Market Overview

As of 2024, the Qatar warehousing market is valued at USD ~ billion, with a growing CAGR of 5.4% from 2024 to 2030, supported by the rapid growth of e-commerce and logistics infrastructure development. This market is primarily driven by the increasing demand for efficient supply chain solutions, as businesses aim to enhance their storage capabilities to meet heightened consumer expectations. The rise in foreign direct investments has further propelled the warehousing sector, contributing to its expansion and diversification.

Key cities like Doha and Al Rayyan dominate the market due to their strategic locations and connectivity. Doha, as the capital city, serves as a commercial hub, attracting numerous multinational companies that require expansive warehousing solutions. Al Rayyan, adjacent to Doha, benefits from its proximity to transportation networks, facilitating seamless logistics operations. Both cities have witnessed significant investments in modern warehousing facilities, making them integral to the overall growth of the Qatar warehousing market.

Market Segmentation

By Warehouse Type

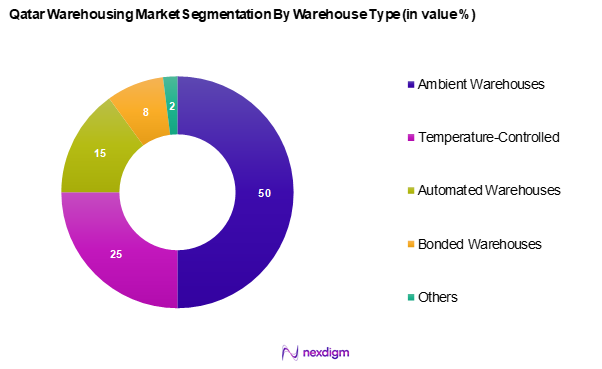

The Qatar warehousing market is segmented into ambient warehouses, temperature-controlled warehouses, automated warehouses, bonded warehouses, and others. Currently, the ambient warehouses segment holds a dominant market share due to their versatility and cost-effectiveness. These warehouses cater to a broad range of industries, including retail and e-commerce, as they are designed to accommodate a variety of products without the need for specialized storage conditions. The rising demand for storage solutions in non-perishable goods further strengthens the position of ambient warehouses in the market.

By Industry Vertical

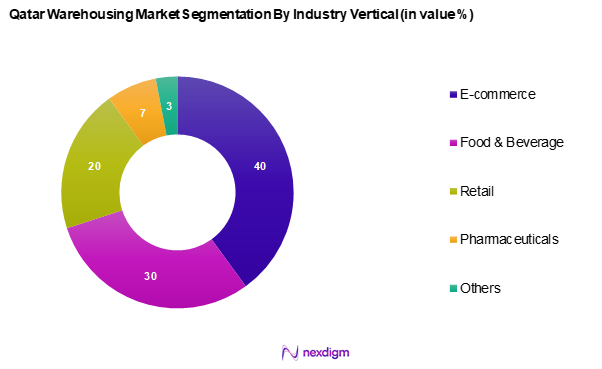

The Qatar warehousing market is segmented into e-commerce, food & beverage, retail, pharmaceuticals, and others. The e-commerce segment dominates the market share, driven by the exponential growth of online shopping and the increasing need for efficient logistics operations to fulfill customer orders. As the e-commerce sector expands, businesses recognize the importance of reliable warehousing solutions that can support rapid delivery times and inventory management, thereby bolstering the demand for warehousing services in this segment.

Competitive Landscape

The Qatar warehousing market is dominated by several major players, including both local and international logistics firms that offer a wide range of warehousing solutions. Companies such as Agility Logistics, GAC Qatar, and Qatar Airways Cargo play pivotal roles in shaping the competitive landscape. Their well-established operations, extensive networks, and investment in advanced technologies significantly influence market dynamics.

| Company | Establishment Year | Headquarters | Warehouse Type | Industry Focus | Key Services |

| Agility Logistics | 1979 | Sulaibiya, Kuwait | – | – | – |

| GAC Qatar | 1979 | Doha, Qatar | – | – | – |

| Qatar Airways Cargo | 1997 | Qatar | – | – | – |

| DB Schenker | 1872 | Essen, Germany | – | – | – |

| CEVA Logistics | 1946 | Marseille, France | – | – | – |

Qatar Warehousing Market Analysis

Growth Drivers

Rising Demand for E-commerce Solutions

The continuous expansion of the e-commerce sector in Qatar has significantly increased the demand for warehousing solutions. The sector’s steady growth has been supported by high internet penetration and a growing preference for online shopping. This shift in consumer behavior is driving the need for efficient warehousing facilities that can handle order fulfillment and inventory management effectively. As a result, logistics firms are expanding their warehousing capacities to meet the increasing demand from e-commerce businesses and enhance operational efficiencies.

Increasing Foreign Direct Investments

Foreign direct investment plays a crucial role in driving Qatar’s warehousing market. Strategic initiatives to attract investments in key sectors, including logistics and warehousing, have strengthened this trend. Enhanced connectivity through major transportation hubs has further contributed to the sector’s expansion. Additionally, the government’s commitment to diversifying the economy under its national vision is fostering investments in logistics infrastructure, ensuring sustained market growth.

