Market Overview

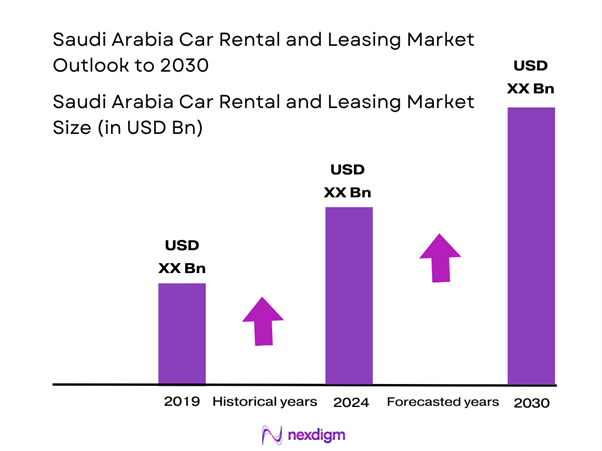

The Saudi Arabia Car Rental and Leasing Market is valued at approximately USD 2.51 billion in 2025 with an approximated compound annual growth rate (CAGR) of 9.21% from 2025-2030, based on a comprehensive analysis of historical data and current industry trends. This growth is primarily driven by factors such as the expansion of tourism, an increasing number of expatriates, and a rising trend towards flexible mobility solutions. Additionally, the emergence of digital platforms for booking rentals has further accelerated the market’s growth.

Key cities such as Riyadh, Jeddah, and Dammam play a significant role in dominating the car rental and leasing sector due to their status as business and travel hubs. Riyadh, as the capital, is central to government activities and corporate operations, while Jeddah serves as a primary port and gateway for pilgrims visiting Mecca. Furthermore, Dammam, known for its industrial base, fosters demand from corporate clients, thus enhancing the market dynamics.

Urbanization in Saudi Arabia has intensified, with urban growth expected to increase urban areas significantly from 88,300 square kilometers in 2022. The government’s commitment to establishing advanced infrastructure, like the Riyadh Metro, which aims to reduce traffic congestion and promote urban mobility, enhances the viability of car rental services. Furthermore, the expansion of road networks, slated to increase by over 5,000 kilometers by end of 2025, facilitates easier access to rental services across the country, reinforcing their appeal among consumers.

Market Segmentation

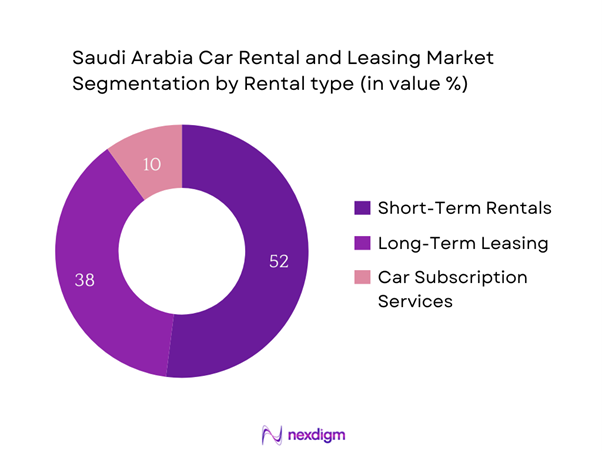

By Service Type

The Saudi Arabia Car Rental and Leasing Market is segmented by service type into Short-Term Rentals, Long-Term Leasing, and Car Subscription Services. Recently, Short-Term Rentals have gained a dominant market share, accounting for 52% of the total market in 2024. This segment’s dominance is attributed to the increasing influx of tourists and business travelers who seek convenient and flexible transportation options. The availability of online booking platforms facilitates quick and easy access to rental vehicles, enhancing customer experience and driving growth in this segment.

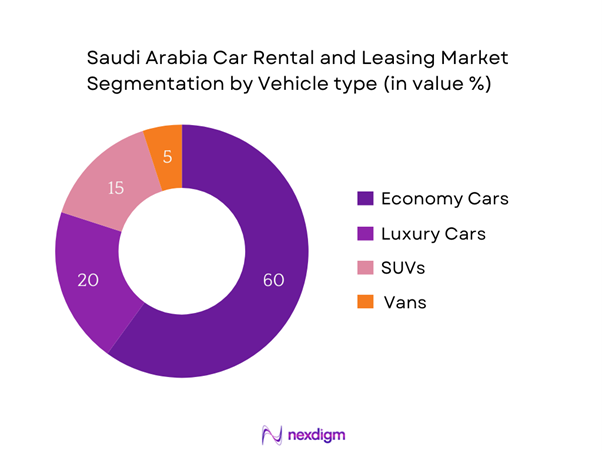

By Vehicle Type

The market is also segmented by vehicle type into Economy Cars, Luxury Cars, SUVs, and Vans. In 2024, Economy Cars hold the largest share, representing 60% of the market. This dominance is largely due to their affordability and practicality for both individual consumers and corporate clients. The economic constraints faced by a significant portion of the population drive demand for cost-effective transportation solutions, making Economy Cars a popular choice among renters.

