Market Overview

The Singapore air crane helicopter market is valued at approximately USD ~ million, primarily driven by the continuous demand from offshore oil & gas operations, urban infrastructure projects, and emergency response needs. With the country’s strategic location in the Southeast Asian region, Singapore has been a hub for oil and gas operations in the region, requiring advanced helicopter services for the transportation of crew and equipment to offshore rigs. Moreover, the expansion of mega infrastructure projects and increasing natural disasters have further fueled the need for specialized air crane helicopter services. The market’s growth is directly tied to these sectors, with expectations for continued demand over the coming years.

Singapore’s dominance in the air crane helicopter market is due to its strategic location as a leading financial and industrial hub in Southeast Asia. As a key player in the global oil and gas sector, it benefits from continuous offshore oil exploration and extraction activities in the South China Sea. Additionally, Singapore’s well-established infrastructure, including one of the busiest ports in the world, drives demand for construction and heavy-lift helicopter services. The government’s commitment to urban development and disaster preparedness also ensures that air crane helicopters are critical for both planned and emergency services, further solidifying the country’s market position.

Market Segmentation

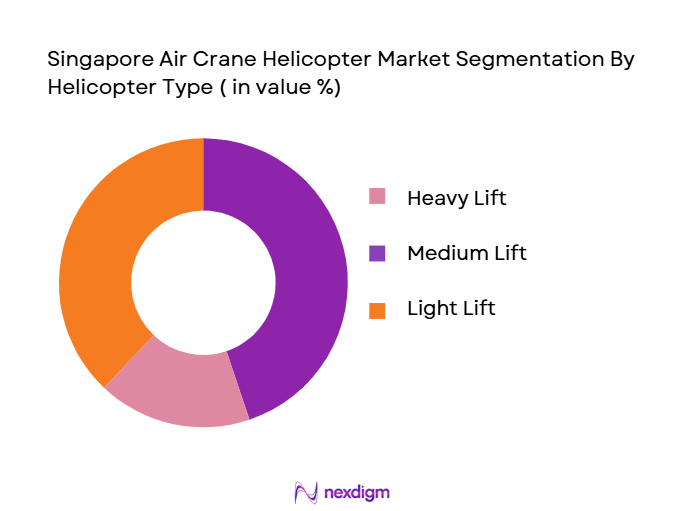

By Helicopter Type

The market is segmented by helicopter type into heavy-lift, medium-lift, and light-lift helicopters. The heavy-lift segment dominates the market, as these helicopters are crucial for offshore oil and gas support, as well as large-scale infrastructure projects. The demand for heavy-lift helicopters is driven by their ability to transport large and heavy cargo, such as industrial equipment, and to service oil rigs located far offshore. These helicopters, like the Sikorsky S-92 and CH-47 Chinook, provide unmatched lifting capacity, which is essential for the complex and heavy-duty operations that characterize Singapore’s industrial and oil sectors. The preference for heavy-lift helicopters is expected to remain strong, as infrastructure and offshore activities continue to expand.

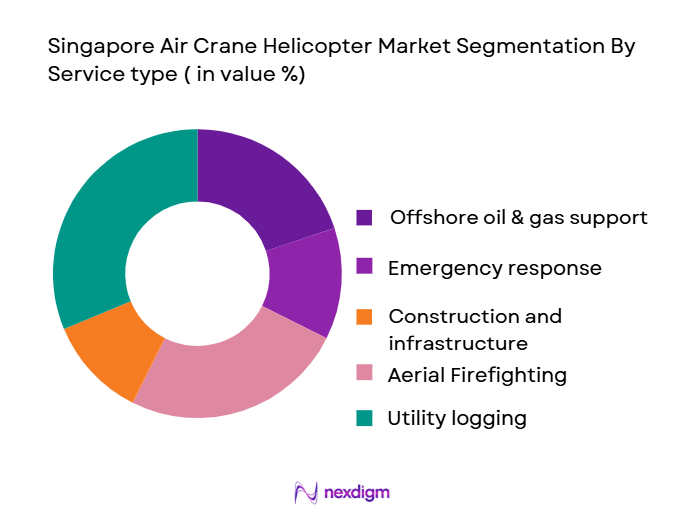

By Service Type

The market is segmented by service type into offshore oil & gas support, construction & infrastructure, emergency & disaster response, utility services, and aerial firefighting. Offshore oil & gas support is the dominant service type, as Singapore is a leading player in the offshore oil exploration industry. With the region’s extensive offshore oil platforms, the demand for heavy-lift helicopters to transport equipment and personnel to and from these sites is consistently high. Additionally, these helicopters are essential for maintaining operations in remote offshore locations where other transportation methods are impractical. The ongoing demand for offshore services is expected to continue, reinforcing the dominance of this service type in the market.

