Market Overview

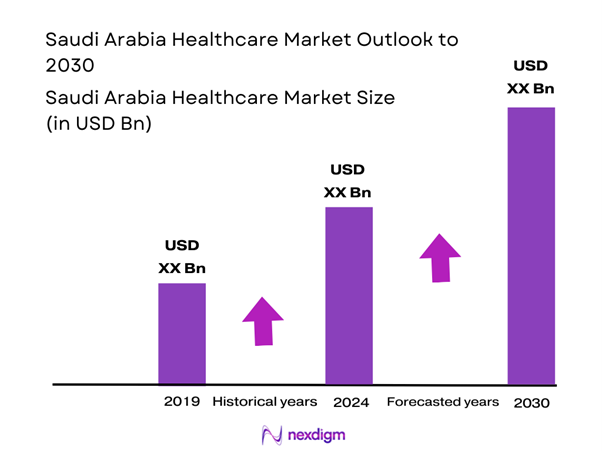

The Saudi Arabia healthcare market is valued at USD 38.5 billion and stands as one of the largest and most dynamic healthcare sectors in the Middle East. This market is driven by several factors, including a rapidly growing population, rising incidence of chronic diseases, and significant government investment aimed at enhancing healthcare infrastructure. The Saudi government has set ambitious plans under Vision 2030, dedicating resources to improve healthcare access and quality, thus contributing to the market’s robust growth.

Major cities like Riyadh, Jeddah, and Dhahran dominate the Saudi healthcare market due to their extensive healthcare facilities, proximity to educational institutions, and the concentration of medical professionals. Riyadh, being the capital, hosts numerous leading hospitals and healthcare organizations, while Jeddah serves as a major port city and financial hub, thus attracting significant healthcare investments. These cities are critical in advancing healthcare services across the region and serve as key healthcare delivery points due to their infrastructure.

The Saudi government is actively promoting health reforms through initiatives such as the National Health Strategy. This policy aims to improve service quality and accessibility, with over USD 20 billion allocated for health projects in 2023 alone. Furthermore, the Ministry of Health plans to construct more than 30 new hospitals and enhance over 200 healthcare centers across the country. This governmental push exemplifies a commitment to facilitating a healthier population, ultimately strengthening the healthcare market’s capacity to cater to rising demands effectively.

Market Segmentation

By Service Type

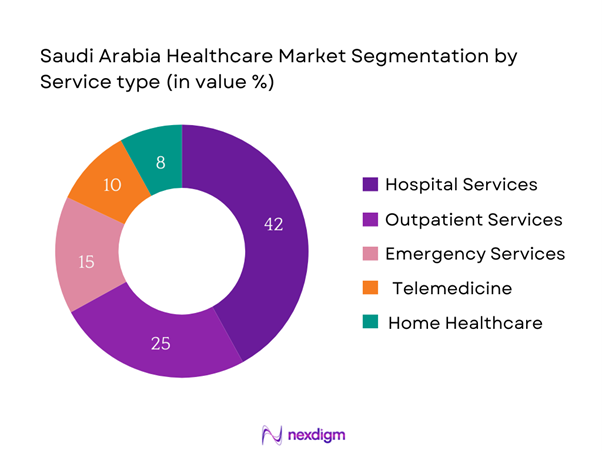

The Saudi Arabia healthcare market is segmented by service type into hospital services, outpatient services, emergency services, telemedicine, and home healthcare. Hospital services dominate the market due to their holistic approach to medical treatment, providing a wide array of services under one roof. With the increasing demand for inpatient care and specialized surgeries, the hospital segment has been the focus of substantial investments from both the government and private sectors. Facilities like King Faisal Specialist Hospital continue to enhance their service offerings, thus solidifying their position in the healthcare landscape.

By Therapy Type

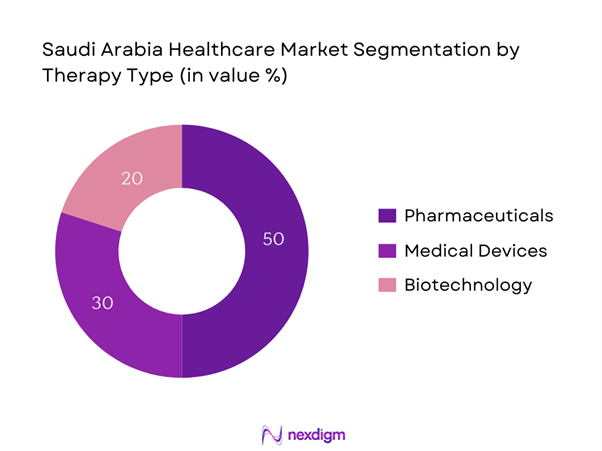

The market is also segmented by therapy type, comprising pharmaceuticals, medical devices, and biotechnology. The pharmaceuticals segment leads the market share due to a robust demand for medication and therapies addressing chronic illnesses like diabetes and hypertension, which are prevalent in the population. The increasing prevalence of non-communicable diseases has prompted significant investment and innovation from pharmaceutical companies, making this segment vital in shaping the overall market dynamics.

