Market Overview

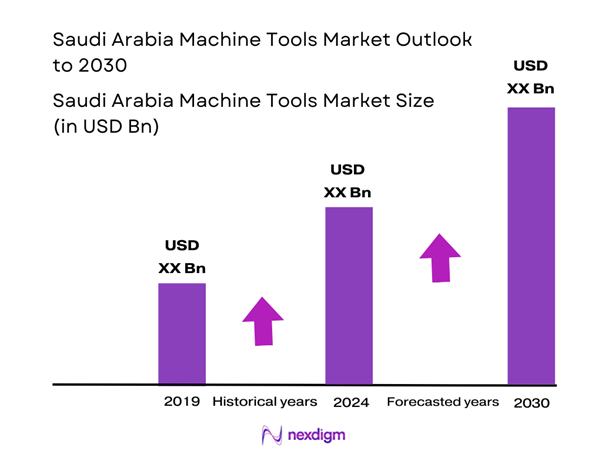

The Saudi Arabia Machine Tools market is valued at approximately USD 3050.1 million in 2024 with an approximated compound annual growth rate (CAGR) of 3.7% from 2024-2030, reflecting robust growth driven by the significant increase in industrial activities and strategic government initiatives aimed at increasing local manufacturing capabilities. The demand for precision engineering and efficient production tools has soared, supported by investments in diversifying the economy away from oil dependence. The overall growth in engineering and manufacturing sectors contributes to the increasing adoption of advanced machining technologies.

Major cities such as Riyadh, Jeddah, and Dammam dominate the Saudi Arabia machine tools market. These cities serve as industrial hubs housing numerous manufacturing plants, logistical facilities, and supportive infrastructure. The emphasis on modernization and automation in manufacturing across these cities amplifies their significance in the market, alongside strong government backing for industrial development and foreign investments aimed at enhancing technological capabilities in local industries.

Government initiatives play a pivotal role in stimulating the machine tools market in Saudi Arabia. The introduction of various development programs, such as the National Industrial Development and Logistics Program, is expected to create over 1.6 million jobs and contribute significantly to the economy. The government has also allocated SAR 57 billion to improve infrastructure, including logistics and manufacturing environments.

Market Segmentation

By Product Type

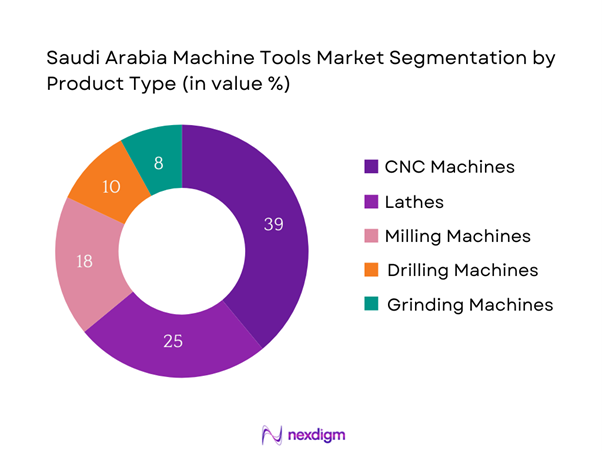

The Saudi Arabia Machine Tools market is segmented by product type into CNC Machines, Lathes, Milling Machines, Drilling Machines, and Grinding Machines. Among these, CNC Machines capture the largest market share, primarily driven by their superior accuracy, flexibility, and the growing demand for automation in various industries. The shift towards digital manufacturing solutions necessitates the adoption of CNC technology, leading to increased productivity and efficiency in manufacturing processes. As industries seek to optimize production and reduce operational costs, the uptake of CNC machines continues to rise alongside the trend toward smart manufacturing, contributing to its dominant market position.

By Application

The market segmentation by application includes Automotive, Aerospace, Electronics, Metal Fabrication, and Construction. The Automotive sector holds a significant market share, attributed to the rapid growth of automotive manufacturing in Saudi Arabia. This expansion is primarily due to the government’s initiatives to bolster local production and reduce imports. Major investments in automotive manufacturing facilities and an increasing number of domestic and international automotive manufacturers entering the market further enhance the demand for machine tools tailored for this sector. The emphasis on high-quality standards and technological advancements in automotive manufacturing makes it a leading application within the machine tools market.

