Market Overview

The Qatar medium and heavy lift helicopters market is expected to grow significantly, driven by the increasing demand for transportation and logistical capabilities in both commercial and defense sectors. The market is bolstered by the expanding infrastructure development and oil & gas sectors in Qatar, with helicopters playing a crucial role in remote area access and emergency services. In 2023, the market was valued at USD ~billion, and by 2024, it is projected to reach USD ~ billion. Factors such as technological advancements and the growing demand for multi-purpose helicopters continue to drive the growth of the market.

Qatar is one of the key players in the Middle East for medium and heavy-lift helicopter operations due to its strategic location, large-scale infrastructure projects, and investment in defense systems. The country’s focus on modernizing its military capabilities has also led to significant demand for heavy-lift helicopters. Additionally, the growth of Qatar’s oil and gas sector is another major contributor to the market’s prominence. The cities of Doha and Al Khor are particularly important due to their proximity to major commercial and defense hubs.

Market Segmentation

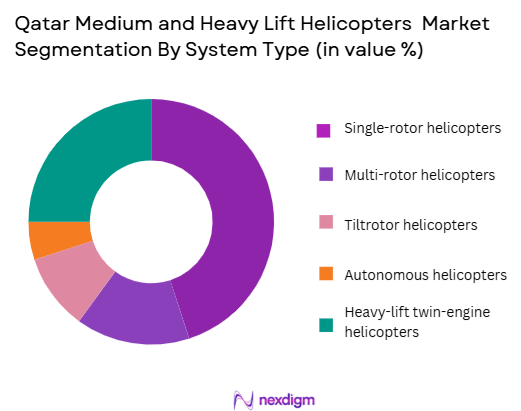

By System Type

The Qatar medium and heavy lift helicopters market is segmented by system type into single-rotor helicopters, multi-rotor helicopters, tiltrotor helicopters, autonomous helicopters, and heavy-lift twin-engine helicopters. Among these, single-rotor helicopters dominate the market. This is due to their efficiency in carrying heavy payloads over long distances, coupled with their established operational history in the region. Single-rotor helicopters, such as the Sikorsky CH-53 and Boeing CH-47 Chinook, continue to be preferred in both defense and civilian sectors, as they are known for their reliability and versatile performance in various operational environments.

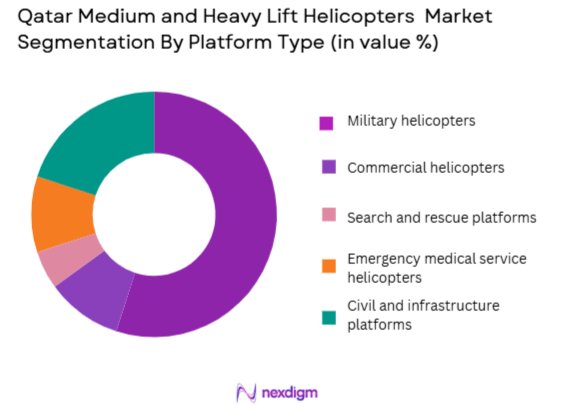

By Platform Type

The market is further segmented by platform type into military helicopters, commercial helicopters, search and rescue platforms, emergency medical service helicopters, and civil and infrastructure platforms. The military helicopters segment holds the largest share in the market due to the significant defense spending in Qatar. The country’s emphasis on enhancing its defense capabilities and maintaining strategic airlift capabilities continues to drive the demand for military-grade helicopters, with the Qatar Armed Forces increasingly investing in advanced helicopter fleets for both combat and logistical operations.

Competitive Landscape

The Qatar medium and heavy lift helicopters market is dominated by a few major players, including local manufacturers and international helicopter manufacturers like Boeing and Airbus. These companies play a vital role in providing helicopters suited for both military and civilian applications. The consolidation in this market highlights the significant influence of these key players, who continue to innovate and adapt to the growing demands of the region’s sectors, such as defense, oil and gas, and emergency services.

| Company Name | Establishment Year | Headquarters | Technology Innovation | Market Reach | Product Portfolio | Defense Contracts | Key Aircraft Models |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | Fort Worth, USA | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

Qatar Medium and Heavy Lift Helicopters Market Analysis

Growth Drivers

Urbanization

Urbanization in Qatar has been a significant driver of demand for medium and heavy-lift helicopters, particularly in the context of infrastructure and development projects. With a growing urban population, expected to surpass 3 million by 2026, the demand for transport solutions for remote sites and infrastructure projects has surged. The country’s rapid urban expansion is supported by the government’s “Qatar National Vision 2030,” which includes extensive infrastructure projects in cities like Doha. This increase in urbanization leads to a rise in demand for helicopters for tasks such as construction and emergency services. As more people move to urban centers, especially in regions like Al Khor and Doha, the need for air mobility solutions will continue to rise.

