Market Overview

As of 2024, the Saudi Arabia green construction market is valued at USD 16.5 billion, with a growing CAGR of 12.4% from 2024 to 2030, influenced by government initiatives aiming for sustainability and an increasing emphasis on eco-friendly building practices. The growth is primarily driven by regulatory support and financial incentives that encourage the adoption of green technologies and sustainability within the construction sector. The market potential is significant, as authorities aim to diversify the economy and reduce reliance on oil revenue.

Riyadh and Jeddah are major cities dominating the Saudi Arabia green construction market due to their ongoing urbanization and development initiatives. Riyadh, as the capital, leads in governmental support and infrastructure projects, while Jeddah benefits from its strategic location as a commercial hub. These cities showcase a blend of traditional and modern architecture, promoting sustainable practices through the integration of green building certifications and eco-friendly materials.

Market Segmentation

By Construction Type

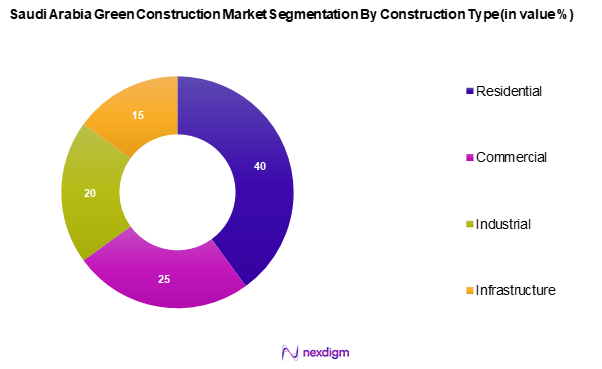

The Saudi Arabia green construction market is segmented into residential, commercial, industrial, and infrastructure. The residential segment holds the dominant market share as it caters to the growing population and urbanization trends. Increasing awareness of environmental sustainability among homeowners is driving demand for energy-efficient homes, equipped with sustainable materials and technologies. The government’s initiatives such as Vision 2030 further bolster this trend, focusing on the development of eco-friendly residential spaces to enhance living standards.

By Green Building Standards

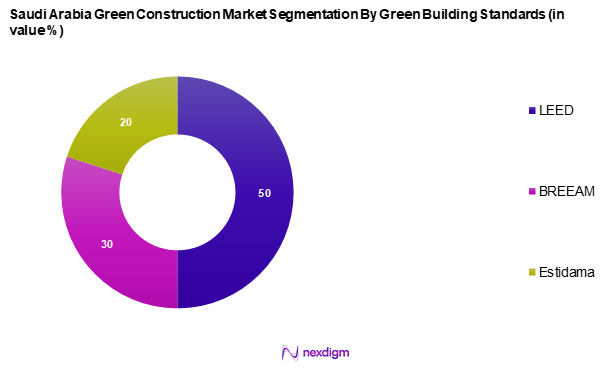

The Saudi Arabia green construction market is segmented into LEED, BREEAM, and Estidama. LEED leads the market owing to its international recognition and the robust framework it provides for sustainable construction. This popularity is fueled by the growing number of developers and businesses seeking LEED certification as a means to enhance their marketability and comply with environmental regulations. Moreover, the support from the Saudi government in promoting LEED-certified buildings aligns with the national objectives for sustainability and energy efficiency.

Competitive Landscape

The Saudi Arabia green construction market is characterized by a mix of strong local players and international firms enhancing competition and innovation. Major players include local companies such as Saudi Ceramic Co. and Edama Organic Solution alongside global entities like SCG International Corporation. This competitive environment fosters continuous improvement in construction practices, technologies, and sustainability initiatives, impacting the overall market growth positively.

