Market Overview

The Saudi Arabia Ice Cream market is valued at USD 648.28 million in 2024 with an approximated compound annual rate of 6.76% from 2024-2030, reflecting robust demand fueled by an expanding population and increasing disposable incomes. Major factors driving this growth include the rising urban population’s preference for indulgent foods, which has shifted consumer behavior towards premium and diverse ice cream offerings. Furthermore, innovative flavors and health-conscious options have attracted a broader customer base, enhancing sales figures as the market adapts to modern trends and demands.

The market is dominated by key cities such as Riyadh, Jeddah, and Dammam. These urban centers serve as commercial hubs, showcasing a vibrant food culture that embraces both traditional and modern flavors. The concentration of retail outlets and increased tourism in these cities also contribute to their dominance, as local and international brands capitalize on the high foot traffic.

The expansion of retail channels significantly enhances access to ice cream products across Saudi Arabia. The retail landscape has evolved with a notable increase in supermarkets, hypermarkets, and convenience stores. By end of 2025, the number of supermarkets is expected to reach 1,500, increasing consumer access to various ice cream brands. Additionally, the introduction of mobile apps and e-commerce platforms helps facilitate direct-to-consumer sales, making ice cream purchasing even more convenient, especially for younger demographics.

Market Segmentation

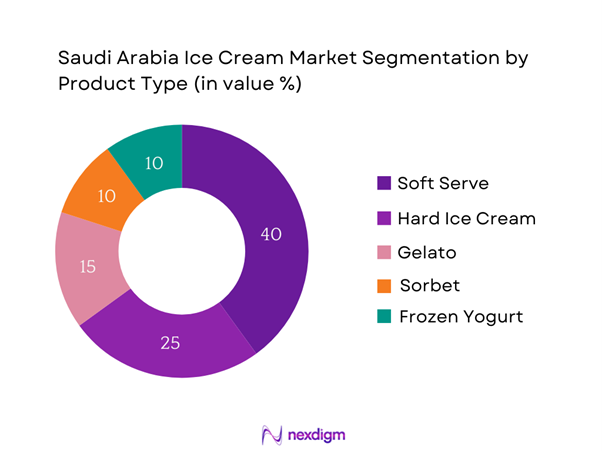

By Product Type

The Saudi Arabia Ice Cream market is segmented by product type into soft serve, hard ice cream, gelato, sorbet, and frozen yogurt. The soft serve segment currently dominates the market share due to its widespread availability and consumer preference for creamy textures. Soft serve ice cream is particularly popular in recreational settings like amusement parks and fairs, where its accessible price point attracts large crowds. Additionally, brands are innovating with unique flavors and toppings for soft serve, further enhancing its appeal in outings and social occasions, leading to sustained consumer interest.

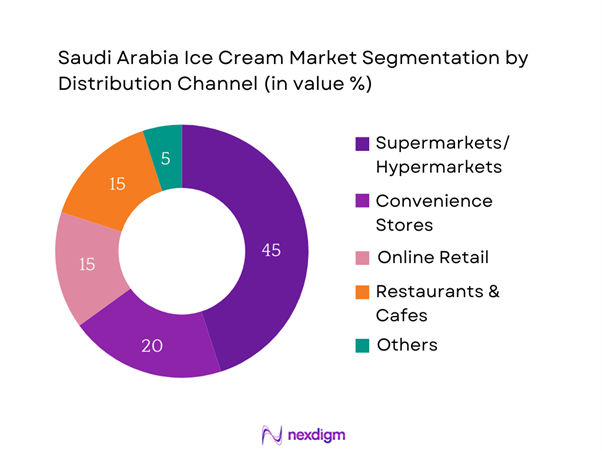

By Distribution Channel

The market is segmented by distribution channel into supermarkets & hypermarkets, convenience stores, online retail, restaurants & cafés, and others. Supermarkets and hypermarkets hold a significant share of the market due to their wide product range and consumer convenience. These retail formats offer extensive promotional campaigns, discounts, and a variety of brands and flavors, enticing consumers to make bulk purchases for home consumption. The shopping experience in these large retail spaces, coupled with availability of international brands, fosters consumer loyalty and repeated sales.

