Market Overview

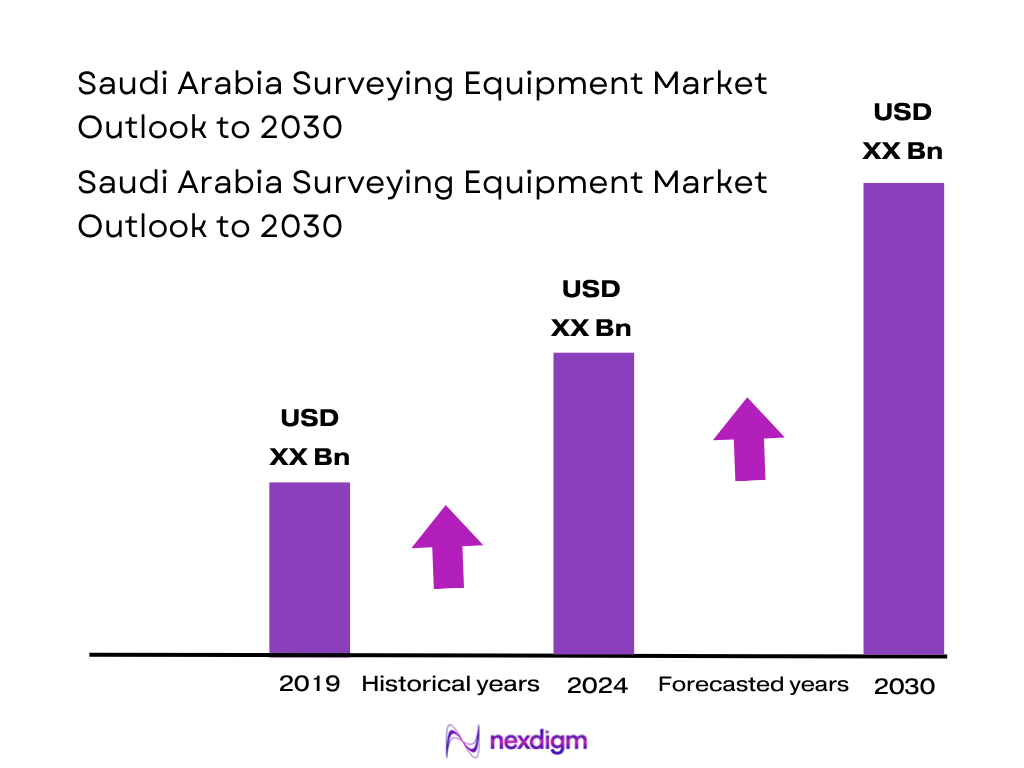

The global land survey equipment market was valued at USD 9.06 billion in 2023 and reached USD 9.55 billion in 2024. This growth is driven by an accelerating demand for precise geospatial data in infrastructure, oil & gas, mining, and urban planning projects. Technological advancements such as robotic total stations, drone-based GIS tools, and AI-enabled data processing have improved accuracy and productivity, thereby supporting the market expansion.

Key urban centres Riyadh, Jeddah, Dammam and economic zones like NEOM dominate the Saudi market owing to large-scale initiatives under Vision 2030 (e.g., NEOM, Red Sea project). Additionally, Eastern Province’s oil & gas hubs rely on advanced GNSS and laser scanning tools for exploration and pipeline infrastructure. These centres contribute most demand due to megaproject density and strong government backing.

