Market Overview

The Singapore aeroengine composites market is valued at approximately USD ~ million in 2025. This growth is primarily driven by increased demand for lightweight materials in aerospace engines, which help improve fuel efficiency and reduce emissions. Technological advancements in composite materials such as carbon fiber and resin systems play a pivotal role in replacing traditional metal components. This demand is driven by the aerospace sector’s continuous push towards more sustainable and efficient aircraft designs, as global aircraft fleets expand to meet increasing air travel demand.

The Singapore aerospace market remains a dominant player in the Asia-Pacific region. As a regional hub for aviation and a center for aerospace R&D, Singapore’s strategic position facilitates access to key markets in Asia and global aviation networks. The Singapore Airshow serves as a platform for showcasing the latest aeroengine technologies and innovations in composite materials. Moreover, Singapore Airlines’ investment in new aircraft is driving the need for high-performance aeroengine composites, establishing the city as a leader in aerospace manufacturing and composite technology.

Market Segmentation

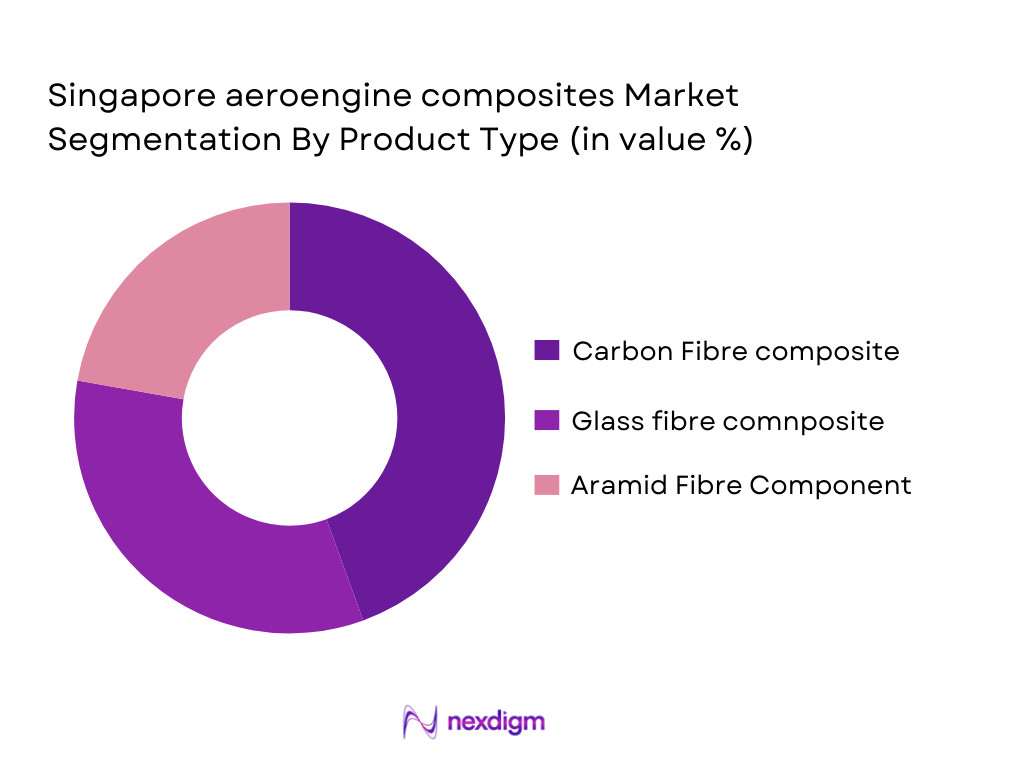

By Product Type

The aeroengine composites market is segmented by product type into carbon fiber composites, glass fiber composites, and aramid fiber composites. Among these, carbon fiber composites hold a dominant market share due to their superior strength-to-weight ratio, which makes them ideal for aerospace applications. These materials are used extensively in engine components such as fan blades and cases, providing improved fuel efficiency and performance. Glass fiber composites, while cheaper, are primarily used in less demanding applications, and aramid fibers are used for their shock-absorbing properties in critical components like engine nacelles.

