parcel Shipments), 2019-2024

- By Average Price (Per m² Warehousing, Per Tonne Freight, Per Parcel Delivery), 2019-2024

- By Service Type (In Value %)

Freight Forwarding

Warehousing & Value‑Added Services (VAS)

Courier‑Express‑Parcel (CEP)

Third‑Party Logistics (3PL) Integrated Services

Cold Chain Logistics - By Contract Model (In Value %)

Long‑Term Contract

Ad‑hoc / Spot Contract

Integrated Multimodal Contract - By End‑User Industry (In Value %)

FMCG

Retail & E‑commerce

Energy & LNG

Pharma & Healthcare

Construction & Industrial Goods - By Mode of Transport (In Value %)

Sea Freight

Air Cargo

Road Transport

Courier & Parcel Services

- Executive Summary

- Qatar Warehousing Ecosystem (Umm Salal, Bu Fasseela, Abu Samra, QFZ sites; bonded & non-bonded)

- Value Chain Analysis (Developers → 3PL/Operators → Tenants → CEP/Last-mile)

- Trends (High-bay automation, mezzanine pick towers, cross-dock, micro-fulfilment)

- Commercial Models (Built-to-Suit, long-lease shell-and-core, multi-client shared sites)

- Technological Advancements (AS/RS, shuttle systems, VNA, cold-chain IoT, RFID)

- Temperature-Controlled & Pharma-grade Storage Overview (GxP, GDP compliance)

- Warehouse Safety & Sustainability (FM-approved systems, solar rooftops, EV yard tractors)

- Land & Utilities Constraints (zoning, power loads, reefer plugs)

- Cross Comparison – Major Warehouse Clusters [Umm Salal, Bu Fasseela, Ras Bufontas, Umm Alhoul] (Plot sizes, utilities, access, customs setup, rents, expansion headroom)

- Qatar Warehousing Market Size (Value / Space m²)

- Market Segmentation (In Value %)

– By Storage Type [Dry/Closed, Temperature-Controlled, Cold Storage, Open Yard, Hazardous]

– By Ownership/Operation [3PL-Operated, Shipper-Owned, Developer-Leased, Free-zone/Bonded] - Qatar Warehousing Future Market Size (Value / Space m²)

- Executive Summary

- 3PL Ecosystem (Integrators, contract logistics, freight + warehousing bundles, reverse logistics)

- Value Chain & Contracting (SOW structuring, KPIs/SLAs, gain-share models)

- Trends (Omnichannel fulfilment, vendor-managed inventory, control towers, near-shoring light assembly)

- Commercial Models (Dedicated vs multi-client, open-book vs closed-book, pay-per-use)

- Technology (Order orchestration, WMS-TMS-YMS stack, IoT telematics, analytics)

Compliance & Certifications (ISO, GDP, TAPA, AEO) - Risk & Continuity (contingency yards, temperature excursions, surge capacity)

- Cross Comparison – Leading 3PLs in Qatar [GWC, DHL Supply Chain, DSV, Kuehne+Nagel, Aramex Solutions, Milaha Logistics] (Vertical focus, m², fleet, automation level, network, value-added scope)

- Qatar 3PL Market Size (Value)

- Market Segmentation (In Value %)

– By Contract Type [Dedicated/Long-term, Shared/Multi-client, Project-based]

– By End-Use [Energy & LNG, FMCG, Retail & E-commerce, Pharma & Healthcare, Industrial/Construction] - Qatar 3PL Future Market Size (Value)

- Executive Summary

- Qatar Freight Forwarding Ecosystem (Sea–Air–Road nodes: Hamad Port, HIA Cargo, Salwa/Abu Samra; Free Zones; ICDs)

- Value Chain Analysis (Shippers → Forwarders → Carriers → Customs → Last-mile)

Trends in Qatar Transportation Industry (Multimodal, transshipment, project cargo, pharma cool-chain) - Commercial Models in Freight Forwarding (FOB/CIF handling, NVOCC, chartering, block-space)

- Technological Advancements (e-AWB, Port Community Systems, WMS/TMS, API-based rate engines)

- Digital Freight Aggregator Market Overview (Road haulage matching, instant quoting, tracking)

- Digital Truck Aggregators Business Model (Brokerage margins, subscription/SaaS, embedded finance)

- Major Challenges leading to Digital Freight Platforms (backhaul imbalance, empty-run km, rate opacity)

- Major Benefits of Digital Freight Aggregator Platforms (utilization lift, dwell-time cuts, visibility)

- Cross Comparison – Major Digital Truck Aggregators [TruKKer, Trella (regional ops), Shipa, local brokers] (Coverage, fleet, tech stack, vertical focus, SLAs, integrations)

- Qatar Freight Forwarding Market Size (Value)

- Market Segmentation (In Value %)

– By Type of End-users [Energy & LNG, Construction & Industrial, Retail & E-commerce, FMCG, Pharma & Healthcare]

– By Mode [Sea, Air, Road, Multimodal] - Qatar Freight Forwarding Future Market Size (Value)