Competitive Landscape

The Saudi Arabia healthcare market is characterized by a few major players, including both local and international firms. This consolidation indicates the significant influence that these key companies wield on the market dynamics. Key competitors not only shape market trends but also engage in strategic collaborations to expand their reach and service capabilities. Major players include:

| Company | Established | Headquarters | Market Focus | Number of Facilities | Employee Count | Annual Revenue | Primary Services |

| Ministry of Health | 1950 | Riyadh | – | – | – | – | – |

| King Faisal Specialist Hospital | 1975 | Riyadh | – | – | – | – | – |

| Saudi German Hospital | 1997 | Jeddah | – | – | – | – | – |

| Dr. Sulaiman Al Habib Medical Group | 1999 | Riyadh | – | – | – | – | – |

| Al Nasser Medical Center | 2001 | Riyadh | – | – | – | – | – |

Saudi Arabia Healthcare Market Analysis

Growth Drivers

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions is a significant driver of the Saudi Arabia healthcare market. As of 2022, approximately 25% of the adult population in Saudi Arabia—which equates to around 7 million people—was diagnosed with high blood pressure, while 15% lived with diabetes (Ministry of Health Saudi Arabia). This sharp increase in chronic conditions necessitates extensive healthcare services and specialized medical attention, leading to an ever-growing demand for healthcare resources, facilities, and trained professionals to tackle these health challenges effectively.

Rising Healthcare Expenditure

Healthcare expenditure in Saudi Arabia has seen a steady increase, reaching approximately USD 40 billion in 2022. This rise is fueled by the government’s commitment to enhancing healthcare services and infrastructure as part of its Vision 2030 initiative. According to the World Bank, public health spending has been prioritized, with an annual allocation of approximately USD 30 billion dedicated to various health improvement programs, signaling a robust investment in health services. This increases focus on quality healthcare serves as a crucial driver for the market, facilitating the growth of various healthcare segments.

Market Challenges

High Costs of Healthcare Services

Despite the significant investments into healthcare, the high costs associated with medical services pose a substantial challenge in Saudi Arabia. A 2022 report highlighted that approximately 60% of residents face difficulties affording medical care, particularly for advanced treatments and surgeries. This financial strain can deter patients from seeking necessary healthcare services, thus exacerbating health issues within the population and leading to a negative impact on long-term healthcare outcomes. These prohibitive costs can limit the growth potential of healthcare providers in the market.

Regulatory Hurdles

Regulatory hurdles continue to present challenges for healthcare stakeholders in Saudi Arabia. As per the latest estimates, the average time required to obtain a healthcare-related license in Saudi Arabia exceeds eight months, creating delays and inefficiencies for new entrants in the healthcare market. This bureaucratic slow process can stifle innovation and pricing strategies for healthcare companies, ultimately impacting the overall growth of the healthcare market. Such regulatory constraints contribute to a challenging environment for entrepreneurship and investment in this sector.

Opportunities

Expansion of Private Sector Healthcare Facilities

There exists ample opportunity for the expansion of private sector healthcare facilities in Saudi Arabia, as the private healthcare market is already experiencing increased demand. In 2022, the private healthcare segment accounted for about 52% of the total healthcare services provided in the country. This growth trajectory indicates a favorable environment for both local and international investments. The government has also acknowledged this trend, actively encouraging public-private partnerships (PPPs) to stimulate market expansion and improve service offerings. The private sector is expected to play a crucial role in achieving the healthcare objectives set in Vision 2030.

Adoption of Telehealth Solutions

The adoption of telehealth solutions presents a promising opportunity for growth in the Saudi healthcare landscape. The COVID-19 pandemic has accelerated the acceptance and utilization of telemedicine services, with the number of consultations rising sharply to approximately 5 million in 2022, providing accessible healthcare options for residents across the Kingdom. The government is now investing in advanced digital health platforms, facilitating the growth of telehealth services significantly. This embrace of technology not only enhances patient access but also optimizes healthcare delivery, fostering an environment for innovative service offerings.

Future Outlook

Over the next five years, the Saudi Arabian healthcare market is expected to exhibit significant growth, driven by continuous government support, ongoing reforms under Vision 2030, and increased demand for innovative healthcare solutions. The sector is poised for transformation with advancements in digital health technologies, telemedicine initiatives, and robust investment in healthcare infrastructure to meet the growing needs of the population. These factors are not only expected to improve healthcare accessibility but also enhance the quality of healthcare delivery across the Kingdom.

