Market Overview

The Singapore Aerobatic Aircraft market is valued at USD ~ million, a result of the growing interest in air sports, leisure flying, and flight training. This market is primarily driven by the expansion of recreational aviation and increasing investments in aviation training infrastructures. Notably, local flight schools and aviation clubs contribute significantly to the demand for aerobatic aircraft, particularly single-engine models designed for aerobatic displays and training. Key growth drivers include government incentives for aviation tourism and airshows, with the Singapore Airshow being a significant event that fosters further investments and visibility in the sector. Additionally, there has been a rise in enthusiasts pursuing private and commercial aerobatic aircraft ownership, bolstered by Singapore’s strategic positioning as a hub for aviation training in Southeast Asia.

Singapore is the dominant player in the Southeast Asian aerobatic aircraft market due to its advanced aviation infrastructure and strategic geographical location. The country benefits from well-established air traffic control systems, aviation laws, and a robust network of flight schools that cater to both local and international clients. Furthermore, Singapore’s commitment to aviation and aerospace development, through initiatives like the Singapore Aerospace Expo and the Singapore Airshow, positions it as a leading destination for aerobatic aircraft. Neighboring countries, such as Malaysia and Thailand, contribute to the market but remain secondary players, relying on Singapore’s aviation ecosystem for training, maintenance, and aircraft sourcing.

Market Segmentation

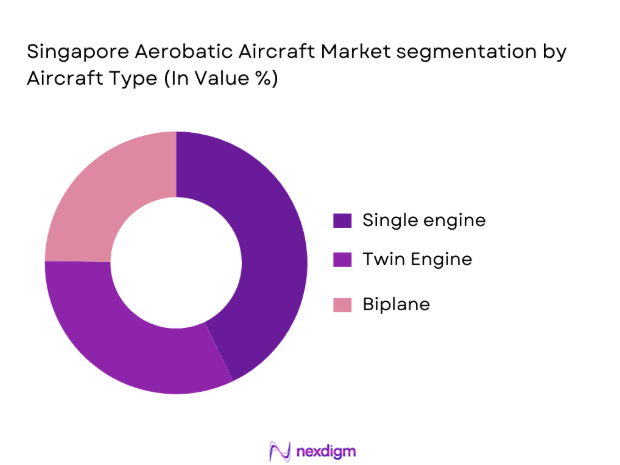

By Aircraft Type

The Singapore Aerobatic Aircraft market is segmented by aircraft type into single-engine, twin-engine, and biplane types. In this segment, single-engine aircraft hold the largest share, driven by their widespread use in aerobatic training and competition events. These aircraft are considered more accessible due to lower acquisition costs and maintenance requirements, making them popular among flight schools, private owners, and aerobatic teams. Brands such as Extra Aircraft and Pitts Special dominate this sub-segment due to their specialized design and performance in aerobatic maneuvers. The biplane sub-segment, while smaller, is gaining popularity due to its vintage appeal and superior handling characteristics for certain types of aerobatic performances.

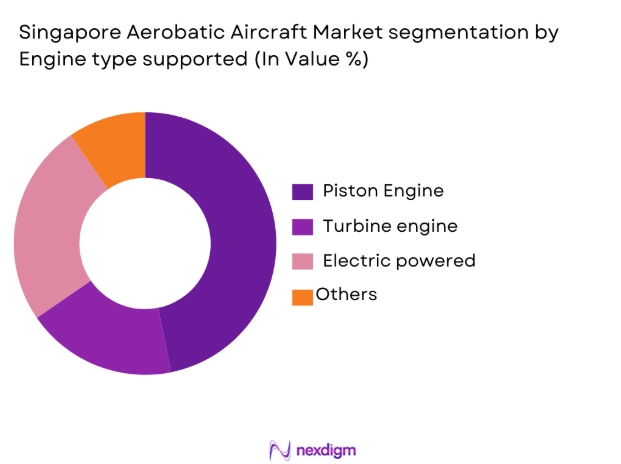

By Engine Type

The engine type segmentation divides the market into piston engines, turbine engines, and electric-powered engines. Piston engines dominate the market, comprising a significant portion of the aerobatic fleet due to their long-established reliability, cost-effectiveness, and ease of maintenance. Piston-powered aerobatic aircraft like the Extra 330 and the Pitts S2 are used widely in competitions and training due to their high-performance capabilities at relatively lower operational costs. Turbine engines are primarily used in higher-end aerobatic aircraft, offering better performance in terms of speed and altitude. The electric-powered engine segment, though nascent, is growing rapidly as technological advances in battery efficiency and green flying solutions continue to take shape.

