Market Overview

The Qatar private jet charter services market is valued at USD ~billion in 2024, driven primarily by the growth of high-net-worth individuals and corporate travel in the region. Qatar’s expanding wealth and its role as a hub for business and leisure travel contribute significantly to the market’s rise. Government support for private aviation also plays a key role in facilitating access to private jets, creating an environment for market growth.Cities such as Doha, which is a major business and leisure hub in the Middle East, dominate the private jet charter services market. Qatar’s strategic location, coupled with its growing tourism industry and strong economic position, places Doha at the center of the region’s aviation demand. The availability of luxurious airport facilities, direct access to global flight routes, and governmental support have all cemented Doha’s dominance in the market.

Market Segmentation

By Aircraft Type

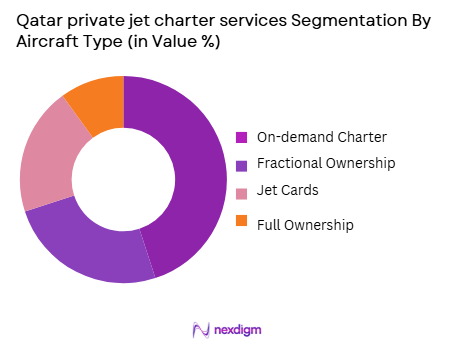

The Qatar private jet charter services market is segmented by aircraft type, including light jets, mid-size jets, heavy jets, ultra-long-range jets, and helicopters. Light jets dominate the market share due to their flexibility, cost-efficiency, and high demand among corporate clients and high-net-worth individuals for short-haul trips. These jets are optimal for regional travel, offering a balance between luxury and operational costs. Their increasing popularity can be attributed to their availability at local airports and their ability to meet the needs of quick, private, and accessible flights, particularly for business executives who require short, high-quality trips.

By Service Type

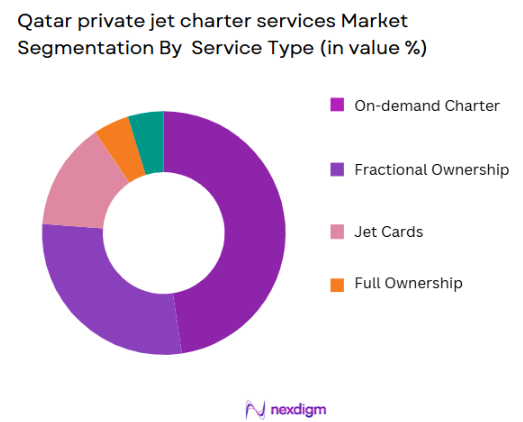

The market is also segmented by service type, including on-demand charter services, fractional ownership, and jet cards. On-demand charter services hold the largest market share in Qatar, accounting for ~% of the market. This is due to the increasing preference for flexibility and convenience, especially among corporate clients and tourists who prioritize customized travel schedules. Fractional ownership and jet cards are also growing, as they cater to high-net-worth individuals seeking a more cost-effective and flexible alternative to full jet ownership.

Competitive Landscape

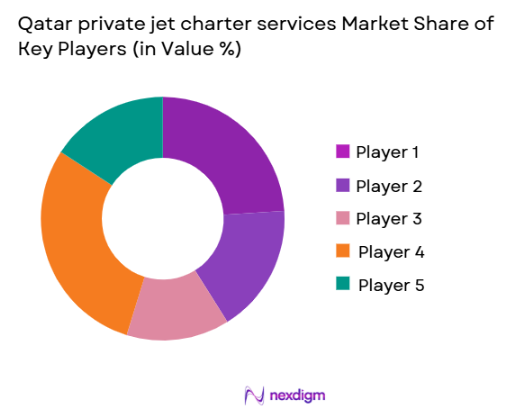

The Qatar private jet charter services market is dominated by key players such as Qatar Airways, Royal Jet, VistaJet, NetJets, and Executive Jet Management. These players leverage their established reputations, luxurious offerings, and strong operational capabilities to maintain a significant market presence. Qatar Airways, with its robust fleet and extensive network, is a major player in both domestic and international markets, while Royal Jet focuses on providing highly personalized services. The presence of global players like VistaJet and NetJets highlights the increasing demand for premium, tailored air travel experiences.

