Market Overview

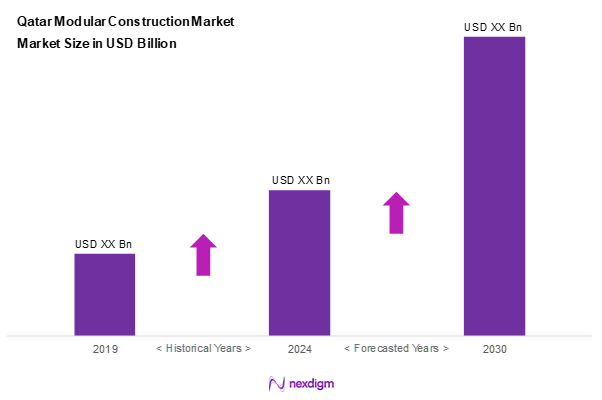

As of 2024, the Qatar modular construction market is valued at USD 1.5 billion, with a growing CAGR of 6.4% from 2024 to 2030, reflecting a significant increase from previous years, driven by rapid urbanization and infrastructure development projects. The demand for modular solutions is propelled by the need for cost efficiencies, speed, and sustainability in construction practices. Additionally, the country’s investments in World Cup-related infrastructure further exemplify the rising need for innovative construction methods.

Key cities dominating the market include Doha, Al Rayyan, and Al Wakrah, largely due to their strategic locations, high population densities, and robust governmental support for infrastructure development. Doha, being the capital, has seen substantial investment in commercial, residential, and public buildings, while Al Rayyan and Al Wakrah are emerging as pivotal urban centers due to ongoing development projects and initiatives that promote modern construction techniques.

Market Segmentation

By Type of Construction

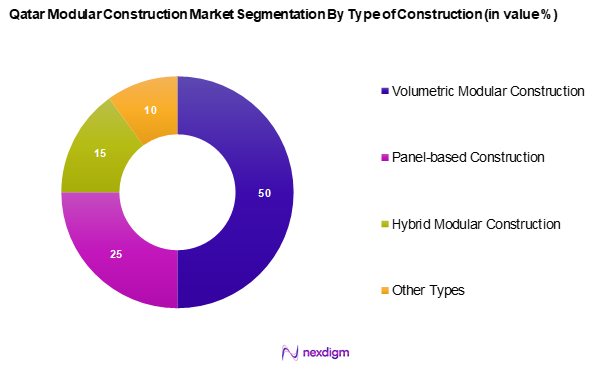

The Qatar modular construction market is segmented into volumetric modular construction, panel-based construction, hybrid modular construction, and other types. Volumetric modular construction holds a dominant market share, primarily due to its efficiency, reduced construction time, and lower labour costs. It allows for components to be manufactured offsite and assembled quickly onsite, aligning with Qatar’s need for rapid response in infrastructure development to support its economic activities and events like the FIFA World Cup.

By End-Use Sector

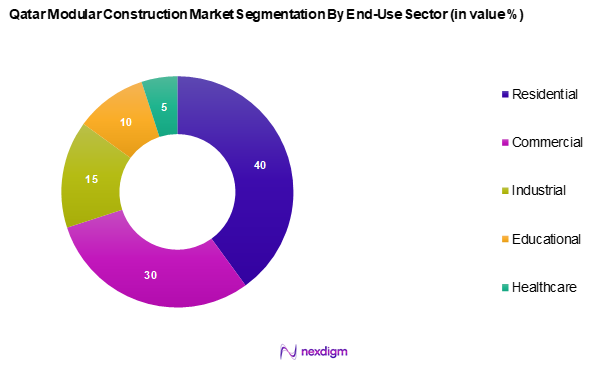

The Qatar modular construction market is segmented into residential, commercial, industrial, educational, and healthcare. The residential segment dominate the market, driven by a robust demand for housing amidst rapid population growth and urbanization. The government’s initiatives to improve living standards and provide affordable housing further reinforce the prominence of this segment, making it a focal point for modular construction solutions.

