Market Overview

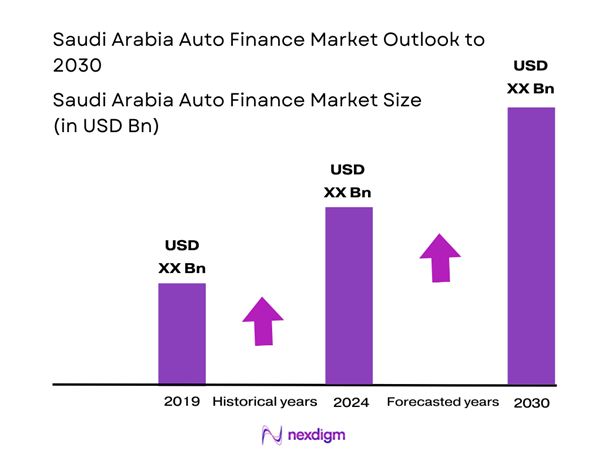

The Saudi Arabia Auto Finance Market is valued at USD 10 billion, reflecting a substantial increase driven by a growing demand for personal vehicles and enhanced financing options. This rise is underpinned by several factors, including favorable government policies encouraging vehicle ownership, an expanding middle class with higher disposable income, and increased competition among financial institutions that provide tailored financing solutions. The market is projected to continue its upward trend as consumer preferences shift towards personal mobility.

Dominant cities, such as Riyadh, Jeddah, and Dammam, play critical roles in the market due to their economic significance and population density. Riyadh, as the capital, is a hub for automotive sales and financing firms, resulting in a high concentration of transactions. Jeddah, with its strategic location as a maritime gateway, stimulates trade and finance activities, while Dammam’s robust industrial base supports a diverse range of customers seeking auto finance options, making these cities pivotal for the market landscape.

Saudi Arabia is increasingly focused on promoting electric vehicle (EV) adoption as part of its Vision 2030 strategy. The government has set a target of having 30% of all vehicles in the country be electric by 2030. In 2022, the number of EVs registered in the country surged to 5,000, with projections estimating this number will reach 20,000 by end of 2025, driven by active subsidies and incentives for consumers purchasing EVs.

Market Segmentation

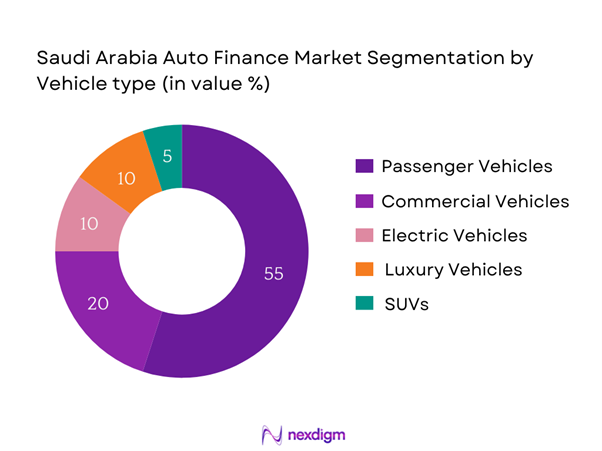

By Vehicle Type

The Saudi Arabia Auto Finance Market is segmented by vehicle type into passenger vehicles, commercial vehicles, electric vehicles, luxury vehicles, and SUVs. Among these, passenger vehicles dominate the market due to their widespread appeal and accessibility. This segment attracts a broad customer base as it caters to personal and family needs, and the continuous inflow of new models keeps consumer interest high. The growing urbanization and rising purchasing power within the population further bolster demand within this segment, ensuring significant market share.

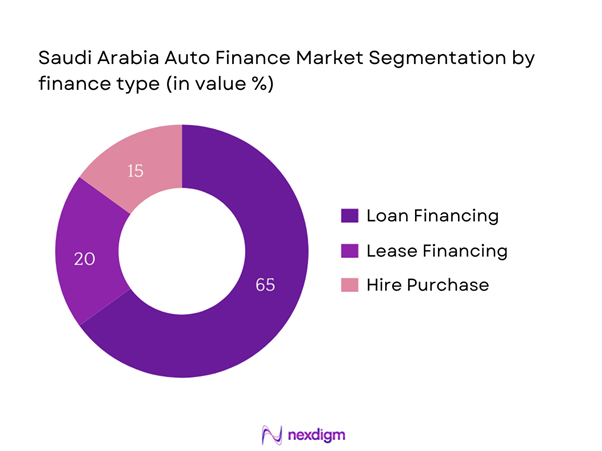

By Finance Type

The segmentation by finance type includes loan financing, lease financing, and hire purchase options. Loan financing holds a dominant position as it provides consumers with the flexibility to own the vehicle outright after payment. This sub-segment appeals to buyers who prefer long-term ownership and offers competitive interest rates from banks and financial institutions. The assurance of asset ownership without continuous payments attracts a significant number of customers, establishing loan financing as the primary method of auto finance in Saudi Arabia.

