Market Overview

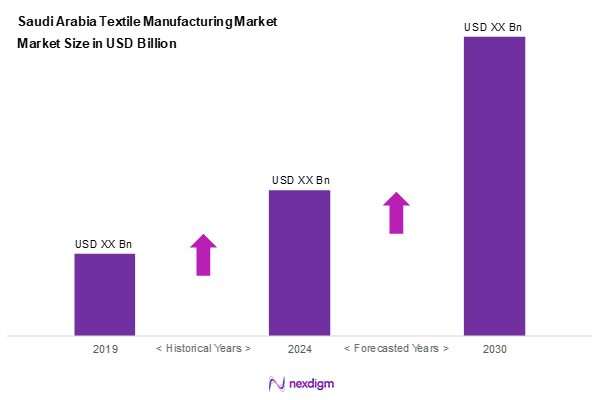

As of 2024, the Saudi Arabia textile manufacturing market is valued at USD 9.6 billion, with a growing CAGR of 3.4% from 2024 to 2030, driven by growing consumer demand and investment in modern technologies to enhance production efficiency. The market has experienced robust growth due to an increase in domestic consumption, improvement in local manufacturing capabilities, and diversification efforts as part of the country’s Vision 2030 initiative. This growth trajectory is supported by strategic investments and government’s long-term plans to boost the sector.

The dominant regions within this market include the Central region, particularly Riyadh, and the Western region, mainly Jeddah, as these cities benefit from superior logistics, infrastructure development, and government support for industrial activities. Additionally, these areas serve as hubs for major textile players and manufacturers, leading to a concentration of market activities, innovations, and skilled labor to meet the increasing demand.

Market Segmentation

By Fabric Type

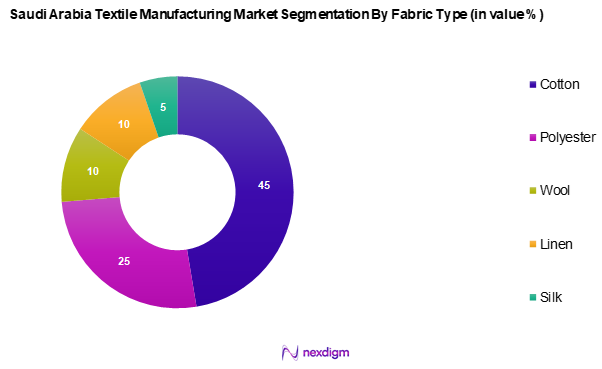

The Saudi Arabia textile manufacturing market is segmented into cotton, polyester, wool, linen, and silk. Among these, cotton is a dominant sub-segment, owing to its strong cultural significance and wide acceptance among consumers for various applications. The versatility, comfort, and breathability of cotton fabric make it a preferred choice for apparel and home textiles, thus capturing a substantial market share.

By Product Type

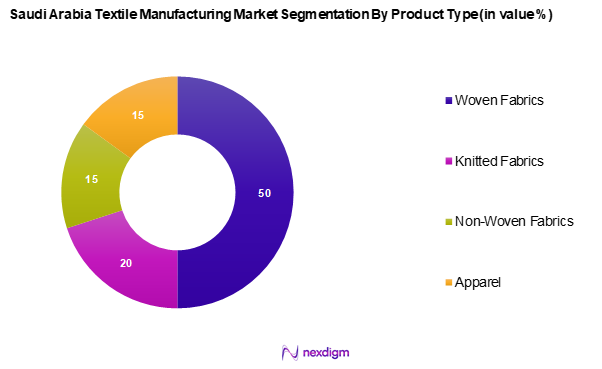

The Saudi Arabia textile manufacturing market is segmented into woven fabrics, knitted fabrics, non-woven fabrics, and apparel. Woven fabrics have captured a significant market share due to their extensive application in clothing, furniture, and home decor. The durability and variety of designs available in woven fabric resonate well with consumer preferences, leading to increased demand and brand loyalty among manufacturers.

