Market Overview

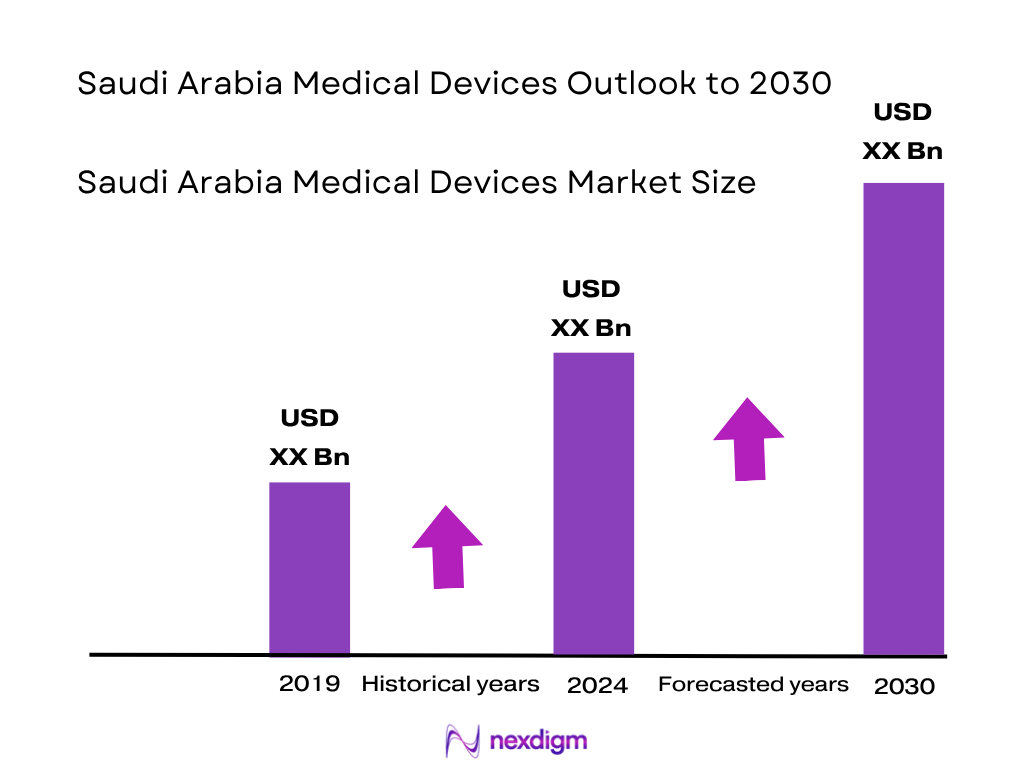

The Saudi Arabia medical devices market is valued at USD 2.11 billion in 2023, rising to USD 2.34 billion in 2024, based on five‑year historical data and validated secondary sources. It is driven by the increasing burden of chronic illnesses such as diabetes, cardiovascular disease and cancer, compounded by government investment under Vision 2030 in advanced healthcare infrastructure and local manufacturing partnerships.

Riyadh, Jeddah and the NEOM/Red Sea region dominate the medical‑devices market due to their concentration of tertiary care hospitals, smart‑hospital pilots and AI‑enabled health initiatives. Riyadh hosts major innovation centres linked to King Saud Medical City, Jeddah leads smart imaging deployments, and NEOM is designed around futuristic healthcare ecosystems integrating autonomous devices.

Based on Nexdigm’s report, the market grows from USD 2.34 billion in 2024 at a CAGR of 6.01% (2024–2032), suggesting a projected value of approximately USD 3.15 billion by 2030.