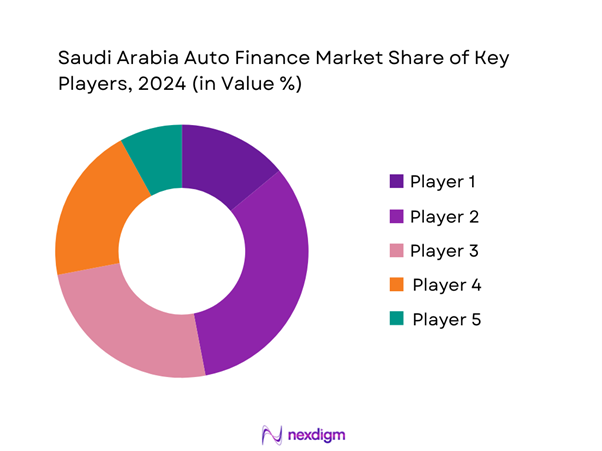

Competitive Landscape

The Saudi Arabia Auto Finance Market is characterized by the presence of several major players including local and international financial institutions. Dominance in this sector is evident among key players such as Al Rajhi Bank and National Commercial Bank, which leverage strong brand equity and comprehensive service offerings. The competitive landscape reflects a mix of established banks and newer entrants, each striving to innovate financing solutions that meet diverse consumer needs.

| Company | Establishment Year | Headquarters | Market Share | Fleet Size | Average Loan Amount | Customer Segments | Digital Platform | Partnerships |

| Al Rajhi Bank | 1957 | Riyadh | – | – | – | – | – | – |

| National Commercial Bank | 1997 | Jeddah | – | – | – | – | – | – |

| Samba Financial Group | 1980 | Riyadh | – | – | – | – | – | – |

| Saudi Investment Bank | 1976 | Riyadh | – | – | – | – | – | – |

| Gulf International Bank | 2006 | Manama | – | – | – | – | – | – |

Saudi Arabia Auto Finance Market Analysis

Growth Drivers

Increasing Demand for Personal Mobility

The demand for personal mobility in Saudi Arabia is significantly increasing, driven by a growing population that reached approximately 36 million in 2023. Furthermore, the number of registered vehicles has crossed 11 million, illustrating a substantial shift towards personal vehicle ownership. This trend is influenced by a youth demographic, where over 60% of the population is under 30 years old, seeking convenient transportation options. The rise in urbanization is also contributing to this demand, with cities like Riyadh experiencing rapid development and increased connectivity, necessitating personal mobility solutions.

Growth of the Middle-Class Population

The expanding middle-class population in Saudi Arabia is a key driver for the auto finance market. As of 2023, over 30% of the population belongs to the middle class, which is projected to increase to 40% by end of 2025. This demographic shift presents a considerable consumer base with the financial capability to invest in personal vehicles. Additionally, the gross domestic product (GDP) per capita is forecasted to reach USD 23,000 in 2024, enhancing disposable incomes and enabling more individuals to seek financing options for vehicle purchases.

Market Challenges

Regulatory Constraints

The regulatory environment for the auto finance market in Saudi Arabia presents significant challenges due to the stringent compliance requirements imposed by the Saudi Arabian Monetary Authority (SAMA). In recent years, the regulatory framework has expanded, including regulations on risk management practices and ensuring consumer protection, which can complicate financing operations. For example, in 2022, SAMA introduced more rigorous consumer credit scoring methods that necessitate financial institutions to invest in better assessment technologies. This regulatory burden may deter smaller firms from competing effectively, as compliance can entail significant costs.

Economic Fluctuations

Economic fluctuations significantly impact the auto finance sector, particularly in relation to oil price volatility, which is a key driver of the national economy. For instance, crude oil prices fell to an average of USD 85 per barrel in 2023 from USD 100 in early 2022, affecting overall economic stability. The World Bank forecasts that any major fluctuations in oil prices could impact GDP growth, which may lead to reduced consumer spending on non-essential items such as vehicles, thereby constraining the auto finance market growth.

Opportunities

Tech-Driven Financing Solutions

The shift towards technology-driven financing solutions presents significant growth opportunities within the Saudi Arabia Auto Finance Market. As consumer preferences evolve, digital platforms are increasingly facilitating vehicle financing processes, with online applications and instant credit approvals becoming more common. By end of 2025, it is projected that 50% of all auto loan applications will be submitted online, capitalizing on the country’s high internet penetration rate, which reached 99% in 2023. This digital transformation is supported by a burgeoning fintech ecosystem that is innovating financial products to meet consumer demands for convenience and efficiency.

