Market Overview

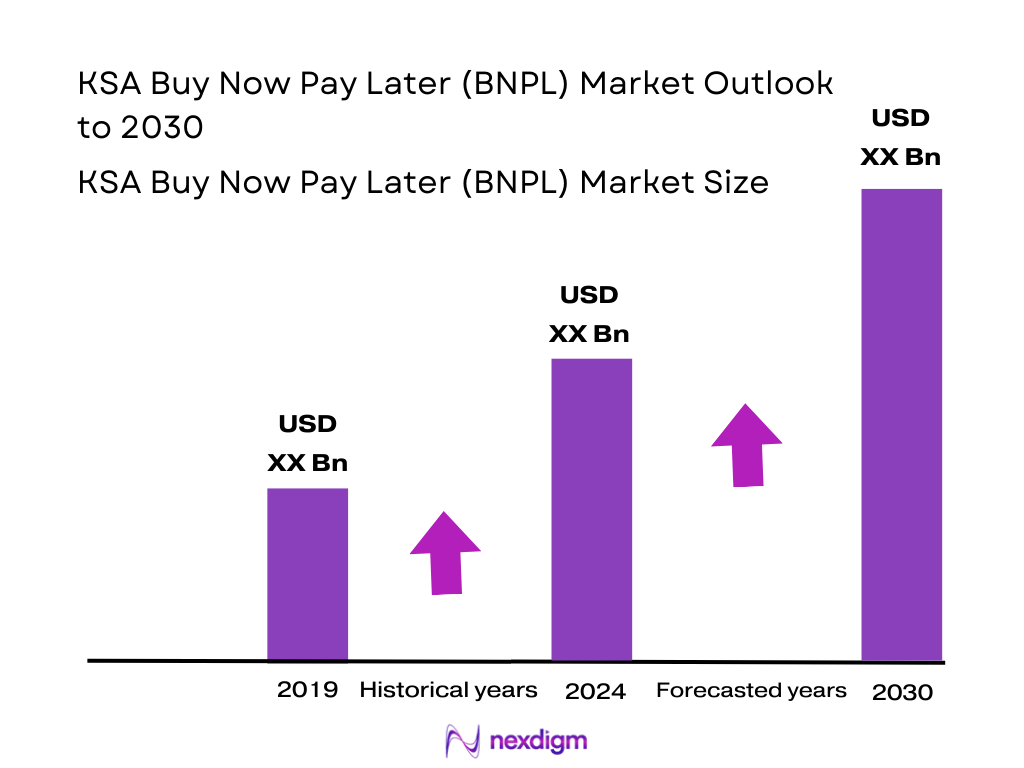

The Saudi Arabia Buy Now Pay Later (BNPL) market is valued at USD 1.31 billion, based on a comprehensive analysis of the past five years, reflecting robust adoption by consumers seeking flexible payment solutions. This growth is powered by high smartphone and internet penetration, low credit card ownership relative to banking penetration, and the appeal of interest‑free installment models, all enabling widespread consumer uptake of BNPL.

Major urban centers such as Riyadh, Jeddah, and Dammam dominate the BNPL market due to their high concentration of digitally savvy consumers, advanced fintech infrastructure, and dense retail ecosystems. These cities benefit from rapid e‑commerce penetration and greater merchant willingness to integrate BNPL, bolstered by a supportive regulatory environment and widespread mobile payment adoption.