| Company Name | Establishment Year | Headquarters | Market Focus | Key Products | Annual Revenue |

| Saudi Ceramic Co. | 1977 | Riyadh, Saudi Arabia | – | – | – |

| Edama Organic Solution | 2018 | Thuwal, Saudi Arabia | – | – | – |

| SCG International Corp |

1978 |

Bangkok, Thailand | – | – | – |

| Eastern Trading & Cont. Est | 1971 | Dammam, Saudi Arabia | – | – | – |

| Green Building Solution | 2020 | Riyadh, Saudi Arabia | – | – | – |

Saudi Arabia Green Construction Market Analysis

Growth Drivers

Government Initiatives and Support

The Saudi government has made sustainability a national priority, embedding it into the broader Vision 2030 strategy. A strong policy framework encourages the construction industry to adopt greener practices through environmental mandates and infrastructure planning. Initiatives like the Saudi Green Initiative are promoting large-scale afforestation and emissions reduction, creating a foundation for environmentally conscious urban development. This commitment is fostering a conducive environment for domestic and international stakeholders to explore opportunities in sustainable construction.

Rising Environmental Awareness

Environmental consciousness among Saudi citizens is on the rise, reflecting a cultural shift towards sustainable lifestyles. There is growing public interest in reducing carbon footprints, recycling, and energy conservation. This evolving mindset is influencing real estate preferences, with more individuals seeking eco-friendly homes and buildings. Both government and private entities are capitalizing on this trend by rolling out awareness campaigns and educational programs to support sustainability, further reinforcing demand for green building solutions.

Market Challenges

High Initial Costs

One of the major hurdles in the adoption of green construction in Saudi Arabia is the significant upfront investment required. Sustainable building materials and energy-efficient systems often come at a premium compared to traditional alternatives. Without widespread access to financial incentives or subsidies, many developers face budget constraints that discourage full-scale adoption. Although the long-term operational savings are evident, the high entry costs remain a considerable barrier.

Regulatory Compliance Issues

The regulatory landscape for green construction is evolving but still poses challenges for stakeholders. While the government has made progress in updating building codes, inconsistencies and gaps remain. Developers often encounter obstacles in navigating certification processes and aligning with sustainability benchmarks. The lack of a unified, streamlined regulatory framework can result in project delays and increased administrative burdens, slowing the momentum of green construction adoption.

Opportunities

Technological Advancements

The continuous evolution of construction technology offers immense potential for the green building sector. Innovations like digital modelling, advanced insulation materials, and smart systems are transforming the way buildings are designed and operated. These tools not only improve energy performance but also streamline construction processes, making sustainable development more accessible and efficient. Embracing these technologies positions Saudi Arabia to become a regional leader in green innovation.

Increase in Renewable Energy Projects

The country’s growing emphasis on renewable energy serves as a natural complement to the green construction market. Large-scale investments in solar and wind energy are reshaping the national energy mix and creating synergy between energy and construction sectors. Integrating renewable technologies into building projects enhances energy self-sufficiency and reduces environmental impact. This trend presents a strategic opportunity for developers to align with national sustainability goals while gaining a competitive edge through greener offerings.

Future Outlook

Over the next 5 years, the Saudi Arabia green construction market is poised for significant growth, driven by the country’s commitment to sustainability and innovation in building practices. The alignment with the Vision 2030 initiative promotes the use of renewable resources and smart technologies in construction. As environmental concerns continue to gain prominence, investments in green infrastructure and sustainable building materials are expected to increase, making the market an attractive opportunity for stakeholders.

Major Players

- Saudi Ceramic Co.

- Edama Organic Solution

- SCG International Corporation

- Eastern Trading & Cont. Est

- Green Building Solution

- Saveto Group

- Saudi Arabian Saipem Ltd.

- Al Kuhaimi Group Holding

- Saudi Readymix Concrete Co.

- Attieh Steel Ltd.

- DTC

- Core GBC

- Saudi Green

- Green Contracting Company

Key Target Audience

- Construction Companies

- Real Estate Developers

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Housing)

- Environmental NGOs

- Architects and Engineers

- Material

- Sustainable Technology Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of stakeholders within the Saudi Arabia green construction market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary goal is to identify critical variables that influence market dynamics, including regulatory frameworks, consumer preferences, and construction trends.

