Market Overview

As of 2024, the Saudi Arabia cold chain market is valued at USD ~ billion, with a growing CAGR of 15.4% from 2024 to 2030, reflecting significant growth driven by the increasing demand for perishable goods and advancements in technology that enhance supply chain efficiency. The market is notably influenced by the rising preferences for fresh food products and an expansion in the e-commerce sector, which requires reliable temperature-controlled storage and transportation solutions.

Saudi Arabia’s key cities, particularly Riyadh, Jeddah, and Dammam, are at the forefront of the cold chain market due to their robust logistics networks and proximity to major import ports. Riyadh, as the capital, serves as the primary hub for domestic distribution, while Jeddah’s strategic location facilitates international trade. Dammam’s development as an industrial centre further supports the growth of cold chain solutions, fulfilling both local and international demand.

Market Segmentation

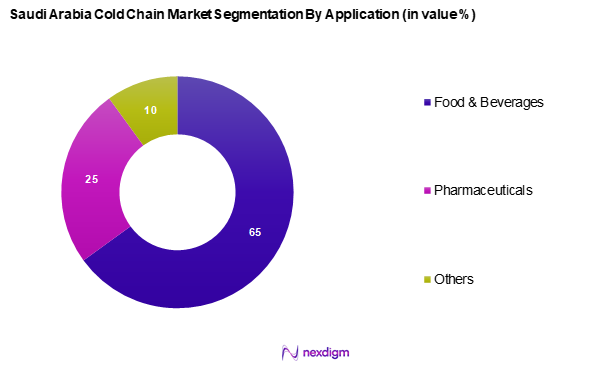

By Application

The Saudi Arabia cold chain market is segmented into food & beverages, pharmaceuticals, and others. The food & beverages segment holds a dominant market share, attributed mainly to the rising urbanization and growing consumer preference for fresh and high-quality food products. This segment includes various sub-segments such as dairy products, fruits & vegetables, and frozen foods, each leveraging the demand for quality and safety in food delivery. The food & beverages sub-segment is particularly strong, driven by a cultural shift towards healthier eating and the increasing consumption of processed and frozen foods. Companies focusing on fresh produce and dairy have invested significantly in cold chain logistics, ensuring product safety and quality throughout the supply chain, which resonates with health-conscious consumers.

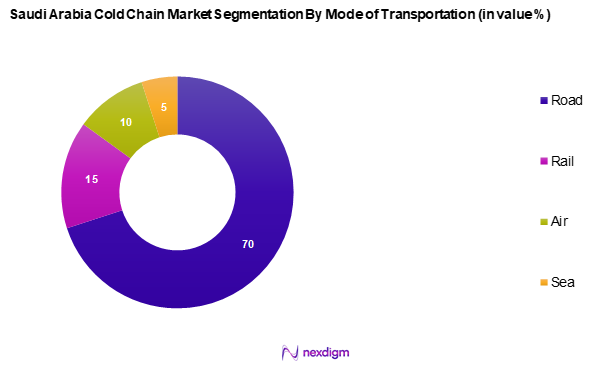

By Mode of Transportation

The Saudi Arabia cold chain market is segmented into road, rail, air, and sea. The road segment dominates the transportation mode, due to its extensive infrastructure and flexibility that allows for door-to-door delivery service. The road transport network in Saudi Arabia is well-developed, facilitating efficient cold chain logistics across urban and rural areas. The growth of e-commerce and online food delivery services has further bolstered the demand for reliable road transport solutions, making it imperative for cold chain providers to enhance their road logistics capabilities.

Competitive Landscape

The Saudi Arabia cold chain market is dominated by key players, including both local and international firms. The competitive landscape is characterized by a few major companies such as Agility Logistics, Al-Theyab Logistics Co., NAQEL Express, Coldstores Group, and IFFCO. These players have expanded their operations through strategic acquisitions and partnerships, offering enhanced cold storage and transportation services. Their ability to adapt to market demands, invest in technology, and maintain high service standards contributes significantly to their competitive edge.

| Company Name | Establishment Year | Headquarters | Market

Share |

Key Services | Market Focus | Technology Utilization |

| Agility Logistics | 1979 | Safat, Kuwait | – | – | – | – |

| Al-Theyab Logistics Co. | 1995 | Riyadh, Saudi Arabia | – | – | – | – |

| NAQEL Express | 2005 | Riyadh, Saudi Arabia | – | – | – | – |

| Coldstores Group | 1976 | Riyadh, Saudi Arabia | – | – | – | – |

| IFFCO | 1975 | Riyadh, Saudi Arabia | – | – | – | – |

Saudi Arabia Cold Chain Market Analysis

Growth Drivers

Increase in E-commerce

The surge in e-commerce activities has been a key driver for the cold chain market in Saudi Arabia. In 2023, the country’s e-commerce sector witnessed a significant growth, reaching approximately USD 5.15 billion, fuelled by an increase in online shopping behaviour amidst the pandemic and beyond. With Saudi Arabia’s internet penetration rate standing at 99% in 2023, consumers are now more inclined to purchase groceries and perishable goods online. This trend demands efficient cold chain logistics to ensure that products are delivered fresh, thus driving investments in temperature-controlled warehousing and transportation. Such developments are crucial, as the demand for fast and reliable home delivery of perishables is expected to grow.

Growing Urbanization

Urbanization in Saudi Arabia is accelerating, with over 84% of the population now living in urban areas as of 2023. This growing urban population predominantly resides in major cities like Riyadh, Jeddah, and Dammam, creating increased demand for fresh and pre-packaged food products. In 2024, Saudi Arabia’s urban population is projected to exceed 30 million, necessitating robust cold chain solutions to meet the heightened consumption needs. Urban residents demand easy access to fresh produce and various food options, pushing retailers and suppliers to invest in cold storage and distribution systems. This urban influx is a significant factor contributing to the expansion of the cold chain sector.