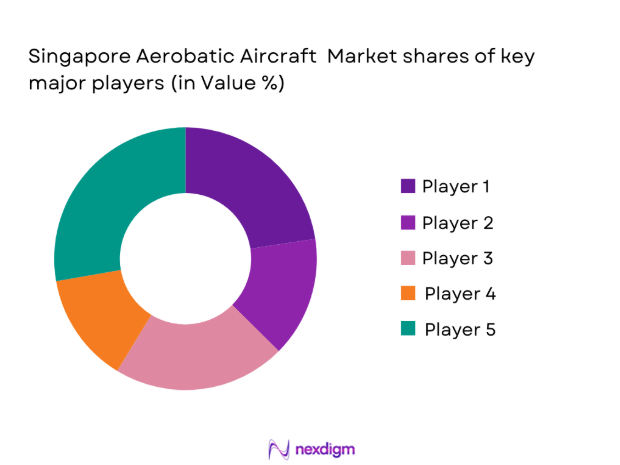

Competitive Landscape

The Singapore Aerobatic Aircraft market is characterized by a mix of local and global players, with a few established companies leading the way. Major players such as Extra Aircraft, Pitts Special, and Zivko Aeronautics dominate the market due to their superior aircraft design, safety features, and longstanding reputation in the aerobatic aircraft segment. These companies are known for offering versatile, high-performance aircraft that are favored by both individual owners and flight schools in Singapore. Additionally, local flight schools such as the Singapore Aviation Academy play a pivotal role in driving demand for aerobatic aircraft as part of their training offerings.

| Company | Establishment Year | Headquarters | Aircraft Type | Engine Type | Market Focus | Training Collaboration |

| Extra Aircraft GmbH | 1982 | Germany | ~ | ~ | ~ | ~ |

| Pitts Special / Aviat | 1944 | USA | ~ | ~ | ~ | ~ |

| Zivko Aeronautics | 1990 | USA | ~ | ~ | ~ | ~ |

| Yakolev (Russia) | 1934 | Russia | ~ | ~ | ~ | ~ |

| Flight Design | 1997 | Germany | ~ | ~ | ~ | ~ |

Singapore aerobatic aircraft Market Analysis

Growth Drivers

Rising Aviation Sports Culture

The growing interest in aviation sports, including aerobatic flying, is supported by rising disposable income and increasing leisure activity participation in Singapore. As per the Singapore Tourism Board, the number of domestic and international visitors attending the Singapore Airshow continues to increase, with over 50,000 attendees in 2023. The International Air Sports Federation (IAF) reports that participation in air sports events is expected to grow, driven by the global increase in sports tourism. Additionally, the Singapore government’s focus on leveraging aviation for tourism is contributing to an increase in both recreational flying and aerobatic sports as part of the country’s overall tourism strategy. According to the World Bank, Singapore’s GDP growth in 2023 was 3.6%, indicating strong consumer spending that supports increased demand for leisure activities like aviation sports.

Improved Affordability & Financing Mechanisms

Affordability in purchasing aerobatic aircraft has significantly improved due to better financing mechanisms. This is evident from data on aviation-related loans offered by Singapore’s OCBC Bank, which have grown by 5% year-on-year since 2022. According to the Monetary Authority of Singapore, the financial sector has seen a rise in loan approvals for personal aviation purposes, largely due to relaxed collateral requirements and increased availability of specialized loans. The overall credit growth in Singapore has accelerated to 6% in 2023, leading to more individuals and small businesses opting for aircraft ownership. This has made aerobatic aircraft more accessible to both private owners and flight schools.

