Market Overview

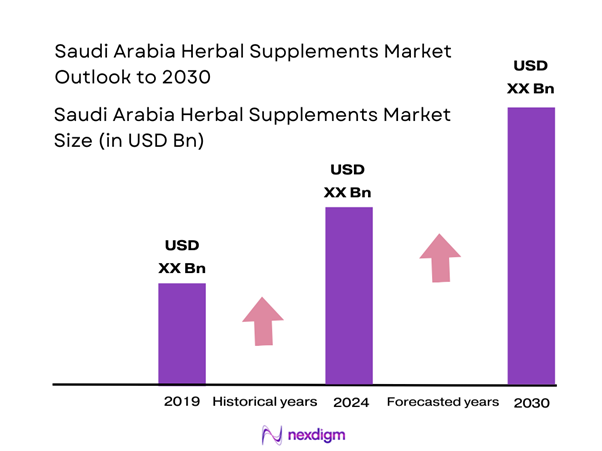

The Saudi Arabia herbal supplements market is valued at USD 1.2 billion in 2024 with an approximated compound annual growth rate of 8% from 2025-2030, building on a robust historical growth attributed to increasing consumer awareness surrounding the benefits of natural health solutions and the growing inclination towards preventive healthcare. The market growth is significantly driven by shifting consumer preferences, which demand natural and organic food that align with their health goals.

The market is primarily dominated by major cities such as Riyadh, Jeddah, and Dammam, which serve as economic and commercial hubs. Riyadh, being the capital, showcases a concentration of healthcare facilities and diverse retail options, thus fostering the availability of herbal products. Jeddah’s strategic location as a port city facilitates importation and efficient distribution networks, while Dammam’s industrial base supports local production. These cities’ significance contributes to shaping the market dynamics through increased consumption and awareness of herbal supplements.

The Saudi government is providing regulatory support for herbal products through frameworks that endorse the safety and efficacy of these goods. In alignment with Vision 2030, which aims to promote health and wellness, the Saudi Food and Drug Authority (SFDA) has developed guidelines and regulations to facilitate the registration and approval of herbal supplements. In 2023, the SFDA reported that around 1,300 herbal products were officially registered, indicating growing institutional support for the industry.

Market Segmentation

By Product Type

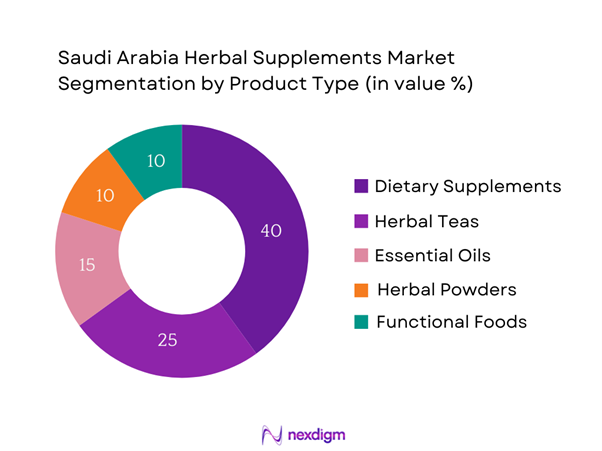

The Saudi Arabia herbal supplements market is segmented by product type into dietary supplements, herbal teas, essential oils, herbal powders, and functional foods. The dietary supplements segment dominates the market share due to an evolving health-conscious consumer base increasingly opting for convenient and effective health solutions. This segment includes well-established brands that appeal to diverse health needs, such as vitamins, minerals, and proprietary blends. The growing trend of preventive healthcare, coupled with an emphasis on fitness and overall wellness, fosters this segment’s growth trajectory.

By Application

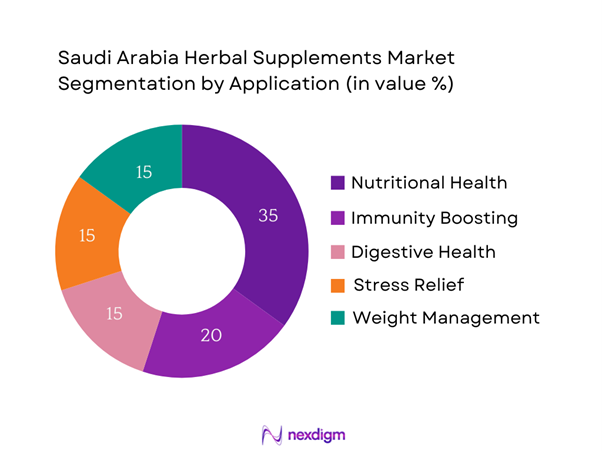

The market is also segmented by application into nutritional health, immunity boosting, digestive health, stress relief, and weight management. The nutritional health application dominates the market due to the growing awareness of health and wellness among consumers, emphasizing the benefits of dietary supplements in fulfilling nutritional gaps. This trend is further amplified by marketing campaigns highlighting the importance of maintaining optimal health through natural means. As more individuals seek to improve their general well-being, the demand for herbal supplements in this category continues to rise.