Market Challenges

Investment Requirements

Despite the expansion of the cold chain sector, substantial financial commitments remain a significant barrier. Establishing and maintaining cold storage facilities and refrigerated transport systems require high capital investments. Many businesses, especially smaller enterprises, face challenges in securing funding due to the cost-intensive nature of the industry. Economic uncertainties and fluctuating operational expenses further add to the financial strain, affecting the pace of market development. Overcoming these investment challenges is critical to ensuring a resilient and efficient cold chain network.

Infrastructure Limitations

Infrastructure limitations significantly hinder the growth potential of the cold chain market in Saudi Arabia. Currently, it is reported that approximately 30% of produce is lost due to inadequate storage facilities and transportation systems, resulting in waste and economic losses. Many regions, especially rural areas, face challenges in accessing refrigerated logistics, creating gaps in the supply chain. The lack of an integrated cold chain network impedes the effective distribution of perishable goods, further perpetuating these challenges. Addressing these infrastructure deficiencies is crucial for ensuring product quality and reducing waste in the cold chain sector.

Opportunities

Digitalization and Automation

The integration of digital and automated solutions presents a transformative opportunity for the cold chain market. Technological advancements, such as real-time monitoring systems and IoT-enabled sensors, are improving efficiency and reducing spoilage risks. Companies are increasingly adopting automation to streamline operations, enhance labor productivity, and optimize energy consumption. As businesses recognize the benefits of data-driven logistics management, the adoption of digital tools is expected to drive significant improvements in cold chain reliability and cost-effectiveness.

Expansion in Emerging Market

The diversification of Saudi Arabia’s economy beyond traditional sectors is creating new opportunities for the cold chain industry. Initiatives aimed at boosting agricultural production and exports are fuelling demand for advanced cold storage and transportation solutions. As the country strengthens its presence in global markets, the need for efficient logistics to maintain the quality of perishable goods is becoming increasingly important. This expansion is expected to encourage innovation in cold chain technologies and create new growth avenues for industry stakeholders.

Future Outlook

The Saudi Arabia cold chain market is expected to witness substantial growth, driven by evolving consumer preferences, technological advancements, and increasing investment in infrastructure. As the demand for perishable goods continues to rise, coupled with the growth of e-commerce channels, it becomes imperative for stakeholders to enhance their operational efficiencies and improve service delivery standards.

Over the next five years, the focus will be on sustainability, with companies increasingly adopting eco-friendly practices and technologies to minimize their carbon footprint while maintaining product quality. This trend, along with government initiatives to promote food safety and quality standards, will pave the way for a more robust cold chain infrastructure in the region.

Major Players

- Agility Logistics

- Al-Theyab Logistics Co.

- NAQEL Express

- Coldstores Group

- IFFCO

- Transworld Group

- Wared Logistics

- Almajdouie Logistics

- 3 Camels Party Logistics

- Global Star Group

- Mansour Al Mosaid Group

- A.P. Moller – Maersk

- Takhzeen Logistics

- Mosanada Logistics Services

- Others

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Health)

- Importers and Exporters

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Logistics and Supply Chain Companies

- Retail Chains

- Food Safety and Quality Assurance Organizations

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing a comprehensive ecosystem map that includes all major stakeholders in the Saudi Arabia cold chain market. Extensive desk research, utilizing secondary and proprietary databases, is conducted to gather vital industry-level information and to identify the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

The analysis includes compiling historical data related to the Saudi Arabia cold chain market. Key metrics assessed include market penetration rates and revenue generation across various service providers. A thorough evaluation of service quality metrics is also conducted to ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

In this step, hypotheses are developed and tested through rigorous consultations with industry experts via Computer-Assisted Telephone Interviews (CATIs). This interaction captures operational and financial insights from a diverse array of companies, helping to refine and affirm the market data collected previously.

Step 4: Research Synthesis and Final Output

The final phase engages directly with leading cold chain companies to gather in-depth insights on product segments, sales performance, consumer preferences, and key influencers of market dynamics. This direct engagement is crucial in validating the data derived from the bottom-up analysis, ensuring a comprehensive and accurate representation of the Saudi Arabia cold chain market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increase in E-commerce

Growing Urbanization - Market Challenges

Investment Requirements

Infrastructure Limitations - Opportunities

Digitalization and Automation

Expansion in Emerging Market - Trends

Sustainability Initiatives

Increasing Demand for Smart Cold Chain Solutions - Government Regulation

Saudi Food and Drug Authority (SFDA) standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Application, (In Value %)

Food & Beverages

Pharmaceuticals

Others - By Temperature Range, (In Value %)

Chilled

Frozen

Ambient - By Mode of Transportation, (In Value %)

Road

Rail

Air

Sea - By Geography, (In Value %)

Riyadh

Jeddah

Dammam

Other Regions - By Market Structure, (In Value %)

Organized

Unorganized

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Application Segment, 2024 - Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Market Share, Technological Capabilities, Customer Base, Revenue, Distribution Networks)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Profiles of Major Companies

Coldstores Group of Saudi Arabia

Mosanada Logistics Services

Wared Logistics

Agility Logistics

NAQEL Express

Al-Theyab Logistics Co.

IFFCO

Almajdouie Logistics

Camels Party Logistics

United Warehouse Company

Takhzeen Logistics

Transworld Group

Mansour Al Mosaid Group

A.P. Moller – Maersk

Global Star Group

Others

- Consumer Demand and Behaviour

- Industry-Specific Requirements and Budget Allocations

- Needs Assessment of Key Stakeholders

- Decision-Making Processes in Procurement

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030