Market Segmentation

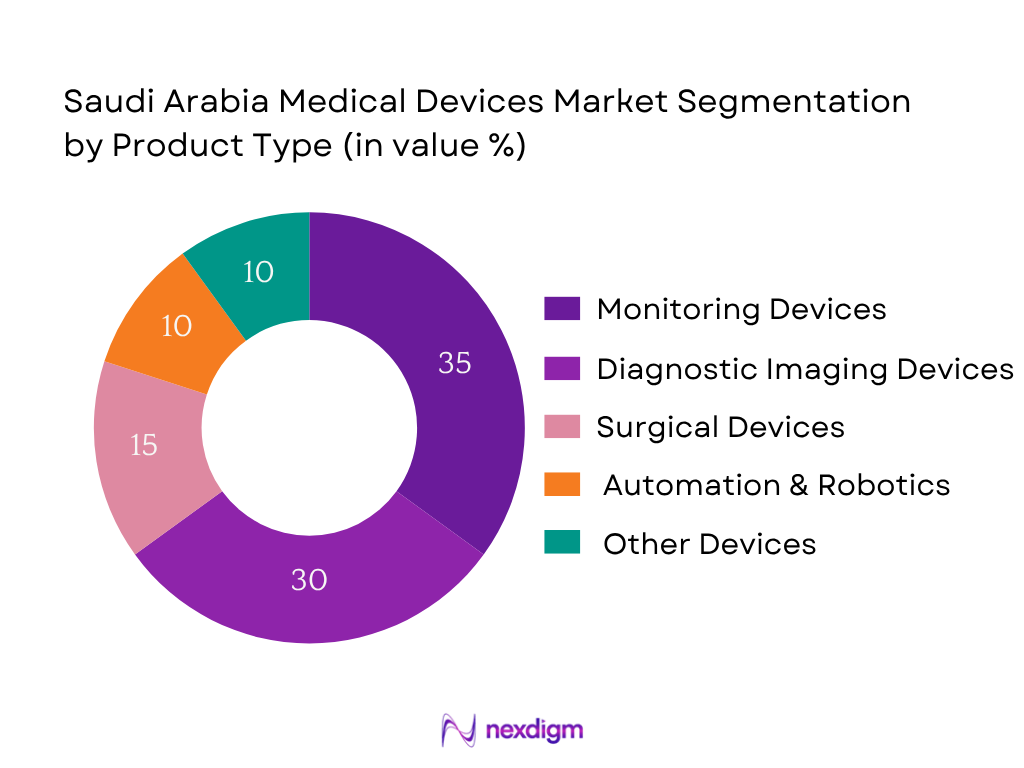

By Product Type

The monitoring devices segment dominates with ~35% share in 2024. This dominance stems from high demand for real‑time physiology tracking, driven by prevalence of chronic diseases and the government’s focus on remote and ICU monitoring. Hospitals prefer continuous‑use monitoring systems over disposable low‑risk devices, bolstering revenue share.

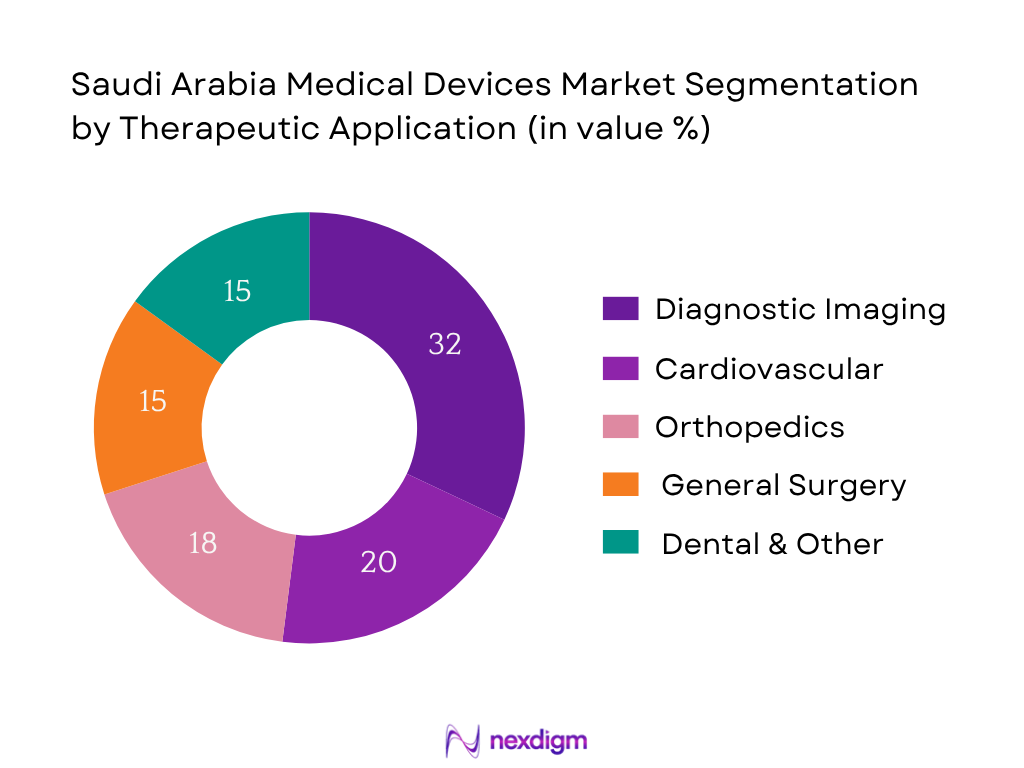

By Therapeutic Application

The diagnostic imaging segment holds highest share (~32%) in 2024. Chronic disease detection and cancer screening drive imaging equipment investments across public and private hospitals. The need for CT, MRI, X‑ray and ultrasound systems for both communicable and non‑communicable disease diagnostics underpins dominance.