Major Players

- Ministry of Health

- King Faisal Specialist Hospital

- Saudi German Hospital

- Sulaiman Al Habib Medical Group

- Al Nasser Medical Center

- United Health Group

- Dallah Healthcare Company

- Mouwasat Medical Services

- Al Habib Medical Group

- Al Nahdi Medical Company

- NMC Healthcare

- Advanced Medical Solutions

- Al-Faisaliah Group

- Al-Watania Medical Group

Key Target Audience

- Hospitals and Healthcare Providers

- Pharmaceutical Companies

- Medical Device Manufacturers

- Health Insurance Firms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health)

- Healthcare Consultants

- Health Technology Companies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves creating a detailed ecosystem map to encompass all major stakeholders within the Saudi Arabia healthcare market. This includes a thorough evaluation of current market trends, key players, and their influences on market dynamics. Extensive desk research is conducted using a combination of secondary and proprietary databases to gather comprehensive information, paving the way for identifying critical variables affecting the market.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the healthcare market is compiled and analyzed. This involves assessing market penetration, the ratio of healthcare facilities to service providers, and resultant revenue generation. An evaluation of service quality statistics is also conducted to ensure the precision and reliability of the revenue estimates, thereby establishing a solid foundational understanding of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses about the market are validated through computer-assisted telephone interviews (CATIs) with industry experts. These experts represent a wide array of organizations within the healthcare sector, offering valuable insights into operational and financial aspects. This consultation process is critical for refining market data, allowing for a more accurate and nuanced understanding of healthcare trends in Saudi Arabia.

Step 4: Research Synthesis and Final Output

The final phase consists of direct engagement with multiple healthcare providers to gain detailed insights into service segments, patient preferences, and operational efficiencies. This interaction serves to confirm and complement statistics derived from both the top-down and bottom-up approaches, resulting in an exhaustive, validated analysis of the Saudi Arabia healthcare market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Key Milestones in Healthcare Development

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Prevalence of Chronic Diseases

Rising Healthcare Expenditure

Government Initiatives for Healthcare Improvement - Market Challenges

High Costs of Healthcare Services

Regulatory Hurdles - Opportunities

Expansion of Private Sector Healthcare Facilities

Adoption of Telehealth Solutions - Trends

Shift Towards Preventive Healthcare

Digital Transformation in Healthcare - Government Regulations

Healthcare Policies and Standards

Licensing and Accreditation Processes - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Expenditure, 2019-2024

- By Service Type (In Value %)

Hospital Services

– Inpatient Care

– Surgical Procedures

– Intensive Care Units

Outpatient Services

– General Consultations

– Specialty Clinics

– Diagnostic Service

Emergency Services

– 24×7 Trauma Care

– Ambulance & First Response

– Emergency Surgeries

Telemedicine

– Virtual Consultations

– Remote Monitoring

– Tele-ICU and Specialist Services

Home Healthcare

– Post-Surgical Recovery Support

– Elderly Care

– Chronic Disease Management - By Therapy Type (In Value %)

Pharmaceuticals

– Prescription Drugs

– Over-the-Counter (OTC) Drugs

– Generic Medications

Medical Devices

– Diagnostic Equipment

– Surgical Instruments

– Monitoring Devices

Biotechnology

– Biologics

– Biosimilars

– Cell & Gene Therapy Products - By Distribution Channel (In Value %)

Hospital Pharmacies

– Public Sector Hospitals

– Private Hospital Chains

Retail Pharmacies

– Pharmacy Chains

– Independent Pharmacies

Online Pharmacies

– App-Based Pharmacies

– E-commerce Portals with Health Products - By Geography (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Patient Demographics (In Value %)

Pediatric

– Neonatal Care

– Pediatric Vaccination and Nutrition

Adult

-General Health Services

– Preventive Health Checkups

Geriatric

– Long-Term Care Services

– Geriatric Disease Management

– Palliative and End-of-Life Care

- Market Share of Major Players (Based on Value/Volume), 2024

Comparative Market Share by Service Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Service Type, Number of Facilities, Number of Providers, Unique Value Offerings, and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Profiles of Key Competitors

Ministry of Health Saudi Arabia

King Faisal Specialist Hospital

Saudi German Hospital

United Health Group

Al Habib Medical Group

Dr. Sulaiman Al Habib Medical Group

Dallah Healthcare Company

Al Nahdi Medical Company

Mouwasat Medical Services

NMC Healthcare

Al-Faisaliah Group

GPH

Al-Muhaidib Group

Al-Nahdi Medical Co.

Al-Watania Medical Group

- Market Demand and Utilization Patterns

- Consumer Purchasing Power and Budget Allocations

- Regulatory Compliance Requirements

- Patient Needs and Satisfaction Levels

- Decision-Making Processes in Healthcare Purchases

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Expenditure, 2025-2030