Competitive Landscape

The Saudi Arabia herbal supplements market is characterized by a competitive landscape comprising several key players. Major companies such as Herbalife International and Himalaya Drug Company have established strong footholds, competing on various fronts, including product innovation and marketing strategies. This consolidation showcases the influence of these prominent firms in shaping market trends and consumer preferences.

| Company | Established Year | Headquarters | Product Portfolio | Market Presence | Focus Area | Online Presence |

| Herbalife International | 1980 | Los Angeles, USA | – | – | – | – |

| Himalaya Drug Company | 1930 | Bengaluru, India | – | – | – | – |

| Amway Corporation | 1959 | Ada, Michigan, USA | – | – | – | – |

| Nature’s Way | 1969 | Springville, Utah, USA | – | – | – | – |

| Organic India | 1990 | Ramnagar, India | – | – | – | – |

Saudi Arabia Herbal Supplements Market Analysis

Growth Drivers

Increasing Health Consciousness

The rising health consciousness among consumers in Saudi Arabia has led to a paradigm shift in dietary habits, with an increasing number of individuals adopting preventive healthcare measures. As per the Saudi Arabian Ministry of Health, chronic diseases such as diabetes and hypertension are rising, with diabetes prevalence alone at over 7 million cases in 2023, pushing consumers towards natural remedies and herbal supplements. The health-focused initiatives and campaigns aimed at educating the public about the benefits of a healthy lifestyle further bolster this trend, creating a larger audience for herbal products.

Rising Disposable Income

Rising disposable income levels in Saudi Arabia are directly impacting the herbal supplements market, as more consumers are able to afford premium health products. According to data from the World Bank, the Gross National Income (GNI) per capita in Saudi Arabia increased from USD 22,340 in 2022 to approximately USD 23,560 in 2024. This growth in income enhances consumers’ ability to invest in health and wellness, with more individuals seeking to improve their health through natural and organic herbal products. The improved economic conditions thus play a critical role in driving the demand for herbal supplements.

Market Challenges

Regulatory Hurdles

Despite the overall regulatory support, complexities in obtaining approvals and navigating compliance can pose challenges within the herbal supplements market. The SFDA’s rigorous standards for product safety, labeling, and marketing compliance require manufacturers to invest significant time and resources ensuring adherence. In 2023, reports indicated that over 30% of products submitted for registration faced delays due to incomplete documentation or unmet quality standards. This impediment may restrict market entry for smaller players, ultimately impacting the diversity of herbal offerings available to consumers.

Market Fragmentation

Market fragmentation presents another significant challenge in the Saudi Arabian herbal supplements sector. The presence of numerous local and international players, each with varying levels of brand recognition, leads to intense competition and a lack of standardization among products. In 2023, the top five brands accounted for less than 35% of the market share, indicating that smaller brands often struggle to compete against well-established players. This fragmentation can confuse consumers and complicate purchasing decisions, potentially hindering the growth of the industry as a whole.

Opportunities

Expansion of E-Commerce

The expansion of e-commerce platforms in Saudi Arabia presents significant opportunities for herbal supplements market growth. The Saudi Arabian e-commerce market was valued at USD 10 billion in 2023, with projections indicating continued growth as a result of increasing internet penetration, which reportedly reached 95% of the population. With more consumers turning to online shopping for convenience and accessibility, herbal supplement companies can leverage these platforms to reach a broader audience, thus driving sales and brand awareness. This transition to digital is a crucial avenue for growth moving forward.

Rising Demand for Natural Products

The increasing consumer preference for natural and organic products presents another lucrative opportunity for herbal supplements. With the global organic food market valued at USD 1.4 trillion in 2023, a rising demand for clean-label products is reflected in the local market as well. As consumers become more aware of the health benefits and efficacy of herbal supplements, brands that position themselves as natural and organic are likely to witness significant uptake. This trend is evidenced by a reported 52% increase in the consumption of herbal remedies and dietary supplements in recent years, showcasing the clear opportunity for companies to capitalize on this growth area.

