Market Overview

As of 2024, the Saudi Arabia logistics market is valued at USD ~ billion, with a growing CAGR of 6.4% from 2024 to 2030, driven by government-led infrastructure initiatives and an uptick in international trade. The growth is driven by investments in logistics infrastructure, enhancing efficiency and service quality across the supply chain. Rising e-commerce activities and the diversification of economic sectors contribute significantly to market growth.

The dominant cities in the Saudi logistics market include Riyadh, Jeddah, and Dammam, which serve as the primary logistics hubs in the region. Riyadh is strategically positioned as the capital city and a significant business centre, while Jeddah, with its expansive port, is crucial for maritime logistics. Dammam is vital due to its proximity to oil and manufacturing industries, contributing to a diverse logistical ecosystem that supports both local and regional distribution.

Market Segmentation

By Mode of Transport

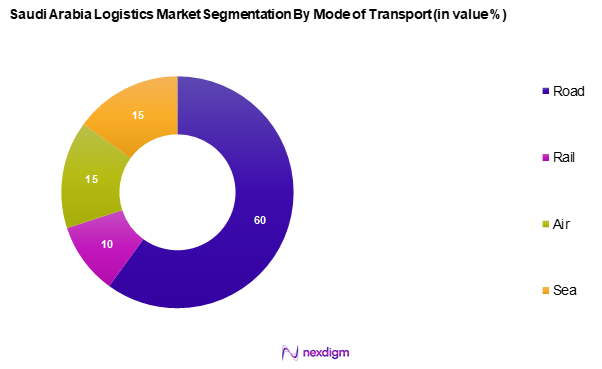

The Saudi Arabia logistics market is segmented into road, rail, air, and sea. Road transport dominates with a substantial market share of 60% in 2024, attributed to its extensive road network and ease of access to urban and rural areas. The flexibility, door-to-door service availability, and faster delivery times provided by road transport make it the preferred choice for many businesses. The growing e-commerce sector further emphasizes road logistics as critical for rapid last-mile delivery solutions.

By Service Type

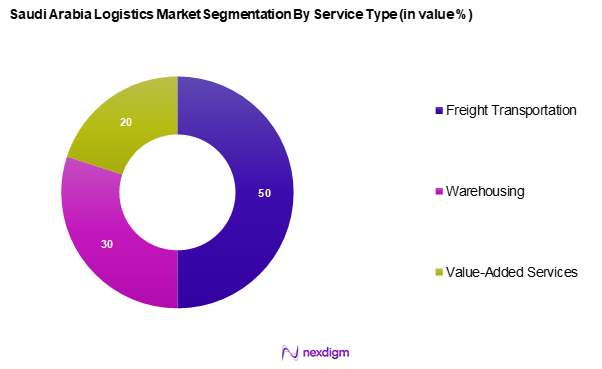

The Saudi Arabia logistics market is segmented into freight transportation, warehousing, and value-added services. Freight transportation holds the dominant share at 50%, driven by the surging demand for efficient freight solutions as the economy diversifies. The complexity and volume of goods transported make freight transportation essential, with companies investing heavily in logistics services for better supply chain management. Additionally, increased trade activity in various sectors supports this segment’s growth.

Competitive Landscape

The Saudi Arabia logistics market is characterized by a competitive landscape dominated by several key players, including both local companies and multinational corporations. The consolidation of major players reflects their significant control over market dynamics. Key names include Agility Logistics, Aramex, and DHL Supply Chain, among others.

| Company Name | Establishment Year | Headquarters | Market Share | Service Offering | Revenue (USD billion) | Technology Adoption |

| Agility Logistics | 1979 | Safat, Kuwait | – | – | – | – |

| Aramex | 1982 | Amman, Jordan | – | – | – | – |

| DHL Supply Chain | 1969 | Bonn, Germany | – | – | – | – |

| SHARAF GROUP | 1968 | Dubai, UAE | – | – | – | – |

| GAC | 1956 | Jeddah, Saudi Arabia | – | – | – | – |

Saudi Arabia Logistics Market Analysis

Growth Drivers

Government Initiatives

The Saudi Arabian government has made substantial investments in infrastructure development, focusing on enhancing the logistics sector as part of its Vision 2030 initiative, which aims to diversify the economy away from oil dependence. In 2022, infrastructure spending reached approximately USD 47 billion, with significant allocations for transport and logistics projects, including the development of new ports and transport infrastructure improvements. These investments not only create efficient logistical networks but also increase the country’s appeal as a logistics hub connecting East and West. The ongoing upgrades to the road and rail networks are expected to boost the logistics industry’s capacity and efficiency.

Increase in International Trade

International trade is a critical driver of growth for the logistics market in Saudi Arabia, bolstered by the country’s strategic location. In 2022, Saudi Arabia’s total merchandise exports amounted to USD 278 billion, fostering increased logistics demand for efficient transportation of goods. Moreover, as global trade volumes are projected to extend beyond USD 30 trillion by 2025, Saudi Arabian logistics providers are set to benefit significantly. The government is enhancing trade agreements with Asia, Europe, and Africa, aiming to remove barriers and streamline customs processes, further propelling logistics growth.