Challenges & Operational Constraints

Airspace Restrictions & Regulatory Barriers

Airspace restrictions in Singapore continue to pose challenges for the aerobatic aircraft sector. In 2023, the Civil Aviation Authority of Singapore (CAAS) imposed stringent regulations on aerobatic flights over densely populated areas, limiting the venues for airshows and training. Singapore’s airspace is one of the most controlled in the world, making it difficult for aerobatic pilots to train or perform outside designated zones. The country’s air traffic volume, which increased by 5% in 2023, also contributes to congestion, further restricting aerobatic operations. These restrictions result in higher operational costs for aerobatic aircraft operators who must navigate the complex regulatory environment.

High Capital Intensity & Maintenance Costs

The high capital costs associated with aerobatic aircraft and the ongoing maintenance requirements continue to be significant barriers to entry. In 2023, the Singapore Airshow noted that the cost of entry-level aerobatic aircraft had increased

by 8% due to rising material costs and global supply chain disruptions. In addition, the Aviation Safety Council of Singapore reports that maintenance costs for aerobatic aircraft are 20-25% higher than for standard aircraft, primarily due to the specialized equipment and rigorous certification required. As a result, many flight schools and small operators face challenges in maintaining a fleet of aerobatic aircraft, limiting the growth potential of smaller businesses.

Opportunities

Expansion of Electric-Powered Aerobatic Aircraft

As the demand for sustainable aviation solutions grows, there is a significant opportunity for the development and adoption of electric-powered aerobatic aircraft in Singapore. Currently, the Singapore government is highly supportive of green technologies, and this is reflected in initiatives such as the Singapore Green Plan 2030, which aims to reduce carbon emissions and encourage the use of electric vehicles, including electric aircraft. The electric-powered aircraft segment, though still emerging, is gaining attention from both private and public sectors. In 2023, the Civil Aviation Authority of Singapore (CAAS) reported a rising interest in hybrid and electric aircraft technologies, which are expected to contribute to cleaner air and quieter operations. Manufacturers focusing on electric aerobatic aircraft are likely to benefit from government incentives, including tax breaks for green technology adoption. With growing support for sustainable aviation and an increasing demand for eco-friendly flying options, electric aerobatic aircraft offer a strong market opportunity in Singapore’s aviation ecosystem.

Rise of Aviation Tourism & International Airshows

Aviation tourism, particularly through events like the Singapore Airshow, presents a significant market opportunity. In 2023, Singapore’s tourism industry reported an influx of international tourists drawn by aviation events, which saw over 50,000 attendees at major airshows. With a strong global reputation for hosting prestigious airshows, Singapore has the potential to further capitalize on aviation tourism by expanding the number of international aeronautic events held in the country. The Singapore government’s push to increase aviation-related tourism through subsidies and marketing initiatives is likely to fuel the demand for aerobatic aircraft, particularly for airshow performances and corporate sponsorships. The expanding aviation tourism sector will create opportunities for both aircraft manufacturers and operators to supply aircraft for demonstrations, exhibitions, and flying experiences. This segment is poised for growth as more countries and aviation enthusiasts flock to Singapore to experience world-class airshows.

Future Outlook

Over the next 5 years, the Singapore Aerobatic Aircraft market is expected to grow steadily, driven by continued government investment in aviation tourism, the increasing popularity of airshows, and growing private sector engagement in aerobatic sports. Additionally, technological advancements in aircraft design and engine types are expected to contribute to the increasing adoption of aerobatic aircraft. Key factors such as environmental concerns and a push for sustainable aviation technologies may also contribute to the rise in electric-powered aerobatic aircraft, albeit at a slower pace. Furthermore, expanding training facilities and the increasing demand for pilot certifications will support growth in the domestic aerobatic aircraft market.

Major Players in the Market

- Extra Aircraft GmbH

- Pitts Special / Aviat Aircraft

- Zivko Aeronautics

- Yakolev (Russia)

- Flight Design

- Pipistrel

- SCHEIBE Aircraft GmbH

- Sukhoi Aviation

- Tecnam

- Honda Aircraft Company

- Icon Aircraft

- Aero Vodochody

- Turbine Aircraft

- Swiss Pilatus

- L-39 Albatros

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore, Ministry of Transport)

- Aerobatic Flight Schools

- Aerospace and Aviation Equipment Manufacturers

- Private Aircraft Owners

- Recreational and Competitive Aerobatic Pilots

- Aviation Event Organizers

- Airshow and Display Teams (Singapore Airshow, AeroExpo Asia)

Research Methodology

Step 1: Identification of Key Variables

In this phase, key market variables related to aircraft types, engine technologies, and distribution networks are identified through an extensive combination of desk research, industry reports, and consultations with experts in the field. This provides an ecosystem map that highlights the critical factors influencing the market.