Future Outlook

In the coming years, the Saudi Arabia herbal supplements market is expected to exhibit substantial growth driven by an increasing emphasis on preventive healthcare, innovations in product formulations, and a growing number of consumers shifting toward health-oriented lifestyle choices. The rise in awareness regarding the benefits of herbal products and dietary supplements is anticipated to further boost demand. Additionally, the expansion of distribution channels through e-commerce platforms will foster accessibility, ultimately contributing to market growth.

Major Players

- Herbalife International

- Himalaya Drug Company

- Amway Corporation

- Nature’s Way

- Organic India

- Solgar Vitamin and Herb

- Blackmores

- New Chapter

- Kyolic

- Frontier Co-op

- Sabinsa Corporation

- Young Living Essential Oils

- Natures Bounty

- Traditional Medicinals

- Herbalife NutraBlend

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority)

- Health and Wellness Retailers

- Pharmaceutical Companies

- Health Insurance Providers

- Fitness and Nutrition Coaches

- Grocery and Supermarket Chains

- E-commerce Platforms

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves mapping the complete ecosystem of stakeholders in the Saudi Arabia herbal supplements market. Through extensive desk research utilizing secondary and proprietary databases, we gather detailed industry-level insights. The aim is to identify key variables influencing market growth, including consumer trends, regulatory frameworks, and competitive landscapes.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical and current data related to the herbal supplements market. It entails assessing the penetration of various product categories, evaluating the synergy between market players, and identifying revenue-generating factors. Service quality metrics and performance indicators are also examined to validate data integrity.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we develop hypotheses regarding market dynamics and validate them through qualitative consultations. Engaging with industry experts through one-on-one interviews, we collect insights from diverse businesses in the herbal supplements domain. Their operational experiences will refine our understanding of market drivers and barriers.

Step 4: Research Synthesis and Final Output

The final phase focuses on synthesizing collected data and insights to present a comprehensive analysis. This includes engaging with herbal supplement manufacturers to gather detailed information on product segments, consumer preferences, and sales performance. These engagements serve to validate findings derived from previous analysis phases, ensuring a thorough and reliable report.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Health Consciousness

Rising Disposable Income

Regulatory Support for Herbal Products - Market Challenges

Regulatory Hurdles

Market Fragmentation - Opportunities

Expansion of E-Commerce

Rising Demand for Natural Products - Trends

Custom Supplements

Sustainability in Sourcing - Government Regulation

Compliance with Health Standards

Quality Assurance Policies - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Dietary Supplements

– Capsules

– Tablets

– Softgels

Herbal Teas

– Green Tea

– Chamomile Tea

– Ginger Tea

Essential Oils

– Lavender Oil

– Peppermint Oil

– Tea Tree Oil

Herbal Powders

– Ashwagandha

– Turmeric

– Moringa

Functional Foods

– Herbal-Infused Snacks

– Fortified Beverages

– Nutraceutical Bars - By Application (In Value %)

Nutritional Health

– Daily Vitamin Support

– Mineral Absorption

Immunity Boosting

– Cold & Flu Resistance

– Antioxidant Support

Digestive Health

– Detox Supplements

– Gut Flora Balancing

Stress Relief

– Sleep Enhancers

– Anxiety Support

Weight Management

– Metabolism Boosters

– Appetite Suppressants - By Distribution Channel (In Value %)

Offline Retail

– Pharmacies

– Supermarkets & Hypermarkets

– Specialty Health Stores

Online Retail

– Brand E-commerce Websites

– Marketplaces

– Subscription-Based Wellness Platforms - By Consumer Type (In Value %)

Adults

Seniors - By Region (In Value %)

Riyadh & Surrounding Cities

Dammam

Al Khobar

Jeddah

Makkah & Madinah

Abha

Jazan

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Herbal Supplements Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Companies

Natures Bounty

Amway

Herbalife Nutrition

GNC Holdings, Inc.

Abbott Laboratories

Nestle Health Science

Pfizer Inc.

NOW Foods

NutraClick

Blackmores Limited

Nature’s Way

Jamieson Wellness

Glanbia Performance Nutrition

Vitabiotics Ltd.

Sundown Naturals

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030