Market Overview

The Qatar offshore helicopters market is valued at approximately USD ~ billion in 2024, driven by the ongoing demand for helicopter services in offshore oil and gas exploration, personnel transfer, search and rescue (SAR) missions, and logistical support. The country’s expanding energy sector, particularly its liquefied natural gas (LNG) and offshore oil fields, continues to spur demand for reliable, efficient helicopter transport services. Qatar’s significant oil reserves and growing maritime operations contribute to the need for advanced rotorcraft, ensuring both operational efficiency and personnel safety. Furthermore, increasing investments in energy infrastructure and military modernization in the region are driving market growth, highlighting the vital role of offshore helicopter services for personnel, cargo transport, and emergencies.

Qatar’s offshore helicopter market is largely concentrated in cities such as Doha, Mesaieed, and Al Khor, which serve as hubs for offshore energy operations, particularly in the gas and oil sector. These cities are home to major oil and gas infrastructure, with Doha as the center for energy policy and business dealings. The country’s strategic location in the Persian Gulf, with proximity to major offshore fields, coupled with its regulatory framework for aviation, supports its dominance in the region. Additionally, Qatar’s collaboration with global helicopter service providers, including those from Europe and the U.S., further strengthens its position in the offshore helicopter market.

Market Segmentation

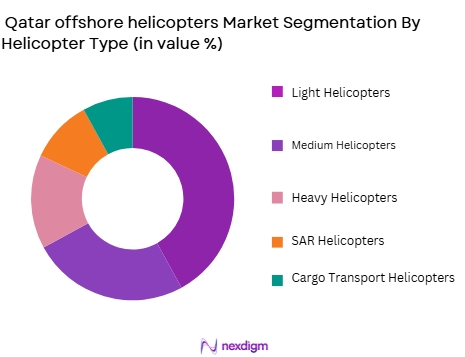

By Helicopter Type

Medium Helicopters dominate the Qatar offshore helicopter market, driven by their versatility in carrying both passengers and cargo to and from offshore platforms. These helicopters, such as the S-92 and EC225, are well-suited for transporting personnel, heavy cargo, and medical evacuations, offering a balance of range, capacity, and efficiency. The demand for medium helicopters has increased with the growing scale of offshore energy exploration and operational complexity. They are ideal for Qatar’s extensive offshore infrastructure, which requires both long-range and heavy-lift capabilities. Additionally, these helicopters are critical in providing services to the oil and gas industry, making them the preferred choice for operators.

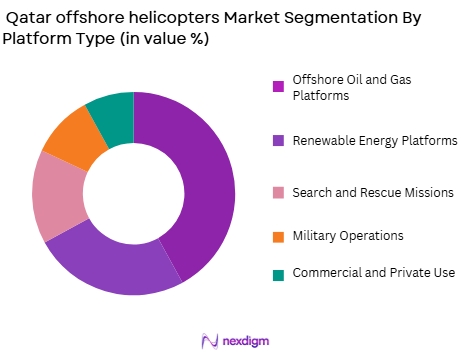

By Platform Type

Offshore Oil and Gas Platforms dominate the Qatar offshore helicopter market, accounting for the largest share. The substantial offshore oil and gas reserves in Qatar, particularly in the North Field gas project, are the primary drivers behind the need for helicopter transport. These platforms require regular personnel transfer, emergency evacuations, and cargo logistics, which offshore helicopters fulfill. The Qatar Energy Corporation (Qatar Petroleum) and other international energy companies rely heavily on helicopters to support their operations in the offshore oil fields. These platforms continue to be the largest source of demand for helicopter services, making them the dominant sub-segment in this market.

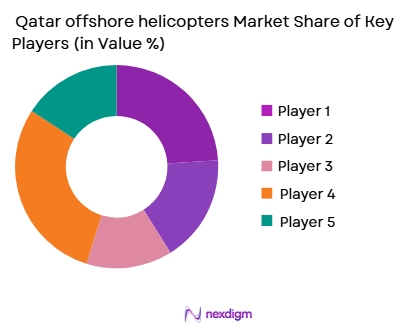

Competitive Landscape

The Qatar offshore helicopter market is highly competitive, with a mix of global players and regional service providers. The market is influenced by both local companies like Gulf Helicopters and international heavyweights such as Bristow Group and HeliService International. The significant role of helicopters in offshore oil and gas exploration, SAR, and military applications drives competition among service providers. The consolidation of the market by major players has helped improve service quality and expand fleets to cater to the growing demand from the energy sector.