Market Challenges

Regulatory Compliance Issues

Regulatory compliance presents a significant challenge for the warehousing sector in Qatar. Businesses must adhere to strict health, safety, and environmental regulations, with non-compliance leading to potential penalties or operational disruptions. Many companies face difficulties in navigating these regulatory frameworks while striving to maintain high service quality and operational efficiency. This complexity adds an additional layer of challenge for warehousing firms in the country.

Land Availability Restrictions

Competition for industrial land, particularly in strategic locations, poses a notable challenge for warehousing expansion. Limited availability in prime areas forces developers to consider alternative locations, which can increase transportation costs and complicate logistics operations. The growing urbanization and ongoing infrastructure development further constrain land resources, making it increasingly difficult to secure suitable spaces for new warehousing facilities.

Opportunities

Expansion of Logistics Infrastructure

The ongoing development of logistics infrastructure presents significant growth opportunities for the warehousing market. Government investments in transportation networks and logistics facilities are improving supply chain processes and strengthening Qatar’s position as a regional logistics hub. The development of free trade zones and enhanced port capabilities are also creating additional incentives for businesses to establish warehousing operations in the country.

Adoption of IoT and Automation

The integration of IoT and automation technologies is transforming warehouse operations by improving efficiency and inventory management. Increased investment in smart warehousing solutions is enabling real-time inventory tracking and advanced data analytics, enhancing decision-making and reducing operational costs. As logistics firms recognize the benefits of automation in improving accuracy and reducing labour dependency, the adoption of these technologies is expected to accelerate, further strengthening the warehousing market in Qatar.

Future Outlook

Over the next five years, the Qatar warehousing market is projected to experience substantial growth, driven by increasing investments in logistics infrastructure and the expanding e-commerce sector. Continued government support for economic diversification and initiatives to boost the supply chain ecosystem are expected to further enhance growth prospects. As businesses strive to improve efficiency and meet consumer demand, innovative warehousing solutions will play a pivotal role in shaping the market landscape.

Major Players

- Agility Logistics

- GAC Qatar

- Qatar Airways Cargo

- DB Schenker

- CEVA Logistics

- XPO Logistics

- DHL Supply Chain

- JAS Forwarding

- Kuehne + Nagel

- Aramex

- Loadline Logistics

- Multinational Logistics Service Providers

- Qatar Logistics

- Al-Futtaim Logistics

- Wared Logistics

Key Target Audience

- Logistics and Supply Chain Managers

- E-commerce Companies

- Retail Businesses

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Ministry of Transport and Communications)

- Infrastructure Development Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar warehousing market. This step relies on extensive desk research, utilizing a combination of secondary data sources, such as industry reports, company websites, and government publications. The primary goal is to identify and define crucial variables that influence market dynamics, including market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data regarding the Qatar warehousing market. This includes assessing market penetration rates, the ratio of warehouses to logistics companies, and revenue generation within various segments. Additionally, an evaluation of performance metrics—such as storage capacity and customer demand—is conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through structured interviews with industry experts representing diverse companies in the logistics and warehousing sectors. These consultations provide valuable insights into operational practices, customer preferences, and strategic challenges, aiding in the refinement and corroboration of the market data collected.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with multiple warehousing and logistics service providers to gather detailed insights regarding product segments, market trends, sales performance, and client needs. This interaction serves to verify and supplement the statistics obtained through the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Qatar warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Demand for E-commerce Solutions

Increasing Foreign Direct Investments - Market Challenges

Regulatory Compliance Issues

Land Availability Restrictions - Opportunities

Expansion of Logistics Infrastructure

Adoption of IoT and Automation - Trends

Growth of Micro-Fulfillment Centers

Sustainability Practices in Warehousing - Government Regulation

Import & Export Regulations

Health and Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Rental Rate, 2019-2024

- By Warehouse Type, (In Value %)

Ambient Warehouses

Temperature-Controlled Warehouses

Automated Warehouses

Bonded Warehouses

Others - By Industry Vertical, (In Value %)

E-commerce

Food & Beverage

Retail

Pharmaceuticals

Others - By Region, (In Value %)

Doha

Al Rayyan

Madinat ash Shamal

Al Khor

Others - By Service Type, (In Value %)

Storage Services

Value-Added Services

Transportation & Distribution - By Ownership Type, (In Value %)

Third-Party Logistics (3PL)

Private Warehousing

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Edible Oil Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Segment, Number of Warehouses, Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Service Types for Major Players

- Detailed Profiles of Major Companies

Agility Logistics

GAC Qatar

Qatar Logistics

DB Schenker

Qatar Airways Cargo

CEVA Logistics

DHL Supply Chain

Kuehne + Nagel

XPO Logistics

Aramex

JAS Forwarding

Agility

Al-Futtaim Logistics

Loadline Logistics

Multinational Logistics Service Providers

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Rental Rate, 2025-2030