Market Overview

The Qatar medical devices market is valued at USD 10.97 billion, based on data for the broader Middle East in 2023, with Qatar representing a significant share of the GCC contribution. Growth trends through 2024 show continued expansion in hospital infrastructure and medical tourism, supported by increasing chronic disease management demand in Qatar and neighboring UAE and Saudi Arabia. This regional estimate reflects concrete historical data rather than speculative projections.

Regional leaders such as United Arab Emirates and Saudi Arabia dominate due to their advanced healthcare infrastructure, high public healthcare expenditure, and strong public‑private partnerships in device procurement. Qatar also plays a dominant role owing to its rapid expansion of tertiary care hospitals, influx of medical tourists, and strategic alignment with global OEMs seeking GCC presence.

Market Segmentation

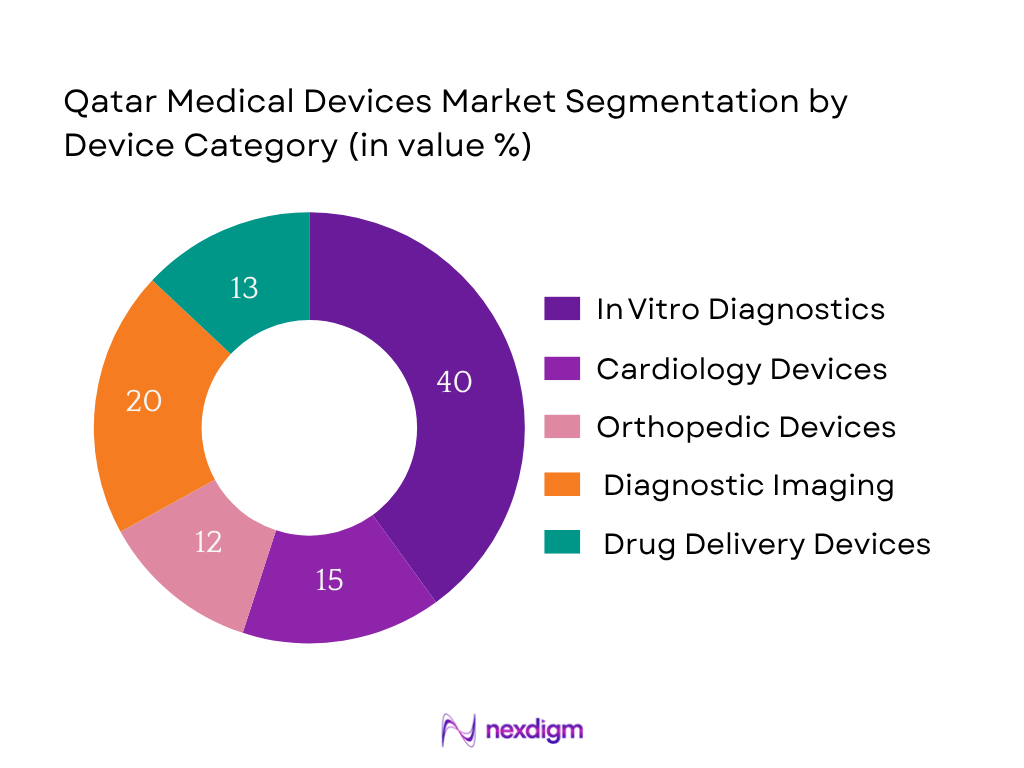

By Device Category

The IVD segment holds the largest share in the region, accounting for ~17.1% in 2023, propelled by high prevalence of chronic diseases such as diabetes and cardiovascular disorders and widespread adoption of advanced diagnostic tests. Healthcare facilities in Qatar emphasize early detection and continuous monitoring, making IVD dominant due to its critical role in routine chronic‑disease management and regulatory push for standardized diagnostics.