Market Segmentation

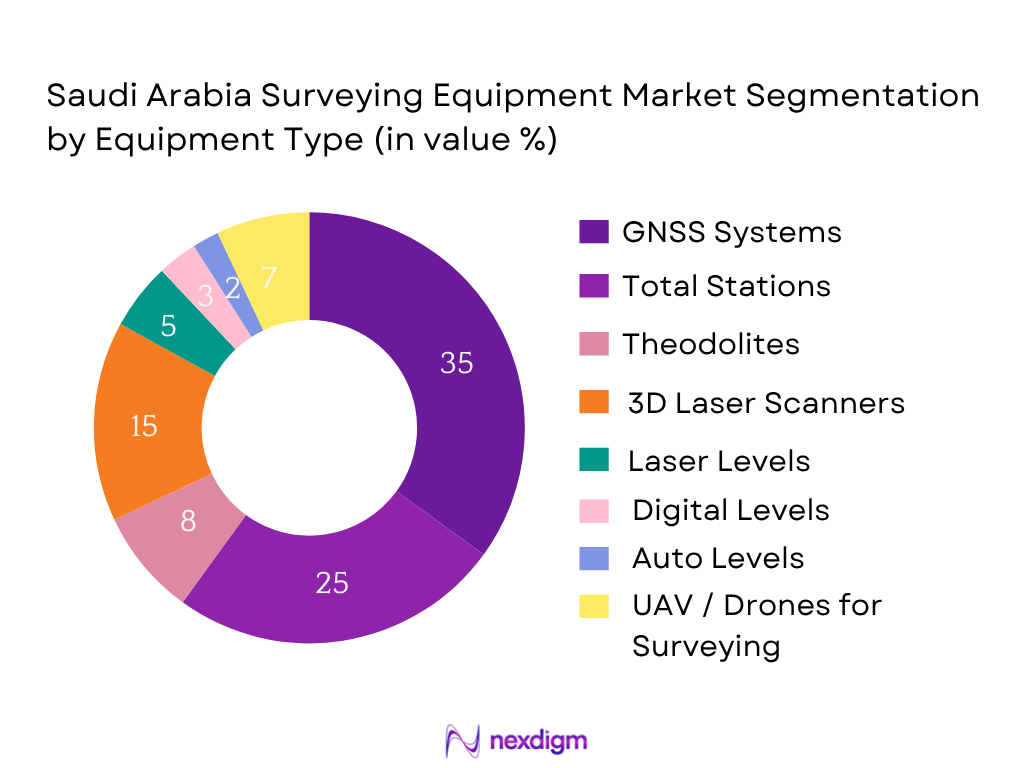

By Equipment Type

The most dominant segment is GNSS Systems, holding a market share of 35% in 2024. Their dominance is driven by their ability to deliver real-time kinematic (RTK) precision and seamless integration with cloud-based geospatial platforms. These systems are extensively used in large-scale infrastructure, pipeline alignment, and remote terrain surveys across Saudi Arabia’s giga-projects such as NEOM and Riyadh Metro.