Market Segmentation

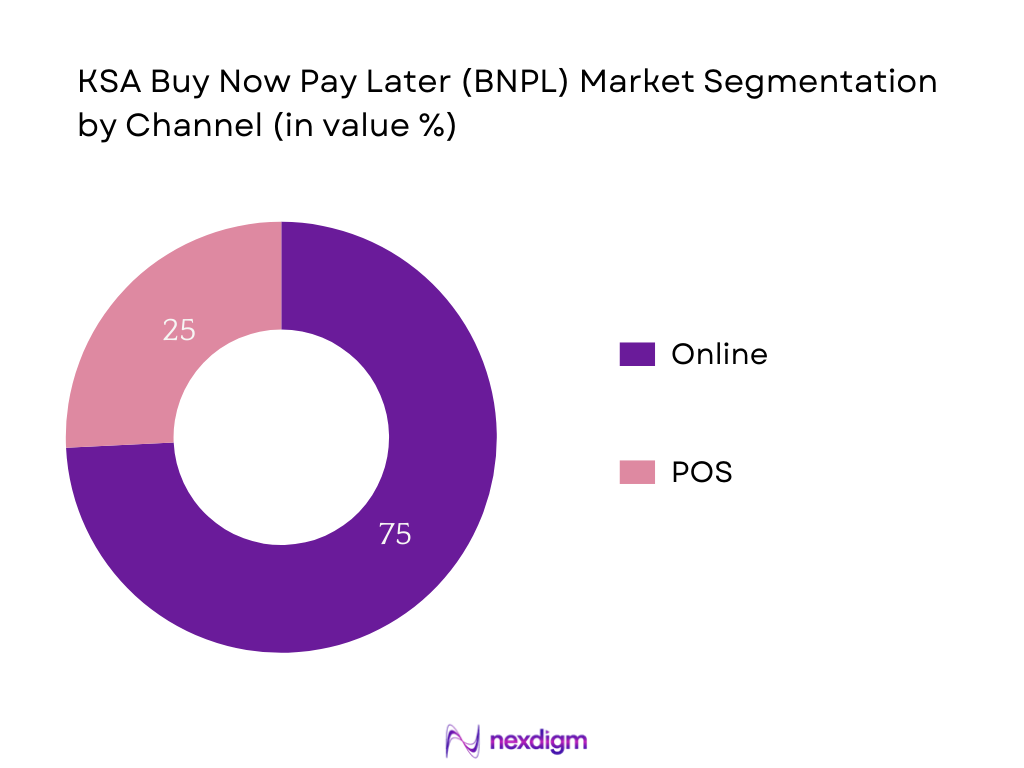

By Channel

The Saudi BNPL market’s online segment commands the largest share, credited to rapidly expanding e‑commerce platforms and consumer preference for seamless digital checkouts. Young, mobile-first shoppers find BNPL appealing for high‑value purchases, while merchants benefit from increased conversion rates and larger basket sizes through embedded BNPL at checkout.