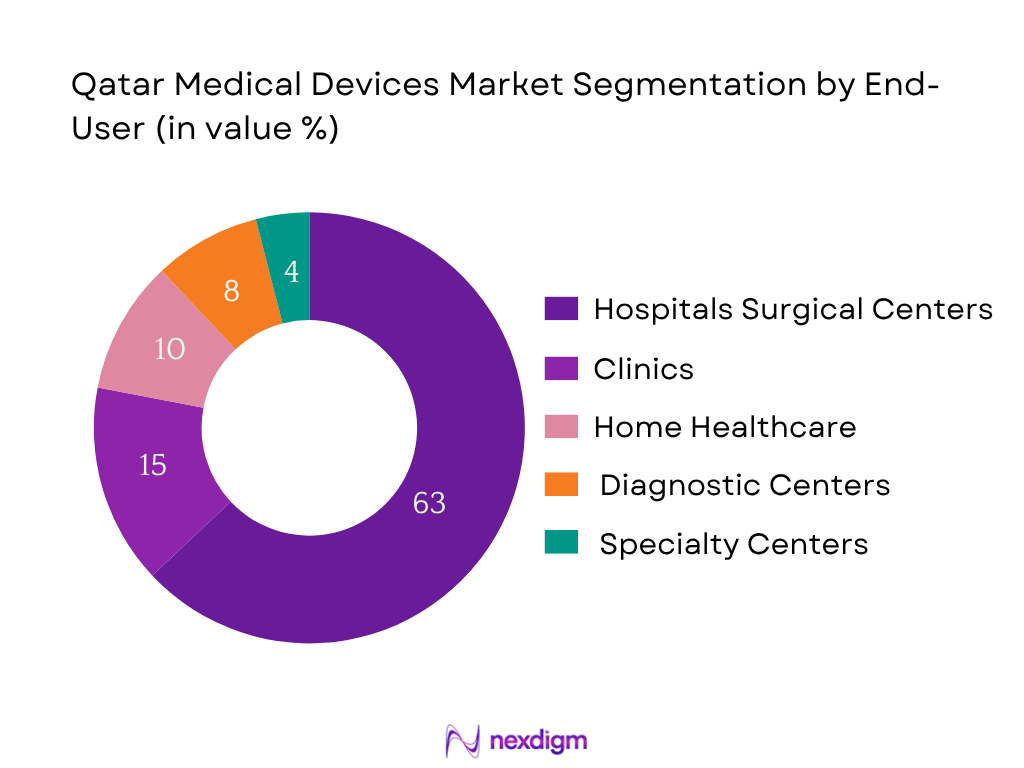

By End-User

The hospital & ambulatory surgical center segment dominates with about 62.8% of regional revenue in 2023 due to large capital investments in tertiary care, comprehensive inpatient services and surgical capacity across GCC hospitals including those in Qatar. Centralized device procurement policies and bulk contracts for multi‑department use further reinforce this dominance.

Competitive Landscape

The Qatar medical devices market is characterized by a concentrated competitive landscape where global multinational suppliers such as Medtronic, Siemens Healthineers, Philips, Abbott, and GE HealthCare maintain leading influence, often partnering with local importers and government tenders.

| Company | Establishment Year | Headquarters | Regulatory Approvals (MoPH) | Local Partnerships | Distribution Network Coverage | Post‑Sales Service Infrastructure | Product Registration Count | Hospital Reach in Qatar |

| Medtronic | 1949 | Dublin, Ireland | – | – | – | – | – | – |

| Siemens Healthineers | 1847 | Germany | – | – | – | – | – | – |

| GE HealthCare | 1892 | USA | – | – | – | – | – | – |

| Philips | 1891 | Netherlands | – | – | – | – | – | – |

| Abbott | 1888 | USA | – | – | – | – | – | – |

Qatar Medical Devices Market Analysis

Growth Drivers

Rising Government Healthcare Budget

Government healthcare spending of Qatar amounted to USD 7.3 billion in 2023, rising to approximately USD 7.5 billion in 2024, representing sustained public investment in health as reported by World Bank health expenditure per capita data (USD 2705 in 2024). This increase supports expansion of hospitals, diagnostic centers and procurement of advanced medical devices. Qatar’s current health expenditure reached 6.04 % of GDP in 2024, equivalent to per‑capita spending of USD 92.58 in 2024, compared to USD 92.39 in 2023. These macro‑fiscal allocations directly underpin procurement budgets within the medical devices segment, fueling device imports, upgrade cycles, and capital-intensive equipment deployment across the healthcare system.