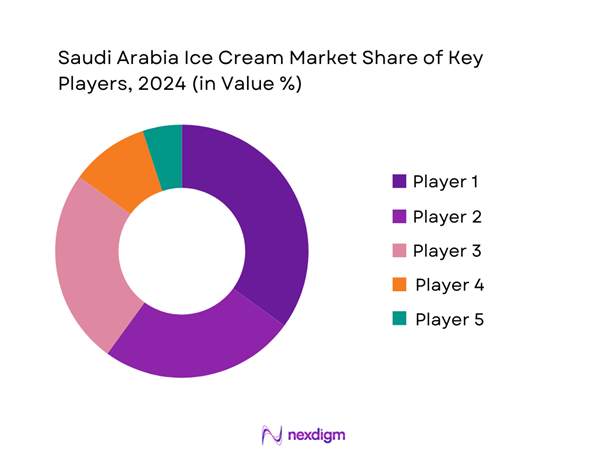

Competitive Landscape

The Saudi Arabia Ice Cream market is characterized by a competitive landscape featuring both local and international players. Major companies include Almarai Company, Nestlé S.A., Unilever PLC, Al Kabeer Group, and Baskin-Robbins. This consolidation highlights the significant influence of these key companies. Their range of products, strategic marketing, and vast distribution networks allow them to maintain a competitive edge in the ever-evolving market.

| Company Name | Establishment Year | Headquarters | Product Range | Geographic Presence | Sustainability Initiatives |

| Almarai Company | 1977 | Riyadh, Saudi Arabia | – | – | – |

| Nestlé S.A. | 1866 | Vevey, Switzerland | – | – | – |

| Unilever PLC | 1929 | Rotterdam, Netherlands | – | – | – |

| Al Kabeer Group | 1979 | Jeddah, Saudi Arabia | – | – | – |

| Baskin-Robbins | 1945 | Glendale, California | – | – | – |

Saudi Arabia Ice Cream Market Analysis

Growth Drivers

Rising Urbanization

Urbanization in Saudi Arabia plays a crucial role in the consumption patterns of ice cream. The urban population in the kingdom is projected to surpass 90% by end of 2025, with cities like Riyadh and Jeddah becoming central hubs of retail and entertainment. This urban shift fosters a fast-paced lifestyle, increasing demand for on-the-go treats like ice cream. Furthermore, urban residents exhibit more diverse dietary preferences, contributing to the growth of specialty ice cream outlets offering various flavors and formats.

Cultural Adaptation of Ice Cream Consumption

The cultural perception of ice cream within Saudi society has evolved, leading to a greater acceptance and increased consumption of frozen desserts. Traditional sweets are increasingly being complemented by modern ice cream varieties, driving consumption. Saudi Arabia has witnessed a rise in ice cream sales, with a reported consumption rate of 1.25 liters per person annually. This cultural shift emphasizes a growing preference for innovative flavors and formats, making ice cream a popular choice across various age groups.

Market Challenges

Seasonality of Demand

The ice cream market in Saudi Arabia experiences significant seasonal fluctuations, impacting revenue consistency throughout the year. Traditionally, peak consumption occurs during the warmer months, particularly in June through September, while colder months see a downturn in sales. In 2022, it was reported that sales could drop by 30% during off-peak months, heavily relying on seasonal promotions and marketing campaigns to sustain interest. This seasonality poses challenges for manufacturers and retailers to manage inventory and production cycles efficiently.

Fluctuating Raw Material Prices

The ice cream industry is significantly affected by fluctuating raw material prices, particularly dairy products and sugar. Current reports indicate that milk prices in Saudi Arabia have increased by over 15% in the last year due to supply chain disruptions and rising global demand. Such volatility affects production costs, making it challenging for manufacturers to maintain profitability without raising prices, which could dissuade budget-conscious consumers from purchasing premium products.

