Market Overview

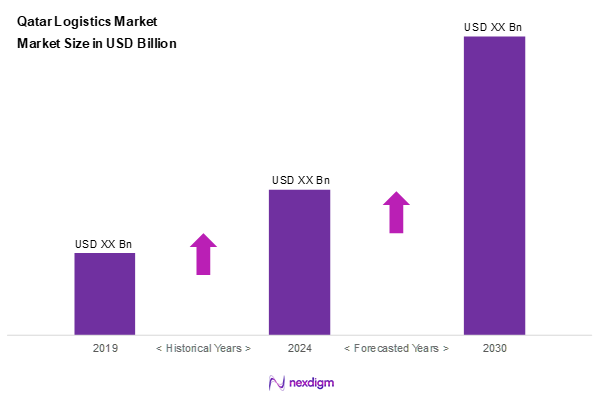

As of 2024, the Qatar logistics market is valued at USD ~ billion, with a growing CAGR of 6.4% from 2024 to 2030, based on a comprehensive historical analysis of market developments. This substantial market size is driven by the rapid growth of e-commerce, government initiatives to improve transport infrastructure, and the country’s strategic geographic position as a trade hub within the GCC region. Investments in logistics infrastructure, such as the Hamad Port and significant upgrades to road and rail networks, are pivotal in enabling efficient supply chain solutions.

Qatar’s logistics market is characterized by major cities including Doha, Al Rayyan, and Umm Salal, which dominate due to their critical infrastructure and connectivity. Doha, as the capital, serves as the central hub for logistics activities owing to its advanced port facilities and air cargo capabilities at Hamad International Airport. The concentration of retail, manufacturing, and energy sectors in these cities further enhances their strategic importance, reinforcing the logistics capabilities required to meet growing domestic and regional demand.

Market Segmentation

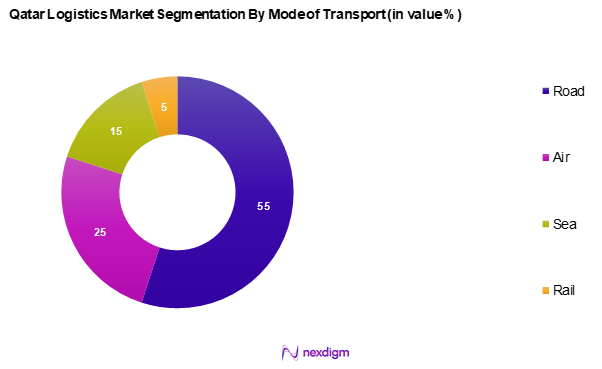

By Mode of Transport

The Qatar logistics market is segmented into road, air, sea, and rail. The road transport segment currently holds a dominant market share due to its flexibility and wide-reaching capabilities across various sectors. Road logistics are particularly favored because they enable efficient last-mile delivery, which is critical in the rapidly growing e-commerce landscape. As businesses increasingly prioritize speed and convenience to maintain competitive advantages, road transport remains the go-to solution for logistics providers.

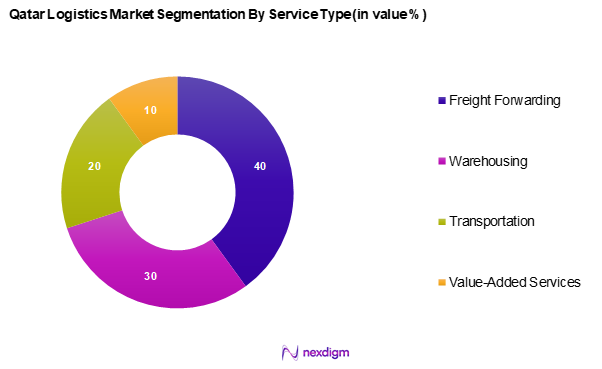

By Service Type

The Qatar logistics market is segmented into freight forwarding, warehousing, transportation, and value-added services. Among these, freight forwarding commands a significant market share driven by increasing international trade activities and the rise of e-commerce platforms. Freight forwarders streamline complex logistics processes, facilitating smoother shipment flow between buyers and sellers, which is vital in today’s fast-paced market environment. Their role in customs clearance and supply chain optimization makes them indispensable in logistics operations.

Competitive Landscape

The Qatar logistics market is dominated by a limited number of key players, each vying for market leadership through specialized services and extensive networks. Major companies such as Qatar Airways Cargo, GWC, and Milaha dominate due to their established infrastructure, financial strength, and broad service portfolio, enabling them to respond swiftly to market demands.

| Company Name | Establishment Year | Headquarters | Market Segment | Number of Employees | Key Services Offered | Market Strategy |

| Qatar Airways Cargo | 1997 | Doha, Qatar | – | – | – | – |

| GWC | 2004 | Doha, Qatar | – | – | – | – |

| Milaha | 1957 | Doha, Qatar | – | – | – | – |

| DHL Qatar | 1969 | Doha, Qatar | – | – | – | – |

| Agility Logistics | 1979 | Kuwait (regional hub) | – | – | – | – |

Qatar Logistics Market Analysis

Growth Drivers

Boom in E-commerce

The rapid growth of e-commerce in Qatar is a primary driver for the logistics market. As of 2023, the e-commerce market in Qatar is expected to reach USD 2.8 billion, significantly influenced by a surge in online shopping during and post-pandemic. The Qatar Ministry of Transport and Communications reported that over 60% of the population engaged in online shopping, escalating the demand for efficient logistics solutions. This boom necessitates advanced warehousing and last-mile delivery services, pushing logistics companies to innovate their operational strategies to accommodate rising customer expectations.