Competitive Landscape

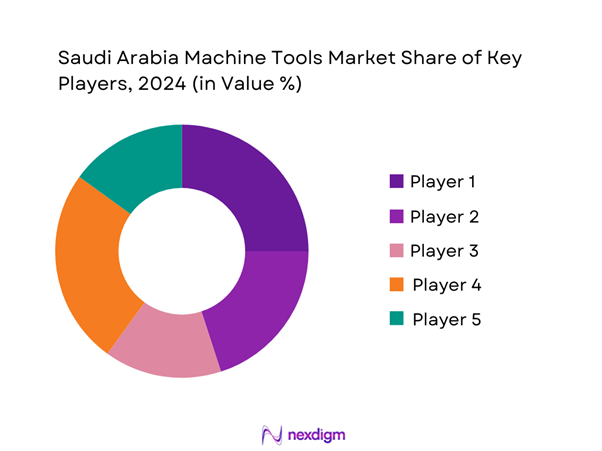

The Saudi Arabia Machine Tools market is dominated by key players that include both local entities and international brands. Companies like Al-Khodari & Sons, Saudi Machinery Company, and Takamul Investment lead the market, while global brands such as Siemens AG and Mitsubishi Electric also hold significant positions. This competitive landscape showcases a blend of strong local expertise combined with advanced technologies from established global manufacturers, reflecting a consolidated market that is conducive to sustained growth.

| Company | Establishment Year | Headquarters | Market Share | Product Types | Key Applications | Revenue (2024) |

| Al-Khodari & Sons | 1977 | Riyadh | – | – | – | – |

| Saudi Machinery Company | 1982 | Jeddah | – | – | – | – |

| Takamul Investment | 2003 | Dammam | – | – | – | – |

| Siemens AG | 1847 | Munich, Germany | – | – | – | – |

| Mitsubishi Electric | 1921 | Tokyo, Japan | – | – | – | – |

Saudi Arabia Machine Tools Market Analysis

Growth Drivers

Technological Advancements

Technological advancements are significantly shaping the machine tools landscape in Saudi Arabia. The country has witnessed investments exceeding USD 20 billion into research and development related to manufacturing technologies through various national initiatives. Furthermore, the introduction of 3D printing and CNC technologies is transforming production capabilities across industries. The Saudi government has emphasized the need for innovation in its Vision 2030 strategy, with a projected allocation of SAR 1.4 billion for technological development in manufacturing. This push furthers the modernization of tools and processes, positioning Saudi Arabia at the forefront of manufacturing excellence.

Rising Industrialization

The rise of industrialization in Saudi Arabia is a critical growth driver for the machine tools market. The Kingdom’s industrial output reached approximately USD 45 billion in 2022, primarily fueled by sectors such as automotive, aerospace, and construction. With an annual industrial growth rate of over 4%, the manufacturing sector is witnessing a robust transformation, spurred by a diversification strategy aimed at reducing oil dependency. Additionally, the government’s aim to increase the contribution of the manufacturing sector to the GDP to 20% by 2030 means a significant demand for advanced machine tools is on the horizon.

Market Challenges

High Initial Investment Costs

High initial investment costs present a notable challenge for the machine tools market in Saudi Arabia. The acquisition of advanced machinery can cost upwards of USD 500,000, which often hinders small and medium enterprises (SMEs) from upgrading or expanding their manufacturing capabilities. Additionally, maintenance and skilled labor training add further financial burdens to businesses in this sector. According to the Saudi Ministry of Industry and Mineral Resources, over 65% of SMEs cite financial constraints as a primary barrier to adopting new technologies, limiting their ability to compete effectively within the industry.

Skilled Labor Shortage

A shortage of skilled labor directly impacts the efficiency and competitiveness of the machine tools market in Saudi Arabia. As of 2022, the unemployment rate among Saudi youth aged 15-24 stood at 26.6%, with many lacking the technical competencies needed in manufacturing sectors. The National Skills Development Program is attempting to bridge this gap by providing educational initiatives aimed at equipping the workforce with practical skills. However, the current gap still leaves a significant portion of the market in need of skilled labor, resulting in potential project delays and increased operational costs for manufacturers.

Opportunities

Adoption of Automation

The current market environment presents a significant opportunity for the adoption of automation within the machine tools sector in Saudi Arabia. With the Fourth Industrial Revolution taking root, many local industries are investing in smart technologies to stay competitive. Reports indicate that approximately 60% of manufacturers are exploring or have begun implementing automation processes in their operations. The anticipated reduction of labor costs by nearly 30% and improvements in production efficiency signal a thriving opportunity for machine tool manufacturers to cater to this evolving demand. As industries look to enhance productivity, the role of automation in the machine tools market is poised to expand.

Expansion of Renewable Energy Sector

The expansion of the renewable energy sector in Saudi Arabia creates fertile ground for growth opportunities in the machine tools market. As the government aims to generate 58.7 GW of renewable energy by 2030, specifically from solar and wind, there is an increasing need for advanced machine tools to manufacture components for this sector. Presently, investments in renewable energy projects have surpassed USD 30 billion, signaling a robust market trajectory. With the growing focus on sustainable energy solutions, machine tool manufacturers that adapt their offerings to support renewable energy applications will likely capture significant market share in the upcoming years.

