Market Overview

As of 2024, the Saudi Arabia warehousing market is valued at USD ~ billion, with a growing CAGR of 4.6% from 2024 to 2030, with continuous growth driven by the surging e-commerce sector and increasing demands on supply chain efficiencies. The expansion of logistics facilities is being fuelled by both domestic retailers and international companies aiming to penetrate the Gulf region. Growth factors such as urbanization and the need for improved logistics infrastructure are also contributing to this market progression.

Dominant cities in the Saudi Arabia warehousing market include Riyadh and Jeddah, which are prominent due to their strategic locations that facilitate trade and logistics. Riyadh serves as the political and economic nerve centre, while Jeddah is a key port city that plays a vital role in trade. The combined attributes of infrastructure development and geographic positioning support the growth of warehousing in these locations.

Market Segmentation

By Function

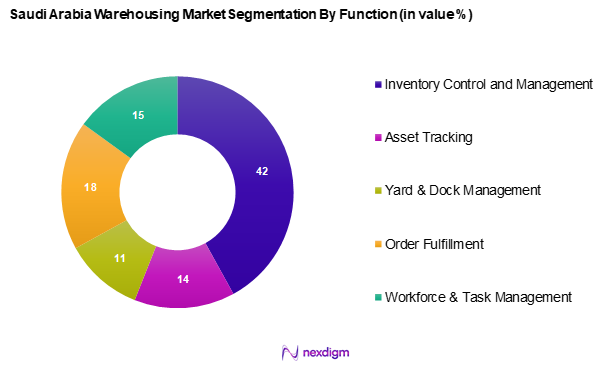

The Saudi Arabia warehousing market is segmented into inventory control and management, asset tracking, yard & dock management, order fulfilment, and workforce & task management. Inventory control and management holds a dominant market share due to the increasing need for efficient stock management in retail and e-commerce, where timely fulfilment can significantly impact customer satisfaction. The rise in e-commerce requirements has elevated demand for advanced inventory management systems that ensure efficiency and accuracy, making this a critical sub-segment within the warehousing market.

By Type

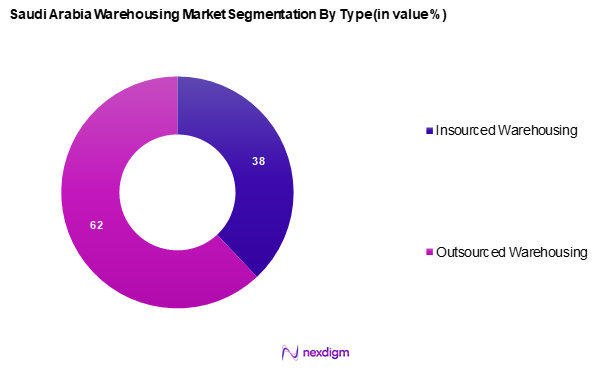

The Saudi Arabia warehousing market is segmented into insourced warehousing and outsourced warehousing. Outsourced warehousing is witnessing stronger market dynamics, attributed to the growing trend of logistics providers offering specialized services that allow companies to focus on their core business operations while ensuring streamlined warehousing solutions. The shift toward outsourced warehousing stems from companies recognizing the cost advantages and operational flexibility that come with leveraging third-party logistics providers. This trend is particularly evident in sectors with fluctuating demand and operational challenges, driving businesses to adopt more adaptable warehousing strategies.

Competitive Landscape

The Saudi Arabia warehousing market is dominated by a few major players, highlighting a concentrated competitive landscape. Key players include Kuehne+Nagel, CEVA Logistics, and DB Schenker, each known for their extensive logistics networks and service offerings that cater to a diverse range of industries.

| Company | Establishment Year | Headquarters | Services Offered | Market Expertise | Recent Developments |

| Kuehne+Nagel | 1890 | Schindellegi, Switzerland | – | – | – |

| CEVA Logistics | 1946 | Marseille, France | – | – | – |

| DB Schenker | 1872 | Essen, Germany | – | – | – |

| Aramex | 1982 | Dubai, UAE | – | – | – |

| GAC | 1956 | Jeddah, Saudi Arabia | – | – | – |

Saudi Arabia Warehousing Market Analysis

Growth Drivers

Increasing E-commerce Activities

The e-commerce sector in Saudi Arabia is experiencing rapid expansion, fuelled by widespread internet adoption and a growing preference for online shopping. Government initiatives aimed at enhancing the digital economy are further accelerating this trend, positioning e-commerce as a crucial driver of warehousing demand. This shift is prompting businesses to invest in modern warehousing solutions to support seamless order fulfilment and efficient logistics operations.

Growing Urbanization

Urbanization continues to reshape the warehousing market, with a growing concentration of the population in key metropolitan areas. This demographic shift is driving demand for consumer goods and services, necessitating advanced logistics infrastructure. Major cities are undergoing significant infrastructure developments, enhancing supply chain efficiencies and making warehousing investments more attractive for businesses looking to capitalize on evolving consumer behaviour.

Market Challenges

Regulatory Compliance

Regulatory frameworks governing warehousing operations in Saudi Arabia are becoming increasingly stringent, particularly concerning the storage and handling of specialized goods. Adhering to these evolving regulations presents operational complexities and financial implications for businesses. Companies must continually invest in compliance training and technological solutions to ensure adherence to legal requirements, which adds to the operational burden.