Step 2: Market Analysis and Construction

Here, historical data, customer behavior, and industry trends are gathered and analyzed. This includes production rates, unit volumes, and pricing structures. The data is cross-verified with primary research findings to ensure accuracy and robustness in the final market estimates.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, hypotheses and models derived from initial research are validated through expert consultations, including interviews with aeronautic engineers, flight instructors, and aircraft manufacturers. This phase ensures that market projections align with real-world trends and industry knowledge.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all collected data to create a comprehensive, market-ready report. This includes data-driven insights, market segmentation, future outlook, and competitive analysis. The result is a validated report that serves as a valuable resource for stakeholders in the Singapore Aerobatic Aircraft market.

- Executive Summary

- Research Methodology & Market Constructs (Market Definition of Aerobatic Aircraft, Data Sources, Estimation Models, Validation Methods, Market Definitions & Core Assumptions, Airframe & Flight System Classification Logic, Aerobatic Market Sizing Approach Units, Shipments, ARR, Value Chain Triangulation Framework

- Aerobatic Market Scope & Boundaries

- Singapore Aviation Ecosystem Architecture

- Singapore’s Aerobatic Airspace Profile & Training Zones

- Role of Government Aviation Bodies

- Influence of Singapore Airshow & Aviation Events on Adoption & Investment

- Growth Drivers

Rising Aviation Sports Culture

Improved Affordability & Financing Mechanisms

Government Tourism Aviation Initiatives

Local Flight Training & Certification Demand - Challenges & Operational Constraints

Airspace Restrictions & Regulatory Barriers

High Capital Intensity & Maintenance Costs

Noise & Environmental Regulations

Skills & Pilot Availability - Market Trends & Innovation Levers

Electric / Hybrid Aerobatic Platforms

Lightweight Composite Adoption

Advanced Avionics & Safety Tech

Simulator‑Led Training Integration - SWOT Analysis

- Porter’s Five Forces

- By Revenue (AED/USD/SGD), 2020-2025

- By Volume (Units Delivered), 2020-2025

- Average Selling Price Trends, 2020-2025

- Unit Production vs Import Trends, 2020-2025

- Aircraft Type (In Value %)

Single-engine

Twin-engine

Biplane

Monoplane

Electric-powered - Application type (In Value %)

Recreational Flying

Competition / Display

Flight Training & Certification

Airshow Contract Operation

Corporate Events - Engine Type (In Value %)

Piston Engine

Turbine Engine

Hybrid / Electric

High-Performance Avionics Platforms

- Market Share & Competitive Positioning

- Cross‑Comparison Parameters (Business Model Focus, Aircraft Performance Benchmarks, Geographic Coverage & Support Footprint, Certification Levels & Compliance History, Innovation Index, After‑Sales & Spares Network Density)

- SWOT Analysis Major Competitors

- Detailed Company Profiles

Extra Aircraft GmbH

Zivko Aeronautics

Pitts Special / Aviat Aircraft

Yakolev

Global Flight Dynamics

Turbine Aerobatic Specialist OEMs

Advanced Flight Systems

Flight Design / Composite Craft Makers

Local Singapore Flight Schools

Asia‑based OEM Distributors

Kitplane Manufacturers

Electric Aerobatic Innovators

Simulator & Training Tech Providers

Aftermarket Maintenance & Parts Firms

Event & Display Operators

- User Purchase Decision Framework

- Utilization Profiles

- Price Sensitivity & Budget Allocation

- Ecosystem‑Specific Regulatory Compliance

- Pain Points & Growth Demand Signals

- Revenue & Volume Forecast, 2026-2035

- Price Trend Projection, 2026-2035

- Best / Base / Cautious Case Models, 2026-2035

- Demand by Segmentation & Geography, 2026-2035