Competitive Landscape

The Saudi Arabia Car Rental and Leasing Market is dominated by several key players, each contributing significantly to the industry’s growth. Notable companies include Hertz, Avis, Al-Futtaim, Budget, and Carrefour. This consolidation reflects the substantial market influence these major brands hold, driven by their extensive service offerings, strong brand recognition, and established customer loyalty.

| Company | Establishment Year | Headquarters | Number of Locations | Fleet Size | Services Offered | Key Partnerships |

| Hertz | 1918 | Estero, Florida | – | – | – | – |

| Avis | 1946 | Parsippany, New Jersey | – | – | – | – |

| Al-Futtaim | 1930 | Dubai, UAE | – | – | – | – |

| Budget | 1958 | Parsippany, New Jersey | – | – | – | – |

| Carrefour | 1992 | Dubai, UAE | – | – | – | – |

Saudi Arabia Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Demand for Flexible Mobility Solutions

The demand for flexible mobility solutions in Saudi Arabia is driven by a burgeoning population, projected to reach approximately 36 million in 2024. This growth is accompanied by an increasing trend of urban migration, with around 83% of the population expected to reside in urban areas by 2025. Furthermore, the Saudi Vision 2030 initiative encourages the development of the gig economy and flexible work arrangements, propelling the need for adaptable transportation solutions. As urban areas continue to expand, more individuals are turning to car rentals as a practical alternative to ownership.

Rising Tourism and Business Travel

Tourism and business travel are pivotal growth drivers in the Saudi Arabia car rental market, with the global tourist arrivals anticipated to soar to 23 million by end of 2025. This growth aligns with the government’s focus on tourism as part of Saudi Vision 2030, which aims to diversify the economy away from oil dependency. Additionally, business travel is reinforced by the ongoing development of mega-projects, including NEOM, which is expected to attract significant foreign investment and travelers. The influx of business professionals and tourists accelerates the demand for rental vehicles as convenient transportation options.

Market Challenges

Regulatory Compliance and Safety Standards

Regulatory compliance is a major challenge in the Saudi car rental market, reflecting increasing safety standards set forth by the Ministry of Interior and the Ministry of Transport. In 2022, the government implemented stringent vehicle inspection protocols, with over 1 million vehicles inspected annually to ensure compliance with safety regulations. This increasing oversight aims to enhance road safety, yet it also places additional operational burdens on car rental companies. As these regulations continue to evolve, compliance will be a critical focal point for industry stakeholders.

Fluctuations in Fuel Prices

Fluctuating fuel prices pose significant challenges to the car rental industry in Saudi Arabia, where fuel prices saw a marked increase, reflecting a shift in government policies. Gasoline prices rose to approximately SAR 2.18 per liter in 2022, a consequence of subsidy reductions aimed at diversifying the economy and reducing fiscal burdens. Such fluctuations impact operational costs for rental companies and ultimately influence rental pricing constructs. As the government navigates its economic transition, these fuel price dynamics will continue to affect the market landscape.

Opportunities

Expansion of Electric Vehicle Rentals

The expansion of electric vehicle rentals offers significant growth opportunities in the Saudi Arabia car rental market, aligning well with the government’s commitment to sustainability and clean energy. As of 2022, Saudi Arabia aims to have at least 30% of vehicles on the road being electric by 2030, with ongoing investments in charging infrastructure expected to reach USD 1.2 billion. This strategic push for electric mobility not only captures the environmentally conscious consumer segment but also positions rental companies to capitalize on changing consumer preferences as demand for electric vehicles increases.

Digital Transformation in the Sector

Digital transformation within the car rental sector presents lucrative opportunities for growth as businesses adapt to evolving consumer expectations. The rapid adoption of mobile technology has led to an increase in online bookings, with e-commerce transactions in the travel and tourism sector projected to hit USD 18 billion by end of 2025. Integration of advanced booking technologies and platforms can streamline operations, enhance customer experience, and expand market reach. Embracing digital solutions could result in a competitive advantage for rental companies in capturing tech-savvy customers.

Future Outlook

Over the coming years, the Saudi Arabia Car Rental and Leasing Market is poised for considerable growth, driven by rising consumer demand for flexible and cost-effective transportation solutions. Factors such as continuing urbanization, government infrastructure investments, and the expansion of digital service offerings will further propel market advancements, making it a dynamic sector to watch.