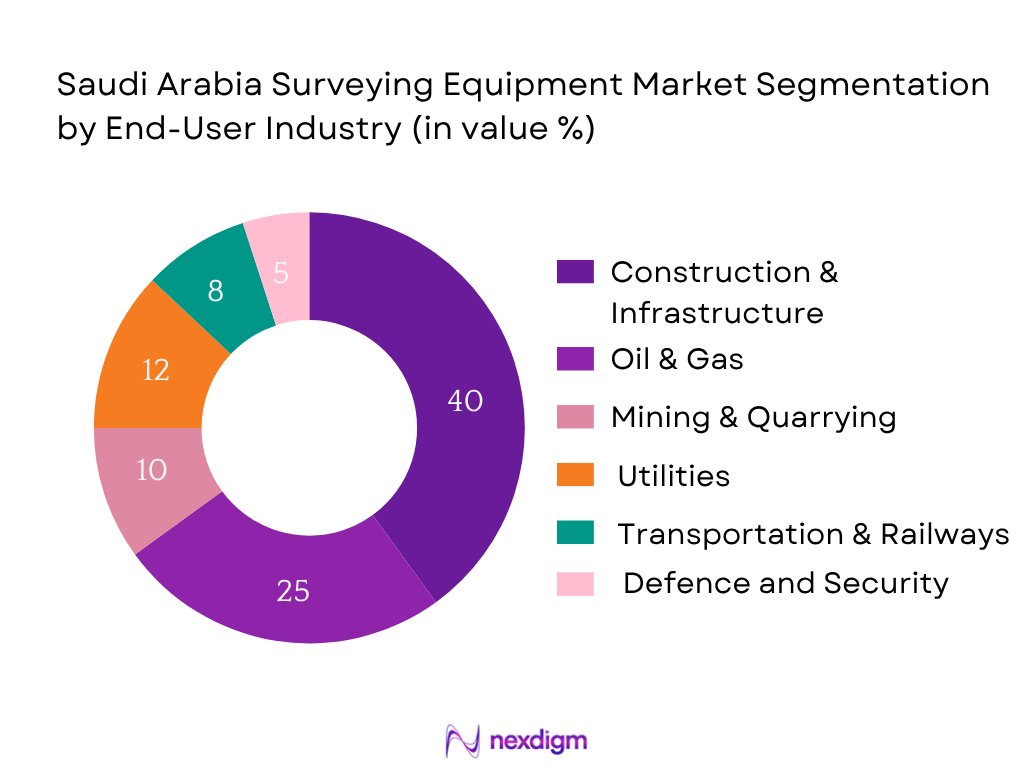

By End-User Industry

Segmnets include Construction & Infrastructure, Oil & Gas, Mining & Quarrying, Utilities, Transportation & Railways, Defense & Security. The most dominant is Construction & Infrastructure with 40%. Fueled by Vision 2030’s giga‑projects (NEOM, Riyadh Metro), construction firms actively procure total stations, robotic GNSS systems, and 3D laser scanners. The high demand is due to performance efficiency, regulatory compliance, and smart-city rollouts.

Competitive Landscape

The Saudi surveying equipment market is concentrated among global and regional OEMs such as Trimble, Leica Geosystems, Topcon, Nikon, Stonex. These firms dominate due to channel strength, after-sales support, and innovation. Local demand from giga‑projects makes competition steep, but aftermarket access and service networks differentiate leaders.

| Company | Est. Year | Headquarters | Product Range | Authorized Dealers | Service Centers | Tech Integration (LiDAR/GNSS/AI) | Warranty & Support |

| Leica Geosystems (Hexagon) | 1993 | Switzerland | – | – | – | – | – |

| Trimble Inc. | 1978 | USA | – | – | – | – | – |

| Topcon Corporation | 1932 | Japan | – | – | – | – | – |

| Stonex | 2002 | Italy | – | – | – | – | – |

| Nikon-Trimble | 2012 | Japan-USA | – | – | – | – | – |

Saudi Arabia Surveying Equipment Market Analysis

Growth Drivers

Vision 2030 infrastructure push

Saudi Arabia’s Vision 2030 has catalyzed infrastructure investment, with total infrastructure project spending reaching USD 1.3 trillion since inception, including USD 28.7 billion allocated to NEOM alone, per Business Insider . Meanwhile, public-private investment in infrastructure across MENA surged to USD 380 billion in 2023, a 10% year-on-year rise. The Riyadh Metro’s opening cost USD 22.5 billion, signifying government preparedness to adopt precision surveying instruments to support engineering excellence. These large-scale undertakings accelerate procurement and deployment of advanced surveying tools—such as GNSS systems, total stations, and LiDAR scanners—to ensure accurate site mapping, alignment integrity, and structural quality.

Giga-projects

Major giga-projects—NEOM (USD 28.7 billion), Jeddah Central (USD 20 billion), and Soudah Peaks (USD 7.7 billion budget)—demand rigorous spatial data and monitoring. For example, Jeddah Central’s USD 3.2 billion awarded for stadium, opera house, and oceanarium in 2024 reflects the requirement for high-precision surveying in mega-urban planning. Across these projects, initial construction phases incorporate up to 5.7 km² of redevelopment and require layered topographical, hydrographic, and cadastral surveys. This complexity fuels demand for UAV, robotic total stations, and 3D laser scanners capable of handling large terrains. The scale of investments underscores sustained equipment acquisition through 2025, driven by project milestones and regulatory milestones.

Market Challenges

High initial capital

Cutting-edge surveying systems (e.g., GNSS RTK units, 3D LiDAR scanners) often cost between USD 30,000–100,000 each. In a region where public debt stands at 26.5% of GDP, and the Public Investment Fund (PIF) manages over USD 700 billion, cash-flow prioritization poses procurement barriers. Although Saudi maintains robust reserves, borrowing levels increased to finance mega-projects, with forecasts of budget deficits through 2026. This fiscal environment leads to delayed equipment rollout, with Ministries of Municipal and Rural Affairs and Royal Commissions deferring non-critical instrumentation amid cost rationalization. Investments are consequently phased, and high upfront costs slow surveyor adoption of best-in-class technology over commodity-grade alternatives.

