Market Overview

The Qatar more electric aircraft market is anticipated to witness substantial growth driven by the demand for sustainable aviation solutions and technological advancements in electric propulsion. The market size is USD ~ based on recent historical assessments, indicating a steady increase in the adoption of electric aircraft in both commercial and urban air mobility sectors. This growth is attributed to significant investments in electric propulsion systems, battery technology, and supportive government policies aimed at reducing carbon emissions. A prominent driver is the growing emphasis on reducing the aviation industry’s environmental impact, with companies and governments focusing on integrating more energy-efficient and eco-friendly technologies.

The market’s dominance is concentrated in Qatar, where the government’s focus on innovation in the aviation sector and the availability of advanced infrastructure for electric aircraft are critical factors. The country’s strategic initiatives, such as government-backed funding for electric aviation projects and partnerships with leading aerospace companies, are accelerating the development and integration of electric aircraft technologies. Qatar’s strategic location as a hub for aviation in the Middle East further reinforces its leadership in this market, supported by its robust regulatory framework and significant investments in infrastructure development.

Market Segmentation

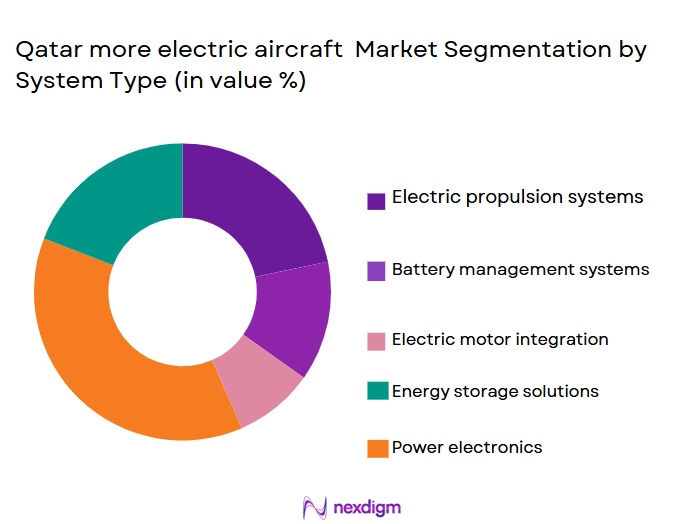

By System Type

Qatar more electric aircraft market is segmented by product type into electric propulsion systems, battery management systems, electric motor integration, energy storage solutions, and power electronics. Recently, electric propulsion systems have dominated the market share due to factors such as the increasing demand for eco-friendly solutions in aviation, advancements in motor efficiency, and the need for sustainable energy sources. Propulsion systems are a crucial component of electric aircraft, with improvements in their design and integration enabling more efficient and cost-effective electric aviation operations. As the global aviation industry shifts toward more sustainable practices, the demand for advanced electric propulsion systems continues to grow, supported by regulatory initiatives that incentivize green technology.

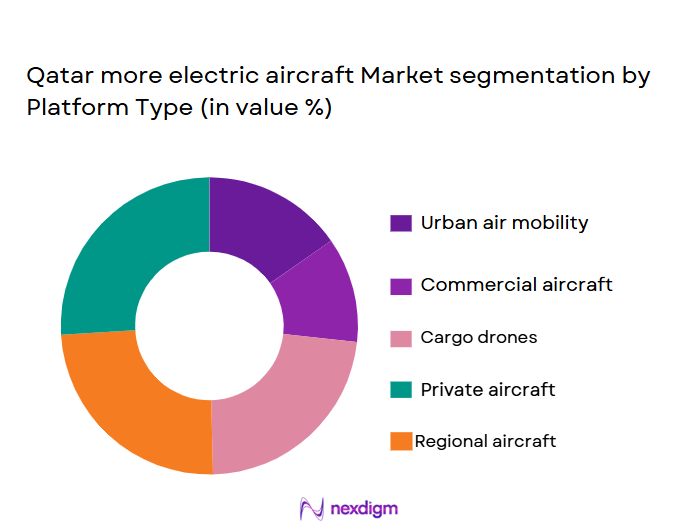

By Platform Type

Qatar more electric aircraft market is segmented by platform type into urban air mobility, commercial aircraft, cargo drones, private aircraft, and regional aircraft. Recently, urban air mobility has seen the dominant market share due to the growing need for innovative transportation solutions in congested urban areas and advancements in electric vertical take-off and landing (eVTOL) technologies. Urban air mobility platforms offer a promising solution for reducing traffic congestion and providing quick, eco-friendly transport options, which aligns with the trends in sustainable urban development. Additionally, government support and strategic investments in this sector have further boosted the growth of urban air mobility solutions.