Competitive Landscape

The Singapore air crane helicopter market is dominated by a mix of global and regional players. Major players like Sikorsky Aircraft, Airbus Helicopters, and Bell Helicopter hold significant market share due to their established presence in the region and their ability to offer advanced and reliable heavy-lift helicopters. The competitive landscape is also influenced by local operators such as Changi Aviation and Heliconia Helicopters, who provide specialized services tailored to Singapore’s unique operational needs. The market’s high entry barriers, such as regulatory requirements and high capital costs, mean that only a few key players dominate the landscape.

| Company Name | Establishment Year | Headquarters | Fleet Size | Service Type | Safety Standards Compliance | Market Focus |

| Sikorsky Aircraft | 1923 | USA | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | USA | ~ | ~ | ~ | ~ |

| Changi Aviation | 2000 | Singapore | ~ | ~ | ~ | ~ |

| Heliconia Helicopters | 2005 | Singapore | ~ | ~ | ~ | ~ |

Singapore Air Crane Helicopter Market Analysis

Growth Drivers

Offshore Oil & Gas Support

Singapore is a major regional hub for maritime and energy logistics, with marine fuel sales at the world’s largest bunker hub reaching ~ million metric tons, up from ~ million tons, reflecting intense vessel movement and offshore support activity. The Maritime and Port Authority reports ~ billion gross tons of vessel arrival tonnage, indicating extensive offshore operations that require aerial logistics support, particularly for oil and gas platform servicing, crew changes, and equipment lifts where sea transit is impractical. Helicopter heavy‑lift capabilities are utilized to connect offshore rigs with Singapore’s port infrastructure and support regional energy supply chains.

Mega Infrastructure Projects

Singapore’s transport sector is highly active, with ~ aircraft landings recorded in combined civil aviation statistics, underscoring robust aviation activity and infrastructure utilization. Major expansion projects including Changi Airport enhancements and regional connectivity works elevate demand for specialized lift services. The city‑state’s GDP of USD ~ billion and growth momentum provide financial capacity for complex projects requiring helicopters for construction logistics such as tower erection, heavy equipment placement, and remote site access. These mega infrastructure needs directly feed into the adoption of air crane helicopters for efficient project execution.

Market Challenges

High Operational and Capital Costs

Air crane helicopter operations involve significant fixed and variable costs. Acquiring heavy‑lift helicopters such as CH‑47 or Sikorsky S‑92 class variants involves multimillion‑dollar capital outlays, while ongoing aviation fuel, maintenance, and logistics escalate expenditure in a national economy where aviation transport statistics show nearly ~aircraft landings annually, reflecting substantial utilization demands on support infrastructure. These operational demands require robust financial backing and restrict market entry to well‑capitalized operators able to sustain continuous maintenance and regulatory compliance.

Skilled Workforce Shortage

Singapore’s aviation workforce has recovered to pre‑pandemic staffing levels, yet the specialized nature of heavy‑lift helicopter pilots and support crew remains a constraint. The aviation sector restoration acknowledged workforce rebuilding as critical, but advanced heavy‑lift rotorcraft operations demand niche skills beyond standard aviation crew certification. This gap can slow service delivery and fleet utilization. The broader civil aviation context underscores the need for focused training and workforce development to sustain high‑intensity operational deployment of air crane services.

Opportunities

Technological Advancements in Lift Systems

Technological innovation in rotorcraft design, materials science, and avionics presents growth opportunities for Singapore’s air crane helicopter market. With GDP at USD ~ billion and strong digital infrastructure, operators can invest in advanced lift systems that improve payload efficiency and operational range. Technologies such as lighter composite structures, enhanced autopilot systems, and precision load management interfaces increase mission capability and safety margins for offshore and urban logistics tasks. These capabilities support expanding service portfolios in a high‑demand aviation hub.

Market Expansion into Southeast Asia and Regional Offshore

Singapore’s strategic location and robust aviation infrastructure enable operators to extend services across Southeast Asia’s offshore landscapes. The Asia Pacific helicopter market was valued at USD ~ billion overall, indicating regional reliance on aerial services for oil & gas, medical evacuation, and disaster response. Singapore-based operators are well‑positioned to capture regional contracts, leveraging cross‑border connectivity and the city‑state’s status as a transport and logistics hub to serve neighboring markets with specialized air crane capabilities.