Competitive Landscape

The Saudi medical devices market is concentrated among global multinationals and a few domestic players with strong SFDA approvals and local supply partnerships. The market is led by major international firms such as GE HealthCare, Philips Healthcare, Siemens Healthineers, Medtronic and Johnson & Johnson. Their dominance reflects in-depth regulatory expertise, broad device portfolios, long‑standing procurement contracts (especially with NUPCO) and established distribution networks in Riyadh and Jeddah.

| Company | Establishment Year | Headquarters | SFDA Licensing & CE/FDA Approvals | Product Focus (Monitoring / Imaging / Surgical) | Local Manufacturing or Assembly | Tender Contracts with NUPCO/MOH | AI / IoMT Integration Capability | Distribution Network Reach |

| GE HealthCare | 1892 | USA | – | – | – | – | – | – |

| Siemens Healthineers | 1847 | Germany | – | – | – | – | – | – |

| Philips Healthcare | 1891 | Netherlands | – | – | – | – | – | – |

| Medtronic | 1949 | Ireland/USA | – | – | – | – | – | – |

| Johnson & Johnson | 1886 | USA | – | – | – | – | – | – |

Saudi Arabia Medical Devices Market Analysis

Growth Drivers

Expansion of Public Healthcare Infrastructure (Vision 2030 Investments)

Public healthcare spending reached SAR 214 billion (USD 57.1 billion) in the government’s 2024 budget, accounting for approximately 17% of total government expenditure. This substantial allocation reflects ongoing commitment to Vision 2030’s Health Sector Transformation Program, which targets privatization and modernization across hospitals, digital infrastructure, and telemedicine. Concurrently, investments of USD 1.5 billion were earmarked for health IT and telehealth in 2024, bolstering adoption of connected medical devices across public healthcare networks. Together, these macro‑level infrastructure investments elevate demand for medical devices in public hospitals and digital health-enabled institutions.

Rising Non‑Communicable Disease Burden

Non‑communicable diseases are responsible for approximately 22,000 deaths annually, representing 35% of total mortality in Saudi Arabia. The direct healthcare spending on major NCDs (cardiovascular, diabetes, cancer, respiratory diseases) reached SAR 66 billion (USD 18 billion) in recent years, with total economic losses estimated at USD 24.4 billion. These figures underscore acute and chronic care demand across diagnostic imaging, monitoring, and treatment devices. With high NCD incidence requiring medical device-enabled diagnostics and continuous management, demand for devices like imaging systems and patient monitors remains elevated.

Market Challenges

Stringent SFDA Approval Timelines and Regulations

The SFDA’s medical device classification and approval process require multiple stages of regulatory compliance, audits, and documentation. Alignment to CE/FDA equivalence is mandatory for high-risk categories. This extended timeline delays market entry and inventory availability. Regulators also mandate local technical file translations and on-ground testing, increasing administrative burden. These stringent requirements can delay device launch by months and impede responsiveness to urgent public healthcare procurement cycles, especially under Vision 2030 infrastructure timelines.

High Import Dependency and Customs Delays

Saudi Arabia continues to import the majority of advanced medical devices from international suppliers, subjecting shipments to customs clearance and logistical bottlenecks. Import delays—often exceeding 4–6 weeks for critical-care imaging or surgical systems—result from customs audits and SFDA registry inspections. This raises lead time for hospital deployments and adds costs tied to warehousing and demurrage. Such delays undermine responsiveness to acute demand spikes in public hospital expansions and smart facility rollouts.

Opportunities

Public‑Private Partnerships in Diagnostic Expansion

The Saudi government plans to privatize 295 hospitals by 2030, promoting public-private investment in diagnostic infrastructure. Currently, government spends approximately SAR 214 billion (USD 57.1 billion) on healthcare, offering scale opportunities for private diagnostic providers. Public-private partnerships (PPPs) are increasingly leveraged to develop imaging centres and surgical units within both existing and new facilities. Such joint ventures encourage investments in diagnostic devices, radiology suites and advanced surgical platforms aligned to PPP contracts.

Future Outlook

Over the next six years the Saudi Arabia medical devices market is expected to show robust growth, supported by transformative healthcare policies, Vision 2030‑driven infrastructure spending, and continued digital transformation. Adoption of telemedicine, remote monitoring and AI‑enhanced diagnostics will accelerate. Localization policies and private sector collaborations will further expand market size and offer white‑space opportunities for innovative device manufacturers.