Skill gaps in automation tools

Despite Saudi’s digital transformation—AI comprising 1% of digital GDP (~USD 4.8 billion) and digital economy at 15% of USD 900 billion GDP in 2023 —surveying education and field proficiency with robotic instruments and LiDAR remain limited. BIM, digital twin, and UAV integration require trained operators. Riyadh Metro hired 586 driverless cars requiring tech-savvy workforce support . According to Ministry of Communications and IT, tech-sector employment rose from 150,000 to 381,000 between 2021 and 2024, but fewer than 10% are licensed for surveying-grade equipment calibration and operation. Skills shortages pose risk to project timelines and data quality, necessitating curriculum updates and certification programmes—yet the lag undermines rapid digital adoption.

Market Opportunities

Drone-integrated surveys

Saudi Arabia operates over 176 km of driverless metro lines across 85 stations—deployed since December 2024. This spread creates substantial demand for frequent as-built mapping, asset monitoring, and overhead clearance surveys. Drone-based LiDAR systems, starting at USD 50,000 per unit, enable rapid, high-resolution data acquisition over urban infrastructure. The Digital Infrastructure index rise, part of USD 3 billion 5G rollouts, enables real-time UAV data streaming . With NEOM’s futuristic development and giga-projects resetting construction norms, UAV surveys enable remote sites to be monitored continually—reducing manual labor and boosting field safety. Current adoption in oil/gas fields and metro corridors reveals untapped potential in utilities map accuracy and smart city readiness, positioning drone surveying as a critical future capability.

Digital cadastral mapping expansion

Saudi Arabia’s urban footprint rose sharply: population near 33 million in 2023. Rising land parcel transactions necessitate precise cadastral surveying. Government digitalisation initiatives include new Insolvency and procurement laws to streamline land processes and enhance digital transparency. The Saudi Survey Authority, under MOMRA, is digitising property data with GIS-linked cadastral maps. Combined with PIF-funded municipal developments, digital cadastral efforts boost demand for GNSS, GIS-enabled total stations, and cloud platforms. The 15% digital GDP share and rapid tech workforce growth underscore readiness for modernization. These dynamics highlight the need to replace traditional pin‑based parcel sketches with geospatially accurate, interactive cadastral databases—an opportunity driving future commercial investment in survey systems.

Future Outlook

Over the next six years, the Saudi surveying equipment market is expected to expand significantly, driven by the ongoing gigaprojects under Vision 2030, increasing adoption of robotic and AI‑enabled instruments, and growing use of UAVs for large-scale surveys. Continued private investment in infrastructure and rising digital twin initiatives will also elevate demand.

Major Players

- Leica Geosystems (Hexagon)

- Trimble Inc.

- Topcon Corporation

- Nikon‑Trimble

- Stonex

- CHCNAV

- South Surveying & Mapping

- FOIF

- RIEGL

- GeoMax

- DJI (Enterprise Survey)

- NavVis

- Sokkia

- Hi‑Target

- Carlson Software

Key Target Audience

- Infrastructure & Construction Companies

- Oil & Gas Exploration Firms

- Mining & Quarrying Corporations

- Utilities Operators (Water, Energy, Telecom)

- Transportation & Railway Development Agencies

- Investments and venture capital firms

- Municipal urban planning departments (e.g., Riyadh Development Authority)

- Government and regulatory bodies (Ministry of Municipal and Rural Affairs, Saudi Survey Authority)

Research Methodology

Step 1: Identification of Key Variables

We developed an ecosystem map of stakeholders in Saudi surveying — OEMs, government bodies, end‑users — using secondary and proprietary data. Critical parameters like equipment adoption rates, import dependency, and infrastructure forecasting were identified.

Step 2: Market Analysis and Construction

Historical data (2021–2023) on revenues and unit sales were compiled. Analysis of price trends, end-user procurement cycles, and product lifecycle was conducted to ensure revenue estimate robustness.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions were validated through interviews with professionals — surveying firms, project consultants, public agency officials — via CATI surveys, confirming field deployment trends and investment timing.

