Market Overview

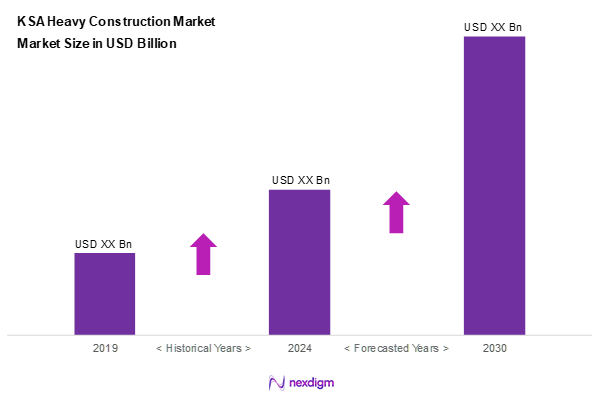

As of 2024, the Saudi Arabia heavy construction market is valued at USD 35 billion, with a growing CAGR of 7.4% from 2024 to 2030, driven by substantial government investments in infrastructure and urban development. Factors such as the Vision 2030 initiative, which aims to diversify the economy beyond oil, are propelling growth. The heavy construction sector is expected to witness robust demand from government-backed infrastructure projects and investments, leading to increased market activity.

The leading cities in the Saudi Arabian heavy construction market are Riyadh, Jeddah, and Dammam. Riyadh remains the central hub owing to its status as the capital and rapid urbanization projects. Jeddah’s coastal developments and Dammam’s logistics and industrial projects contribute significantly to the market’s dynamics, highlighting the regional focus on extensive urbanization and infrastructure enhancements.

Market Segmentation

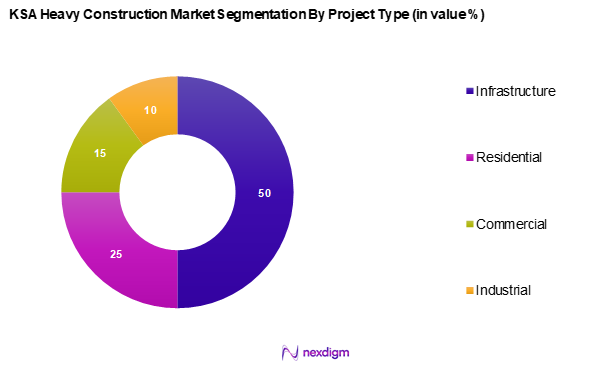

By Project Type

The Saudi Arabia heavy construction market is segmented into infrastructure, residential, commercial, and industrial. The infrastructure segment dominates the market, accounting for a substantial share in 2024, due to the government’s emphasis on improving transportation networks, utilities, and public facilities, essential for economic diversification and supporting urban growth.

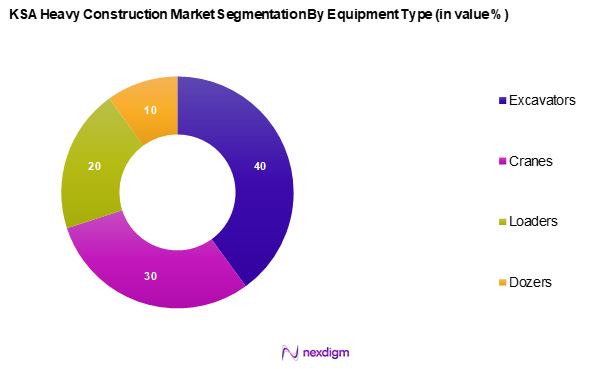

By Equipment Type

The Saudi Arabia heavy construction market is segmented into excavators, cranes, loaders, and dozers. Excavators lead this segment, reflecting their essential role in various construction activities, including site preparation and groundwork. Their versatility in handling diverse tasks ensures a continual demand in an expanding market driven by large-scale infrastructure projects.

