Market Overview

The Singapore Airborne SATCOM market is valued at approximately USD ~ million in 2025, with steady growth anticipated in the coming years. The market is primarily driven by the increasing demand for in‑flight connectivity, advancements in satellite technology, and Singapore’s strategic positioning in the Asia-Pacific as a major aviation hub. Airborne SATCOM systems offer critical communication capabilities, including high-speed internet, real-time data transmission, and secure communications for both commercial and defense applications. This market’s growth is further fueled by the rise in passenger traffic, expansion of the aerospace industry, and the increasing reliance on satellite communication for military and ISR (Intelligence, Surveillance, and Reconnaissance) operations.

Singapore is the dominant player in the Southeast Asian Airborne SATCOM market, driven by its strategic location as a global aviation hub and its strong governmental support for technological advancements. The city-state is home to major airports like Changi, which facilitates a high volume of both passenger and cargo flights, creating a robust demand for reliable SATCOM systems. Other dominant countries in the region, such as Japan and South Korea, also play significant roles due to their advanced aerospace and defense sectors. These countries benefit from strong governmental policies supporting innovation and infrastructure development in satellite communication.

Market Segmentation

By Installation Type

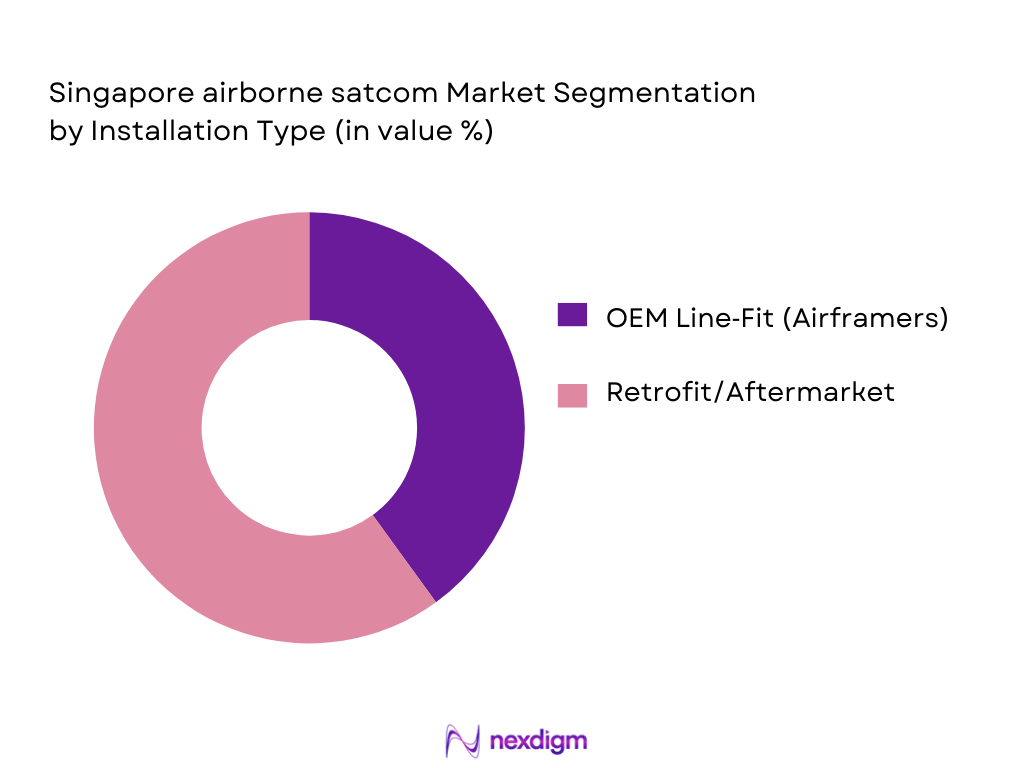

The Singapore Airborne SATCOM market is segmented by installation type into OEM line‑fit and retrofit/aftermarket solutions. OEM line‑fit involves the integration of SATCOM systems directly into new aircraft during production, while retrofit solutions cater to older fleets seeking system upgrades. Retrofit systems hold a dominant share in this segment as commercial airlines and defense operators prioritize upgrading existing fleets with advanced communication capabilities to meet growing data demands. As fleet modernization efforts increase, retrofit solutions are expected to continue leading the market.

