Market Overview

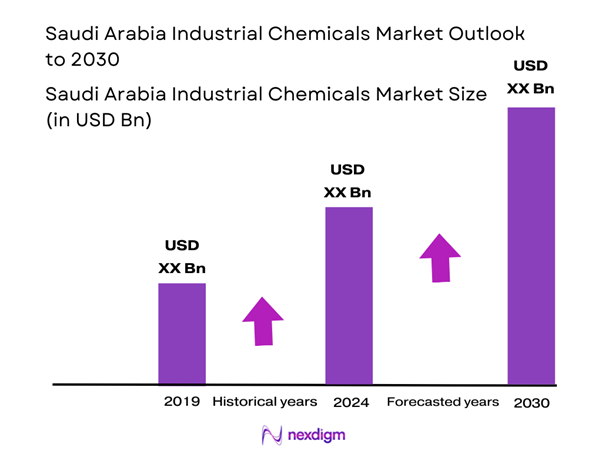

The Saudi Arabia Industrial Chemicals Market is valued at approximately USD 20 billion, based on a comprehensive analysis of historical industry data. The growth of this market is primarily driven by the increasing demand for petrochemicals, specialty chemicals, and agrochemicals across various sectors, including construction, automotive, and healthcare. This demand is further fueled by government investments in infrastructure and industrial diversification, aiming to reduce reliance on oil revenues.

The market is dominated by key cities such as Riyadh, Jeddah, and Dammam, which serve as industrial hubs due to their strategic locations and infrastructure development. The presence of major companies and plants in these cities has led to a concentration of resources, talent, and logistics networks that support the industrial chemicals sector. Additionally, these cities benefit from direct access to shipping routes, enhancing export capabilities of chemical products and attracting foreign investments.

Government initiatives play a pivotal role in fostering industrial growth in the Kingdom. The National Industrial Development and Logistics Program (NIDLP) represents a colossal effort to inject USD 500 billion into enhancing industry logistics, manufacturing, and export services. By emphasizing domestic manufacturing, these efforts aim to increase the sector’s GDP contribution and minimize dependency on imports. The government’s focus on economic diversification, as detailed in Vision 2030, positions Saudi Arabia as a global industrial hub and promotes the flourishing of domestic manufacturing sectors, including the chemicals industry.

Market Segmentation

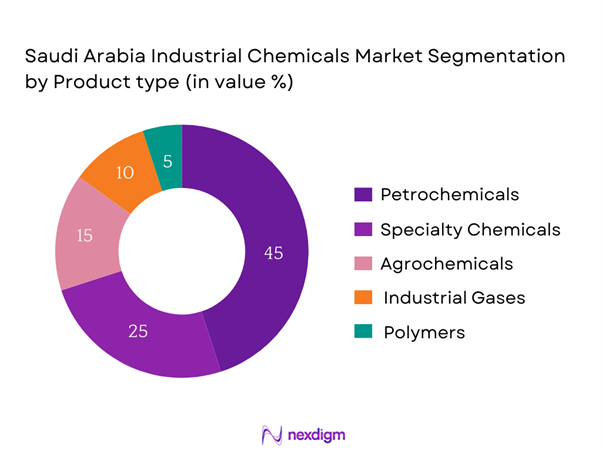

By Product Type

The Saudi Arabia Industrial Chemicals Market is segmented by product type into petrochemicals, specialty chemicals, agrochemicals, industrial gases, and polymers. Currently, petrochemicals hold a dominant market share in this segment owing to Saudi Arabia’s position as a leading producer of crude oil, which serves as a fundamental raw material for petrochemical production. The market benefits from established infrastructure and expertise, allowing for cost-effective production and a robust supply chain. Major brands have leveraged these advantages to secure long-term contracts with key clients, ensuring the steady demand for petrochemicals across various industries.

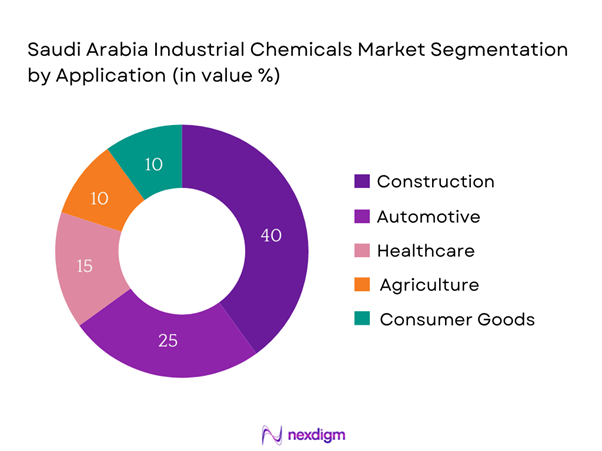

By Application

The market is also segmented by application into construction, automotive, healthcare, agriculture, and consumer goods. The construction sector dominates this market segment due to the ongoing infrastructure development projects within the country, supported by government initiatives aiming to boost local manufacturing and development. The growth of the construction industry drives demand for various industrial chemicals used in producing building materials and coatings, contributing to the overall market’s performance. With significant public spending on housing and infrastructure, the construction sector’s robust growth is expected to continue and play a critical role in the industrial chemicals landscape.