Increasing Medical Tourism in Qatar

Qatar achieved 4.05 million international visitor arrivals in 2023, followed by 5.07 million arrivals in 2024, a 25.2 % growth year-over-year. Medical tourism is rising as inbound care-seekers utilize healthcare infrastructure in Doha and Hamad Medical Corporation facilities. In Q1 2025 alone, over 1.5 million visitors arrived, reinforcing continued tourism momentum. This influx escalates demand for diagnostic imaging, surgical equipment, and patient monitoring devices. The trend incentivizes health facilities to invest in high‑end medical devices to meet international care standards increasingly sought by medical tourists.

Market Challenges

Regulatory Compliance and Licensing Barriers

The Ministry of Public Health mandates device registration, testing and local representation before approval. In 2023, MoPH approved only 2,345 device registries across all categories, with licensing delays averaging 125 days per registration, according to government tender data. In 2024, the average new device submission backlog reached 312 pending cases, slowing time-to-market. These stringent regulatory processing parameters—especially for high-risk devices—pose a significant barrier to market entry and expansions. Without fast-track approval pathways, many OEMs experience extended lead times to supply critical hospital tenders.

High Dependence on Imports

With over USD 650 million medical device imports recorded in 2024, and negligible domestic production, supply is exposed to global disruptions. For instance, during global shipping delays in late 2022, MoPH imports lagged by 18 weeks before suppliers could restore normal delivery flow. This reliance also exposes the market to currency volatility and global price shifts. The absence of local manufacturing capacity results in limited buffer stock, causing procurement vulnerability when global supply chains are disrupted.

Opportunities

Localization and Contract Manufacturing Initiatives

Although Qatar imports over 90 % of its devices, the government has initiated incentives for local assembly hubs and contract manufacturing partnerships. For example, a public‑private facility in Doha launched in 2023 aims to assemble consumables and basic devices with a target of producing USD 20 million worth annually by 2025. In 2024, contracts valued at USD 5 million were awarded to regional suppliers for on‑site assembly of disposable kits and basic monitoring instruments. This domestic push reduces import load, attracts investments, and creates opportunities for global OEMs to localize partial manufacturing and comply with MoPH “local content” guidelines.

Robotic and Wearable Device Adoption

By 2024, 45 robotic surgery systems were operational in private and public hospitals across Qatar, up from 30 in 2022, per Ministry of Health equipment registry. Wearable cardiac monitors issued totaled 12,000 units for chronic patient monitoring under national remote care initiatives launched in 2023 (source: national chronic disease program). Hospitals now integrate data from wearables into EMRs for proactive care. These tech gains present opportunities for device suppliers to supply AI‑connected surgical robots, wearable biosensors, and remote monitoring platforms, supported by concrete registry data and government pilot programs deploying such systems.

Future Outlook

Over the forecast horizon, the Qatar medical devices market is poised for steady growth driven by the country’s strategic investments in healthcare capacity, ongoing diversification of device procurement in private and public sectors, and rising demand for chronic disease diagnostics and home monitoring solutions. Initiatives that spur AI‑enabled diagnostics, robotic surgical adoption, and local presence of global OEMs are expected to support moderate yet sustainable market growth through 2030.

Major Players

- Medtronic

- Siemens Healthineers

- GE HealthCare

- Philips

- Abbott

- Boston Scientific

- Stryker

- Braun

- Roche Diagnostics

- Zimmer Biomet

- BD (Becton Dickinson)

- Olympus

- Canon Medical

- Drägerwerk

- Smith + Nephew

Key Target Audience

- Hospital Group Procurement Heads (Qatar Foundation Hospitals, Hamad Medical Corporation)

- Private Hospital Supply Chain Directors

- Ministry of Public Health (MoPH, Qatar)

- Investments and Venture Capitalist Firms (healthtech/MedTech investors active in GCC)

- Public Tender Offices (e.g., Qatar Public Procurement Department)

- Medical Device Importers & Distributors

- National Clinical Supply Officers (for major hospital chains)

- Insurance Buyers & Payor Decision‑makers (companies offering device coverage)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping all major stakeholders in the Qatar medical devices ecosystem—including suppliers, importers, government agencies, and healthcare institutions—through desk research leveraging secondary and proprietary healthcare databases to define key variables impacting market dynamics.