- Executive Summary

- VAS Ecosystem (Kitting, labelling, postponement, customization, co-packing, light assembly, QA/QC)

- Value Chain Touchpoints (Inbound → QC → VAS cell → storage → outbound)

Trends (On-site customization for e-commerce, pharma serialization, returns refurbishment) - Commercial Models (Per-unit, per-hour cell, throughput-based; bundled with storage)

- Technology & Tooling (Print-and-apply, automated cartonization, dimensioners, vision systems)

- Regulatory & Quality (GMP/GDP for pharma, food safety standards, HS-code changes)

- Cross Comparison – VAS Capabilities by Operator [GWC, DHL, Aramex, K+N, DSV] (Scope depth, throughput/hr, QA, integrations, reverses)

- Qatar VAS Market Size (Value)

- Market Segmentation (In Value %)

– By Service Type [Kitting & Co-packing, Labelling & Barcoding, Light Assembly/Customization, Reverse Logistics/Refurbishment, QA/QC & Testing]

– By End-Use [Retail & E-commerce, FMCG, Pharma & Healthcare, Electronics, Automotive/Industrial] - Qatar VAS Future Market Size (Value)

- Executive Summary

- CEP Ecosystem (Postal, integrators, regional CEP, e-commerce platforms, aggregators, lockers)

- Value Chain (Line-haul, sortation hubs, last-mile; returns & cash-on-delivery handling)

- Trends (Same-day/On-demand, micro-fulfilment, PUDO/lockers, cross-border GCC lanes)

- Commercial Models (Contracted B2B, platform-led B2C, prepaid vs COD, subscription bundles)

- Technology (Route optimization, dynamic ETA, address intelligence, handhelds)

- Service Quality & Compliance (On-time metrics, loss/damage controls, DDP/Incoterms for x-border)

- Cross Comparison – CEP Leaders in Qatar [Qatar Post, Aramex, DHL Express, FedEx, UPS, Shipa] (Network, delivery speed tiers, lockers/PUDO, customs brokerage, returns stack, APIs)

- Qatar CEP Market Size (Value / Shipments)

- Market Segmentation (In Value %)

– By Service Speed [Same-day, Next-day, Economy]

– By Customer Type [B2C E-commerce, B2B Documents/Parcels, Cross-border] - Qatar CEP Future Market Size (Value / Shipments)

- Growth Drivers

Strategic GCC Location and Global Trade Connectivity

Infrastructure Investments (Hamad Port, Hamad International Airport, Free Zones)

E‑commerce and Retail Market Expansion

Cold Chain Growth for Food and Pharma

Increasing LNG Export Volumes - Market Challenges

Limited Land Availability and High Warehousing Rents

Complex Regulatory and Customs Procedures

Shortage of Skilled Logistics Workforce

Heavy Dependence on Imports for Goods and Equipment - Opportunities

Development of Automated and Vertical Warehousing

Expansion of Inland Logistics Parks (Abu Sulba, Umm Salal)

Free Zone and Bonded Warehouse Growth

Technology Adoption (IoT, WMS, TMS) - Trends

Shift Towards 3PL Integrated Logistics Contracts

Rapid Growth in CEP and Last‑Mile Delivery

Sustainable Logistics and Green Warehousing Initiatives - Government Regulation

Qatar Free Zones Authority Incentives

Customs Modernization and Single‑Window Clearance - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocations

- Regulatory Compliance Requirements by Sector

- Needs, Desires, and Pain Point Analysis

- Decision‑Making Process of Logistics Buyers

- Market Share of Major Players (By Value and Volume)

Market Share by Service Type (Freight, Warehousing, CEP, Cold Chain) - Cross Comparison Parameters

Business Model (3PL, Freight Forwarder, CEP, In‑house)

Total Warehousing Capacity (m², Cold Chain Proportion)

Network Reach (Ports, Free Zones, Logistics Parks)

Fleet Assets and Modal Strength (Air, Sea, Road)

Technology Adoption Level (Automation, IoT, AI, WMS)

Client Industry Focus (E‑commerce, LNG, FMCG, Pharma)

Pricing Model and Tariff Structure (Per Tonne, Per Parcel, Per m²)

Recent Expansions, M&A, and Strategic Partnerships - SWOT Analysis of Major Players

- Pricing Analysis (Warehousing Rates, Freight Rates, CEP Rates)

- Detailed Company Profiles

Gulf Warehousing Company (GWC)

Aero Freight Company Ltd

Qatar Airways Cargo

Qatar Navigation Q.P.S.C. (Milaha)

Nakilat

Gulf Agency Company (GAC) Qatar

Aramex Qatar

DHL Qatar

FedEx Qatar

DSV Qatar

Kuehne+Nagel Qatar

Ali Bin Ali Holding Logistics

Bin Yousef Cargo

Seven Seas Freight

Qatar Post

- By Value (USD Billion), 2025-2030

- By Volume (Freight Tonnage, TEUs, Parcel Shipments), 2025-2030

- By Average Price (Per m² Warehousing, Per Tonne Freight, Per Parcel Delivery), 2025-2030