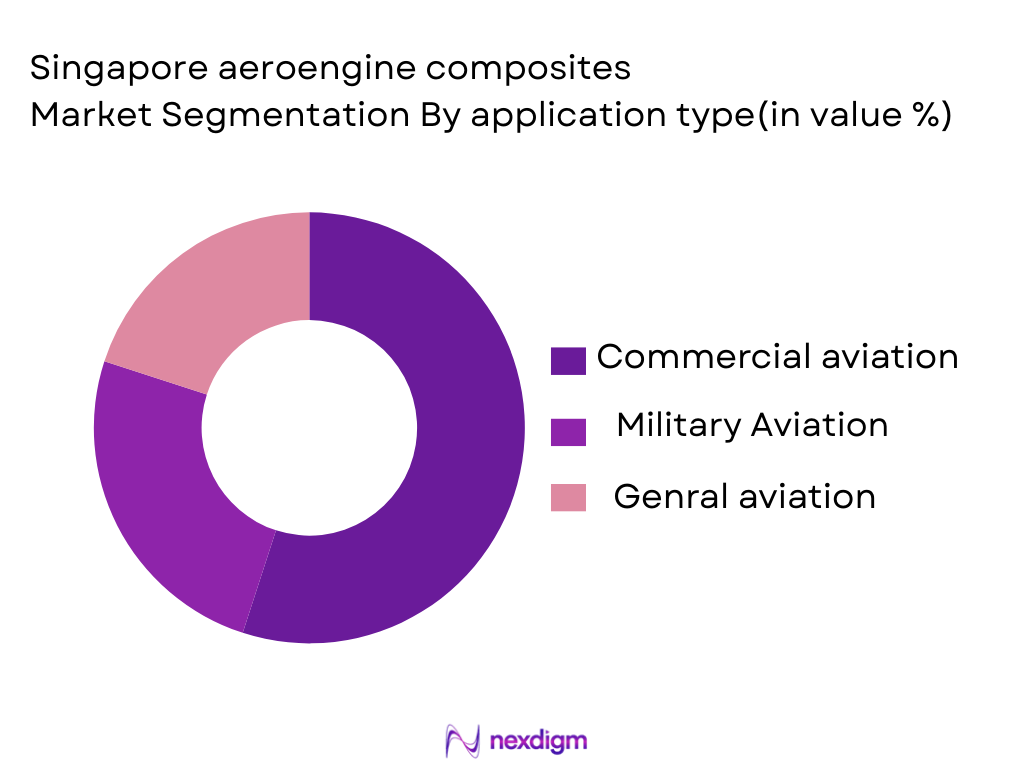

By Application

The aeroengine composites market is also segmented based on applications, which include commercial aviation, military aviation, and general aviation. Commercial aviation dominates this segment due to the growing demand for fuel-efficient aircraft across global fleets. Airlines, particularly Singapore Airlines, invest heavily in advanced composite materials to reduce weight and improve fuel efficiency. The military aviation segment is seeing growth due to the increasing need for advanced composite materials in fighter jets and unmanned aerial vehicles (UAVs). The general aviation segment has smaller demand but is rising as private jet owners seek efficiency upgrades.

Competitive Landscape

The Singapore aeroengine composites market is highly competitive with several global and regional players. Key manufacturers include GE Aviation, Rolls-Royce, and Safran, who have a substantial presence in the market due to their established relationships with major airlines and military clients. Singapore Airlines also plays a crucial role in driving demand by incorporating the latest composite technology into its aircraft. Local manufacturers like Singapore Technologies Aerospace are capitalizing on the growing demand for composite components through strategic partnerships with international aerospace companies. The consolidation of large players within the aerospace supply chain highlights the significant role of key companies in influencing the overall market landscape.