Competitive Landscape

The Qatar more electric aircraft market is characterized by a competitive landscape where major aerospace players and technology firms collaborate to drive innovation. The market has seen a consolidation of large aerospace firms with startups focusing on urban air mobility solutions. The influence of major players is significant as they work together to overcome technological and regulatory barriers, with a focus on ensuring sustainable development. Partnerships between government bodies, private companies, and research institutions are also playing a critical role in advancing the market’s growth. As the industry moves towards mass adoption of electric aircraft, these major players are positioning themselves for future success.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| MagniX | 2009 | USA | ~ | ~ | ~ | ~ | ~ |

| ZeroAvia | 2017 | USA | ~ | ~ | ~ | ~ | ~ |

| Vertical Aerospace | 2016 | UK | ~ | ~ | ~ | ~ | ~ |

Qatar more electric aircraft Market Analysis

Growth Drivers

Government Support for Sustainable Aviation

Government policies promoting clean energy adoption in aviation are driving the growth of the Qatar more electric aircraft market. Initiatives such as subsidies, funding for research, and regulatory frameworks supporting eco-friendly aircraft technologies are key drivers. These policies are aimed at reducing the carbon footprint of the aviation industry, a major contributor to global emissions. Additionally, with international agreements and environmental regulations, governments worldwide are encouraging the transition to electric aircraft, creating a favorable market environment. In Qatar, the government’s focus on fostering innovation through investments in electric aviation further enhances the market potential. With these policies, stakeholders are motivated to accelerate the development of electric aircraft technologies, making them more accessible to airlines and other end-users. The government’s commitment to supporting the aviation sector with favorable regulations boosts investor confidence and encourages innovation in electric propulsion systems, leading to accelerated growth in the market.

Technological Advancements in Electric Propulsion Systems

The rapid advancements in electric propulsion systems are a major driver of market growth. These systems are becoming more efficient, reliable, and cost-effective, making electric aircraft more viable for commercial use. Innovations in battery technology, including improvements in energy density and charging speeds, are directly contributing to the development of electric aircraft. Research and development activities are focused on enhancing the performance of electric motors, batteries, and other critical components, with several companies successfully demonstrating electric aircraft prototypes. The increasing demand for low-emission solutions in aviation is fueling these technological advancements. These innovations are expected to reduce operational costs, making electric aircraft more attractive to airlines and operators. The improvements in propulsion efficiency are also making electric aircraft a viable option for longer distances, further expanding the scope of their use in commercial aviation. As technology continues to evolve, the potential for electric aircraft to dominate the aviation sector in the coming years remains high.

Market Challenges

High Development and Certification Costs

One of the primary challenges faced by the Qatar more electric aircraft market is the high cost of developing and certifying electric aircraft. The process of designing, testing, and certifying new aircraft technologies requires significant investments in research, development, and infrastructure. For electric aircraft, this challenge is particularly pronounced due to the need for advancements in electric propulsion systems, battery technology, and safety measures. Certification bodies such as the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) require extensive testing and validation before granting approval for commercial use. These stringent certification processes, coupled with the high cost of developing new technologies, create barriers for startups and even established aerospace firms. Moreover, the cost of ensuring the safety and reliability of electric aircraft is a major concern, particularly given the unfamiliarity with electric propulsion systems compared to traditional jet engines.

Limited Infrastructure for Electric Aircraft

Another significant challenge is the limited infrastructure available to support the widespread adoption of electric aircraft. Unlike traditional aircraft, which can rely on established airports with fueling infrastructure, electric aircraft require specialized charging stations and maintenance facilities tailored to their unique power requirements. In Qatar, while there is strong government support for infrastructure development, the growth of the necessary infrastructure is still in its early stages. The lack of sufficient charging stations and maintenance centers for electric aircraft may slow down the market’s growth. Airlines and other operators are hesitant to invest in electric aircraft if the necessary infrastructure is not in place to support their operations. Without substantial investments in ground infrastructure, the widespread adoption of electric aircraft could be delayed, hindering the market’s potential.

Opportunities

Expansion of Urban Air Mobility Solutions

The growing interest in urban air mobility (UAM) presents significant opportunities for the Qatar more electric aircraft market. UAM solutions, such as electric vertical takeoff and landing (eVTOL) aircraft, offer a promising alternative for reducing traffic congestion in urban areas. With the increasing urbanization of the Middle East, particularly in Qatar, the demand for efficient transportation solutions in crowded cities is rising. Electric aircraft are well-suited for these applications due to their low emissions, quiet operations, and ability to navigate congested areas. Qatar’s government is already supporting UAM initiatives, and the presence of major players in the region is facilitating the development of this market segment. The expansion of UAM solutions could drive the adoption of electric aircraft and offer substantial growth opportunities in the coming years. Furthermore, the growing interest in eco-friendly transportation options and the backing of sustainable technologies provide a favorable environment for UAM to thrive, driving the electric aircraft market forward.