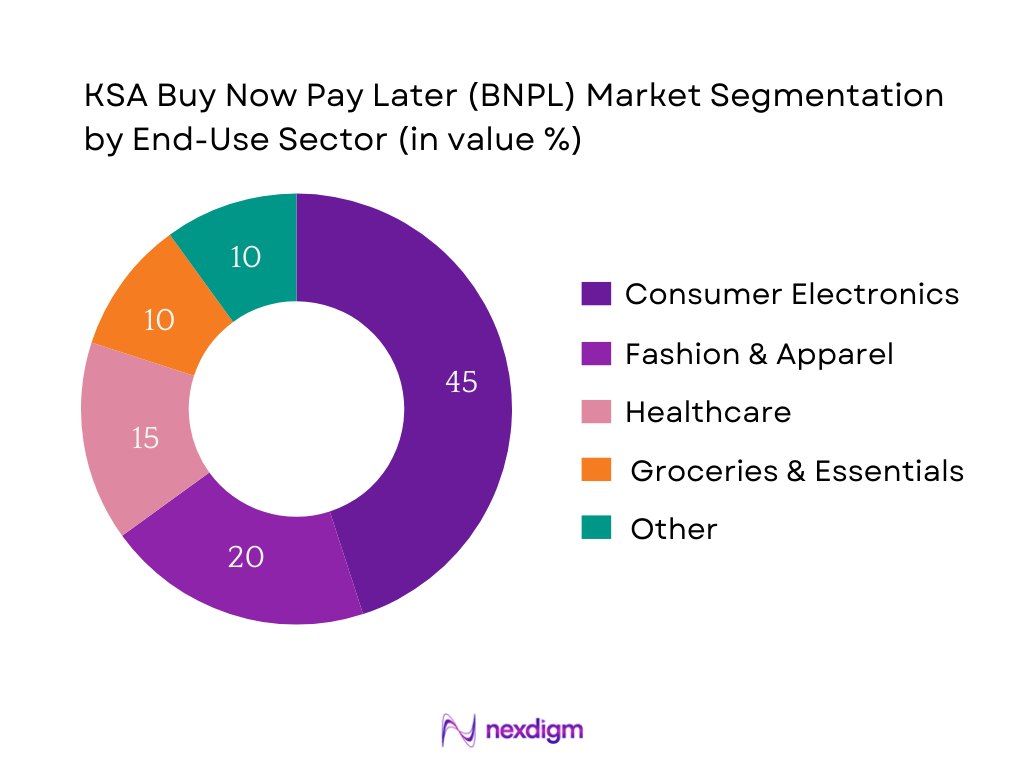

By End‑Use Category

Consumer electronics dominate the BNPL end‑use segmentation, driven by high‑value items such as smartphones, laptops, and gaming systems. The tech‑savvy demographic in urban centers favors installment models to spread costs without interest. Retailers integrate BNPL to capitalize on this trend, resulting in elevated conversion metrics and growth for electronics purchases via installment plans.

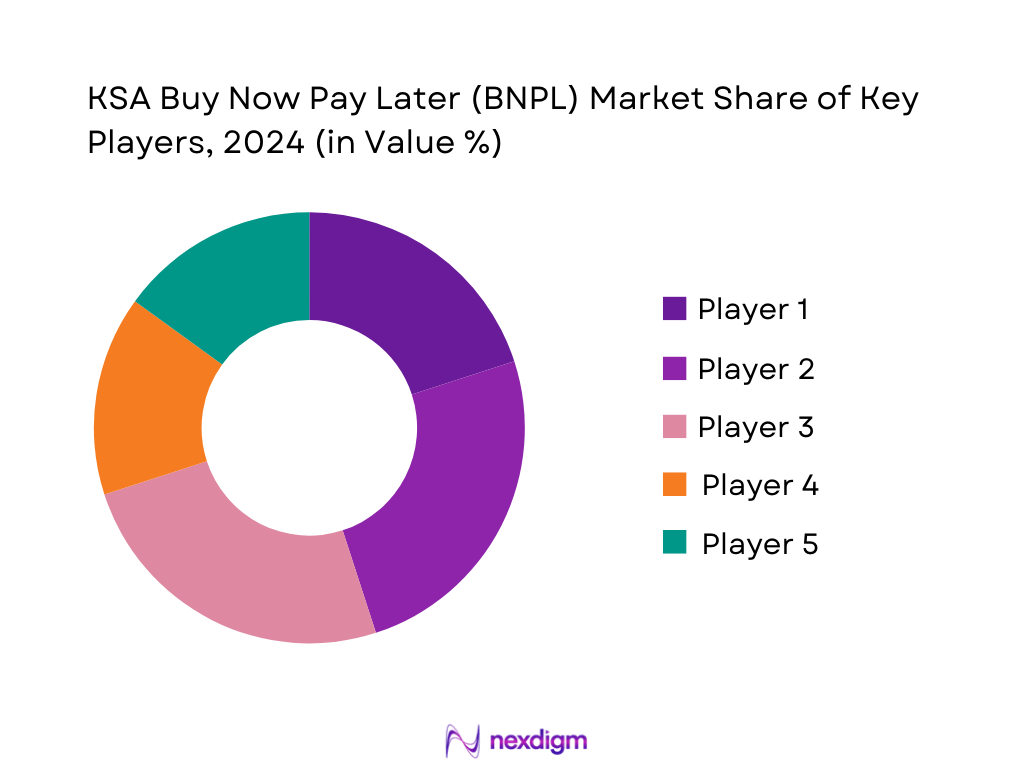

Competitive Landscape

The market is concentrated around a few major players such as Tamara, Tabby, Spotti, Postpay, and STC Pay. Their dominance underscores the consolidation and maturity of the market, signaling high entry barriers and competitive depth in consumer adoption and merchant partnerships.

| Company | Established | Headquarters | GMV Under Management | Merchant Network Size | Take‑Rate / Fee Model | Embedded Finance Partners |

| Tamara | — | Saudi Arabia | — | — | — | — |

| Tabby | — | Saudi Arabia | — | — | — | — |

| Spotti | — | Saudi Arabia | — | — | — | — |

| Postpay | — | Saudi Arabia | — | — | — | — |

| STC Pay | — | Saudi Arabia | — | — | — | — |

KSA BNPL Market Analysis

Growth Drivers

Rise in Smartphone Penetration and Mobile Cellular Use

Saudi Arabia registers 157.8 mobile cellular subscriptions per 100 people in 2023, up from 149.8 in 2022, indicating widespread access to mobile devices among residents. This penetration enhances BNPL adoption, as consumers increasingly rely on smartphones for e‑commerce and digital payments. With nearly automatic mobile connectivity, consumers can access BNPL apps and checkout integrations seamlessly. The rising base of mobile subscriptions provides the foundational infrastructure for BNPL’s digital-first financing model, enabling real-time point-of-sale approvals and deep integration with online retail channels.