Major Players

- Hertz

- Avis

- Al-Futtaim

- Budget

- Carrefour

- Theeb Rent a Car

- Zaatar Car Rental

- National Car Rental

- Sixt

- Budget Car Rental

- KeyCar

- Limo Rent

- Careem

- Saudi Rent a Car

- Al-Jazeera Equipment and Hawarah Rental Services

Key Target Audience

- Automotive Manufacturers

- Logistics Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Transport)

- Hospitality Industry Services

- Tourism and Travel Agencies

- Fleet Management Companies

- Corporate Businesses

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves establishing a comprehensive ecosystem map that outlines all major stakeholders within the Saudi Arabia Car Rental and Leasing Market. Extensive desk research is undertaken, utilizing a mix of secondary data from credible industry reports, academic journals, and proprietary databases to gather detailed information. This step’s primary goal is to identify and define critical variables influencing market dynamics, including demand drivers and consumers’ preferences.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Saudi Arabia Car Rental and Leasing Market is compiled and analyzed. This includes assessment metrics like market penetration rates, the distribution ratio of car rentals versus leases, and resulting revenue figures. In addition, an evaluation of service quality metrics and customer satisfaction surveys is conducted to ensure the accuracy and reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on initial findings and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts across various segments of the market. These consultations provide invaluable operational and financial insights from seasoned professionals, which are instrumental in refining and corroborating the initial market data. The insights gained help in understanding the competitive landscape and consumer behavior more deeply.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with a variety of car rental firms to gather detailed insights on product segments, sales performance, consumer preferences, and other critical factors that influence market trends. This interaction serves to verify and complement the statistics derived from the bottom-up analysis, ensuring a robust and accurate depiction of the Saudi Arabia Car Rental and Leasing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution and Industry Background

- Timeline of Major Players

- Business Cycle Dynamics

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Flexible Mobility Solutions

Rising Tourism and Business Travel

Urbanization and Infrastructure Development - Market Challenges

Regulatory Compliance and Safety Standards

Fluctuations in Fuel Prices - Opportunities

Expansion of Electric Vehicle Rentals

Digital Transformation in the Sector - Trends

Growth of Online Booking Platforms

Shift Towards Smart Mobility Solutions - Government Regulation

Licensing and Operational Compliance

Road Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Revenue, 2019-2024

- By Fleet Size, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Service Type (In Value %)

Short-Term Rentals

– Daily Rentals

– Weekly Rentals

– Weekend Packages

Long-Term Leasing

– 6–12 Month Lease

– 1–3 Year Lease

– Corporate Fleet Leasing

Car Subscription Services

– Monthly Subscription Plans

– Pay-as-You-Go Subscriptions

– All-inclusive Packages - By Vehicle Type (In Value %)

Economy Cars

– Sub-compact Cars

– Hatchbacks

– Entry-level Sedans

Luxury Cars

– Premium Sedans

– Sports Cars

– Executive Limousines

SUVs

– Compact SUVs

– Mid-size SUVs

– Full-size SUVs / 4x4s

Vans

– Passenger Vans (e.g., 7–15 seaters)

– Commercial Vans

– Minibuses - By End-User Segment (In Value %)

Individual Consumers

– Tourists and Expats

– Domestic Travelers

– Daily Commuters

Corporate Clients

– Business Travelers

– Employee Transport Solutions

– Project-Based Fleet Contracts

Government Agencies

– Ministry & Municipal Use

– Law Enforcement and Emergency Services

– Public Sector Transportation Needs - By Distribution Channel (In Value %)

Online Platforms

– Aggregator Platforms (e.g., Yelo, eZhire)

– Company-Owned Booking Portals

– Mobile App-based Rentals

Traditional Rental Shops

– Airport Rental Counters

– City-Based Rental Branches

– Hotel-Partnered Kiosks - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share of Major Players by Revenue, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Fleet Size, Market Penetration, Distribution Channels, Customer Experience Enhancement Strategies, Technology Adoption, and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Companies

Hertz

Avis

Al-Futtaim

Budget

Europcar

Sixt

National Car Rental

Zaatar Car Rental

Theeb Rent a Car

KeyCar

Limo Rent

Al-Jazeera Equipment and Hawarah Rental Services

Careem (Ride-Hailing Services)

Saudi Rent a Car

Gulf Car Rentals

- Market Demand Dynamics

- Consumer Preferences and Price Sensitivity

- Regulatory and Compliance Experiences

- Needs and Challenges in Car Rental Decisions

- Influence of Brand Reputation on Choices

- By Revenue, 2025-2030

- By Fleet Size, 2025-2030

- By Average Daily Rental Rate, 2025-2030