Step 2: Market Analysis and Construction

During this phase, historical data and market insights pertaining to the Saudi Arabia green construction market are compiled and analyzed. This includes evaluating market penetration rates, assessing the ratio of green construction projects to traditional ones, and identifying factors influencing revenue generation. Additionally, service quality metrics are analyzed to ensure the accuracy and reliability of the revenue estimates provided.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the trends and growth factors of the green construction sector will be developed and validated through interviews with industry experts. These consultations will encompass a diverse array of companies involved in various aspects of green construction, delivering valuable insights into operational practices and financial realities. Such input is instrumental in refining and corroborating the broader market data.

Step 4: Research Synthesis and Final Output

The final phase entails engaging with key manufacturers and stakeholders within the green construction sector to gathered detailed insights on product offerings, sales performance, and consumer preferences. This direct interaction will serve to validate statistics derived from earlier analytical methodologies, ensuring a comprehensive and accurate analysis of the Saudi Arabia Green Construction market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Initiatives and Support

Rising Environmental Awareness

Growing Investment in Infrastructure - Market Challenges

High Initial Costs

Regulatory Compliance Issues

Lack of Skilled Workforce - Opportunities

Technological Advancements

Increase in Renewable Energy Projects - Trends

Adoption of Smart Building Technology

Integration of Circular Economy Practices - Government Regulation

Building Codes and Standards

Incentives for Green Construction - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Project Cost, 2019-2024

- By Construction Type (In Value %)

Residential

– Eco-Friendly Villas

– Green Apartment Complexes

– Low-Carbon Housing Units

Commercial

– Energy-Efficient Office Buildings

– Sustainable Retail Malls

– Green Hospitality Projects (Hotels/Resorts)

Industrial

– Green Warehouses

– LEED-Certified Factories

Eco-Friendly Logistics Parks

Infrastructure

– Sustainable Road Projects

– Green Metro & Transit Systems

– Water-Efficient Public Infrastructure - By Green Building Standards (In Value %)

LEED

– LEED Platinum

– LEED Gold

– LEED Silver

BREEAM

– BREEAM Outstanding

– BREEAM Excellent

– BREEAM Very Good - By Material Used (In Value %)

Sustainable Materials

– Bamboo

– Certified Wood

– Low-VOC Paints

Recycled Materials

– Recycled Steel

– Reclaimed Wood

– Crushed Concrete

Energy-Efficient Materials

– Insulated Panels

– Reflective Roofing

– High-Performance Glass - By Geographic Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah - By Market Structure (In Value %)

Organized Sector

– Licensed Green Builders

– LEED/BREEAM Certified Contractors

– Government-Registered Urban Developers

Unorganized Sector

– Small-Scale Local Builders Using Green Techniques

– Informal Housing Upgrades with Sustainable Materials - By Housing Type (In Value %)

Multi-Family

– Eco-Friendly Apartment Blocks

– Net-Zero Energy Housing Societies

Single-Family

– Sustainable Villas

– Off-Grid Low-Carbon Homes

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Construction Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenue Metrics, Distribution Channels, Unique Value Propositions, Green Certifications & Ratings, Innovation in Green Materials, Energy Efficiency Technologies, Water & Waste Management Systems)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Profiles of Key Companies

Saudi Ceramic Co

Saveto Group

Saudi Arabian Saipem Ltd.

Al Kuhaimi Group Holding

Edama Organic Solution

Saudi Readymix Concrete Co.

Attieh Steel Ltd.

Eastern Trading & Cont. Est

Green Building Solution

Green Contracting Company

Saudi Green

SCG International Corporation

DTC

Core GBC

- Demand and Utilization Patterns

- Investment Trends and Financial Allocations

- Regulatory and Compliance Considerations

- Needs, Desires, and Pain Point Analysis

- Decision-Making Processes

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Project Cost, 2025-2030