Future Outlook

Over the next decade, the Singapore air crane helicopter market is expected to show steady growth driven by continuous government support for infrastructure development, advancements in helicopter technology, and increasing demand for eco-friendly lift solutions. The expansion of Singapore’s offshore oil & gas industry, along with significant construction projects in the region, will continue to provide opportunities for helicopter service providers. Additionally, technological advancements in hybrid and electric propulsion systems are likely to play a key role in shaping the future of the market by reducing operational costs and increasing the efficiency of helicopter services.

Major Players in the Market

- Sikorsky Aircraft

- Airbus Helicopters

- Bell Helicopter

- Changi Aviation

- Heliconia Helicopters

- Bristow Group

- Erickson Incorporated

- Columbia Helicopters

- Kaman Corporation

- Lockheed Martin

- Textron Aviation

- Russian Helicopters

- Global Helicopter Service

- Gulf Helicopters

- ERA Helicopters

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Oil & Gas Operators

- Infrastructure Development Companies

- Emergency Response Agencies

- Construction Contractors

- Helicopter Service Operators

- Insurance Firms

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key variables that influence the Singapore air crane helicopter market, including demand from the offshore oil & gas sector, construction projects, and emergency services. Secondary research sources, such as government reports and industry data, will be used to outline these variables and their impact on market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the Singapore air crane helicopter market will be analyzed. The focus will be on assessing demand from different sectors, the fleet size of service providers, and the growth of helicopter service requirements across various industries. Revenue and utilization trends will also be examined to validate market size estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through consultations with industry experts, including helicopter operators, government regulators, and oil & gas industry professionals. These consultations will provide insights into market challenges, operational practices, and financial dynamics, helping to refine the market outlook.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data collected from primary and secondary sources to produce a comprehensive market analysis. This will include detailed profiles of key players, SWOT analysis, and projections for future market trends. The output will be a thorough and validated market report that reflects the latest industry developments and future growth prospects.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview Timeline of Major Players

- Supply Chain and Value Chain Analysis

- Growth Drivers

Offshore Oil & Gas Support

Mega Infrastructure Projects

Urbanization and Expansion

Climate Change and Disaster Response Needs - Market Challenges

High Operational and Capital Costs

Skilled Workforce Shortage

Regulatory Compliance and Aviation Safety - Trends

Adoption of IoT and AI for Predictive Maintenance

Integration with Smart City Initiatives

Hybrid and Electrification Technologies - Opportunities

Technological Advancements in Lift Systems

Market Expansion into Southeast Asia and Regional Offshore

Fleet Modernization and Diversification - Government Regulations

Civil Aviation Authority Standards and Safety Regulations

Environmental Compliance for Aviation Operations

Localized Regulations on Offshore Operations - SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Helicopter Type (In value%)

Heavy-Lift

Medium-Lift

Light-Lift - By Service Type (In value%)

Offshore Oil & Gas Support

Construction & Infrastructure

Emergency & Disaster Response

Utility

Aerial Firefighting - By Region (In value%)

Central Singapore

Offshore

Residential Areas

Urban Expansion Zones - By Fleet Ownership Model (In value%)

Owned

Leased

Wet-Leased - By Lift Capacity (In value%)

Up to 5,000 kg

5,001-10,000 kg

Above 10,000 kg

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Revenue, Fleet Size, Safety Standards, Customer Touchpoints, Distribution Channels)

- SWOT Analysis of Key Players

- Pricing Analysis for Helicopter Service Providers

- Detailed Profiles of Major Companies

Erickson Inc.

Sikorsky Aircraft (a Lockheed Martin company)

Kaman Aerospace

Russian Helicopters / Rostvertol

Airbus Helicopters

Boeing Rotorcraft Systems

Leonardo Helicopters

Bell Helicopter

Lockheed Martin

Northrop Grumman

Aerospace Industrial Development Corporation (AIDC)

Helibras

Hindustan Aeronautics Limited (HAL)

SAAB AB

Korea Aerospace Industries (KAI)

- Market Demand and Utilization Trends

- Key Purchasing Drivers (Cost, Performance, Service Reliability)

- Budget Allocation and Financial Analysis of Operators

- Regulatory and Compliance Considerations

- Decision-Making Process for Fleet Acquisition

By Value, 2026-2035

By Volume, 2026-2035

By Average Price, 2026-2035