Competitive Landscape

The Saudi Arabia Industrial Chemicals Market is dominated by several major players, including local and international companies. This consolidation highlights the significance of established firms in maintaining market share and influencing industry trends. The competitive landscape is characterized by continuous innovations, mergers, and collaborations aimed at enhancing operational efficiency and addressing environmental challenges.

| Company Name | Establishment Year | Headquarters | Annual Revenue | Market Position | Product Offerings | R&D Investments |

| Saudi Basic Industries Corp (SABIC) | 1976 | Riyadh, Saudi Arabia | – | – | – | – |

| Saudi Kayan Petrochemical | 2008 | Al-Jubail, Saudi Arabia | – | – | – | – |

| Tasnee | 1985 | Riyadh, Saudi Arabia | – | – | – | – |

| Petrofraction | 2010 | Al-Jubail, Saudi Arabia | – | – | – | – |

| Chemanol | 1999 | Jubail, Saudi Arabia | – | – | – | – |

Saudi Arabia Industrial Chemicals Market Analysis

Growth Drivers

Increasing Demand from Diverse Industries

The demand for industrial chemicals in Saudi Arabia is driven by various sectors, including construction, automotive, and agriculture. Construction activities are crucial, with urbanization projects such as NEOM and Qiddiya attracting investments worth USD 500 billion. The automotive industry is also expanding, propelled by the government’s Vision 2030 which targets a production capacity of 300,000 vehicles annually. Additionally, the agriculture sector’s focus on achieving food security has led to the increased use of agrochemicals, further fueling demand for the industrial chemicals market.

Infrastructure Development Projects

Infrastructure development projects in Saudi Arabia, such as the Saudi Landbridge Project and investments in new industrial cities, bolster the industrial chemicals market. The Saudi Landbridge Project, featuring over 1,200 kilometers of new railways, received funding commitments of USD 7 billion, enhancing logistical efficiency for bulk chemicals transportation. These infrastructural advancements support project developments, facilitating the seamless distribution of chemicals for industrial use. As manufacturing conditions improve, Saudi Arabia strengthens its influence within the regional and global market for industrial chemicals.

Market Challenges

Volatility in Raw Material Prices

The industrial chemicals market faces challenges due to fluctuating raw material prices, predominantly influenced by global crude oil markets. For instance, crude oil prices ranged between USD 70 to USD 100 per barrel over the past few years, impacting the pricing stability of petrochemicals. This volatility affects production costs and profit margins, compelling manufacturers to hedge against price fluctuations. Consequently, strategic resource management becomes essential for chemical producers to ensure stable output and competitiveness in the global market, especially given Saudi Arabia’s heavy reliance on oil-based inputs.

Stringent Environmental Regulations

The implementation of stringent environmental regulations poses significant challenges for the industrial chemicals market in Saudi Arabia. The Saudi government has tightened regulations to curb industrial emissions and promote sustainable practices, aiming to reduce carbon emissions by 130 million tons annually. Compliance with these regulations necessitates investments in modern technologies and sustainable production processes, which initially increase operational costs for manufacturers. These regulations, while aligning with global environmental standards, require industries to evolve rapidly, increasing the financial burden on small and medium enterprises in the chemical sector.

Opportunities

Adoption of Green Chemistry

The adoption of green chemistry within the industrial chemicals market offers new growth opportunities. The government’s focus on sustainable energy has catalyzed investments in eco-friendly chemical production processes, with USD 1 billion allocated to renewable energy projects. The transition to green chemistry reduces environmental impact and aligns with Saudi Arabia’s commitment to sustainability. This shift attracts global investors and companies eager to partner in developing environmentally sustainable chemical solutions, enhancing Saudi Arabia’s position as a leader in sustainable industrial practices.

Technological Advancements in Production

Technological advancements in chemical production are creating substantial opportunities within the industry. Innovations such as process automation and digital manufacturing enhance operational efficiency and product quality. The government has invested around USD 1 billion in industrial research and development to promote such advancements. By embracing cutting-edge technologies, chemical producers can optimize production processes, reduce waste, and lower costs, ensuring enhanced competitiveness in regional and international markets. These advancements also enable the sustainable transition the Saudi Kingdom is aiming for, presenting opportunities for increased market share.

Future Outlook

Over the next five years, the Saudi Arabia Industrial Chemicals Market is expected to witness significant growth, driven by continuous advancements in production technologies and the government’s focus on economic diversification. Ongoing infrastructure projects and the push towards sustainable practices will further stimulate demand for various industrial chemicals. As global environmental regulations tighten, companies that focus on green chemistry and innovative product development will likely gain a competitive edge.