Competitive Landscape

The Saudi Arabia heavy construction market is characterized by the presence of key players such as Saudi Binladin Group, El Seif Engineering Contracting Company, and others. This sector sees significant consolidation, with these firms holding a substantial share of the market, indicative of their robust capabilities and established reputations.

| Company Name | Establishment Year | Headquarters | Number of Projects | Revenue (USD Billion) | Employee Count | Market Specific Parameter 1 |

| Saudi Binladin Group | 1931 | Jeddah, Saudi Arabia | – | – | – | – |

| El Seif Engineering Contracting Co. | 1975 | Riyadh, Saudi Arabia | – | – | – | – |

| Nesma & Partners Contracting Co. Ltd. | 1919 | Al Khobar, Saudi Arabia | – | – | – | – |

| Almabani General Contractors | 1972 | Jeddah, Saudi Arabia | – | – | – | – |

| Al Rashid Trading & Contracting Co. | 1957 | Riyadh, Saudi Arabia | – | – | – | – |

Saudi Arabia Heavy Construction Market Analysis

Growth Drivers

Government Investment in Infrastructure

The Saudi government is investing heavily in infrastructure with planned capital expenditure of SAR 300 billion (approximately USD 80 billion) allocated for the development of roads, railways, and public facilities for the upcoming years. This investment supports the overarching Vision 2030 plan, aimed at diversifying the economy beyond oil dependence. Notably, infrastructure development projects like the Riyadh Metro, which is valued at SAR 86 billion, significantly highlight the government’s commitment to bolstering infrastructural frameworks. Additionally, rising population estimates project Saudi Arabia’s population to reach 39 million by 2025, further necessitating infrastructure expansion.

Urbanization Trends

Saudi Arabia’s urbanization is accelerating, with approximately 84% of the population now residing in urban areas, as reported in 2022. This shift translates to a high demand for construction projects, particularly residential and commercial developments. The country’s urban population is projected to grow by over 2.4 million people annually. The cities of Riyadh and Jeddah are experiencing rapid growth, driving the need for enhanced urban infrastructure. This urban influx significantly impacts housing, transportation, and various services, propelling the construction sector forward as it seeks to address these systemic demands.

Market Challenges

Regulatory Hurdles

Navigating the regulatory landscape poses significant challenges for stakeholders in the Saudi heavy construction market. The government has established stringent building codes and regulatory frameworks to enhance safety and environmental standards, requiring compliance from construction firms. However, these evolving regulations can lead to project delays and increased costs. According to the World Bank’s Ease of Doing Business Index, Saudi Arabia ranked 62nd in 2022, indicating that navigating regulations remains a critical hurdle for construction companies, hindering timely project execution.

Workforce Shortage

The Saudi Arabia heavy construction sector faces a pressing workforce shortage, compounded by a lack of skilled labor. The National Labor and Social Development Ministry reports that the construction industry requires over 90,000 additional skilled workers to meet project demands effectively. Additionally, ongoing initiatives to localize labor would require companies to navigate a complex landscape of talent acquisition while investing in training programs to enhance local skills. Without addressing this shortfall, the capacity to undertake large-scale projects may be limited.

Opportunities

Technological Advancements (e.g., BIM)

Technological advancements offer substantial opportunities for growth within the Saudi heavy construction market. Building Information Modeling (BIM) is increasingly adopted by industry players to enhance project management and efficiency. The market for BIM solutions is projected to reach USD 9.5 billion by 2025, supported by a growing emphasis on digitization in construction processes. The adoption of advanced technologies like drones and AI and blockchain powered analytics enhances project oversight, reduces wastage, and improves overall operational performance, positioning firms at a competitive advantage.

Sustainable Construction Methods

The focus on sustainable construction methods is shaping the future growth of the Saudi heavy construction market. With the Kingdom’s commitment to achieving sustainability goals, initiatives are underway to promote green building practices and materials. According to the Saudi Green Initiative outlined in 2021, the government aims to plant 10 billion trees and raise the share of renewable energy to 50% of its total energy mix by 2030. The adoption of sustainable practices not only enhances environmental compliance but also opens new market segments focused on eco-friendly developments. This shift is spurred by increasing public awareness and regulatory pressures, paving the way for innovative construction solutions that prioritize sustainability.

Future Outlook

Over the next five years, the Saudi Arabia heavy construction market is expected to exhibit substantial growth thanks to strategic government initiatives aimed at infrastructure enhancement as part of Vision 2030. The continued focus on urbanization and residential development projects will drive demand for heavy construction services and equipment. With the global push towards more sustainable construction practices gaining traction, companies are likely to invest in technology and innovative solutions to cater to evolving market needs.