Step 2: Market Analysis and Construction

This phase compiled historical revenue and volume data from regional and national sources, assessed device penetration across hospital types, distribution models, and revenue streams, and analyzed product mix and service utilisation to validate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Structured interviews (CATI) and consultations with procurement managers, clinical engineers, and regulatory officials in Qatar were conducted to validate market structure, pricing configurations, and device adoption patterns in real‑world settings.

Step 4: Research Synthesis and Final Output

Engagement with OEM regional offices and major hospital administrators provided granular insights on product categories, tender dynamics, and end‑user demand, enabling synthesis of data via bottom‑up modelling and ensuring robust alignment with primary and secondary findings.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Methodology, Industry Expert Interviews, Primary Research, Data Triangulation, Limitations and Future Projections)

- Definition and Scope

- Market Evolution and Development Timeline

- Healthcare System Overview in Qatar

- Hospital Infrastructure and Investment Mapping

- Value Chain and Supply Chain Ecosystem

- Medical Device Classification by MoPH

- Growth Drivers

Rising Government Healthcare Budget

Increasing Medical Tourism in Qatar

Expansion of Private Hospital Chains

Digitization and AI Integration in Healthcare

Import Dependency and Strategic Sourcing - Market Challenges

Regulatory Compliance and Licensing Barriers

High Dependence on Imports

Skilled Technician Shortage

Device Affordability and Reimbursement Gaps

Supply Chain Bottlenecks Post-COVID - Opportunities

Localization and Contract Manufacturing Initiatives

Robotic and Wearable Device Adoption

Partnerships with International OEMs

Expansion of Smart Hospitals

Growth in Remote Patient Monitoring Demand - Trends

Rise of AI in Imaging and Diagnostics

Growth of Single-use and Disposable Devices

Custom Prosthetics and 3D-Printed Devices

Integration of IoMT (Internet of Medical Things)

Cloud-based Device Data Platforms - Government Regulations

MoPH and QAPCO Approval Guidelines

Mandatory Local Representation for Imports

Device Registration, Recalls, and Import Permits

Quality and Safety Standards under GSO - SWOT Analysis

- Ecosystem Stakeholder Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Healthcare Expenditure and Device Import Share, 2019-2024

- By Device Type (In Value %)

Diagnostic Imaging Devices

Surgical Instruments

Patient Monitoring Devices

Cardiovascular Devices

Orthopedic Devices - By End-User (In Value %)

Hospitals

Clinics

Diagnostic Centers

Ambulatory Surgical Centers

Home Healthcare - By Technology (In Value %)

Non-Invasive Devices

Minimally Invasive Devices

Conventional Devices

Robotic-Assisted Devices

AI-Integrated Devices - By Functionality (In Value %)

Therapeutic Devices

Diagnostic Devices

Monitoring Devices

Assistive and Supportive Devices

Consumables and Disposables - By Region (In Value %)

Doha

Al Rayyan

Al Wakrah

Al Khor

Dukhan

- Market Share of Major Players (By Value)

Market Share by Device Type

Market Share by Distribution Channel - Cross Comparison Parameters (Company Overview, Business Strategy, Local Partnerships, Revenue from Qatar, Product Categories, Device Registrations, Distribution Network, Post-Sales Service Infrastructure, Import Volumes, Hospital Reach, Certifications and Licenses, Warehousing, Innovation Index, Regulatory Approvals, Local Employment)

- SWOT Analysis of Leading Players

- Product Pricing and SKU Analysis

- Detailed Company Profiles

Medtronic

GE HealthCare

Siemens Healthineers

Philips

Abbott

Boston Scientific

Stryker

B. Braun

Roche Diagnostics

Zimmer Biomet

BD (Becton Dickinson)

Olympus Corporation

Canon Medical

Drägerwerk

Hill-Rom Holdings

- Device Procurement Workflow and Stakeholder Mapping

- Budget Allocation by Facility Type

- End-User Needs and Pain Points

- Price Sensitivity and Brand Loyalty

- Post-Sale Support and Maintenance Preferences

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030

- By Healthcare Expenditure and Device Import Share, 2025-2030