Opportunities

Growth of the E-commerce Sector

The ongoing growth of the e-commerce sector in Saudi Arabia presents a significant opportunity for the ice cream market. E-commerce sales reached USD 20.7 billion in 2024, driven by increased internet penetration and consumer preferences for online shopping. Ice cream brands can capitalize on this trend with direct-to-consumer strategies, creating relationships with customers and offering unique and products. This shift not only allows for greater market reach but also facilitates personalized shopping experiences with options for home delivery, thereby attracting a younger demographic looking for convenience. With a burgeoning e-commerce infrastructure and delivery services, ice cream brands can enhance their visibility and improve sales channels.

Innovative Product Development

The demand for innovative product offerings in the ice cream market is witnessing a progressive rise, especially with emerging consumer preferences for unique flavors and textures. The growing interest in artisanal ice creams and niche markets, such as vegan and lactose-free options, provides a substantial opportunity for manufacturers. In 2022, approximately 20% of ice cream produced in the region was classified as specialty, indicating a shift towards gourmet or health-oriented products. Investments into research and development facilitate brands in capitalizing on the trend towards customization and personalized user experiences.

Future Outlook

Over the next five years, the Saudi Arabia Ice Cream market is expected to show significant growth driven by increasing consumer demand for unique flavors and premium products, along with a rise in global and local brand offerings. The ongoing trend of health-conscious ice cream options, along with environmentally sustainable practices in sourcing and packaging, will further accelerate market developments. The expansion of retail channels, particularly e-commerce, will enhance accessibility for consumers, ensuring continued growth in this dynamic market landscape.

Major Players

- Almarai Company

- Nestlé S.A.

- Unilever PLC

- Al Kabeer Group

- Baskin-Robbins

- Häagen-Dazs

- Dairy Queen

- Movenpick Ice Cream

- Ben & Jerry’s

- Magnum

- Unibic Foods

- General Mills

- Dreyers Grand Ice Cream

- Ice Cream Factory

- Saudi Dairy & Foodstuff Company (SADAFCO)

Key Target Audience

- Ice Cream Manufacturers

- Distributors and Wholesalers

- Retail Chains (Supermarkets and Hypermarkets)

- Food Service Operators (Restaurants and Cafés)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Food and Drug Authority)

- Market Analysts and Industry Consultants

- Importers and Exporters of Frozen Foods

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabian Ice Cream market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Saudi Arabian Ice Cream market. This includes assessing market penetration rates, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, an evaluation of quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, based on primary sources and credible databases.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through direct engagement with industry experts representing diverse companies in the ice cream sector. These consultations will provide valuable operational and financial insights that are instrumental in refining and corroborating the market data, ensuring that our findings are grounded in practical experience.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and direct engagement with ice cream manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabian Ice Cream market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Growth Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Urbanization

Changing Consumer Preferences

Seasonal Demand Trends - Market Challenges

Price Sensitivity

Distribution Constraints - Opportunities

Expansion into Healthier Segments

Innovation in Flavors and Formats - Trends

Focus on Sustainability

Increase in Artisan Ice Cream Brands - Government Regulation

Food Safety Standards

Import Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Soft Serve

Hard Ice Cream

Gelato

Sorbet

Frozen Yogurt - By Distribution Channel (In Value %)

Supermarkets & Hypermarkets

Convenience Stores

Online Retail

Restaurants & Cafés

Others - By Flavor (In Value %)

Vanilla

Chocolate

Strawberry

Other Fruit Flavors

Specialty Flavors - By Packaging Type (In Value %)

Cups

Cones

Tubs

Bar Packaging

Others - By Region (In Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Ice-Cream Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenues , Brand Portfolio, Distribution Strategies, Revenue Estimation, Market Position, Margins, Production Capacity, Unique Value Proposition, Others)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Product Variants

- Detailed Profiles of Major Companies

Almarai

Baskin-Robbins

Häagen-Dazs

Magnolia

Dairy Queen

Cold Stone Creamery

Nestlé

Mondelēz International

Unilever (Cornetto, Ben & Jerry’s)

Al-Faisal Ice Cream

Gelato Divino

Noosa

Al-Ahlia Ice Cream

Tooty Fruity

Rani Ice Cream

- Market Demand Analysis

- Consumer Preferences

- Purchasing Behavior

- Loyalty and Brand Recognition

- Decision-Making Factors

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030