Key Players

- GE HealthCare

- Siemens Healthineers

- Philips Healthcare

- Medtronic

- Johnson & Johnson

- Boston Scientific

- Abbott Laboratories

- Becton Dickinson

- Fresenius Medical Care

- Mindray (Saudi operations)

- Zimmer Biomet

- Drägerwerk AG & Co. KGaA

- Smith+Nephew

- Olympus Corporation

Key Target Audience

- Public sector procurement agencies (NUPCO, Ministry of Health)

- Private hospital chains (e.g., Dr. Sulaiman Al Habib Medical Group)

- Distributor and logistics firms investing in medtech infrastructure

- Medical device manufacturers planning KSA market entry

- Local medical equipment assembly or OEM partners

- Investment and venture capitalist firms (funding MedTech startups in Saudi)

- Government and regulatory bodies (SFDA, Ministry of Health Digital Health Programme)

- Specialized hospital planning developers targeting smart‑hospital roll‑outs

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping key stakeholders within the Saudi medical devices ecosystem—hospital chains, distributors, manufacturers, regulatory bodies—using secondary sources from MF reports and SFDA publications to define critical decision variables.

Step 2: Market Analysis and Construction

Historical data of market revenues, device category splits, and procurement channel ratios were compiled from published reports (MRFR, Meticulous, ExpertMR). Market penetration and device-use frequency were analyzed to estimate segment-specific revenues and verify consistency.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market growth drivers, product segmentation, and procurement behavior were validated using interviews (CATI) with regulatory officials at SFDA, MOH procurement managers, hospital biomedical engineers and distributor executives operating in Riyadh and Jeddah.

Step 4: Research Synthesis and Final Output

Final insights were cross-verified with direct engagement of selected device suppliers and distributors in Saudi Arabia. These interactions bridged bottom-up compilation with top-down validation, ensuring accuracy of segmentation, shares, pricing and forecast assumptions.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Healthcare and MedTech Market Genesis

- Regulatory Landscape: SFDA & NUPCO Role

- Market Lifecycle and Technology Adoption Curve

- Supply Chain & Value Chain Analysis (Manufacturers, Importers, Distributors, End Users)

- Growth Drivers

Expansion of Public Healthcare Infrastructure (Vision 2030 Investments)

Rising Non-Communicable Disease Burden

Increasing Demand for Advanced Surgical and Diagnostic Technologies

Growing Geriatric and Lifestyle-Related Healthcare Demand

Government Procurement through NUPCO and Localization Targets - Market Challenges

Stringent SFDA Approval Timelines and Regulations

High Import Dependency and Customs Delays

Fragmented Distribution Ecosystem

CapEx Constraints in Private Hospitals

Pricing and Reimbursement Limitations - Opportunities

Public-Private Partnerships in Diagnostic Expansion

Growth in AI-Integrated Medical Devices

Wearable Devices and Remote Monitoring Uptake

Localization through National Industrial Development Strategy (NIDLP)

Investment Incentives in Special Economic Zones - Trends

IoMT Devices for Home Diagnostics

Shift Toward Digital Health and Robotics

Integration of EHRs and Smart Devices

Demand for Sustainable and Disposable Devices

Telemedicine Equipment Surge - Regulatory Environment

Saudi Food and Drug Authority (SFDA) Classification Guidelines

Import Licensing, Audits, and MDR Compliance

NUPCO Centralized Procurement System

Tariff Structures and VAT Considerations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Diagnostic Imaging Devices

Patient Monitoring Devices

Surgical Instruments

Orthopedic Devices

Cardiovascular Devices - By Application (In Value %)

Cardiology

Radiology

General Surgery

Neurology

Orthopedics - By End User (In Value %)

Public Hospitals

Private Hospitals

Clinics & Specialty Centers

Homecare Settings

Diagnostic Laboratories - By Technology (In Value %)

Non-Invasive Devices

Minimally Invasive Devices

Wearable Medical Devices

Connected (IoMT) Medical Devices

AI and Robotics-Enabled Devices - By Region (In Value %)

Riyadh

Jeddah

Eastern Province (Dammam, Khobar)

Mecca and Medina

Other Regions

- Market Share of Major Players (By Value/Volume)

Market Share by Device Category

Market Share by Public Procurement Contracts (NUPCO) - Cross Comparison Parameters (Company Overview, Organizational Structure, Product Specialization by Segment, Licensing and Approvals (SFDA, CE, FDA), Local Partnerships and Distribution Reach, Logistics Infrastructure (Warehouses, Distribution Centers), Public Tenders Won (NUPCO, MOH), Innovation Index (Patents Filed, AI Integration Capabilities))

- SWOT Analysis of Key Players

- Pricing and Tendering Trends Across Major SKUs

- Profiles of Major Companies

Siemens Healthineers

GE HealthCare

Philips Healthcare

Medtronic

Stryker

Becton Dickinson

Johnson & Johnson

Abbott Laboratories

Boston Scientific

Zimmer Biomet

Roche Diagnostics

Canon Medical

Mindray

Draeger

Hikma Medical Equipment

- Procurement Behavior across Public vs Private Hospitals

- Budget Allocation Trends

- Import and Localization Preferences

- Clinical and Administrative Pain Points

- Innovation Adoption Willingness

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030