Industrialization

Qatar’s continued industrialization, particularly in sectors such as oil and gas, infrastructure, and defense, has driven the demand for medium and heavy-lift helicopters. Industrial growth in Qatar is bolstered by its significant natural gas reserves, the world’s third-largest, and ongoing large-scale industrial projects like the North Field Expansion, which is set to increase LNG production capacity. The expansion of industrial zones and energy production plants in areas such as Ras Laffan and Mesaieed increases the need for heavy-lift helicopters for equipment transportation and emergency evacuations. The country’s industrial sector saw a growth rate of ~% in 2024, further cementing the industrialization-driven demand for aerial logistics.

Restraints

High Initial Costs

High initial procurement costs remain a significant restraint for the growth of the medium and heavy-lift helicopter market in Qatar. The cost of acquiring a new helicopter, along with necessary modifications and certifications, can be a barrier for smaller operators and companies. For instance, the purchase cost of a heavy-lift helicopter such as the Sikorsky CH-53K is estimated at USD ~million, excluding operational costs. Given the capital-intensive nature of these investments, smaller companies and new market entrants face significant challenges. Despite the overall growth of the Qatari aviation sector, the high upfront capital required for helicopter purchases, coupled with ongoing maintenance expenses, is a major challenge for market penetration.

Technical Challenges

Medium and heavy-lift helicopters face several technical challenges in terms of maintenance, performance under extreme environmental conditions, and integration with newer technologies. Qatar’s harsh climate, characterized by extreme heat and sandstorms, can impact the performance and durability of helicopters. Additionally, the lack of adequate technical infrastructure to support complex maintenance procedures can increase downtime and reduce the availability of helicopters. Qatar’s aviation industry has been addressing these challenges by enhancing service facilities, but issues related to complex maintenance protocols still hinder the full operational capacity of helicopters.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the growth of Qatar’s medium and heavy-lift helicopter market. New developments in helicopter design, particularly in areas such as fuel efficiency, safety systems, and automation, are expected to reduce operational costs and increase fleet performance. For example, the integration of digital avionics and advanced composite materials is already improving the operational life of helicopters in Qatar. The development of electric and hybrid-electric helicopters, with a reduced carbon footprint, presents a major opportunity for the market. As global demand for eco-friendly solutions rises, Qatar’s growing focus on sustainability aligns with these technological trends, creating a favorable environment for future growth.

International Collaborations

International collaborations between Qatari helicopter operators and global manufacturers are expected to create vast opportunities for market expansion. Qatar’s strategic location and strong financial backing make it an attractive partner for global companies. Collaborations like the one between Qatar Airways and Airbus Helicopters aim to modernize the Qatari fleet and introduce new technologies, expanding the availability of cutting-edge helicopters in the region. Additionally, joint ventures with defense and aerospace companies to enhance the military sector’s capabilities will contribute significantly to the market. The increasing role of international partnerships, particularly for defense and civil sectors, will open up new avenues for market growth.

Future Outlook

Over the next decade, the Qatar medium and heavy lift helicopters market is expected to show steady growth, fueled by rising demand from the defense sector, infrastructure projects, and offshore oil and gas operations. Government investments in defense modernization programs and large-scale infrastructure initiatives are expected to continue driving the demand for helicopters. Additionally, the trend toward multi-role helicopters and technological advancements in automation and fuel efficiency will contribute to the market’s growth. This is especially true for platforms that offer enhanced capabilities for both military and civil applications, such as search and rescue, cargo transport, and medical evacuation.