Market Challenges

Infrastructure Limitations

Despite ongoing investments, infrastructure limitations continue to pose challenges to the logistics sector in Saudi Arabia. As of 2023, logistics performance index scores indicate that Saudi Arabia ranks 51 out of 160 countries. Concerns specifically revolve around the quality of transport infrastructure, which hampers effective freight transport. Improved road and port facilities are essential to meet growing demands, as significant congestion and aging infrastructure can lead to increased transit times and operational inefficiencies, negatively impacting service delivery in the logistics market.

Regulatory Hurdles

The logistics industry in Saudi Arabia faces regulatory hurdles that challenge its efficiency and operational capabilities. In 2022, customs clearance times were an average of 7 days, significantly longer than the 3-days average benchmark set by other leading economies. Bureaucratic challenges, administrative bottlenecks, and evolving regulations can create delays for logistics companies. As the government continues to implement reforms aimed at improving the business environment, addressing these regulatory issues will be crucial for the sector’s sustainable growth.

Opportunities

Smart Logistics Technology

The adoption of smart logistics technology presents a significant opportunity in the Saudi Arabian logistics market. As technology adoption increases, the use of IoT and AI is expected to enhance operational performance in logistics management. As of 2023, approximately 40% of logistics companies in Saudi Arabia reported the use of advanced technology platforms for tracking and monitoring shipments. These technologies streamline processes, improve transparency, and reduce costs, allowing logistics providers to respond quickly to market changes and consumer demands, thus positioning the market for considerable growth in the coming years.

Green Supply Chain Initiatives

As sustainability becomes a focal point for businesses globally, there are growing opportunities for green supply chain initiatives in Saudi Arabia. Recent government studies show a 30% increase in companies adopting sustainable practices. Transportation accounts for a significant portion of greenhouse gas emissions, and the logistics sector is responding through investments in eco-friendly vehicles and energy-efficient technologies. This shift not only helps companies comply with environmental regulations but also appeals to sustainability-conscious consumers and businesses, thus driving future growth in the logistics market.

Future Outlook

Over the next few years, the Saudi Arabia logistics market is expected to witness robust growth driven by continuous government investment in infrastructure and technology, alongside an increase in trade and e-commerce activities. The anticipated advancements in logistics technology, including automation and smart logistics solutions, will significantly shape the market’s landscape.

Major Players in the Market

- Agility Logistics

- Aramex

- DHL Supply Chain

- SHARAF GROUP

- GAC Group

- GCC Supply Chain

- Kuehne + Nagel

- Al-Futtaim Logistics

- DB Schenker

- CEVA Logistics

- RAK Logistics

- Bolloré Logistics

- XPO Logistics

- FedEx Logistics

- UPS Supply Chain Solutions

Key Target Audience

- Investors and venture capitalist firms

- Government and regulatory bodies (e.g., Ministry of Transport, Saudi Arabian General Investment Authority)

- Logistics service providers

- E-commerce businesses

- Manufacturing companies

- Retail chains

- Construction firms

- Automotive industry stakeholders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves developing a comprehensive ecosystem map of all major stakeholders within the Saudi Arabia logistics market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather critical industry-level information. The main goal is to identify and define key variables that influence the market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data concerning the Saudi Arabia logistics market is compiled and analyzed. This includes evaluating market penetration, the relationship between different transport service providers, and overall revenue generation. Additionally, service quality metrics are assessed to ensure the reliability and accuracy of revenue estimates, giving a clearer picture of market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be generated and later validated through systematic interviews with industry experts. This process may involve computer-assisted telephone interviews (CATIs) with representatives from a diverse range of companies operating within the logistics sector. These interactions will provide essential operational and financial insights, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final step includes engaging with various logistics companies to gather detailed insights into their product segments, sales performance, customer preferences, and other significant factors. This direct engagement helps to verify and enhance the statistics obtained from the bottom-up approach, ensuring a comprehensive and validated analysis of the Saudi Arabia logistics market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Initiatives

Increase in International Trade - Market Challenges

Infrastructure Limitations

Regulatory Hurdles - Opportunities

Smart Logistics Technology

Green Supply Chain Initiatives - Trends

Rise of E-commerce Logistics

Adoption of Autonomous Vehicles - Government Regulation

Transportation Policies

Customs Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport, (In Value %)

Road

Rail

Air

Sea - By Service Type, (In Value %)

Freight Transportation

Warehousing

Value-Added Services - By End-User Vertical, (In Value %)

Manufacturing

Consumer Goods

Retail

Food and Beverages

IT Hardware

Chemicals

Construction

Automotive

Telecom

Others - By Type of Transport Services, (In Value %)

Third-Party Logistics (3PL)

Fourth-Party Logistics (4PL) - By Region, (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Mode of Transport Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue Analysis, Service Offerings, Technology Adoption)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Agility Logistics

Aramex

DHL Supply Chain

SHARAF GROUP

GAC Group

GCC Supply Chain

Kuehne + Nagel

Al-Futtaim Logistics

DB Schenker

CEVA Logistics

RAK Logistics

Bolloré Logistics

XPO Logistics

FedEx Logistics

UPS Supply Chain Solutions

- Market Demand and Utilization Patterns

- Purchasing Power Analysis

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Mode of Transport, 2025-2030