Market Overview

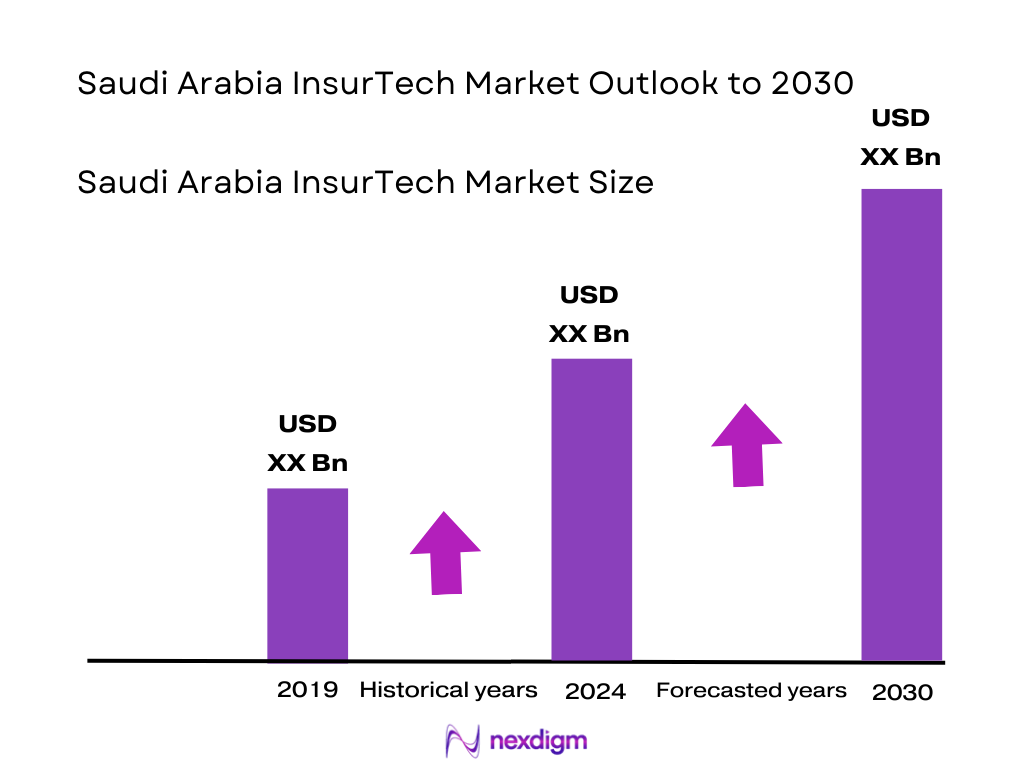

The Saudi Arabia InsurTech market is valued at USD 92.70 million in 2024. This valuation reflects growth driven by regulatory frameworks such as SAMA’s innovation sandbox, greater adoption of usage‑based and telematics‑based insurance products, and rising consumer demand for personalized digital insurance solutions. The technology‑enabled service offerings and data‑driven underwriting are expanding rapidly in the Kingdom.

The dominant cities and regions within Saudi Arabia leading the InsurTech market include Riyadh and Jeddah, largely due to their roles as financial, administrative, and technological hubs. In addition, these cities host headquarters of major insurance and fintech regulators, Insurers, Reinsurers, and large tech‑firms, which accelerates innovation adoption. Also, the import of skilled labour and concentration of digital infrastructure (high broadband, smartphone penetration) is stronger in these urban centres. Regionally, Saudi Arabia leads in the GCC for InsurTech activity because of aggressive Vision 2030 policies, large insurance premium base in life & health sectors, and high government spending on digital transformation.