Infrastructure Developments

Significant investments in infrastructure are enhancing Qatar’s logistics capabilities. The Qatar government is deploying over USD 200 billion for infrastructure development in preparation for the FIFA World Cup and beyond. This includes the expansion of Hamad Port, which now has a capacity to handle up to 1.7 million TEUs (Twenty-foot Equivalent Units), thus improving maritime logistics. Furthermore, advancements in road and rail networks facilitate seamless connectivity between urban centers and trade routes, reinforcing Qatar’s position as a logistics hub in the Gulf region.

Market Challenges

Regulatory Compliance

Strict regulatory requirements present challenges for logistics firms operating in Qatar. Companies must adhere to a complex framework governing customs, health, and safety standards. Non-compliance can lead to financial penalties and increased operational costs, making it essential for businesses to invest in compliance measures, technology, and employee training to maintain smooth operations.

Competition from Global Players

The presence of major international logistics firms intensifies competition within the Qatari market. Established global companies leverage their extensive networks and advanced operational efficiencies to strengthen their market position. This competitive landscape pressures local firms to enhance their service offerings and optimize costs to sustain profitability and market relevance.

Opportunities

Digital Transformation in Logistics

The adoption of digital technologies presents significant opportunities for the logistics sector. Companies are increasingly integrating advanced solutions such as artificial intelligence, IoT, and block chain to enhance supply chain visibility and efficiency. Embracing digital transformation enables logistics providers to streamline operations, reduce costs, and improve service quality, positioning them for long-term success.

Expansion of Free Zones

The growing number of free zones in Qatar is fostering favorable conditions for logistics operations. These zones attract businesses through tax incentives and simplified customs processes, facilitating seamless trade and supply chain management. The influx of foreign investment and the establishment of new enterprises within these zones contribute to job creation and drive further growth in the logistics sector.

Future Outlook

Over the next few years, the Qatar logistics market is expected to experience substantial growth, driven by continuous government investment in infrastructure, advancements in logistics technology, and the rising demand for efficient supply chain solutions. The shift towards digital logistics systems, coupled with increasing e-commerce activities, will further propel the market forward, establishing Qatar as a key logistics hub within the region.

Major Players

- Qatar Airways Cargo

- GWC

- Milaha

- DHL Qatar

- Agility Logistics

- Kuehne + Nagel

- DB Schenker

- FedEx Qatar

- Aramex

- UPS Qatar

- Panalpina

- CEVA Logistics

- XPO Logistics

- JAS Forwarding

- Al-Futtaim Logistics

Key Target Audience

- E-commerce Companies

- Retail Corporations

- Manufacturing Firms

- Logistics and Freight Forwarding Services

- Government and Regulatory Bodies (Ministry of Transport and Communications, Economic Development Office)

- Investments and Venture Capitalist Firms

- Oil & Gas Industry Stakeholders

- Infrastructure Development Agencies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we construct a comprehensive ecosystem map that captures all major stakeholders within the Qatar logistics market. This step relies on extensive desk research, employing a combination of secondary sources, industry reports, and proprietary databases to gather rich insights into the market dynamics. The primary goal is to identify and define critical variables that significantly influence market behavior and trajectory.

Step 2: Market Analysis and Construction

This step involves meticulously compiling and analyzing historical data relevant to the Qatar logistics market. Our analysis includes assessing various elements such as market penetration rates, the ratio of transport options to service providers, and the consequent revenue generation across different logistics segments. We also evaluate operational statistics to ensure reliability and accuracy in revenue estimates derived from our research.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are crafted and subsequently scrutinized through computer-assisted telephone interviews (CATIs) with industry professionals representing a broad spectrum of logistics entities. These discussions yield valuable operational and financial insights from practitioners, thus allowing for refinement and corroboration of initial market data, leading to more robust findings.

Step 4: Research Synthesis and Final Output

The final phase incorporates direct engagements with diverse logistics firms to collect in-depth insights into their specific service segments, sales performance, consumer preferences, and other pertinent market variables. Such interactions validate and enrich the statistics gathered through a bottom-up research approach, ensuring that our analysis of the Qatar logistics market is comprehensive, precise, and substantiated by real-world data.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Boom in E-commerce

Infrastructure Developments - Market Challenges

Regulatory Compliance

Competition from Global Players - Opportunities

Digital Transformation in Logistics

Expansion of Free Zones - Trends

Automation and Technology Integration

Green Logistics Initiatives - Government Regulation

Import and Export Regulations

Safety and Compliance Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport, (In Value %)

Road

Air

Sea

Rail - By Service Type, (In Value %)

Freight Forwarding

Warehousing

Transportation

Value-Added Services - By End-User Sector, (In Value %)

Retail

Manufacturing

Oil & Gas

Healthcare - By Geographic Region, (In Value %)

Doha

Al Rayyan

Umm Salal

Al Wakrah - By Customer Type, (In Value %)

B2B

B2C

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Mode of Transport Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue, Revenue by Service Type, Number of Touchpoints, Distribution Channels, Market Share, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Qatar Airways Cargo

GWC

Milaha

DHL Qatar

Agility Logistics

Al-Futtaim Logistics

DB Schenker

Kuehne + Nagel

Aramex

CEVA Logistics

Expeditors

UPS Qatar

Panalpina

XPO Logistics

JAS Forwarding

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030