Market Overview

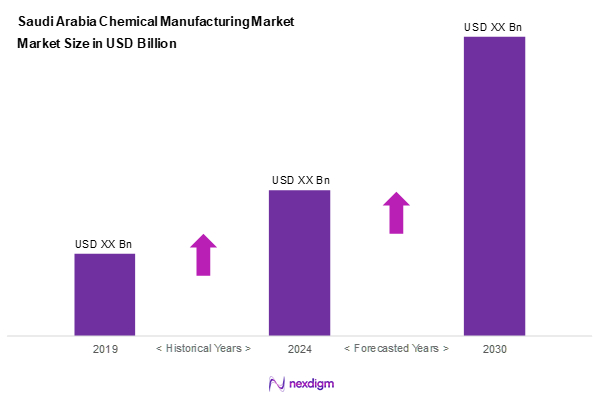

As of 2024, the Saudi Arabia chemical manufacturing market is valued at USD 39.1 billion, with a growing CAGR of 2.4% from 2024 to 2030. This valuation is propelled by robust industrialization and growing demand for petrochemical products globally. As consumer needs evolve, the market adapts, focusing on sustainable practices and innovations that drive investment in research and development.

Key regions contributing significantly to the market include the Eastern Province, Riyadh, and the Western Province, which collectively house major production facilities and logistical hubs. The Eastern Province is particularly dominant due to its proximity to key oil reserves and the presence of industry-leading companies such as SABIC and Sadara. The economic emphasis on diversification and reducing reliance on oil significantly strengthens these regions’ positions within the chemical manufacturing sector.

Market Segmentation

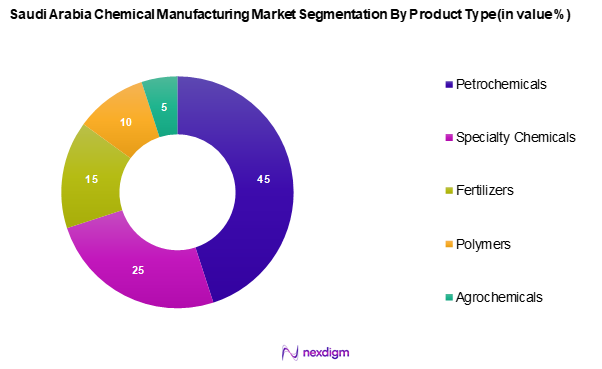

By Product Type

The Saudi Arabia chemical manufacturing market segmented into petrochemicals, specialty chemicals, fertilizers, polymers, and agrochemicals. Among these, petrochemicals hold the most significant market share due to their foundational role in various industries, including automotive and construction. The vast availability of raw materials along with Saudi Arabia’s strategic investment in refining and manufacturing capabilities ensures that petrochemicals remain the cornerstone of the chemical sector. Enhanced demand from emerging markets further cements the position of this sub-segment as a leader in the overall market.

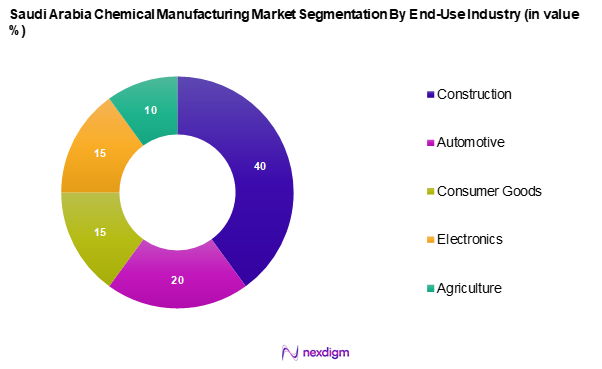

By End-Use Industry

The Saudi Arabia chemical manufacturing market segmented into construction, automotive, consumer goods, electronics, and agriculture. The construction industry dominates this segment, driven by ongoing infrastructure projects and urban development initiatives. The increasing investments in housing, commercial establishments, and transportation networks contribute significantly to the demand for chemicals used in construction materials such as adhesives, coatings, and sealants. The growth in this sector highlights the critical role that chemicals play in facilitating development.