Rising Interest in Sustainable Mobility Solutions

The growing interest in sustainable mobility solutions is a prominent opportunity for future growth in the auto finance sector. As awareness regarding climate change increases, consumers are more inclined towards eco-friendly vehicles such as hybrids and electric cars. In 2022, the number of charging stations for electric vehicles expanded to over 500 facilities nationwide, bolstering the market for EV financing. As the government accelerates its push for sustainable transport, financial institutions that enhance their offerings to support green vehicles could see increased demand for these financing options in the future.

Future Outlook

Over the next few years, the Saudi Arabia Auto Finance Market is projected to show significant growth driven by supportive government policies, enhancements in digital financing solutions, and a substantial shift in consumer preferences towards personal vehicles. Introduction of electric vehicles paired with financing options will likely boost market dynamics as environmental considerations gain traction among consumers. This period of evolution signifies a transition towards versatile financing methods that respond to the changing automotive landscape.

Major Players

- Al Rajhi Bank

- National Commercial Bank

- Samba Financial Group

- Saudi Investment Bank

- Gulf International Bank

- Abdul Latif Jameel Finance

- Hala Financial Services

- Al-Ahli Bank

- Dallah Auto Finance

- Royal Bank of Canada

- Riyad Bank

- Alinma Bank

- Banque Saudi Fransi

- Arab National Bank

- United Saudi Commercial Bank

Key Target Audience

- Automotive Manufacturers

- Dealership Networks

- Commercial Fleet Operators

- Investment and Venture Capitalist Firms

- Government Regulatory Bodies (Saudi Arabian Monetary Authority, Ministry of Commerce)

- Financial Institutions

- Private and Public Sector Companies

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial step involves constructing a comprehensive ecosystem map that encompasses all major stakeholders within the Saudi Arabia Auto Finance Market. This process relies on extensive desk research, utilizing secondary and proprietary databases to gather detailed industry-level information. The objective is to identify and define critical variables that significantly influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Saudi Arabia Auto Finance Market is compiled and analyzed. This includes evaluating market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. An assessment of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses will undergo validation through computer-assisted telephone interviews (CATIs) with industry experts representing diverse companies within the auto finance sector. These consultations provide invaluable insights into operational and financial aspects, instrumental in refining and corroborating the collected market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple auto finance firms to gain detailed insights into product segments, sales performance, customer preferences, and relevant factors. This engagement serves to verify and complement the data derived from the bottom-up approach, ensuring a comprehensive and validated analysis of the Saudi Arabia Auto Finance Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Personal Mobility

Growth of the Middle-Class Population

Government Initiatives Promoting EV Adoption - Market Challenges

Regulatory Constraints

Economic Fluctuations - Opportunities

Tech-Driven Financing Solutions

Rising Interest in Sustainable Mobility Solutions - Trends

Digital Transformation in Finance

Increased Adoption of Telematics - Government Regulation

Compliance Requirements for Financial Products

Regulations Relating to Credit Rating Agencies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Passenger Vehicles

– Sedans

– Hatchbacks

– Compact Cars

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy Commercial Vehicles (HCVs)

Pickup Trucks

– Electric Vehicles

– Battery Electric Vehicles (BEVs)

– Plug-in Hybrid Electric Vehicles (PHEVs)

Luxury Vehicles

– Executive Sedans

– High-Performance Sports Cars

– Luxury SUVs

SUVs

– Compact SUVs

– Mid-size SUVs

– Full-size SUVs - By Finance Type (In Value %)

Loan Financing

– Fixed Rate Loans

– Variable Rate Loans

Lease Financing

– Operating Lease

– Financial Lease

Hire Purchase

– Balloon Payment Schemes

– Fixed Monthly Installments - By Distribution Channel (In Value %)

Banks

– Islamic Banks

– Conventional Banks

Non-Banking Financial Companies (NBFCs)

– Vehicle-Focused NBFCs

– Diversified NBFCs

Direct Sellers

– In-house Financing by Dealerships

– Manufacturer-backed Finance Arms

Online Platforms

– Auto Aggregator Websites

– Bank/NBFC Digital Portals - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Customer Segment (In Value %)

Individual Customers

– Salaried Individuals

– Self-employed Professionals

Corporate Clients

– Small and Medium Enterprises (SMEs)

– Large Corporations

– Fleet Operators

Government Bodies

– Ministries and Government Departments

– Public Sector Units (PSUs)

- Market Share of Major Players by Value/Volume, 2024

Market Share by Vehicle Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenue by Finance Type, Number of Touchpoints, Distribution Channels, Unique Value Offerings, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Al Rajhi Bank

Samba Financial Group

National Commercial Bank

Gulf International Bank

Banque Saudi Fransi

Alinma Bank

Saudi Investment Bank

Arab National Bank

Dallah Auto Finance

Riyad Bank

Al-Futtaim Group

Abdul Latif Jameel Finance

Hala Financial Services

Al-Ahli Bank

Tamweel Al-Oula

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030