| Company | Establishment Year | Headquarters | Aircraft Fleet Size | Service Coverage | Key Offering | Customer Segment |

| Qatar Airways | 1993 | Doha, Qatar | ~ | ~ | ~ | ~ |

| Royal Jet | 2003 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ |

| VistaJet | 2004 | Malta | ~ | ~ | ~ | ~ |

| NetJets | 1964 | Columbus, USA | ~ | ~ | ~ | ~ |

| Executive Jet Mgmt | 1997 | Dubai, UAE | ~ | ~ | ~ | ~ |

Qatar private jet charter services Market Analysis

Growth Drivers

Increase in Military Expenditures by Australia

Australia’s defense spending has shown a consistent upward trajectory in recent years. In 2024, Australia’s defense budget reached AUD ~billion, representing a notable increase from previous years. This funding boost reflects the country’s strategic focus on enhancing defense capabilities, including the procurement of precision-guided munitions (PGMs). The Australian government’s commitment to modernizing its defense forces and strengthening its military readiness amidst growing security concerns in the Indo-Pacific region directly drives the demand for advanced munitions. As a result, the increased defense expenditure plays a pivotal role in propelling market growth for PGMs.

Rising Demand for Precision in Warfare

The shift towards more precise, efficient, and cost-effective military solutions has intensified the demand for precision-guided munitions in recent years. In 2024, military operations in the Indo-Pacific region have been marked by increasing reliance on PGMs to achieve high precision with minimal collateral damage. Australia’s commitment to enhancing its military capabilities in response to regional instability has contributed to the growing demand for PGMs. Additionally, the integration of advanced technologies in military operations and the demand for more surgical strikes are driving investments in PGMs, allowing for more accurate targeting and reducing the risk of civilian harm.

Market Challenges

High Cost of Advanced Munitions Systems

The development and procurement of advanced precision-guided munitions systems come with significant costs. As of 2024, the average cost of developing and deploying PGMs in Australia has exceeded AUD ~billion for large-scale systems. The high costs are primarily attributed to research and development (R&D) expenses, which account for a substantial portion of the budget. Moreover, the integration of advanced technologies such as AI and enhanced targeting systems into PGMs further increases production costs. These financial challenges pose significant barriers to expanding PGMs deployment, particularly in smaller or less affluent regions of the defense industry.

Limited Availability of Indigenous Manufacturing Capacity

Australia’s reliance on international suppliers for the manufacturing of advanced precision-guided munitions poses a key challenge to its defense capabilities. In 2024, less than ~% of PGMs in Australia are produced domestically. Despite efforts to strengthen indigenous defense manufacturing, such as the establishment of local defense production facilities, the country still faces limitations in scaling up production to meet growing demand. These constraints have been exacerbated by a global supply chain shortage for critical components, which limits Australia’s ability to rapidly expand its PGM manufacturing capabilities and achieve self-reliance.

Market Opportunities

Integration of AI and IoT in PGMs

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into precision-guided munitions presents a significant growth opportunity for the market. In 2024, Australia has begun incorporating AI into its defense systems, with a particular focus on enhancing targeting accuracy, autonomous decision-making, and real-time data analysis. The use of IoT in PGMs allows for better communication between systems, improving operational efficiency and responsiveness during missions. The ongoing R&D in AI and IoT technologies is expected to boost the effectiveness of PGMs, driving their adoption within Australia’s defense sector and opening up new market opportunities.

Collaborations with International Defense Contractors

Australia’s defense sector is increasingly collaborating with international defense contractors, facilitating the exchange of advanced technologies and expertise in the development of precision-guided munitions. In 2024, Australia entered several key defense partnerships, particularly with countries like the United States and the United Kingdom, to jointly develop and deploy next-generation PGMs. These collaborations allow Australia to benefit from technological advancements and more cost-effective production, which not only enhances its military capabilities but also offers significant market opportunities for companies involved in defense manufacturing.