Step 4: Research Synthesis and Final Output

We engaged OEMs and distributors active in the region to cross‑verify our bottom‑up estimates. Field visits and technical discussions enriched the analysis, ensuring accurate validation of findings.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Primary and Secondary Research Approach, Analyst Validation, Triangulation, Limitations and Future Projections)

- Definition and Scope

- Market Genesis and Evolution

- Market Structure and Lifecycle

- Regulatory Landscape and Licensing Framework (Surveying Standards, GSO, MOMRA, SAMA Permits)

- Industry Ecosystem and Stakeholder Mapping

- Value Chain and Supply Chain Analysis

- Growth Drivers

Vision 2030 infrastructure push

Giga-projects

Digital twin integration - Market Challenges

High initial capital

Skill gaps in automation tools - Market Opportunities

Drone-integrated surveys

Digital cadastral mapping expansion - Market Trends

Cloud-based software integration

Real-time RTK technology

Modular surveying systems - Government Regulations

GCC Metrology Laws

Land Surveying Act

Remote Sensing Approvals - SWOT Analysis

- Stakeholder Ecosystem (MOI, MODON, ZATCA, Ministry of Housing, Survey Authority)

- Porter’s Five Forces Analysis

- Import Dependency and Tariff Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Unit Price, 2019-2024

- By Import vs. Domestic Manufacturing Ratio, 2091-2024

- By Equipment Type (In Value %)

GNSS Systems

– RTK GNSS

– Static GNSS

– Network GNSS

Total Stations

– Manual Total Stations

– Robotic Total Stations

Theodolites

– Digital Theodolites

– Optical Theodolites

Laser Levels

– Rotary Laser Levels

– Line Laser Levels

Digital Levels

– Bar-coded Staff Levels

– Automatic Digital Levels

Auto Levels

– Manual Focus

– Self-leveling

3D Laser Scanners

– Terrestrial Laser Scanners

– Handheld Scanners

UAV/Drones for Surveying

– Fixed-Wing Drones

– Multi-Rotor Drones

– LiDAR-equipped Drones - By Technology (In Value %)

Manual

– Traditional Surveying Tools

– Optical Instruments

Robotic/Automated

– One-person Total Station Systems

– Automated GNSS Monitoring

IoT-Enabled

– Real-time Data Transfer Devices

– Smart Asset Trackers

LiDAR-Based Systems

– Terrestrial LiDAR

– Aerial LiDAR

AI-Integrated Surveying Tools

– Predictive Modeling Systems

– Automated Feature Recognition Tools - By End-User Industry (In Value %)

Construction and Infrastructure

Oil & Gas

Mining & Quarrying

Utilities (Water, Power, Telecom)

Transportation and Railways

Defense & Security - By Application (In Value %)

Topographic Survey

– Land Elevation Mapping

– Terrain Modeling

Cadastral Survey

– Property Boundary Definition

– Legal Land Parcel Mapping

Hydrographic Survey

– Inland Water Mapping

– Coastal and Port Surveys

Engineering Survey

– Site Layouts

– Structure Alignment Surveys

Deformation Monitoring

– Dam and Bridge Monitoring

– Landslide and Slope Movement

GIS Data Collection

– Urban Planning

– Environmental Mapping - By Region (In Value %)

Riyadh Region

Makkah & Madinah

Eastern Province

Southern Region

Northern Border Region

NEOM and Special Economic Zones

- Market Share of Major Players (By Value and Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue (Total & Survey Equipment Share), Revenue by Equipment Type, Distribution Network, Number of Technical Support Centers, Technology Integration, Warranty and After-Sales Services, Product Certification & Compliance, Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis of Major SKUs (Brand-wise, Series-wise)

- Detailed Profiles of Major Players:

Leica Geosystems (Hexagon AB)

Topcon Corporation

Trimble Inc.

Nikon-Trimble

Stonex

CHCNAV (Shanghai Huace)

South Surveying & Mapping

FOIF

RIEGL

GeoMax

DJI (Enterprise Survey Drones)

NavVis

Sokkia

Hi-Target

Carlson Software

- Procurement Process & Budget Allocation

- Purchasing Power by Sector

- Vendor Selection Criteria

- Challenges Faced by End Users

- Decision-Making Units

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030

- By Technology Adoption Penetration, 2025-2030