Significant Youth Population and Preference Against Traditional Credit

Saudi Arabia’s population totals 35.3 million in 2024, with over 70% of citizens under the age of 35, per the General Authority for Statistics. This youthful demographic—digital-native and financially discerning—tends to shy away from conventional credit mechanisms, preferring flexible installment solutions like BNPL. The large cohort of younger users, many new to credit, drives BNPL usage as a modern, accessible alternative to credit cards or loans. This demographic skew ensures sustained demand for digital installment models that align with youthful spending behaviors and smartphone usage patterns.

Key Market Challenges

Merchant Reluctance Due to Narrow Profit Margins

Private sector employment in Saudi Arabia grew by 12% on average in 2024, signifying strong business activity and hiring trends. Yet, many merchants, especially in MSME segments, face pressure on margins. Retailers operate under rising input costs and tight profitability, limiting their appetite for BNPL schemes that charge take rates or delay settlements. The modest operational leeway constrains BNPL partnerships; merchants remain cautious, opting for immediate-payment options rather than absorbing financial service costs. BNPL providers must therefore tailor fee structures or offer value-add services to offset merchant concerns.

Regulatory Ambiguity and Incomplete Credit Bureau Linkages

The regulatory landscape is still evolving. While Vision 2030 emphasizes digital transformation, there is no unified central credit bureau integration currently accessible for BNPL providers, complicating risk assessment and underwriting. Without centralized data, BNPL firms rely on internal scoring or limited data aggregation, raising operational risk. Regulatory frameworks remain generalized under SAMA’s broader fintech guidelines, lacking BNPL‑specific clarity. This regulatory gap creates uncertainty for both providers and merchants concerning compliance procedures and consumer protection protocols.

Emerging Opportunities

BNPL Expansion into Healthcare and Education Verticals

With Saudi population at 35.3 million and a youthful median age under 35, there is a rising demand for education and healthcare services financed by installment. Young families and students seek cost-spreading solutions for tuition and medical expenses. BNPL providers now tap into these essential verticals, partnering with healthcare clinics and educational institutes to offer flexible payments, mitigating affordability barriers without resorting to credit cards or loans. This diversification enhances BNPL’s societal relevance and broadens its merchant ecosystem beyond retail alone.

Government-Led Cashless Economy Under Vision 2030

Saudi Arabia’s Vision 2030 continues to propel digital infrastructure development. The sharp decline in youth unemployment—now at a record low of 7% in 2024, down from higher levels—demonstrates economic momentum and expanding private sector activity. This digital-forward environment fosters BNPL’s acceptance as the government incentivizes cashless transactions, smart payments, and fintech adoption. Regulatory digitization efforts, combined with growing employment, boost consumer spending capacity and confidence in electronic payments, thereby positioning BNPL as key to the Kingdom’s modern financial ecosystem.

Future Outlook

Over the next several years, the Saudi Arabia BNPL market is poised for sustained expansion, with projected growth driven by deepening fintech penetration, increasing consumer comfort with installment-based payments, and broader merchant acceptance across both online and offline channels. Regulatory clarity and Vision 2030’s digital economy push will further cement BNPL’s role in the Kingdom’s financial ecosystem.

Major Players

- Tamara

- Tabby

- Spotti

- Postpay

- STC Pay

- HyperPay

- ToYou

- QisstPay

- Cashew Payments

- Telr

- Afterpay (regional presence)

- Local bank‑based BNPL services (e.g., digital banks)

- Mastercard (via partnerships)

- PayPal (merchant integrations)

- Mastercard‑affiliated services

Key Target Audience

- Investment and venture capital firms

- Government and regulatory bodies (e.g., Saudi Central Bank – SAMA; Ministry of Finance)

- Large enterprise merchants and retail chains

- Fintech investors and accelerators

- Digital wallet and super‑app platforms

- BNPL provider product strategy teams

- E‑commerce marketplaces

- Retail payment infrastructure providers

Research Methodology

Step 1: Identification of Key Variables

The process begins with mapping all stakeholders within the Saudi BNPL ecosystem—providers, merchants, government bodies, and consumers—through thorough literature review and secondary research via industry databases and regulatory reports, defining key variables influencing market trends.

