Market Overview

The Saudi Arabia digital thermometers market is valued at approximately USD ~ million, based on a comprehensive analysis of recent industry data. Market growth is primarily driven by increasing health awareness among consumers and a rising prevalence of chronic diseases, which has resulted in a surge in demand for effective monitoring tools. The convenience and accuracy of digital thermometers compared to traditional options further contribute to their growing adoption in both home settings and healthcare institutions, bolstered by innovations in smart health technologies.

Riyadh, Jeddah, and Dammam dominate the digital thermometers market, owing to their expansive healthcare infrastructure and high population density. These cities benefit from substantial healthcare funding, making it easier for hospitals and clinics to invest in advanced diagnostic equipment. Additionally, urban centers are witnessing an increase in health-conscious consumers opting for reliable home health monitoring tools, thereby reinforcing the market’s growth in these regions.

Market Segmentation

By Product Type

The Saudi Arabia digital thermometers market is segmented by product type into non-contact thermometers, contact thermometers, and smart thermometers. Among these, non-contact thermometers hold a dominant market share due to their growing popularity during health emergencies, particularly amid the COVID-19 pandemic. Their ease of use and ability to provide quick and accurate readings without requiring physical contact make them the favored choice in hospitals and homes alike. The increasing emphasis on hygiene and preventive healthcare is further driving the demand for this segment.

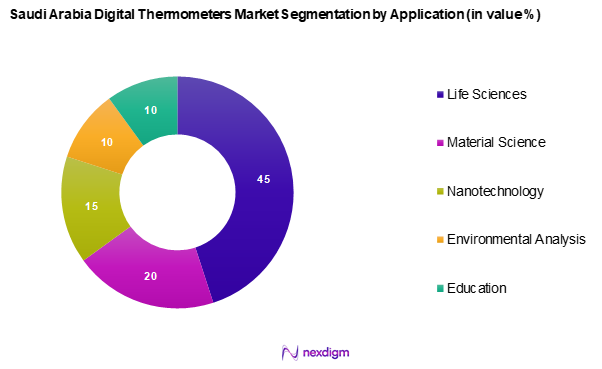

By Application

The market is also segmented by application into home use, healthcare institutions, and industrial applications. The home-use segment is rapidly gaining traction as individuals increasingly opt for health monitoring devices to manage their health proactively. This segment stands out due to the rise in health awareness and the convenience of easy-to-use digital thermometers for self-monitoring. During times of illness or fever, households are turning to these devices for quick assessments, thereby enhancing this segment’s prominence in the overall market.

Competitive Landscape

The Saudi Arabia digital thermometers market is characterized by a mix of established multinational corporations and local manufacturers. Key players include Koninklijke Philips N.V., Braun, Omron, Exergen, and Thermo Fisher Scientific. The market consolidation reflects the significant influence of these key companies, which are recognized for their innovative products and strong brand loyalty among consumers. These market leaders continually invest in research and development to enhance digital thermometer technology and expand their product lines.

| Company | Establishment Year | Headquarters | Product Range | Distribution Channels | R&D Investment | Market Presence |

| Koninklijke Philips N.V. | 1891 | Amsterdam, Netherlands | – | – | – | – |

| Braun | 1921 | Kronberg, Germany | – | – | – | – |

| Omron | 1933 | Kyoto, Japan | – | – | – | – |

| Exergen | 1992 | Watertown, USA | – | – | – | – |

| Thermo Fisher Scientific | 2006 | Waltham, USA | – | – | – | – |

Saudi Arabia Digital Thermometers Market Analysis

Growth Drivers

Increasing Health Awareness

The rising awareness of personal health management in Saudi Arabia is playing a crucial role in driving the demand for digital thermometers. Nationwide health initiatives are emphasizing early detection and continuous monitoring of health conditions, leading to greater public engagement in routine health tracking. As more individuals prioritize preventive healthcare due to evolving lifestyle trends and heightened health concerns, the adoption of digital thermometers has witnessed a substantial increase.

Rising Prevalence of Chronic Diseases

The growing incidence of chronic diseases such as diabetes and cardiovascular conditions is contributing to the expansion of the digital thermometers market. With healthcare professionals advocating for regular health monitoring, individuals and medical institutions are increasingly relying on digital thermometers to support effective disease management. This trend underscores the need for reliable and easy-to-use health monitoring devices in both home and clinical settings.

Market Challenges

Regulatory Compliance Issues

Stringent regulatory frameworks for medical devices present a challenge for companies operating in the Saudi digital thermometers market. Strict approval processes and compliance requirements set by regulatory authorities can delay product availability and pose entry barriers for new players. Ensuring adherence to safety and quality standards remains a critical concern for manufacturers navigating the regulatory landscape.