Major Players

- Saudi Basic Industries Corp (SABIC)

- Saudi Kayan Petrochemical

- Tasnee

- Petrofraction

- Chemanol

- Al-Jubail Petrochemical Company

- The National Industrialisation Company (NIC)

- Al-Hokair Group

- Qatar Petrochemical Company (QAPCO)

- Gulf Chemicals and Industrial Oils

- Yansab (Yanbu National Petrochemical Company)

- Advanced Petrochemical Company

- Saudi Industrial Investment Group

- SABIC Agri-Nutrients

- Obeikan Investment Group

Key Target Audience

- Government and Regulatory Bodies (e.g., Saudi Ministry of Industry and Mineral Resources)

- Manufacturers and Suppliers in Chemical Industries

- Distributors and Wholesalers of Chemical Products

- Investments and Venture Capitalist Firms

- End-user Industries (Construction, Automotive, Healthcare, etc.)

- Environmental and Sustainability Consultancy Firms

- Trade Associations and Chambers of Commerce

- Industrial Equipment Manufacturers and Suppliers

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing a comprehensive map of stakeholders in the Saudi Arabia Industrial Chemicals Market. The approach is underpinned by extensive desk research and an analysis of secondary and proprietary sources to gather robust industry data. The goal is to define the essential variables that influence market dynamics and to set the foundation for subsequent analyses.

Step 2: Market Analysis and Construction

In this phase, historical data concerning the Saudi Arabia Industrial Chemicals Market is compiled and analyzed. This includes evaluating market penetration rates, analyzing the ratio of suppliers to manufacturers, and assessing revenue generation. Furthermore, quality statistics are assessed to ensure the accuracy and reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through computer-assisted telephone interviews (CATIs) with industry experts drawn from various sectors of the chemicals industry. These consultations provide invaluable insights into operational and financial characteristics, helping to refine and corroborate the gathered market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with several key manufacturers and distributors to obtain detailed information on product segments and sales performance. This interaction serves to verify and enhance the statistics derived from the bottom-up approach, ensuring a comprehensive and accurate analysis of the Saudi Arabia Industrial Chemicals Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand from Diverse Industries

Government Initiatives for Industrial Growth

Infrastructure Development Projects - Market Challenges

Volatility in Raw Material Prices

Stringent Environmental Regulations - Opportunities

Adoption of Green Chemistry

Technological Advancements in Production - Trends

Shift Towards Biochemical Products

Innovations in Sustainable Manufacturing - Government Regulation

Regulatory Framework and Compliance Standards

Environmental Protection Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Petrochemicals

– Ethylene

– Propylene

– Benzene

– Methanol

– Toluene

Specialty Chemicals

– Adhesives and Sealants

– Coatings and Inks

– Water Treatment Chemicals

– Corrosion Inhibitors

– Textile Auxiliaries

Agrochemicals

– Fertilizers

– Pesticides

– Plant Growth Regulators

– Soil Conditioners

Industrial Gases

– Oxygen

– Nitrogen

– Hydrogen

– Carbon Dioxide

– Argon

Polymers

– Polyethylene (PE)

– Polypropylene (PP)

– Polyvinyl Chloride (PVC)

– Polyethylene Terephthalate (PET)

– Engineering Plastics - By Application (In Value %)

Construction

– Cement Additives

– Waterproofing Chemicals

– Sealants and Grouts

– Construction Polymers

Automotive

– Lubricants and Coolants

– Paints and Coatings

– Plastic Components

– Battery Chemicals

Healthcare

– Pharmaceutical Intermediates

– Disinfectants and Sterilants

– Laboratory Reagents

Agriculture

– Crop Protection Agents

– Soil Enhancers

– Irrigation Chemicals

Consumer Goods

– Detergents and Cleaning Agents

– Personal Care Ingredients

– Plastic Packaging - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer to Industrial Buyer

– Strategic Partnerships and Long-Term Contracts

Distributors

– Regional Chemical Distributors

– Third-party Industrial Distributors

Online Platforms

– B2B E-commerce Portals

– Manufacturer-Owned Portals

Retail Outlets

– Industrial Supply Stores

– Chemical Retail Chains - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By End User Industry (In Value %)

Pharmaceutical Industry

– API and excipient manufacturing

– Laboratory and production chemicals

Food & Beverage Industry

– Preservatives and Additives

– Packaging Polymers

– Cleaning and Sanitation Chemicals

Textile Industry

– Dyes and Finishing Agents

– Sizing and Printing Chemicals

– Softening and Washing Agents

Electronics Industry

– Etching and Cleaning Chemicals

– Semiconductor Process Materials

– Encapsulation Resins

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Production Capabilities, Distribution Channels, R&D Investments, Market Reach, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players in Saudi Arabia Industrial Chemicals Market

- Detailed Profiles of Major Companies

SABIC

Aramco

Petrofraction

National Petrochemical Company

Saudi Kayan

Tasnee

Chemanol

Al-Jubail Petrochemical Company

Al-Tamimi Group

Al-Babtain Group

Gulf Chemicals and Industrial Oils

INEOS

National Industrialization Company (NIC)

Qatar Petrochemical Company

l-Hokair Group

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030