Future Outlook

Over the next 5-10 years, Qatar’s private jet charter services market is expected to grow significantly, driven by the continued rise in luxury and corporate travel demand. The region’s strategic positioning as a business hub, coupled with ongoing investments in aviation infrastructure and increasing demand for personalized travel experiences, will propel market expansion. Government policies promoting the aviation sector and advancements in aircraft technology will further support the market’s growth, making private aviation more accessible to an expanding customer base.

Major Players

- Qatar Airways

- Royal Jet

- VistaJet

- NetJets

- Executive Jet Management

- FlyExclusive

- XOJET

- JetSmarter

- Flexjet

- Air Partner

- JetSetGo Aviation

- Gama Aviation

- Al Bateel Aviation

- TAG Aviation

- Air Charters

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- High-net-worth Individuals

- Corporate Executives

- Tourism and Leisure Companies

- Luxury Travel Agencies

- Aviation Operators and Brokers

- Commercial Aircraft Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first step is to identify the key drivers and variables impacting the Qatar private jet charter services market. This includes analyzing government policies, aviation infrastructure, and consumer trends. Secondary research using industry reports and government publications will help in constructing a comprehensive framework for market analysis.

Step 2: Market Analysis and Construction

We will gather historical data on the market size, segmentation, and consumer behavior. This will involve an in-depth examination of trends in aircraft demand, preferences for service types, and pricing strategies to assess market performance over the past five years.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses regarding market drivers, growth, and opportunities will be validated through expert consultations with industry leaders in aviation, corporate travel, and government bodies. These insights will be used to refine the market assumptions and validate the forecasted growth trajectory.

Step 4: Research Synthesis and Final Output

We will synthesize all collected data, combining historical data, expert opinions, and market intelligence, to generate a final report. This will provide a validated, data-driven analysis of the Qatar private jet charter services market with a forecast for future growth.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in high-net-worth individuals and corporate travel

Government regulations supporting private aviation

Expansion of tourism and leisure travel in the region - Market Challenges

High operating and maintenance costs of private jets

Airspace congestion and operational restrictions

Regulatory compliance challenges in charter services - Trends

Shift towards sustainable aviation fuel

Growth in demand for personalized in-flight services

Technological advancements in aircraft tracking and booking systems

- Market Opportunities

Growing demand for fractional ownership and air taxi services

Increasing demand for luxury travel experiences

Expanding the use of technology in booking and management systems - Government regulations

Private aviation safety standards

Customs and immigration regulations for private flights

Environmental regulations on aircraft emissions - SWOT analysis

Strength: Increasing investment in the private jet market

Weakness: High operational costs and maintenance requirements

Opportunity: Growth in regional tourism and corporate aviation - Porters 5 forces

Threat of new entrants: Moderate, with high capital investment barriers

Bargaining power of suppliers: High, due to limited aircraft manufacturers

Threat of substitutes: Low, as private jet travel offers a unique value proposition

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Jets

Mid-Size Jets

Heavy Jets

Ultra-Long-Range Jets

Helicopters - By Platform Type (In Value%)

Business Aviation

Tourism & Leisure Aviation

Government & Military Aviation

Medical & Emergency Aviation

Corporate Aviation - By Fitment Type (In Value%)

Aircraft Charter

Aircraft Ownership

Aircraft Management

Air Taxi Services

Fractional Ownership - By EndUser Segment (In Value%)

High-net-worth Individuals

Corporates & Executives

Government Agencies

Tourists & Leisure Travelers

Emergency & Medical Services - By Procurement Channel (In Value%)

Direct Charter Services

Brokerage Services

Membership Programs

Online Charter Platforms

Airline Partnership Programs

- Market Share Analysis

- CrossComparison Parameters(Aircraft Availability, Operational Cost, Luxury Features, Environmental Impact, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Qatar Airways

Gulfstream Aerospace

Emirates Executive

JetSetGo Aviation

VistaJet

NetJets

Flexjet

Bombardier

Air Partner

Lufthansa Private Jet

XOJET

Royal Jet

Charter Jets

JetSmarter

FlyExclusive

- Growing demand from high-net-worth individuals and executives

- Rise in corporate and business travel in Qatar

- Demand for emergency and medical aviation services

- Increasing preference for seamless, luxurious travel experiences

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035