| Company | Year Established | Headquarters | Revenue (USD) | Market Focus | Key Partnerships |

| GE Aviation | 1917 | Cincinnati, USA | ~ | ~ | ~ |

| Rolls-Royce | 1906 | Derby, UK | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ |

| Singapore Technologies Aerospace | 1979 | Singapore | ~ | ~ | ~ |

| United Technologies (Collins Aerospace) | 1934 | Farmington, USA | ~ | ~ | ~ |

Singapore Aeroengine Composites Market Analysis

Growth Drivers

Increasing Fleet of Aircraft

The growth in the global fleet of commercial and military aircraft is a key driver for the aeroengine composites market. As of 2023, global aircraft deliveries were expected to rise by 5.2%, reaching 1,500 aircraft globally. This surge in fleet expansion results in a higher demand for composite materials, which are crucial for reducing aircraft weight and improving fuel efficiency. The increased aircraft demand is particularly evident in Asia, where countries like Singapore and China are investing heavily in aviation infrastructure, directly contributing to the growth of the aeroengine composites market

Advancements in Lightweight Materials

Technological advancements in lightweight composite materials are driving demand in the aeroengine sector. Composites such as carbon fiber and glass fiber offer significant weight reduction, leading to improved fuel efficiency. The adoption of advanced composite materials for both engine components and airframes is increasing, driven by continuous R&D and innovations. For example, Singapore Airlines is using advanced composites in its new aircraft models, showcasing the importance of lightweight materials in meeting both environmental and performance standards.

Market Challenges

High Composite Material Costs

Despite the benefits, the high costs of composite materials pose a significant challenge for manufacturers in the aeroengine market. As of 2024, carbon fiber production costs are approximately USD 25 per kilogram, much higher than traditional metal alloys. This cost discrepancy limits the widespread adoption of advanced composites, especially in markets where cost-efficiency is a priority. The challenge is particularly pronounced in emerging markets, where companies are hesitant to invest in expensive composites for low-cost aircraft models, potentially slowing market growth.

Sustainability & Recycling Issues

Sustainability remains a critical challenge in the use of aeroengine composites. While composites significantly improve fuel efficiency, their recycling processes are complex and costly. Most composite materials, including carbon fiber, are not easily recyclable, creating environmental concerns as aircraft reach the end of their lifecycle. Regulatory frameworks in the EU and Asia are tightening, pushing for more sustainable practices in the aerospace industry. The high recycling cost and limited reusability of these materials create an urgent need for breakthroughs in composite recycling technologies.

Opportunities

Strong R&D Investments in Composites

Ongoing research and development investments in composite materials offer significant opportunities for the aeroengine composites market. Companies are investing heavily in innovative materials, including thermoplastic composites, which offer faster processing times and lower costs compared to traditional thermoset composites. With Singapore investing significantly in aerospace R&D, public-private partnerships have been central to driving new material developments. The demand for more efficient, lightweight, and environmentally friendly materials continues to rise, creating growth opportunities for advanced composites in aerospace.

Expansion of Singapore Airlines’ Fleet

The expansion of Singapore Airlines’ fleet is one of the key growth opportunities for the aeroengine composites market. Singapore Airlines plans to increase its fleet size by 10-15% over the next 5 years, which includes the purchase of new aircraft that incorporate advanced composite materials for better fuel efficiency and performance. This expansion has led to a significant increase in the demand for aeroengine composites, particularly for aircraft structures and engine components. As the airline grows, composite materials become integral in meeting both performance and environmental objectives.

Future Outlook

Over the next decade, the Singapore aeroengine composites market is expected to experience continued growth, driven by advancements in material science and aerospace innovation. As the global fleet of commercial aircraft continues to grow, there will be a significant demand for lighter, stronger composite materials that help improve fuel efficiency and reduce emissions. Moreover, the rising emphasis on environmentally sustainable aviation will create new opportunities for manufacturers to develop eco-friendly composite materials. Investment in R&D by both government bodies and private players will further support the growth of this market.