| Company | Establishment Year | Headquarters | Fleet Size | Service Focus | Major Platforms Served | Safety Certifications |

| Gulf Helicopters | 1970 | Doha, Qatar | ~ | ~ | ~ | ~ |

| Bristow Group | 1955 | Houston, USA | ~ | ~ | ~ | ~ |

| HeliService International | 1984 | Hamburg, Germany | ~ | ~ | ~ | ~ |

| CHC Helicopter | 1947 | Vancouver, Canada | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | Marignane, France | ~ | ~ | ~ | ~ |

Qatar offshore helicopters Market Analysis

Growth Drivers

Increased Offshore Oil and Gas Exploration

Qatar’s offshore oil and gas sector is witnessing significant expansion due to rising global energy demands and the discovery of new reserves. This increased exploration is driving the demand for offshore helicopter services, as helicopters are critical for transporting personnel and equipment to and from offshore platforms. The harsh environment and remote locations of offshore drilling operations make helicopters the preferred mode of transportation, ensuring operational efficiency and safety. As Qatar continues to develop its energy sector, helicopter services are expected to see a steady rise in demand. This growth will be further supported by investments in state-of-the-art aircraft and safety measures that meet international aviation standards. Offshore helicopters play a vital role in ensuring the seamless operation of offshore activities by facilitating quick personnel transfers, equipment movement, and emergency evacuation capabilities, contributing significantly to Qatar’s energy production efforts.

Technological Advancements and Fleet Upgrades

Advancements in helicopter technology, such as the development of more fuel-efficient engines, improved safety systems, and enhanced navigation capabilities, are positively impacting the Qatar offshore helicopter market. These innovations not only improve operational efficiency but also enhance the safety and comfort of passengers and crew members. Helicopter operators are increasingly investing in fleet upgrades, replacing older models with newer, more advanced aircraft. This shift towards more modern fleets is increasing the reliability and effectiveness of offshore helicopter services, making them a key enabler for offshore activities. The integration of autonomous technologies and the development of greener, sustainable aviation practices also present opportunities for future growth in the market.

Market Challenges

High Operating Costs

One of the primary challenges faced by Qatar’s offshore helicopter industry is the high operational and maintenance costs associated with helicopter fleets. The offshore environment is demanding, subjecting helicopters to wear and tear that increases maintenance frequency and costs. Additionally, the cost of acquiring, maintaining, and upgrading helicopters is significant, which can result in high capital expenditures for operators. Fuel expenses are another major cost driver, especially given the long distances helicopters must cover to reach offshore oil rigs and platforms. This combination of operational and fuel costs can limit profitability and make it challenging for operators to remain competitive in the market. These high costs may also impact the affordability of services for energy companies, potentially limiting market growth.

Regulatory and Safety Compliance

Offshore helicopter operators must adhere to stringent regulatory and safety standards set by aviation authorities, including international organizations such as the International Civil Aviation Organization (ICAO) and local authorities. Compliance with these regulations often requires significant investments in training, certification, and fleet management, which can be costly for operators. Furthermore, changes in regulations or the introduction of new safety standards can necessitate expensive fleet upgrades or operational changes. In addition, the challenging weather conditions in the region, such as high winds and extreme temperatures, make compliance with safety requirements more difficult, adding another layer of complexity for operators. These regulatory challenges can strain the resources of companies and may lead to delays or operational disruptions.

Opportunities

Expansion of Renewable Energy Projects

As Qatar diversifies its energy portfolio to include renewable energy sources, there is a growing opportunity for offshore helicopters to support offshore wind farms, solar energy installations, and other renewable projects. Helicopters can provide essential services, such as transporting workers, equipment, and supplies to renewable energy sites that are often located in remote offshore areas. The increasing demand for renewable energy is expected to drive the need for offshore helicopter services, especially in the development of large-scale offshore wind farms and other energy installations. This market shift presents a chance for helicopter operators to tap into a new and emerging sector, complementing traditional oil and gas operations.

Collaborations with International Operators

Qatar’s offshore helicopter industry has significant potential for growth through strategic partnerships and collaborations with international helicopter operators. Global companies with advanced technologies and established best practices can work with local operators to enhance service offerings, expand fleets, and access new market opportunities. Through collaborations, Qatar can benefit from the expertise of global players while ensuring that local regulations and safety standards are met. Additionally, partnerships may allow operators to share costs and expand their reach to neighboring markets, increasing competitiveness. With growing demand for offshore helicopter services in the Middle East and beyond, international collaborations present a viable avenue for growth and market expansion.