Major Players

- Saudi Binladin Group (SBG)

- El Seif Engineering Contracting Company

- Nesma & Partners Contracting Co. Ltd.

- Almabani General Contractors

- Al Rashid Trading & Contracting Company (RTCC)

- Al Bawani Company

- Al Ayuni Investment and Contracting Company

- Shibh Al Jazira Contracting Company (SAJCO)

- Alharbiholding

- Al Yamama Company

- Al Kifah Contracting Company

- Haif Company

- Alfanar Construction

- AlFouzan Construction Company

Key Target Audience

- Government and Regulatory Bodies (e.g., Ministry of Municipal and Rural Affairs, Saudi Arabian General Investment Authority)

- Investments and Venture Capitalist Firms

- Construction and Engineering Firms

- Real Estate Developers

- Urban Planning Agencies

- Infrastructure Financing Institutions

- Material Suppliers

- Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem, which includes identifying significant stakeholders in the Saudi Arabia heavy construction market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The aim is to define critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Saudi Arabia heavy construction market is compiled and analyzed. This involves assessing market penetration, the ratio of various project types, and resulting revenue generation. An evaluation of service quality metrics will be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATIs) with industry experts from diverse companies. These consultations are crucial for obtaining valuable operational and financial insights directly from industry professionals, which are essential for refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with multiple heavy construction companies to gain in-depth insights into project segments, financial performance, consumer preferences, and industry trends. This interaction serves to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia heavy construction market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Investment in Infrastructure

Urbanization Trends

Economic Diversification Initiatives - Market Challenges

Regulatory Hurdles

Workforce Shortage - Opportunities

Technological Advancements (e.g., BIM)

Sustainable Construction Methods - Trends

Digitalization of Construction Processes

Increased Focus on Green Building - Government Regulation

Building Codes and Standards

Subsidies for Green Construction

Compliance and Safety Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Project Cost, 2019-2024

- By Project Type (In Value %)

Infrastructure

– Roads and Highways

– Railways and Metro Systems

– Airports

– Ports and Harbors

Residential

– High-Rise Housing Complexes

– Affordable Housing Projects

– Gated Communities

Commercial

– Office Towers

– Retail Centers and Malls

– Hospitality (Hotels, Resorts)

Industrial

– Warehouses

– Factories

– Industrial Parks

– Oil & Gas Processing Units - By Equipment Type (In Value %)

Excavators

– Crawler Excavators

– Wheeled Excavators

– Mini Excavators

Cranes

– Tower Cranes

– Mobile Cranes

– Overhead Cranes

Loaders

– Skid-Steer Loaders

– Backhoe Loaders

– Wheel Loaders

Dozers

– Crawler Dozers

– Mini Dozers

– Swamp Dozers - By End-User Sector (In Value %)

Government

– Public Infrastructure Development

– Housing Projects

– Smart Cities and Giga Projects

Private Sector

– Real Estate Developers

– Industrial Estate Builders

– Institutional Investors

Utility Services

– Water and Sewage Networks

– Power Transmission Projects

– Renewable Energy Parks - By Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar - By Construction Material (In Value %)

Concrete

– Ready-Mix Concrete

– Precast Concrete

– Reinforced Concrete

Steel

– Structural Steel

– Rebar

– Steel Panels

Asphalt

– Hot Mix Asphalt

– Cold Mix Asphalt

Aggregates

– Crushed Stone

– Gravel

– Sand

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Project Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Value Propositions, Revenue Breakdown by Project Type, Technology Utilization, Project Portfolio Diversity, Equipment Ownership & Capabilities, Safety Record & Compliance, Workforce & Labor Efficiency)

- SWOT Analysis of Major Competitors

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Saudi Binladin Group (SBG)

El Seif Engineering Contracting Company

Nesma & Partners Contracting Co. Ltd.

Almabani General Contractors

Al Rashid Trading & Contracting Company (RTCC)

Al Bawani Company

Al Ayuni Investment and Contracting Company

Shibh Al Jazira Contracting Company (SAJCO)

Al Yamama Company

Al Kifah Contracting Company

Haif Company

Alfanar Construction

AlFouzan Construction Company

- Market Demand and Utilization

- Budget Allocations by Sector

- Regulatory Compliance Requirements

- Decision-making Factors

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Project Cost, 2025-2030