Competitive Landscape

The Saudi Arabia chemical manufacturing market is dominated by several major players, including international and local companies. The concentration of industry influence among these key players fosters competitive dynamics that shape market trends and innovation. Prominent companies include SABIC, Sadara Chemical Company, Tasnee, and others who have established their brand presence and operational efficiencies through continual investments in technology and production capacities.

| Company Name | Establishment Year | Headquarters | Market Position | Key Products | Revenue (USD Mn) | Production Capacity |

| SABIC | 1976 | Riyadh, Saudi Arabia | – | – | – | – |

| Sadara Chemical Company | 2011 | al-Jubayl, Saudi Arabia | – | – | – | – |

| Tasnee | 1985 | Al Khobar, Saudi Arabia | – | – | – | – |

| Sipchem | 1999 | Al Khobar, Saudi Arabia | – | – | – | – |

| Saudi Kayan Petrochemical Company | 2007 | Al Jubail, Saudi Arabia | – | – | – | – |

Saudi Arabia Chemical Manufacturing Market Analysis

Growth Drivers

Increasing Industrialization

Saudi Arabia’s industrial sector is expected to grow significantly, driven by the government’s Vision 2030 plan, which aims to diversify the economy away from oil. As of 2023, the manufacturing sector’s contribution to GDP reached 12%, with projections for it to grow at an annual average rate of 4.5% through 2025. This industrial focus has resulted in increased domestic demand for chemicals used in construction, automotive, and consumer goods, further boosting the chemical manufacturing sector. With investments reaching up to USD 32 billion in industrial projects, the momentum supports a favourable landscape for chemical manufacturers.

Demand for Sustainable Solutions

The global transition towards sustainability is influencing the Saudi Arabia chemical manufacturing market significantly. As of 2023, approximately 45% of Saudi companies have committed to adopting sustainable practices to align with international climate agreements. With rising consumer awareness and the increasing pressure from regulatory bodies, demand for eco-friendly chemicals is surging. The Kingdom produced over 7 million tons of sustainable chemical products in the last fiscal year, reflecting a growing market opportunity amid a broader global trend toward sustainability that is poised to shape future investments in the sector.

Market Challenges

Environmental Regulations

Regulatory pressures related to environmental impact are presenting significant challenges for chemical manufacturers in Saudi Arabia. The authorities have introduced stricter guidelines aimed at reducing emissions and promoting cleaner production methods. While these regulations are aligned with long-term sustainability goals, they often require manufacturers to invest heavily in new technologies and upgrades. This creates short-term financial and operational stress, especially for firms that need to adapt legacy systems to meet new compliance standards.

Supply Chain Disruptions

The global supply chain environment continues to influence the chemical sector in Saudi Arabia. Disruptions stemming from global crises and geopolitical instability have caused delays in sourcing raw materials and essential inputs. These supply chain bottlenecks can lead to inconsistent production cycles and increased operational costs. Although efforts are being made to stabilize logistics and sourcing routes, the sector remains vulnerable to international disruptions that may impact efficiency and pricing strategies.

Opportunities

Technological Advancements

Advancements in digital and automated technologies are opening up new avenues for innovation in Saudi Arabia’s chemical manufacturing space. Companies are increasingly integrating smart technologies and artificial intelligence into their operations to enhance efficiency, accuracy, and sustainability. These innovations are not only streamlining manufacturing processes but are also enabling more environmentally conscious production methods. As the industrial sector modernizes, chemical manufacturers stand to benefit from improved productivity and competitive positioning.

Expansion into Emerging Markets

Regional market dynamics are creating favorable conditions for Saudi chemical manufacturers to expand beyond domestic borders. Neighboring regions in the Middle East and North Africa are witnessing a growing appetite for chemical products, offering new growth prospects. By leveraging trade alliances and cross-border partnerships, Saudi firms can deepen their presence in these emerging markets. This expansion enhances their export potential and solidifies their role as key players in regional chemical supply chains.

Future Outlook

The Saudi Arabia chemical manufacturing market is expected to witness considerable growth over the next five years, driven by ongoing government initiatives aimed at diversification away from oil dependency, coupled with advancements in production technologies and sustainable practices. The increasing emphasis on environmentally friendly chemical processes and innovations in product development will further enhance the market landscape. Additionally, strong domestic and regional demand due to infrastructural projects will likely fuel this growth, positioning the market for a robust and sustainable future.