Future Outlook

The future of the Qatar offshore helicopters market appears promising, with significant growth anticipated driven by the country’s expanding offshore energy operations, increasing demand for offshore helicopter services, and the rise of new energy platforms. Over the next 5 to 10 years, the market will likely experience steady growth due to increasing investments in energy infrastructure, coupled with a greater focus on reducing operational risks through improved helicopter safety and efficiency. The transition toward renewable energy sources, particularly offshore wind, will provide new service opportunities for helicopter operators. Furthermore, advancements in hybrid-electric propulsion systems will likely influence the next generation of helicopters used in offshore operations. Continued partnerships between Qatar’s energy giants and helicopter service providers will drive market growth and technological advancement, ensuring that helicopter services remain essential to Qatar’s strategic offshore ambitions.

Market Players

- Gulf Helicopters

- Bristow Group

- HeliService International

- CHC Helicopter

- Airbus Helicopters

- Sikorsky Aircraft

- Leonardo Helicopters

- Bell Helicopter

- AgustaWestland

- Textron Aviation

- H145 Helicopter Services

- International Helicopter Services

- Mil Helicopters

- Thales Group

- Elbit Systems

Key Target Audience

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Offshore Oil and Gas Companies

- Renewable Energy Companies

- Private Helicopter Operators

- Military and Defense Agencies

- Offshore Logistics and Marine Services Providers

- Helicopter Maintenance and Safety Certification Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes major stakeholders, including helicopter operators, energy companies, regulatory bodies, and service providers. This will be underpinned by secondary and primary research using reputable industry sources and databases to identify the key drivers in the offshore helicopter market.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data related to the offshore helicopter market. This includes assessing fleet growth, personnel transfer volumes, and operational safety standards within Qatar’s energy sector. This data will ensure the accuracy of the market size and demand forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through expert interviews and consultations with stakeholders in the offshore helicopter services, energy sector, and aviation. These consultations will provide practical insights and help validate market assumptions and projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered research and feedback to compile a comprehensive market report. This report will include detailed insights into market drivers, competitive landscapes, and technological advancements, ensuring accurate and actionable intelligence for stakeholders in the Qatar offshore helicopter market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased offshore oil and gas exploration in Qatar’s waters

Strong demand for offshore transportation due to growing energy sector

Rising safety and compliance requirements for offshore operations - Market Challenges

High maintenance and operational costs of offshore helicopters

Regulatory compliance and certification for offshore helicopter services

Technological integration challenges with existing fleet - Market Opportunities

Growing demand for offshore renewable energy projects

Technological advancements in helicopter fuel efficiency and emissions reduction

Expansion of helicopter leasing and short-term rental services - Trends

Development of hybrid and electric offshore helicopters

Increased use of AI and automation in helicopter fleet management

Shift towards more versatile, multi-role helicopter platforms - Government regulations

Regulations from Qatar Civil Aviation Authority (QCAA)

International aviation safety standards for offshore operations

Environmental regulations on emissions and fuel usage - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Light Helicopters

Medium Helicopters

Heavy Helicopters

Search and Rescue (SAR) Helicopters

Cargo Transport Helicopters - By Platform Type (In Value%)

Offshore Oil and Gas Platforms

Renewable Energy Platforms

Search and Rescue Missions

Cargo Transportation

Passenger Transfers - By Fitment Type (In Value%)

New Platform Integration

Retrofit and Upgrade

On-demand Helicopter Services

Mobile and Modular Platforms

Emergency and Rescue Missions - By EndUser Segment (In Value%)

Offshore Oil and Gas Companies

Renewable Energy Firms

Government Agencies (Search and Rescue)

Military and Defense Sectors

Private Contractors - By Procurement Channel (In Value%)

Direct Purchase from OEMs

Lease and Rental Agreements

Government and Defense Contracts

Partnerships with Helicopter Service Providers

Third-party Logistics and Maintenance Services

- Cross Comparison Parameters (Technology Integration, Fleet Availability, Safety Standards, Operational Efficiency, Cost Competitiveness, Helicopter Fleet Size, Aircraft Model Variability, Safety Compliance Standards, Operational Reach, Maintenance Infrastructure, Fuel Efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Gulf Helicopters Company

Qatar Airways

Airbus Helicopters

Leonardo Helicopters

Bell Helicopter

Sikorsky Aircraft

Saudia Aerospace Engineering Industries

H145 Helicopter Services

AgustaWestland

Helicopter Association International

Crashed Aircraft Recovery Helicopters

International Helicopter Services

Mil Helicopters

Thales Group

Elbit Systems

- Increased offshore oil and gas operations demand transportation services

- Rising adoption of offshore renewable energy platforms

- Growing need for rapid search and rescue operations in offshore areas

- Expansion of military and defense contracts in offshore helicopter services

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035