Market Overview

The Singapore Advanced Surface Movement Guidance Control Systems (A-SMGCS) market is a vital component of the aviation safety and airport management landscape. In 2024, the market is valued at approximately USD ~ million, driven by an increasing focus on airport safety, the need for efficient ground handling, and the integration of modern technologies such as radar, sensors, and automation systems. The market’s growth is significantly influenced by the expansion of Changi Airport’s infrastructure, continuous investments in high-tech solutions for air traffic control (ATC), and a strong governmental push to meet international aviation safety standards. Additionally, the growing demand for reducing runway incursions and taxiway congestion among major airports has led to the adoption of A-SMGCS systems to improve operational efficiency and safety.

Singapore stands out as the key market for A-SMGCS, with its world-renowned Changi Airport setting benchmarks in aviation safety, operational efficiency, and technological integration. The dominance of Singapore in this market can be attributed to its strategic position as a global aviation hub, the continuous technological upgrades at Changi Airport, and strong regulatory frameworks ensuring adherence to international aviation standards. Other regions, such as parts of the Asia-Pacific including Hong Kong and Japan, also drive the market through their advanced infrastructure and adoption of cutting-edge technology in their airports. These countries prioritize safety, efficiency, and automation, leading to the adoption of sophisticated A-SMGCS solutions.

Market Segmentation

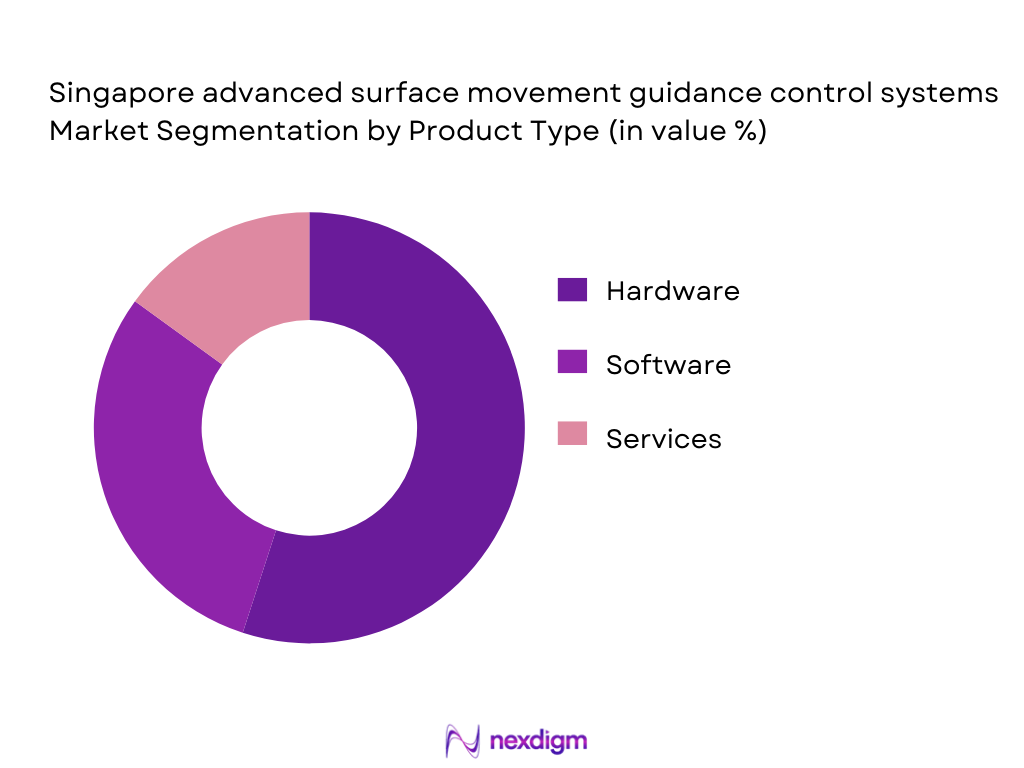

By Product Type

The A-SMGCS market is segmented into hardware, software, and services. Hardware includes surface radar systems, multilateral systems, and sensors that facilitate surveillance, tracking, and monitoring. Software encompasses routing algorithms, safety logic, and real-time data management systems that enable the seamless functioning of the A-SMGCS. Services comprise maintenance, upgrades, and system integration support that ensure smooth operation and performance. In 2024, hardware, specifically surface radar systems, dominated the A-SMGCS market due to their critical role in providing real-time surveillance and tracking of aircraft and vehicles on the airport surface. Radar systems are indispensable for ensuring the safety of ground operations, particularly during poor visibility conditions such as fog and heavy rain. The high demand for surface radar systems is also driven by technological advancements that increase the precision of these systems, enhancing the overall safety and efficiency of airport ground operations. Additionally, the increasing complexity of air traffic movement at major airports like Changi accelerates the adoption of hardware-based A-SMGCS solutions.