Step 2: Market Analysis and Construction

Historical data on BNPL transaction volumes, GMV, active users, and channel-wise revenue is aggregated and analyzed. Conversion rate improvements, average ticket sizes, and integration metrics inform revenue construction.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions are tested via structured interviews with BNPL operators, merchant partners, and payments regulators. These dialogues validate growth drivers, regulatory impact, and adoption dynamics.

Step 4: Research Synthesis and Final Output

Combining bottom‑up GMV projections and top‑down payment ecosystem trends, the final step synthesizes validated market figures and qualitative insights into a comprehensive, enriched analysis for strategic decision‑making.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Fintech and E-Commerce Penetration Metrics, BNPL GMV Triangulation, Regulatory Mapping (SAMA Framework), Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- BNPL Ecosystem Genesis (Fintech Adoption Timeline, Mobile Wallet Expansion)

- Regulatory Framework (SAMA Licensing for BNPL, Anti-Usury Compliance)

- Fintech Business Model Evolution (Commission Model, Interest-Free Models, Merchant Subsidized Models)

- Value Chain and Stakeholder Mapping (BNPL Provider – Consumer – Merchant – Payment Gateway – Regulator)

- Growth Drivers

Rise in Smartphone Penetration and Mobile Wallet Use

High Youth Population and Credit Card Avoidance Trend - Key Market Challenges

Merchant Resistance Due to Thin Margins

Regulatory Uncertainty and Lack of Central Credit Bureau Integration - Emerging Opportunities

BNPL Expansion into Healthcare and Education Sectors

Government Push for Cashless Economy Under Vision 2030 - Key Trends

BNPL Integration into Super Apps and E-Wallets

Rise in Tier-2 and Tier-3 Region Penetration - Government Regulations (SAMA Framework, Payment Licensing Guidelines, Sharia Compliance)

- SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- Competitive Ecosystem and Deal Landscape

- By Value, 2019-2024

- By Gross Merchandise Value (GMV), 2019-2024

- By Active BNPL Users, 2019-2024

- By Number of BNPL Transactions, 2019-2024

- By Merchant Onboarding Rate, 2019-2024

- By Payment Channel (In Value %)

Online Platforms

Point-of-Sale (POS) Terminals - By Product Category (In Value %)

Consumer Electronics

Apparel & Footwear

Healthcare Services

Education & Skill Development

Groceries & Essentials - By Merchant Type (In Value %)

Enterprise Merchants

Mid-Sized Retail Chains

MSMEs - By Consumer Age Group (In Value %)

Gen Z (18–24)

Millennials (25–40)

Gen X (41–55)

Baby Boomers (56+) - By Region (In Value %)

Riyadh

Jeddah

Dammam & Eastern Province

Other Urban Cities

Rural Regions

- Market Share of Leading Players (by GMV, Active Users)

Competitive Differentiators and Innovations - Cross Comparison Parameters (Company Overview, GMV under Management, Merchant Network Size, Take-Rate & Fee Model, Embedded Finance Partnerships, Fraud Management & Credit Scoring Tech, BNPL Vertical Focus (Essential vs Lifestyle), Shariah-Compliant Product Structuring)

- SWOT Analysis of Major Players

- Pricing & Penalty Structure Analysis (Late Fee Model, Interest vs Zero-Interest)

- Detailed Company Profiles

Tamara

Tabby

Spotti

Postpay

Cashew

Spotii

ToYou

STC Pay

Hala

HyperPay

QisstPay

Afterpay (Expansion Outlook)

Local Banks’ BNPL (Alinma Bank, SNB’s Tamweel Services)

PayTabs

Telr

- BNPL Usage Intensity and Repeat Frequency

- Average Order Value and Payback Period Trends

- Key Purchase Categories by User Demographic

- Consumer Pain Points (Late Fees, Non-Transparent Terms, Credit Reporting)

- Adoption Funnel: Awareness to Repeat Usage

- By Value, 2025-2030

- By GMV, 2025-2030

- By Active BNPL Users, 2025-2030

- By Number of BNPL Transactions, 2025-2030

- By Merchant Onboarding Rate, 2025-2030