Competitive Landscape

The Saudi Arabia textile manufacturing market is characterized by the presence of major players that dominate this sector. The market is consolidated among a few key companies, highlighting their influence and established presence. These companies leverage their strong brand presence, comprehensive distribution networks, and diversified product offerings to establish a competitive edge within the market.

| Company Name | Establishment Year | Headquarters | Market Segment | Annual Revenue (USD) | Production Capacity | Distribution Network |

| Alhokair Group | 1989 | Riyadh, Saudi Arabia | – | – | – | – |

| Saudi Industrial Export Company | 1990 | Jeddah, Saudi Arabia | – | – | – | – |

| Arabian Textile Company | 1995 | Riyadh, Saudi Arabia | – | – | – | – |

| Zamil Industrial | 1974 | Dammam, Saudi Arabia | – | – | – | – |

| Naseej International Trading Co | 1978 | Jeddah, Saudi Arabia | – | – | – | – |

Saudi Arabia Textile Manufacturing Market Analysis

Growth Drivers

Increased Consumer Demand

The textile manufacturing market in Saudi Arabia is witnessing robust growth, largely driven by expanding urbanization and a steadily growing population. With more people moving to cities, there’s a noticeable rise in lifestyle changes and fashion consciousness. A burgeoning middle class with higher disposable incomes is fueling the demand for apparel, home textiles, and technical fabrics. The fashion retail industry is especially seeing increased activity, with youth and families driving demand for branded and lifestyle-oriented textile products. This shift in consumer behavior is prompting local manufacturers to innovate and diversify their offerings.

Investment in Advanced Technology

Technological advancements are playing a transformative role in the textile sector across Saudi Arabia. Manufacturers are increasingly adopting automation, smart textiles, and environmentally friendly production methods. These innovations are helping companies enhance productivity, reduce waste, and align with global trends toward sustainable manufacturing. The shift toward Industry 4.0 technologies is further enabling manufacturers to optimize processes and stay competitive. Such advancements are not only meeting evolving consumer expectations but also helping firms adapt to stricter regulatory and environmental standards.

Market Challenges

Competition from Low-Cost Imports

A key challenge for domestic textile manufacturers is the influx of low-cost imports, particularly from regions known for mass production and competitive pricing. These imports offer a wide range of affordable options, which often attract price-sensitive consumers. This external competition is putting pressure on local firms to innovate, improve quality, and manage costs more efficiently to retain their market share. The need for protective trade policies and stronger branding initiatives is becoming more pressing to ensure the sustainability of local production.

Regulatory Compliance Issues

The tightening of environmental and regulatory frameworks has added operational complexity for manufacturers. New standards around waste management, emissions, and sustainability are requiring firms to upgrade their infrastructure and processes. While these changes align with global best practices, they also introduce additional costs and compliance burdens. Navigating these regulations demands significant resource allocation and strategic planning, making it essential for textile companies to stay proactive and agile in their compliance strategies.

Opportunities

Growth of Sustainable Fabrics

Sustainable and eco-friendly textiles are emerging as a major growth avenue for the Saudi textile market. There is a growing consumer preference for organic, recycled, and low-impact materials, driven by rising environmental awareness. This shift presents a valuable opportunity for manufacturers to reposition themselves as leaders in sustainable production. By embracing green technologies and ethical sourcing practices, local firms can meet both domestic and international demand for responsible textile products, thereby enhancing their brand value and market reach.

Expansion in Emerging Markets

Regional expansion into nearby developing markets, particularly in the Middle East and Africa, offers promising potential. These regions are experiencing demographic shifts and increased urban development, leading to higher demand for textile products. Saudi Arabia’s geographic location and existing trade relations make it well-positioned to serve these emerging markets. By strengthening export capabilities and forming strategic partnerships, local manufacturers can diversify their market presence and tap into new revenue streams. This cross-border growth could significantly boost the industry’s resilience and long-term success.

Future Outlook

Over the next five years, the Saudi Arabia textile manufacturing market is expected to witness significant growth as a result of increasing domestic demand and ongoing advancements in production technologies. The emphasis on sustainability and innovation will further drive the sector’s evolution, supported by governmental initiatives aimed at diversifying the economy and promoting local manufacturing. With the anticipated growth in consumer consciousness towards eco-friendly products, the market is well-positioned for progressive changes that will enhance both environmental responsibility and product quality.