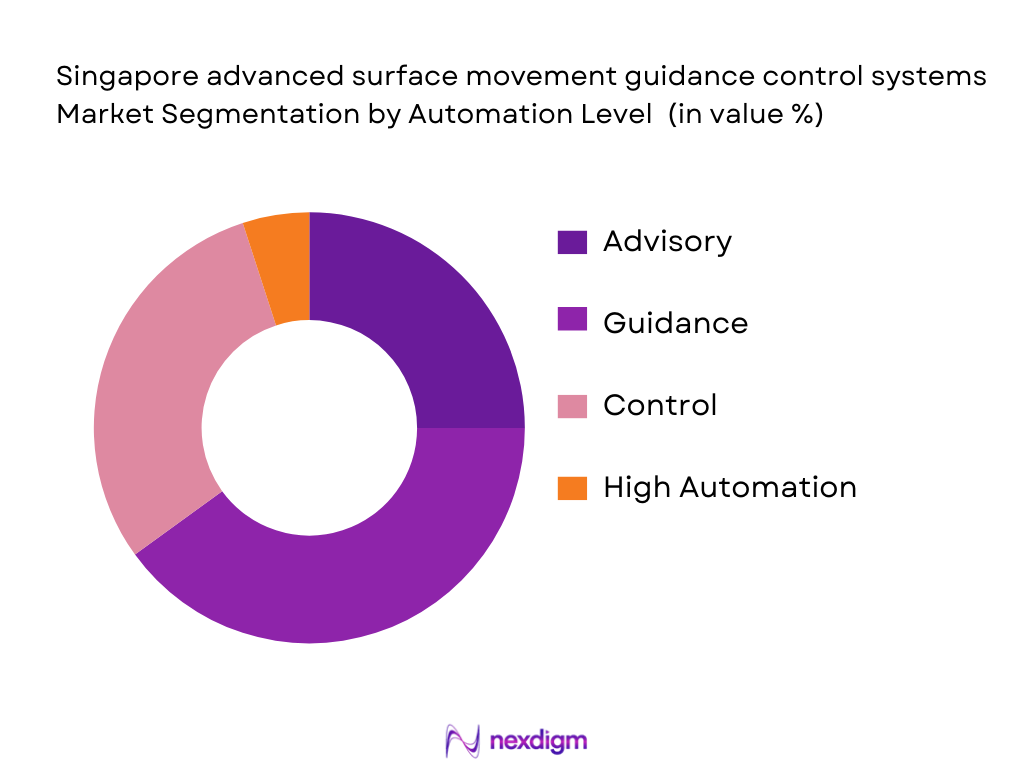

By Automation Level

Automation levels in A-SMGCS are categorized into advisory, guidance, control, and high automation systems. Advisory systems provide situational awareness to air traffic controllers, while guidance systems assist in routing aircraft and vehicles. Control systems offer automated decision-making capabilities, and high automation systems enable fully autonomous surface movement management. The guidance and control systems have the largest market share, driven by their capability to reduce human error, optimize aircraft movement, and improve ground operational efficiency. The increasing implementation of Level 3 and Level 4 automation in major airports like Changi Airport has created substantial demand for control systems that integrate seamlessly with existing ATC systems. These systems enhance the decision-making processes for ground movements and optimize runway capacity, further improving the safety and efficiency of airport operations.