Major Players in the Market

- Boeing

- Airbus Helicopters

- Lockheed Martin

- Bell Helicopter

- Leonardo

- Sikorsky

- MD Helicopters

- Enstrom Helicopter Corporation

- Russian Helicopters

- Kaman Corporation

- China Aviation Industry Corporation

- Russian Helicopters

- Heli-One

- Bristow Group

- Airbus

Key Target Audience

- Military procurement agencies

- Oil and gas companies

- Emergency medical service providers

- Aviation leasing companies

- Infrastructure and construction firms

- Commercial helicopter operators

- Government and regulatory bodies

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying all major stakeholders within the Qatar medium and heavy lift helicopter market. Secondary research will be conducted to map out the key players, market dynamics, and their respective market shares. This phase also aims to establish critical variables that will influence future market trends, including technology adoption, regulatory impacts, and demand drivers.

Step 2: Market Analysis and Construction

Market analysis will involve gathering historical data, focusing on revenue streams, market growth patterns, and technological advancements. We will evaluate market penetration, especially in the commercial and defense sectors, to estimate the future growth potential of the market. Additionally, detailed insights into the market segments will be considered to understand consumer behavior, service offerings, and competitive dynamics.

Step 3: Hypothesis Validation and Expert Consultation

The third step focuses on hypothesis validation through consultations with industry experts, including helicopter manufacturers, military contractors, and service operators. These insights, gathered through interviews and surveys, will help refine market forecasts and validate assumptions about the market’s current state and potential trajectory.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and validating it with on-the-ground operators, service providers, and aircraft manufacturers. Direct engagement with market leaders will ensure that the data reflects real-time trends and insights. The research output will be a comprehensive report, offering a complete market outlook with insights into key segments and growth drivers.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for oil and gas exploration and extraction in offshore areas

Growth in defense and security budgets in the Middle East

Technological advancements in helicopter design and performance - Market Challenges

High cost of procurement and maintenance

Regulatory restrictions and safety standards

Dependency on geopolitical stability for market growth - Trends

Increased focus on autonomous flight technology

Integration of AI and advanced avionics for safety and navigation

Rising interest in environmentally sustainable helicopter solutions

- Market Opportunities

Advancements in hybrid and electric-powered helicopter technology

Increasing demand for multi-role helicopters in commercial sectors

Expansion of offshore wind energy projects requiring heavy-lift capabilities - Government regulations

Tighter noise pollution regulations for helicopter operations

Stricter emission norms for helicopter fleets

Mandatory compliance with regional aviation safety standards - SWOT analysis

Strengthening defense budgets driving procurement demand

High operational costs creating barriers to entry

Increasing trend of multi-role helicopters offering flexibility - Porters 5 forces

High barriers to entry due to capital-intensive nature

High supplier bargaining power due to limited helicopter manufacturers

Moderate buyer bargaining power from government contracts

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Single-rotor helicopters

Multi-rotor helicopters

Tiltrotor helicopters

Autonomous helicopters

Heavy-lift twin-engine helicopters - By Platform Type (In Value%)

Military helicopters

Commercial helicopters

Search and rescue platforms

Emergency medical service helicopters

Civil and infrastructure platforms - By Fitment Type (In Value%)

OEM-fit helicopters

Aftermarket-fit helicopters

Hybrid fitment helicopters

Retrofit fitment helicopters

Modular fitment helicopters - By EndUser Segment (In Value%)

Defense sector

Oil & gas industry

Construction and infrastructure

Search & rescue organizations

Medical emergency services - By Procurement Channel (In Value%)

Direct procurement from manufacturers

Procurement through government agencies

Procurement through private contractors

Leasing options

Secondary market procurement

- Market Share Analysis

- CrossComparison Parameters(Market share, Innovation rate, Operational cost, Customer loyalty, Regulatory compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

Airbus Helicopters

Bell Helicopter

Leonardo

Sikorsky

Saab Group

Northrop Grumman

MD Helicopters

Enstrom Helicopter Corporation

Russian Helicopters

Kaman Corporation

China Aviation Industry Corporation

Russian Helicopters

Heli-One

Bristow Group

- Oil & gas companies seeking more efficient lifting solutions

- Defense organizations requiring enhanced search and rescue capabilities

- Energy firms needing heavy-lift capabilities for infrastructure installation

- Medical services expanding helicopter-based emergency services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035