Strategic Partnerships in Electric Aviation

Strategic partnerships between aerospace companies, technology firms, and government agencies present another opportunity for the Qatar more electric aircraft market. Collaborations in the development and testing of electric aircraft are essential for overcoming the technological and regulatory challenges associated with electric aviation. By joining forces, stakeholders can share knowledge, reduce costs, and accelerate the time to market for electric aircraft technologies. Partnerships with established aerospace firms can provide smaller companies with access to resources and expertise, enabling them to overcome barriers to entry. Moreover, collaboration with regulatory bodies can help streamline the certification process, ensuring that electric aircraft are brought to market more efficiently. These strategic partnerships are critical for the growth of the electric aircraft market, as they foster innovation and help align industry players with common goals, driving the market toward broader adoption.

Future Outlook

The future outlook for the Qatar more electric aircraft market is promising, with expected growth driven by advancements in electric propulsion technology, increasing government support, and the rising demand for sustainable aviation solutions. Technological developments, particularly in energy storage and battery efficiency, are expected to significantly improve the range and performance of electric aircraft. Additionally, regulatory frameworks designed to support electric aviation and reduce carbon emissions are likely to create a favorable market environment. Demand-side factors, including environmental concerns and cost reductions in the operation of electric aircraft, will further accelerate market growth. Over the next five years, the market is expected to expand significantly, with urban air mobility and commercial electric aircraft becoming more mainstream.

Major Players

• Boeing

• MagniX

• ZeroAvia

• Vertical Aerospace

• Lilium

• Eviation Aircraft

• Heart Aerospace

• Embraer

• Rolls-Royce

• Honeywell Aerospace

• GE Aviation

• Pipistrel

• Bye Aerospace

• Joby Aviation

Key Target Audience

• Government and regulatory bodies

• Airlines

• Private aviation operators

• Cargo operators

• Urban air mobility providers

• Aerospace manufacturers

• Technology developers

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the key variables influencing the market, such as technological developments, regulatory factors, and demand-side drivers.

Step 2: Market Analysis and Construction

This step focuses on building the market model by analyzing past data, trends, and future projections to create a comprehensive market structure.

Step 3: Hypothesis Validation and Expert Consultation

This step validates the hypotheses generated in Step 2 through interviews with industry experts, stakeholders, and key market players to ensure accuracy.

Step 4: Research Synthesis and Final Output

This step synthesizes the data collected and analyzed in the previous steps to generate a final comprehensive report and forecast.

- Executive Summary

- Qatar more electric aircraft Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for sustainable aviation

Government support for clean energy technologies

Advancements in battery technology - Market Challenges

High development and certification costs

Limited availability of electric aircraft infrastructure

Regulatory barriers in the aviation industry - Market Opportunities

Growing investment in electric aircraft by airlines

Strategic partnerships with tech companies

Expansion of electric aircraft testing and demonstrations - Trends

Rising adoption of hybrid-electric propulsion systems

Technological innovations in battery efficiency

Integration of AI for energy optimization in flight

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric propulsion systems

Battery management systems

Electric motor integration

Energy storage solutions

Power electronics - By Platform Type (In Value%)

Urban air mobility

Commercial aircraft

Cargo drones

Private aircraft

Regional aircraft - By Fitment Type (In Value%)

Retrofit systems

Original equipment

Hybrid systems

Standalone electric propulsion

Battery systems for hybrid propulsion - By EndUser Segment (In Value%)

Airlines

Cargo operators

Private aviation

Urban air mobility operators

Government & military agencies - By Procurement Channel (In Value%)

OEM (Original Equipment Manufacturer)

Tier 1 suppliers

Direct purchases

Collaborative ventures

Government procurements

- Market Share Analysis

- Cross Comparison Parameters

(Market share, technological innovation, regulatory compliance, strategic partnerships, geographical presence) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Boeing

Rolls-Royce

Honeywell Aerospace

General Electric

Safran

MagniX

Pipistrel

Bye Aerospace

ZeroAvia

Vertical Aerospace

Lilium

Eviation Aircraft

Heart Aerospace

Embraer

- Airlines focusing on sustainable aviation

- Government agencies investing in green aviation

- Private aviation operators seeking cost reductions

- Cargo operators adopting eco-friendly aircraft solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035