Competition from Low-Cost Alternatives

The market faces intense competition from traditional thermometers, including manual and mercury-based options, which continue to be widely used due to their affordability. Many consumers perceive these conventional models as sufficient for basic health monitoring, making it challenging for digital thermometer manufacturers to differentiate their products and sustain market share.

Opportunities

Adoption of Smart Health Monitoring Systems

The increasing integration of digital health solutions is opening new opportunities for the digital thermometers market. Consumers are showing a growing preference for smart health devices that offer real-time monitoring, mobile connectivity, and advanced analytics. As healthcare technology continues to evolve, digital thermometer manufacturers have the potential to capitalize on this shift by introducing innovative, connected solutions that enhance user experience and healthcare efficiency.

Future Outlook

Over the next several years, the Saudi Arabia digital thermometers market is projected to experience substantial growth, propelled by ongoing advancements in healthcare technology and an increasing focus on preventive health monitoring. The rise in consumer preference for at-home health devices is also anticipated to drive demand, making digital thermometers an essential tool in health management. Furthermore, regulatory support and the integration of smart technology into diagnostic devices will enhance the overall market potential.

Major Players

- Koninklijke Philips N.V.

- Braun

- Omron

- Exergen

- Thermo Fisher Scientific

- ADC

- Hill-Rom

- Medline Industries

- Geratherm

- LCR Hallcrest

- HCP

- CAREL

- A&D Medical

- Infrared Thermometers Inc.

- Yangzhou Weichuang

Key Target Audience

- Hospitals and Healthcare Facilities

- Retailers and Distributors

- Manufacturers of Medical Equipment

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority)

- Home Healthcare Providers

- Medical Supply Companies

- Health and Wellness Organizations

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Saudi Arabia digital thermometers market. Comprehensive desk research utilizing a combination of secondary and proprietary databases is conducted to gather industry-level information. The primary objective of this step is to identify and define the critical variables that influence market dynamics, including technological advancements, regulatory frameworks, and consumer behaviour trends.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Saudi Arabia digital thermometers market is compiled and analysed. This includes assessing market penetration rates, the ratio of product types available in the market, and resultant revenue generation across various segments. Furthermore, an evaluation of product quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates and market-sharing data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through Computer-Assisted Telephone Interviews (CATI) with industry experts spanning a diverse array of companies. These consultations provide valuable operational and financial insights directly from market practitioners, which are instrumental in refining and corroborating the market data. Feedback from experts helps to ensure a nuanced understanding of market dynamics and consumer preferences.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with various thermometer manufacturers to acquire detailed insights into product segments, selling performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement statistics derived from a bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia Digital Thermometers market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Health Awareness

Rising Prevalence of Chronic Diseases - Market Challenges

Regulatory Compliance Issues

Competition from Low-Cost Alternatives - Opportunities

Adoption of Smart Health Monitoring Systems - Trends

Increasing Demand for Home Health Devices - Government Regulation

Medical Device Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

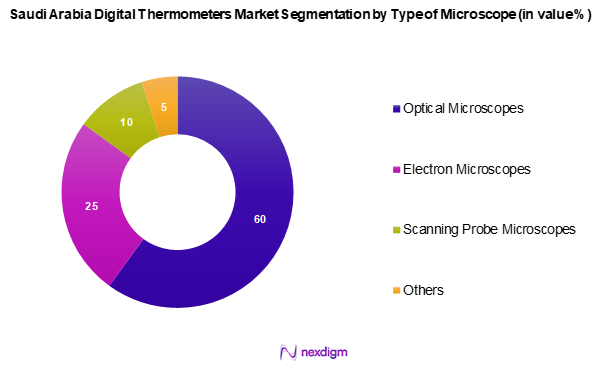

- By Type, (In Value %)

Non-Contact Thermometers

Contact Thermometers

Smart Thermometers - By Application, (In Value %)

Home Use

Healthcare Institutions

Industrial Applications - By Distribution Channel, (In Value %)

Online Retail

Offline Retail - By Region, (In Value %)

Riyadh

Jeddah

Dammam

Khobar - By End-User, (In Value %)

Hospitals

Clinics

Home Users

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Type of Thermometer Segment - Cross Comparison Parameters

(Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Thermometer, Number of Distribution Channels, Number of Dealers, Unique Value Offering) - SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Koninklijke Philips N.V.

Braun

Omron

Exergen

Thermo Fisher Scientific

ADC

Hill-Rom

Medline Industries

Geratherm

LCR Hallcrest

HCP

CAREL

A & D Medical

Infrared Thermometers Inc.

Yangzhou Weichuang

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030