Competitive Landscape

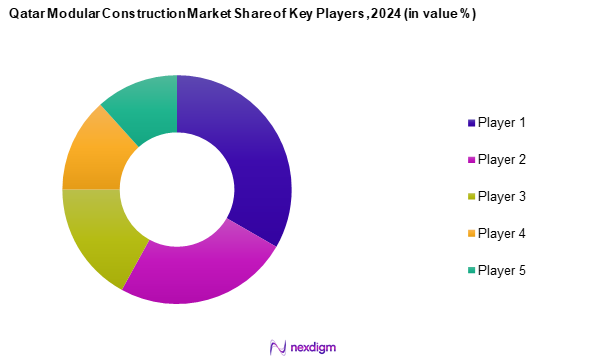

The Qatar modular construction market is characterized by a competitive landscape involving major players such as Domopan and Qatar Speed House. This consolidation underscores the influence and market presence of key companies working in the modular construction sector.

| Company Name | Establishment Year | Headquarters | Market Segment | Annual Revenue (USD) | No. of Projects | Market

Share |

| Domopan | 2006 | Doha, Qatar | – | – | – | – |

| SHELTER Group | 1972 | Doha, Qatar | – | – | – | – |

| Qatar Speed House | 2001 | Doha, Qatar | – | – | – | – |

| Desert Line Group | 2004 | Doha, Qatar | – | – | – | – |

| TSSC Group | 1975 | Dubai, U.A.E. | – | – | – | – |

Qatar Modular Construction Market Analysis

Growth Drivers

Urbanization

Qatar is experiencing a rapid pace of urbanization, which is significantly boosting the demand for modular construction. The government’s strategy includes major investments in infrastructure to support the expanding urban population. Projects like new city developments exemplify the nation’s commitment to building modern, livable spaces. Modular construction aligns well with this urban expansion by offering a fast and sustainable alternative to traditional building methods, helping to meet growing housing needs while keeping construction timelines short and manageable.

Cost Efficiency and Time Savings

Modular construction has gained traction in Qatar due to its ability to reduce construction costs and speed up project delivery. As labor and material expenses continue to rise, the need for cost-effective building solutions becomes even more pressing. Modular techniques minimize waste, optimize resource usage, and require fewer on-site labor hours. These efficiencies allow developers to bring projects to market faster, an advantage in a country where there is a constant demand for residential, commercial, and institutional facilities.

Market Challenges

Regulatory and Compliance Issues

One of the key hurdles for modular construction in Qatar lies in navigating the complex regulatory environment. The construction industry is governed by a wide range of building codes and standards that are frequently updated. Adapting to these evolving regulations can be challenging, especially for firms unfamiliar with the local legal framework. Delays caused by permitting issues or non-compliance can affect project timelines.

Public Perception and Acceptance

Cultural preferences in Qatar continue to favor traditional construction methods, posing a challenge for the adoption of modular solutions. There remains a degree of skepticism among the public regarding the quality, durability, and aesthetics of modular buildings. This perception has slowed the pace of adoption, particularly in residential projects.

Opportunities

Technological Innovations

Qatar’s push toward modernization and smart construction practices is creating fertile ground for technological innovations in modular construction. The adoption of digital tools like Building Information Modeling (BIM) and the use of automation in construction workflows are streamlining operations and improving project outcomes. These advancements allow for greater precision, fewer delays, and enhanced coordination among stakeholders, giving modular construction firms a competitive edge in delivering high-quality, efficient builds.

Expansion into Emerging Sectors

The modular construction sector is poised for growth beyond residential and commercial real estate. Emerging sectors such as healthcare and education present new opportunities, as they increasingly require rapid deployment of facilities. Modular buildings offer the adaptability and speed needed to address urgent infrastructure needs, particularly in growing areas. With the government prioritizing these sectors for development, modular construction is well-positioned to play a vital role in supporting national infrastructure goals.