Competitive Landscape

The Singapore A-SMGCS market is dominated by a few major global players, each providing comprehensive solutions for air traffic and ground management. These companies play a pivotal role in driving innovation and ensuring seamless integration between hardware, software, and services. Key players include Thales, Saab AB, Honeywell, Frequentis, and Indra Sistemas, each contributing to the development of advanced radar, surveillance, and automation systems for ground movement control.

| Company | Year Established | Headquarters | Technology Offering | Product Portfolio | Global Reach | R&D Investment |

| Thales | 2000 | France | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | USA | ~ | ~ | ~ | ~ |

| Frequentis | 1947 | Austria | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Spain | ~ | ~ | ~ | ~ |

Singapore Advanced Surface Movement Guidance Control Systems Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant driver for the adoption of advanced surface movement guidance control systems (A-SMGCS) in Singapore. The country’s urban population has grown steadily, with the population of Singapore’s urban areas reaching ~ million in 2024, as reported by the World Bank. The rise in population has led to greater demand for air traffic services, especially at major airports like Changi. This growth in urban areas, paired with the increasing number of air passengers—projected to surpass ~ million by 2024—necessitates efficient ground operations to handle the higher volume of traffic, positioning A-SMGCS as a vital tool in managing this expansion.

Industrialization

Singapore’s industrialization has accelerated the need for advanced aviation and airport systems, including A-SMGCS. The country’s industrial output, valued at SGD ~ billion in 2024, continues to expand with significant investments in technology and infrastructure. This industrial boom, particularly in sectors such as logistics, manufacturing, and aerospace, is increasing air cargo and flight traffic, which directly impacts airport ground operations. With its strategic position as a global logistics hub, Singapore sees a constant rise in air traffic movements, which necessitates systems like A-SMGCS for effective coordination of airport resources.

Restraints

High Initial Costs

One of the major restraints for the A-SMGCS market in Singapore is the high initial investment required for the installation and maintenance of such advanced systems. The upfront cost of A-SMGCS systems, which includes radar, sensors, and software, can range significantly depending on the scale of the airport. In 2024, Singapore’s government allocated SGD ~ billion for the modernization of Changi Airport’s infrastructure, which includes upgrading its ground control systems. Despite the benefits of automation and efficiency, the high capital expenditure associated with implementing these systems remains a significant barrier for expansion, especially for smaller regional airports.

Technical Challenges

The implementation of A-SMGCS comes with technical challenges, particularly integrating new systems with existing airport infrastructure. For instance, Singapore’s Changi Airport, one of the busiest airports in the world, faces challenges related to data integration, system synchronization, and upgrading legacy systems. The complexity of ensuring seamless communication between radar, sensors, and control towers while maintaining a high level of reliability and accuracy under various weather conditions is a hurdle that requires significant technological innovation and expertise. Additionally, system downtime or glitches in such high-stakes environments can disrupt airport operations, leading to costly delays.

Opportunities

Technological Advancements

Technological advancements present considerable opportunities for growth in the A-SMGCS market in Singapore. Singapore’s government continues to emphasize digital transformation, particularly in aviation, with an increasing focus on AI and machine learning integration for air traffic management. The Ministry of Transport’s “Smart Aviation” initiative, which focuses on automation and AI in ground operations, is set to accelerate the adoption of A-SMGCS. Moreover, the increasing use of 5G connectivity will enable faster data exchange between A-SMGCS components, further enhancing operational efficiency. With continuous investments in emerging technologies, Singapore’s A-SMGCS market is primed to benefit from these advancements, particularly in the automation of ground movement control systems.

International Collaborations

International collaborations also provide substantial opportunities for the growth of A-SMGCS in Singapore. Singapore’s involvement in global aviation bodies such as ICAO and its partnerships with countries in the Asia-Pacific region have allowed it to implement international best practices in air traffic management. The signing of several cooperation agreements with European airports and aviation companies provides Singapore with the opportunity to adopt cutting-edge surface movement control systems. These collaborations are likely to introduce new technologies and advanced systems, promoting further development and modernization of Singapore’s airport ground operations.

Future Outlook

Over the next five years, the Singapore A-SMGCS market is expected to witness considerable growth, driven by a strong push for automation and technological innovation in airport ground operations. The focus will be on reducing operational costs, improving safety, and enhancing the overall passenger experience. The adoption of AI-powered systems, predictive analytics, and the integration of real-time data processing will significantly enhance the operational efficiency of airports. Additionally, the continued modernization of Changi Airport, along with infrastructure upgrades at other regional airports, will further drive the demand for advanced surface movement guidance control systems.

Major Players

- Thales Group

- Saab AB

- Honeywell International Inc.

- Frequentis AG

- Indra Sistemas S.A.

- Raytheon Technologies Corporation

- Ultra Electronics Holdings plc

- Searidge Technologies Inc.