Major Players

- SABIC

- Sadara Chemical Company

- Tasnee

- Sipchem

- Saudi Kayan Petrochemical Company

- Gulf Farabi Petrochemical Co. Ltd.

- Sahara Petrochemicals

- Chemanol

- Gulf Chemical & Industrial Oils

- Al-Badaha Company

- National Petrochemical Industrial Company

- Advanced Petrochemical Company

- Al-Jubail Petrochemical Company

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry and Mineral Resources, Saudi Arabia)

- Manufacturers of Chemical Products

- Distributors and Wholesalers in the Chemical Sector

- Technology Providers and Research Institutions

- End-User Industries (Construction, Automotive, Agriculture)

- Environmental Agencies and NGOs

- Trade Associations and Industry Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia chemical manufacturing market. This phase includes extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics and overall sector performance.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data related to the Saudi Arabia chemical manufacturing market. This includes volumes produced, revenue generated, and the segmentation of businesses within the sector. Additionally, an evaluation of trends and consumer behavior relating to the chemical products will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of organizations involved in chemical manufacturing. These consultations will provide valuable operational and financial insights, essential for refining and corroborating the market data to enhance the report’s accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple chemical manufacturers to collect detailed insights into product segments, sales performance, and consumer preferences. This interaction will be instrumental in verifying and complementing the statistics derived from the bottom-up approach, ensuring a comprehensive and validated analysis of the Saudi Arabia chemical manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Industrialization

Demand for Sustainable Solutions - Market Challenges

Environmental Regulations

Supply Chain Disruptions - Opportunities

Technological Advancements

Expansion into Emerging Markets - Trends

Rise of Green Chemistry

Digitalization of Manufacturing - Government Regulation

Chemical Safety Regulations

Import Tariffs - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type

Petrochemicals

– Ethylene & Propylene

– Methanol

– Butadiene

– Aromatics (Benzene, Toluene, Xylene)

Specialty Chemicals

– Adhesives & Sealants

– Coatings & Paints

– Surfactants

– Water Treatment Chemicals

Fertilizers

– Nitrogen-based (Urea, Ammonium Nitrate)

– Phosphate-based (DAP, MAP)

– Potash-based

– Micronutrients

Polymers

– Polyethylene (LDPE, HDPE, LLDPE)

– Polypropylene (PP)

– Polyvinyl Chloride (PVC)

– Engineering Plastics (ABS, PA, PC)

Agrochemicals

– Herbicides

– Insecticides

– Fungicides

– Biopesticides - By End-Use Industry

Construction

– Paints and Coatings

– Adhesives

– Sealants

– Insulation Materials

Automotive

– Performance Polymers

– Lubricants and Fluids

– Coatings and Adhesives

– Battery Chemicals

Consumer Goods

– Personal Care Ingredients

– Cleaning Chemicals

– Packaging Materials

– Textiles

Electronics

– Semiconductor Chemicals

– Cleaning Agents

– Encapsulation Resins

– PCB Materials

Agriculture

– Fertilizer Inputs

– Pesticide Formulations

– Soil Conditioners

– Crop Protection Chemicals - By Region

Eastern Province

Riyadh

Western Province

Southern Region - By Manufacturing Process

Batch Process

– Specialty Chemicals

– Agrochemical Formulations

– Custom Blends & Low-Volume Products

Continuous Process

– Petrochemicals

– Polymers

– Large-scale Fertilizer Production

Semi-Continuous Process

– Blended Applications

– Industrial Cleaning Chemicals

– Coatings and Intermediate Products - By Distribution Channel

Direct Sales

Distributors

Online Platforms

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenue by Product Type, Distribution Channels, Production Capacity, Unique Value Propositions, and more)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

SABIC

Sadara Chemical Company

Tasnee

Sipchem

Saudi Kayan Petrochemical Company

Gulf Farabi Petrochemical Co. Ltd.

Sahara Petrochemicals

Chemanol

Gulf Chemical & industral Oils

Al-Badaha Company

National Petrochemical Industrial Company

Advanced Petrochemical Company

Al-Jubail Petrochemical Company

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030