Future Outlook

Over the next five years, the Qatar modular construction market is poised for significant growth, driven by urban development initiatives, government support for sustainable construction practices, and a rising demand for affordable housing. The integration of advanced technologies, such as Building Information Modeling (BIM) and automation in production processes, is expected to further enhance the efficiency and appeal of modular construction solutions.

Major Players

- Domopan

- SHELTER Group

- Qatar Speed House

- Desert Line Group

- TSSC Group

- Spacemaker

- Al Wasit Cabins

- COMO Modular Solutions

- Dalal Steel Industries

- Prefabex

- Skyline Champion Corporation

- Morton Buildings Inc.

- Clayton Homes

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Ministry of Municipality and Environment)

- Construction and Infrastructure Developers

- Real Estate Investment Trusts (REITs)

- International Construction Consortiums

- Engineering Firms

- Property Management Companies

- Urban Development Authorities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar modular construction market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Qatar modular construction market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies in the modular construction sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple modular construction manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Qatar modular construction market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Urbanization

Cost Efficiency and Time Savings - Market Challenges

Regulatory and Compliance Issues

Public Perception and Acceptance - Opportunities

Technological Innovations

Expansion into Emerging Sectors - Trends

Increased Adoption of Smart Buildings

Integration of Off-Site and On-Site Construction - Government Regulation

Building Codes and Standards

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Project Size, 2019-2024

- By Type of Construction

Volumetric Modular Construction

– Fully Enclosed Units

– Pre-Fitted Interior Modules

– Multi-Story Stacking Units

Panel-Based Construction

– Wall Panels

– Floor Panels

– Roof Panels

Hybrid Modular Construction

– Combination of Volumetric and Panel Systems

– Core-and-Shell Integration

Other Types

– Flat-Pack Modular Systems

– 2D Element-Based Construction - By End-Use Sector

Residential

– Affordable Housing

– Labor Camps

– Villas and Townhouses

Commercial

– Retail Outlets

– Office Complexes

– Hotels and Serviced Apartments

Industrial

– Site Offices

– Oil & Gas Accommodation Units

– Utility Plant Buildings

Educational

– Modular Classrooms

– School Campuses

– Training Centers

Healthcare

– Clinics

– Mobile Hospitals

– Diagnostic Labs - By Materials Used

Steel

– Light Gauge Steel Frames

– Structural Steel Modules

Concrete

– Precast Concrete Panels

– Concrete Cores

Wood

– Cross-Laminated Timber (CLT)

– Glulam Timber Frames

Plastics

– PVC Panels

– Reinforced Composite Plastics

Others

– Aluminum

– Recycled Materials

– Smart Insulated Panels - By Region

Doha

Al Rayyan

Umm Salal

Al Wakrah

Al Khor

Al Daayen

Dukhan - By Project Delivery Method

Design-Bid-Build

– Traditional Modular Construction Flow

– Clearly Separated Roles

Design-Build

– Single Point Responsibility

– Fast-Track Modular Execution

Construction Management

– CM-at-Risk

– Agency CM Models

Integrated Project Delivery (IPD)

– Collaborative Modular Planning

– Shared Risk and Reward Structure - By Type

Permanent Modular

– Government Housing

– Commercial Infrastructure

Temporary Modular

– Event Structures

– Emergency Shelters

Relocatable Modular

– Military Units

– Mobile Classrooms and Clinics - By Modular

Four-Sided Modules

Mixed Modules and Floor Cassettes

Modules Supported by a Primary Structure

Open-Sided Modules

Partially Open-Sided Modules

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Construction Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Type of Construction, Number of Projects, Distribution Channels, Margins, Unique Value Proposition, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Domopan

SHELTER Group

Qatar Speed House

Desert Line Group

TSSC Group

Spacemaker (a subsidiary of Gulf Contracting Company (GCC))

Al Wasit Cabins

COMO Modular Solutions

Dalal Steel Industries

Prefabex

Skyline Champion Corporation

Morton Buildings Inc.

Clayton Homes

- Market Demand Dynamics

- Purchasing Power and Allocation

- Regulatory Compliance Impact

- Consumer Preferences and Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Project Size, 2025-2030