Major Players

- GE Aviation

- Rolls-Royce

- Safran

- Singapore Technologies Aerospace

- United Technologies (Collins Aerospace)

- Honeywell Aerospace

- Pratt & Whitney

- Mitsubishi Heavy Industries

- Lufthansa Technik

- Boeing

- Airbus

- Teledyne Technologies

- GKN Aerospace

- Spirit AeroSystems

- Nordam

Key Target Audience

- Aerospace Manufacturers

- Military Contractors

- Government and Regulatory Bodies (Singapore Ministry of Defence, Civil Aviation Authority of Singapore)

- Aircraft Fleet Operators

- Aircraft Maintenance Providers

- Composite Material Suppliers

- Investments and Venture Capitalist Firms

- R&D and Technology Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves the construction of an ecosystem map, identifying all major stakeholders within the Singapore aeroengine composites market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to define and map out the critical variables influencing market dynamics, such as technological advancements, material costs, and regulatory factors.

Step 2: Market Analysis and Construction

During this phase, historical data will be compiled and analyzed to understand the market’s growth trajectory. This includes assessing the penetration of composite materials in aeroengine manufacturing and determining revenue generation from various sectors. Additionally, service quality statistics will be evaluated to ensure the accuracy of revenue estimates and market trends, focusing on regional developments like Singapore’s aerospace hub and Asian airline expansions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed will be validated by conducting in-depth consultations with industry experts. These will involve interviews with senior executives from leading aerospace companies and materials suppliers. Expert feedback will be critical in refining market data, enhancing the accuracy of revenue forecasts, and understanding evolving trends in aeroengine composites.

Step 4: Research Synthesis and Final Output

In the final phase, multiple manufacturers and developers will be directly engaged to acquire detailed insights into the use of composites in aeroengine parts. This process ensures that the findings derived from a bottom-up approach align with the real-world data provided by key market players. The final output will offer a comprehensive, validated analysis of the Singapore aeroengine composites market, factoring in all stakeholder perspectives.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Fleet of Aircraft

Advancements in Lightweight Materials

Expanding Military Expenditure - Market Challenges

High Composite Material Costs

Sustainability & Recycling Issues

Supply Chain Disruptions - Opportunities

Strong R&D Investments in Composites

Expansion of Singapore Airlines’ Fleet - Trends

Adoption of Hybrid and Sustainable Materials

Growth in Commercial Aircraft Demands - Government Regulation

Aviation Safety Standards

Import Tariffs and Duties - Singapore Aeroengine Composites

- SWOT Analysis

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Composite Type (In Value %)

Carbon Fiber Reinforced Polymer (CFRP)

Glass Fiber Reinforced Polymer (GFRP)

Aramid Fiber Composites

Other Advanced Composites - By Application (In Value %)

Commercial Aircraft

Military Aircraft

Helicopters

UAVs (Unmanned Aerial Vehicles) - By End-User (In Value %)

OEM (Original Equipment Manufacturer)

MRO (Maintenance, Repair & Overhaul) - By Region (In Value %)

Central Region

Southern Region

Eastern Region

Western Region - By Distribution Channel (In Value %)

Direct Sales

Distributors & Suppliers

Online Channels

- Market Share by Composite Type Segment

- Cross Comparison Parameters (Product Portfolio Breadth, Composite Materials Efficiency, Regulatory Approvals, Distribution Footprint, Manufacturing & Localization Capabilities, R&D Investment, Strategic Partnerships, Technological Advancements)

Detailed Profiles of Major Companies

Toray Industries

Solvay

Hexcel Corporation

SGL Carbon

Mitsubishi Chemical Advanced Materials

Hexcel Corporation

Toray Industries, Inc.

Mitsubishi Chemical Group Corporation

Solvay S.A.

Teijin Limited

SGL Carbon SE

Spirit AeroSystems

Collins Aerospace

FDC Composites

Avior Integrated Product

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035