High Operational Costs

The warehousing sector faces financial pressures due to rising costs associated with labour, real estate, and energy. Additionally, fluctuations in transportation expenses further impact operational efficiency. Businesses must adopt strategic cost-management initiatives, such as process automation and energy-efficient solutions, to mitigate these financial challenges and maintain profitability.

Opportunities

Digital Transformation

The increasing adoption of digital technologies is creating new opportunities for warehousing operations. Businesses are integrating smart warehouse management systems, automation tools, and artificial intelligence to optimize efficiency and improve inventory accuracy. These innovations enhance supply chain resilience and enable companies to meet the growing demands of modern commerce.

Implementation of Sustainability Practices

Sustainability is emerging as a key focus in warehousing, with businesses prioritizing eco-friendly logistics solutions. Initiatives such as optimizing warehouse layouts, leveraging renewable energy, and adopting green supply chain practices are gaining traction. Companies that integrate sustainability into their operations can strengthen their market position, enhance brand reputation, and benefit from supportive government policies aimed at fostering environmentally responsible logistics.

Future Outlook

Over the next several years, the Saudi Arabia warehousing market is expected to experience significant growth, primarily fuelled by advancements in logistics technology and rising demands from e-commerce and retail sectors. The government’s ongoing investments in infrastructure and technology will play a pivotal role in shaping the market, further enhancing operational efficiencies and facilitating the expansion of warehousing capabilities.

Major Players

- Kuehne+Nagel

- CEVA Logistics

- YBA KANOO

- GAC

- Tamer Logistics

- Almajdouie Logistics

- DB Schenker

- Wared Logistics

- Aramex

- MLS

- SMSA Express Transportation Company Ltd.

- Binzagr

- DHL

- HALA

- Sign Logistics

- LSC Warehousing & Logistics Company

- Agility

- Aiduk

- Takhzeen

- fourwinds-ksa

- Camels Party Logistics

- BAFCO

- A. TALKE Ltd.

- LogiPoint

- United Group

- Others

Key Target Audience

- Logistics managers

- Manufacturers

- E-commerce businesses

- Retail chains

- Supply chain consultants

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involves identifying the essential components that shape the dynamics of the Saudi Arabia warehousing market. This includes mapping out the ecosystem that encompasses all major stakeholders—from logistics providers to end-users. Through the use of secondary data and proprietary databases, a comprehensive understanding of the variables influencing the market is formulated.

Step 2: Market Analysis and Construction

In this phase, historical data pertinent to the warehousing market is compiled and analysed. This entails examining the penetration of various services and the relationship between market segments and their revenue generation capabilities. Furthermore, an emphasis is placed on evaluating service quality metrics to ensure robust revenue estimates are established.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy and viability of market hypotheses, the research team conducts consultations via Computer-Assisted Telephone Interviews (CATIs) with industry experts. These professionals represent a diverse range of companies across the warehousing and logistics landscape. Their insights provide operational and financial perspectives, which are crucial for refining the gathered market data and corroborating trends.

Step 4: Research Synthesis and Final Output

The final research phase involves engaging directly with various warehousing and logistics entities to gather detailed insights regarding their product offerings, sales performance, customer preferences, and other relevant dimensions. This interaction is vital for validating the statistical data derived from previous steps and ensures a comprehensive and accurate representation of the Saudi Arabia warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Data Sources, Consolidated Research Approach, Understanding Market Dynamics Through Expert Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing E-commerce Activities

Urbanization - Market Challenges

Regulatory Compliance

High Operational Costs - Opportunities

Digital Transformation

Implementation of Sustainability Practices - Trends

Growth of Smart Warehousing

Rising Demand for Last-Mile Delivery Solutions - Government Regulation

Warehouse Safety Standards

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Component, (In Value %)

Hardware/System

Software

Services - By Function, (In Value %)

Inventory Control and Management

Asset Tracking

Yard & Dock Management

Order Fulfilment

Workforce & Task (Process) Management

Shipping

Predictive Maintenance

Others - By Type, (In Value %)

Insource Warehousing

Outsource Warehousing - By Size, (In Value %)

Small

Medium

Large - By Ownership, (In Value %)

Public Warehouses

Private Warehouses

Bonded Warehouses

Consolidated Warehouse - By Warehousing Storage Nature, (In Value %)

Ambient Warehousing (Around 80°F)

Air Conditioned (56°F and 75°F)

Refrigerated (33°F and 55°F)

Cold/Frozen (Of or Below 32°F) - By WMS Tier Type, (In Value %)

Advanced WMS

Basic WMS

Intermediate WMS - By End User, (In Value %)

Retail and E-Commerce

Transportation and Logistics

Automotive

Healthcare

Food and Beverages

Electrical and Electronics

Chemical

Agriculture

Energy and Utilities

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Warehouse Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Financial Performance, Operational Efficiency, Technology Utilization, Geographic Reach, Client Base)

- SWOT Analysis of Major Players

- Pricing Analysis by Warehouse Type for Major Players

- Detailed Profiles of Major Companies

Kuehne+Nagel

CEVA Logistics

YBA KANOO

GAC

Tamer Logistics

Almajdouie Logistics

DB Schenker

Wared Logistics

Aramex

MLS

SMSA Express Transportation Company Ltd.

Binzagr

DHL

HALA

Sign Logistics

LSC Warehousing & Logistics Company

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030