Market Segmentation

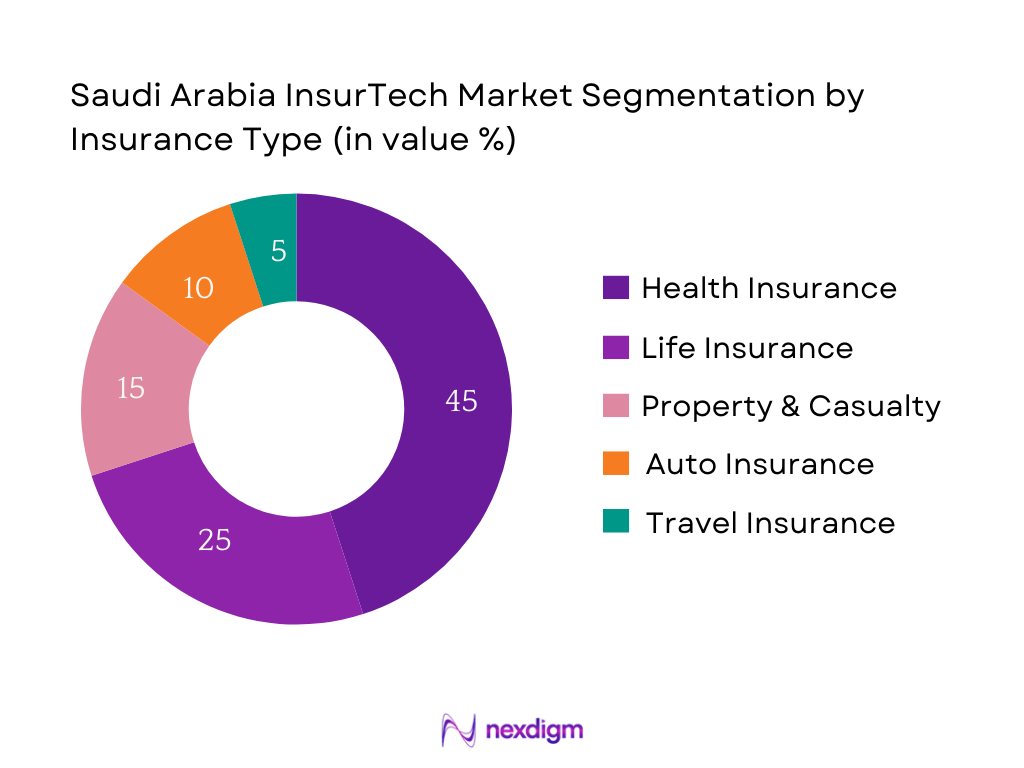

By Insurance Type

In Saudi Arabia InsurTech, Health Insurance holds the dominant market share among insurance types. This is because compulsory and employer‑mandated health coverage has expanded in recent data, pushing premiums to SDR SAR 42 billion in 2024 in health insurance alone. Regulatory pressure for enhanced health‑insurance coverage, growth in telecom/health tech, telemedicine adoption, and digital health platforms all favour health insurance. Auto and P&C are growing, especially with telematics, but health remains ahead due to regulatory mandates, large beneficiary base, and consistent renewal streams.

By Business Model / Service Offering

Among business model types in Saudi Arabia’s InsurTech scene, Aggregators / Digital Brokers are currently leading. These platforms have relatively low barriers to entry, benefit from high consumer awareness, and can more quickly scale compared to fully licensed insurers or MGAs. They leverage partnerships with fintechs, strong online presence, and regulatory frameworks that permit digital brokering and policy comparison. Embedded insurance is growing rapidly (especially via banks, telecoms, e‑commerce), but many embedded models are nascent. Parametric and peer‑to‑peer models are experimental and less mature in regulatory approval. Digital MGAs are emerging but still behind aggregators in terms of customer base and transaction volume.

Competitive Landscape

The Saudi Arabia InsurTech market is marked by a few established incumbents (insurers & Takaful operators) increasingly partnering with or acquiring InsurTech startups, alongside pure InsurTech entities. Competitive pressures are intensifying around technology deployment, regulatory compliance, customer experience, and claims processing speed. Firms that combine strong capital base, regulatory licenses, and tech capabilities are better positioned, leading to a relatively consolidated ecosystem among heads and innovators. Below is a table of 5 major players, with their establishment year, headquarters, and six market‑specific parameters:

| Company | Establishment Year | Headquarters | Business Model Focus | Regulatory / Licensing Status | Key Technology Enablers | Distribution / Channel Strengths | Customer Segment Focus |

| Rasan (Tameeni) | ~2017 | Riyadh, Saudi Arabia | – | – | – | – | – |

| Saudi Takaful / SALAMA | Longstanding insurer | Jeddah / Riyadh | – | – | – | – | – |

| Bupa Arabia | 1997 | Riyadh | – | – | – | – | – |

| Bayzat | ~2013‑2014 | Saudi Arabia (GCC region) | – | – | – | – | – |

| YallaCompare | ~2014 | Dubai (serving GCC) | – | – | – | – | – |

Saudi Arabia InsurTech Market Analysis

Key Growth Drivers

InsurTech Sandbox

Saudi Arabia’s regulatory framework has strengthened through formal innovation sandboxes and stricter oversight by the Saudi Arabian Monetary Authority (SAMA) and related bodies. Non‑oil real GDP rose by 4.5 percent in 2024, with retail, hospitality, and construction contributing heavily. This growth is encouraging insurers and InsurTech firms to develop new financial‑technology models. The availability of a sandbox means that technology trials in underwriting, claims automation, or telematics can safely be piloted with regulatory support, reducing risk for innovators. These conditions are bolstered by overall economic stability, with Saudi’s GDP per capita reported at about USD 30,100 in 2025.