- Rolta India Limited

- Leidos Holdings

- Northrop Grumman Corporation

- ADB SAFEGATE

- L3 Technologies

- Aéroports de Paris (ADP)

- Vanderlande Industries

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore, Ministry of Transport Singapore)

- Airport Authorities (Changi Airport Group, Seletar Airport)

- Airline Operators

- Air Traffic Control Organizations (Air Traffic Control Singapore)

- System Integrators

- Original Equipment Manufacturers (OEMs)

- Technology Solution Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the A-SMGCS market in Singapore. This map identifies the key stakeholders, including airport authorities, technology providers, and government agencies. The focus is on gathering industry-level data through secondary research sources to identify variables that impact market growth and operational dynamics.

Step 2: Market Analysis and Construction

Historical data is gathered and analyzed to assess the market size, penetration of A-SMGCS systems, and growth trends. This includes evaluating the ratio of automated versus manual systems, airport traffic flow data, and technology adoption rates. Additionally, a service quality assessment is conducted to ensure the reliability of the estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with key industry players, including airport authorities, system integrators, and government agencies. These insights, obtained through interviews and surveys, provide an understanding of current trends, challenges, and technological innovations in the A-SMGCS space.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing data from both primary and secondary sources. Direct engagement with manufacturers and stakeholders further validates the data and adds nuance to market forecasts. The final output is a comprehensive, validated report that captures the full market picture.

- Executive Summary

- Research Methodology (Definitions & Standards (ICAO A‑SMGCS Level Classification, CANSO/Eurocontrol Benchmarks), Data Sources & Data Quality Assurance, Market Sizing Methods (Top‑Down & Bottom‑Up Integration), Forecasting Models (CAGR, Scenario Stretch, Monte‑Carlo Simulation), Primary Research & Expert Validation, Assumptions & Limitations)

- A‑SMGCS Landscape & Strategic Role in Aviation Safety

- Operational Protocols & Regulatory Context (CAAS/AIP Regulations)

- A‑SMGCS Implementation History in Singapore

- Singapore Air Traffic & Ground Movement Trends (Changi / Seletar)

- Industry Value Chain (Surveillance → Guidance → Control → Maintenance)

- Growth Drivers

Runway Safety & Incursion Reduction Targets

Taxiway & Apron Efficiency Optimization

Air Traffic Growth & New Routes - Challenges

Legacy Infrastructure Integration Complexity

Skilled ATC Operators Shortage

Cybersecurity & Data Integrity Risk - Technology Trends

AI‑Assisted Routing & Predictive Alerting

Sensor Fusion & High‑Precision Positioning

Cloud & Edge Integration

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Offering Type (In Value %)

Hardware

Software

Services

- By Automation Level (In Value %)

Level 1: Advisory

Level 2: Guidance

Level 3: Control

Level 4: High Automation

Integrated Lighting Control

- By Application Functionality (In Value %)

Surveillance

Routing & Planning

Alerting & Alert Suppression

Guidance: Follow‑The‑Greens

- By Deployment Mode (In Value %)

On‑Premise

Cloud‑Enabled

Hybrid

- By Airport Type (In Value %)

Mega Hub

Secondary Hub

Military / Non‑Commercial

- A‑SMGCS Supplier Landscape

- Cross‑Comparison Parameters (Company Overview (ICAO/FAA Certification), Product Portfolio Breadth (Radar + Multilateration + Software), Safety Alerting Capabilities, Integration Level with Airport Systems (AGL, ATC), Automation Level Coverage, Local Support & Maintenance Network, Singapore Contract Wins & Delivery History, Revenue from A‑SMGCS & Growth Rate

- Competitive Profiles

Thales Group (Radar + Surveillance + Guidance)

Saab AB (A‑SMGCS + Surface Radar Deployments at Changi)

Honeywell International Inc.

Frequentis AG

Indra Sistemas S.A.

Raytheon Technologies Corporation

ADB SAFEGATE Group

Northrop Grumman Corporation

Ultra Electronics Holdings plc

Searidge Technologies Inc.

Rolta India Limited

Leidos Holdings

Raytheon/RTX (Ground Systems)

Thomson Reuters (Aviation Analytics)

Local Integrators / System Integrators

- Airport IT and cybersecurity teams

- Aviation training institutions

- Regulatory compliance units

- Airport planning and investment divisions

- Ground handling operators

- Emergency response teams

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035