Future Outlook

Over the next five years, the Saudi Arabia Machine Tools market is expected to expand significantly, driven by the ongoing industrial diversification efforts and increasing demand for advanced manufacturing solutions. Enhanced government initiatives aimed at fostering local production capacities and the growing trend of automation across various sectors will further propel market growth. The continuous investment in infrastructure and technological advancements will position Saudi Arabia as a key player in the regional machinery and equipment landscape.

Major Players

- Al-Khodari & Sons

- Saudi Machinery Company

- Takamul Investment

- Siemens AG

- Mitsubishi Electric

- Alruqee Machine Tools

- Yamama Cement

- Schneider Electric

- Gulf Industry Fair

- Alesayi Group

- Dynapac

- Bosch Rex

- GE Aviation

- Honeywell International

- KUKA Robotics

Key Target Audience

- Manufacturers in Automotive Sector

- Aerospace Companies

- Electronics Producers

- Metal Fabricators

- Construction Firms

- Government and Regulatory Bodies (Ministry of Industry and Mineral Resources, Saudi Standards, Metrology and Quality Organization)

- Investments and Venture Capitalist Firms

- Industrial Equipment Distributors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia Machine Tools market. Comprehensive desk research is undertaken to utilize a combination of secondary and proprietary databases to gather industry-level information. The primary objective is to identify and define the critical variables related to market dynamics, including demand drivers, regulatory factors, and competitive landscape insights.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Saudi Arabia Machine Tools market is compiled and analyzed. This includes assessing the performance metrics of various sub-components, identifying key growth areas by evaluating the ratio of product types and application sectors, as well as revenue generation. The evaluation of sector-specific growth and market penetration ensures a thorough understanding of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). These interviews provide critical operational and financial insights from a diverse array of companies, including manufacturers, distributors, and technology providers. This interaction is instrumental in refining market data and corroborating the statistical findings.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple stakeholders, including major machine tool manufacturers, to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This comprehensive verification process complements the statistics derived from the bottom-up approach, ensuring a complete, accurate, and validated analysis of the Saudi Arabia Machine Tools market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Driver

Technological Advancements

Rising Industrialization

Government Initiatives - Market Challenges

High Initial Investment Costs

Skilled Labor Shortage - Opportunities

Adoption of Automation

Expansion of Renewable Energy Sector - Trends

Shift Towards Smart Manufacturing

Sustainable Production Practices - Government Regulation

Import Tariffs and Compliance Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

CNC Machines

– CNC Lathes

– CNC Milling Machines

– CNC Drilling Machines

– CNC Grinding Machines

Lathes

– Manual Lathes

– Semi-Automatic Lathes

Milling Machines

– Vertical Milling Machines

– Horizontal Milling Machines

– Universal Milling Machines

Drilling Machines

– Bench Drilling Machines

– Radial Drilling Machines

– Multi-Spindle Drilling Machines

Grinding Machines

– Surface Grinding Machines

– Cylindrical Grinding Machines

– Tool and Cutter Grinding Machines - By Application (In Value %)

Automotive

– Engine Component Machining

– Gear and Transmission Part Production

Aerospace

– Precision Part Manufacturing

– Aircraft Structure Fabrication

Construction

– Fabrication of Structural Steel Elements

– Equipment Component Machining

Electronics

– PCB and Casing Manufacturing

– Connector and Microcomponent Machining

Metal Fabrication

– Welding and Cutting Tools

– Sheet Metal Processing - By Distribution Channel (In Value %)

Direct Sales

– OEM to Enterprise Sales

– Government and Institutional Procurement

Online Sales

– Manufacturer Websites

– B2B Platforms (e.g., Alibaba, Made-in-China)

Distributors and Dealers

– Local Authorized Equipment Dealers

– Industrial Supply Distributors - By End-User Industry (In Value %)

Large Enterprises

– Heavy Engineering Companies

– Automotive Manufacturing Plants

SMBs (Small and Medium Businesses)

– Contract Machining Shops

– Tool & Die Manufacturers

– Maintenance & Repair Workshops - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Machine Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Machine Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Profit Margins by Product Line, Production Plants and Geographic Spread, Production Capacity, Unique Value Offerings, Technology Adoption Level, Key Client Segments / Industries Served, R&D Spending and Innovation Pipeline)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Players

Al-Khodari & Sons

Saudi Machinery Company

Alruqee Machine Tools

Takamul Investment

Al-Ma’aden

Yamama Cement

Al-Falak

Gulf Industry Fair

Alesayi Group

Schneider Electric

Siemens AG

Panasonic Corporation

Bosch Rexroth

Dynap

Mitsubishi Electric

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030