Vision 2030 Reforms

Vision 2030 continues to drive structural change, encouraging both public spending and private sector participation in health, insurance, and digital transformation. In 2023, healthcare and social development took up USD 50.4 billion of the government’s budget, being the second largest outlay after education. This indicates strong state prioritization of health and insurance provisioning. Also, 100 percent of Saudi citizens and 95.9 percent of the total population had basic healthcare coverage in 2024, showing regulatory force and market pull for insurance services. Such reforms push demand for digital platforms, cooperative insurance, and technological improvements in underwriting, claims handling, and customer service.

Key Market Challenges

Legacy Systems

Many incumbent insurance and Takaful companies in Saudi Arabia operate with outdated IT infrastructure and manual or semi‑automated workflows. Even as non‑oil sectors grew by 4.3 percent and non‑oil real GDP grew by 4.5 percent in 2024, the speed of adoption of digital platforms is constrained. Integration with legacy databases, slow policy administraton, and lack of modern data architectures hamper deployment of InsurTech models like real‑time underwriting, usage‑based insurance or telematics. The result is longer development cycles and higher cost of innovation, especially when firms must comply with existing national data protection and regulatory frameworks.

Licensing Delays

Regulatory licensing and compliance processes for insurance, Takaful, or InsurTech operations in Saudi Arabia can take extended time spans. These are influenced by requirements from bodies like SAMA, the Council of Health Insurance (CCHI), and other authorities. Enforcement of mandatory health insurance schemes and expansions (e.g. Cooperative Health Insurance System) have shown that regulatory mechanisms are strong but often slow; for example, the CCHI’s oversight over Cooperative Health Insurance System has required incremental expansions and compliance controls. These delays increase time‑to‑market for InsurTech products, impede investment decisions, and can discourage startups. Given that population is about 35.3 million in 2024 and digital infrastructure penetration is near full (100 percent internet users in 2023), the demand is present but formal licensing lag is a bottleneck.

Opportunities

Microinsurance

With nearly 95.9 percent of the total population having basic healthcare coverage (100 percent among Saudi citizens) in 2024, there remains a minority — particularly among certain expatriate, informal sector, or lower income groups — that are underserved in supplemental insurance, parametric covers, or low‑premium microinsurance products. The high overall digital adoption (internet users as per population reached 100 percent in 2023) means these underserved groups can be reached via mobile or digital platforms. Current regulation mandating heath insurance for expatriates and private sector employees shows institutional support for expanding insurance coverage. Microinsurance providers can leverage this gap, offering low cost, digital‑first products to lower entry barriers.

ESG‑based Insurance

Environmental, Social, and Governance (ESG) considerations are growing globally, and Saudi Arabia is aligning with many sustainability goals under Vision 2030. Although direct numbers for ESG‑insurance adoption are limited, the government’s spending on infrastructure and non‑oil sectors (which grew by 4.6 percent in 2024 in non‑oil real GDP) suggests rising risk exposure to climate, environmental and social issues. Coupled with high digital infrastructure and full internet penetration, there is opportunity for products such as parametric insurance for natural disasters, green building insurance, health insurance linked with wellness / preventive care, and social impact insurance. Regulatory bodies are increasingly attentive to ESG frameworks, opening opportunity for insurers or InsurTechs that embed ESG risk assessments into underwriting and pricing.

Future Outlook

The Saudi Arabia InsurTech market over the upcoming period is expected to see robust growth driven by continued regulatory support, increased consumer demand for digital and personalized insurance solutions, and the maturing of enabling technology. Key themes will include embedded insurance, parametric insurance especially for climate/geo risks, AI‑driven underwriting, and stronger collaboration between traditional insurers and InsurTech startups. There will also be greater investment in risk prevention, data privacy, and cybersecurity as regulatory scrutiny tightens. Key forecasted accelerators include mandatory cover expansions (health, motor), increasing insurance penetration in underserved areas (SME, micro), and rising demand for usage‑based and usage‑driven insurance models (especially in auto). On the other side, challenges such as regulatory delays, talent scarcity, trust and cultural acceptance, claims fraud and data issues may temper growth. By end‑of‑period, the market share of embedded and parametric models is expected to noticeably increase, reshaping the competitive landscape.

Major Players in the Market

- Rasan (Tameeni)

- Saudi Takaful / SALAMA

- Bupa Arabia

- Bayzat

- YallaCompare

- AXA Saudi Arabia

- Allianz Saudi Fransi

- MedGulf Insurance

- SALAMA Cooperative Insurance Company

- Aqeed

- Zavi Technologies

- Takaful Emirates

- Daman Insurance (Saudi operations)

- Digital MGAs entering Saudi Arabia (e.g. global MGA entrants)

- Regional aggregator platforms focussed on GCC cross‑border offers

Key Target Audience

- Investments and Venture Capitalist Firms (e.g. Gulf Capital, STV, Raed Ventures, BECO Capital)

- Government and Regulatory Bodies (Saudi Arabian Monetary Authority – SAMA; Saudi Central Bank; Insurance Authority of Saudi Arabia)

- Traditional Insurers and Takaful Companies seeking digital transformation

- Large Health Service Providers / Hospital Networks evaluating partnerships or InsurTech tie‑ups

- Telecommunication Companies / Tech Vendors interested in embedded insurance opportunities

- Banking Groups with interest in bancassurance or fintech insurance platforms

- Corporate Employers with large employee benefit programmes

- Reinsurers and Risk‑Carrying Entities assessing exposure and tech‑enabled risk pricing

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia InsurTech market. This includes InsurTech startups, incumbent insurers (including Takaful), regulators, reinsurers, distribution intermediaries, and technology vendors. Secondary sources and regulatory filings are used to gather data on these stakeholders.