Major Players

- Alhokair Group

- Saudi Industrial Export Company

- Arabian Textile Company

- Zamil Industrial

- Alsorayai Group

- Baladna Fabrics

- Shaker Group

- Riyadh Textile Company

- Al Abdul Karim Holding

- Al Kayan Group

- Al Nahar International

- Saudi Yarn & Fabrics Manufacturing

- National Factory for Polyester

- Bayt Al Malakia

Key Target Audience

- Manufacturers in the textile industry

- Retailers of textile products

- Investors and venture capitalist firms

- Government and regulatory bodies (Ministry of Industry and Mineral Resources)

- Trade associations in textiles

- Environmental organizations focused on sustainable textiles

- E-commerce platforms specializing in textile sales

- Textile technology providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia textile manufacturing market. This step is derived from extensive desk research and consultations with industry experts to gather comprehensive data on market structure, key players, and significant trends affecting the textile sector.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the textile manufacturing market, specifically looking at production volume, value, and growth rates. To ensure accuracy, we will assess factors such as import/export trends, industry developments, and economic indicators impacting market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through computer-assisted telephone interviews (CATIs) with industry experts, including representatives from key textile companies. This input is invaluable for understanding market movements, consumer preferences, and emerging technologies in textile production.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and insights from industry consultations. This includes validation of product segments, market trends, and competitor analysis, which will culminate in a detailed and comprehensive report on the Saudi Arabia textile manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increased Consumer Demand

Investment in Advanced Technology

Favorable Government Policies - Market Challenges

Competition from Low-Cost Imports

Regulatory Compliance Issues - Opportunities

Growth of Sustainable Fabrics

Expansion in Emerging Markets - Trends

Digitalization in Operations

Rise of Eco-Friendly Products - Government Regulation

Trade Tariffs

Environmental Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Production Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Fabric Type (In Value %)

Cotton

– Organic Cotton

– Combed Cotton

– Carded Cotton

Polyester

– Filament Polyester

– Staple Polyester

– Blended Polyester Fabrics

Wool

– Merino Wool

– Cashmere Wool

– Blended Wool Fabrics

Linen

– Pure Linen

– Linen Blends

– Dyed Linen Fabrics

Silk

– Mulberry Silk

– Tussar Silk

– Blended Silk Fabrics - By End User Industry (In Value %)

Home Textiles

– Bed Linen

– Curtains and Drapes

– Upholstery Fabrics

Technical Textiles

– Medical Textiles

– Geotextiles

– Protective Wear

Automotive Textiles

– Seat Covers

– Headliners

– Floor Carpets

Industrial Textiles

– Conveyor Belts

– Filtration Fabrics

– Insulation Materials

Others

– Military Textiles

– Sportswear Textiles

– Agriculture Textiles - By Product Type (In Value %)

Woven Fabrics

– Plain Weave

– Twill Weave

– Satin Weave

Knitted Fabrics

– Warp Knits

– Weft Knits

– Circular Knits

Non-Woven Fabrics

– Spunbond

– Meltblown

– Needle Punch

Apparel

– Men’s Clothing

– Women’s Clothing

– Children’s Apparel - By Distribution Channel (In Value %)

Direct Sales

Online Sales

Retail Outlets - By Technology (In Value %)

Spinning

– Ring Spinning

– Rotor Spinning

– Air Jet Spinning

Weaving

– Shuttle Weaving

– Shuttleless Weaving

Knitting

– Flatbed Knitting

– Circular Knitting

– Warp Knitting

Dyeing & Printing

– Reactive Dyeing

– Digital Printing

– Screen Printing - By Geography (In Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Province

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Fabric Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Networks, Production Capacity, Unique Value Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Alhokair Group

Saudi Industrial Export Company

Arabian Textile Company

Zamil Industrial

Naseej International Trading Co.

Alsorayai Group

Baladna Fabrics

Shaker Group

Riyadh Textile Company

Al Abdul Karim Holding

Al Kayan Group

Al Nahar International

Saudi Yarn & Fabrics Manufacturing

National Factory for Polyester

Bayt Al Malakia

- Demand and Utilization Analysis

- Purchasing Power Analysis

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Production Volume, 2025-2030

- By Average Selling Price, 2025-2030