Step 2: Market Analysis and Construction

In this phase we compile and analyze historical data for InsurTech revenue streams, number of digital insurance platforms, premium contributions by insurance type (health, life, etc.), and technology adoption levels. We supplement with macroeconomic variables (GDP growth, digital infrastructure, insurance penetration) to validate growth trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about growth drivers (embedded insurance, usage‑based models, regulatory changes) are created and then validated via structured interviews (in‑person or CATI) with senior executives in insurers, InsurTech founders, regulators. Insights include financial projections, regulatory risk, product adoption.

Step 4: Research Synthesis and Final Output

The final phase involves integrating the bottom‑up data (company‑level, product level) with top‑down macro forecasts, reviewing segmentation performance, and projecting forward to 2030. The output includes detailed tables, competitive mapping, forecast scenarios, and strategic recommendations, all checked for consistency and triangulated via multiple sources.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Regulatory Terminology, Market Sizing Framework, Consolidated Research Approach, Primary and Secondary Research Methods, Limitations and Considerations)

- Market Definition and Scope

- Evolution Timeline and Milestones

- Policy and Regulatory Landscape (SAMA, Insurance Authority, PDPL)

- InsurTech Ecosystem Overview (Startups, MGAs, Reinsurers, Aggregators)

- Value Chain and Integration Landscape

- Key Growth Drivers (InsurTech Sandbox, Vision 2030 Reforms, Smartphone Penetration)

- Key Market Challenges (Legacy Systems, Licensing Delays, Low Digital Trust)

- Opportunities (Microinsurance, ESG-based Insurance, B2B2C Models)

- Trends (Telematics Adoption, Blockchain Claims, Wellness-Based Products)

- Government Regulations (SAMA Guidelines, Data Sovereignty under PDPL, InsurTech Licensing Rules)

- SWOT Analysis

- Stake Ecosystem (Insurers, RegTechs, Brokers, Compliance Tech Players)

- Porter’s Five Forces

- By Total Addressable Value, 2019-2024

- By Number of Active InsurTech Platforms, 2019-2024

- By Premium Contribution of Digital Insurance Models, 2019-2024

- By Technology Penetration in Traditional Insurance Firms, 2019-2024

- By Insurance Line (In Value %)

Motor

Health

Property

Travel

Takaful - By Business Model (In Value %)

Aggregators

Digital MGAs

Embedded Insurance Providers

Peer-to-Peer Models

Parametric Insurance - By Technology Enabler (In Value %)

AI & Predictive Analytics

IoT & Telematics

Blockchain & Smart Contracts

Cloud-based Core Insurance Systems

Chatbots & Virtual Agents - By Distribution Channel (In Value %)

Mobile Applications

Web Portals

Bancassurance APIs

FinTech and E-Commerce Partnerships

Offline-to-Online Hybrids - By Customer Segment (In Value %)

Individual Retail Customers

SMEs

Large Corporates

Public Sector Entities

Underbanked & Microinsurance Clients

- Market Share by Value and Volume

Market Share by Insurance Type and Tech Application - Cross Comparison Parameters (Company Overview, Operating Model, Revenue Generation Model, Regulatory Compliance, Technology Stack, Regional Presence, Funding Details, Strategic Partnerships)

- Pricing Analysis across Models (B2B, B2C, B2B2C)

- SWOT Analysis of Leading Players

- Profiles of Key Players

Rasan (Tameeni)

TAWUNIYA

Salama Cooperative

Bupa Arabia

MedGulf

AXA Cooperative

Allianz Saudi Fransi

Aqeed

Bayzat

YallaCompare

ERGO

Infratech Co.

Zavi Technologies

Takaful Emirates

Daman Insurance (KSA)

- Adoption Lifecycle and Usage Frequency

- Premium Size by Segment and Channel

- Feedback Loop and Complaint Redressal Tech

- Perceived Value and Decision Drivers

- By Total Addressable Value, 2025-2030

- By Number of Active InsurTech Platforms, 2025-2030

- By Premium Contribution of Digital Insurance Models, 2025-2030

- By Technology Penetration in Traditional Insurance Firms, 2025-2030