By Platform Type

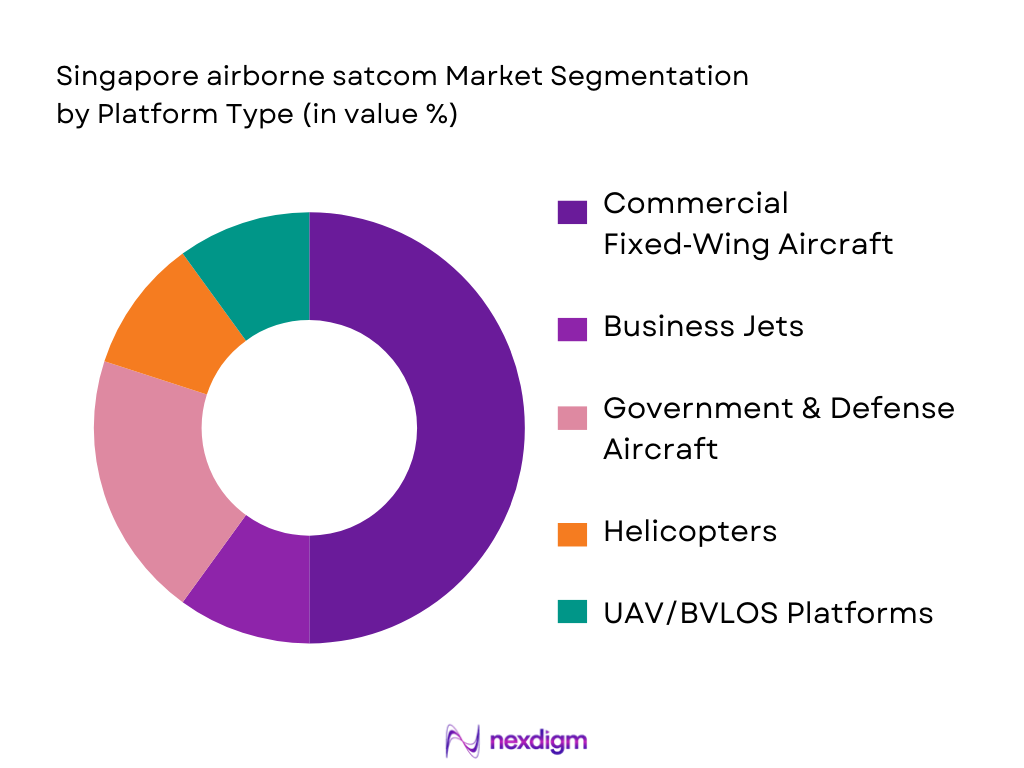

The market is further segmented by platform type, which includes commercial fixed‑wing aircraft, business jets, government & defense aircraft, helicopters, and UAV/BVLOS platforms. Among these, commercial fixed‑wing aircraft dominate the market share, primarily due to the growing demand for in‑flight broadband connectivity among passengers. The significant rise in air travel and increasing passenger expectations for connectivity have driven airlines to prioritize SATCOM integration in their fleets. Additionally, the strong presence of major airline hubs in Singapore and the region supports the widespread adoption of SATCOM systems in commercial aviation.

Competitive Landscape

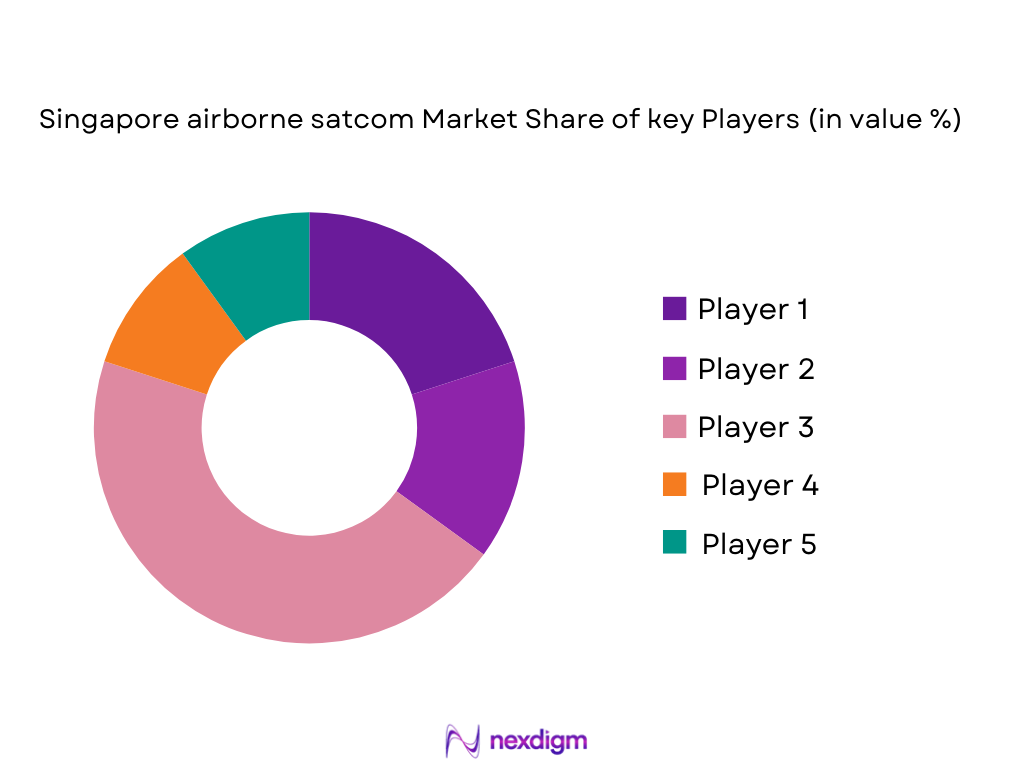

The Singapore Airborne SATCOM market is dominated by a few key players, including both global aerospace companies and local satellite communication providers. These companies offer a wide range of services, including high-throughput satellites (HTS), Ka-band, Ku-band, and L-band services, ensuring seamless communication for both commercial and defense applications. The market is highly competitive, with established companies like Inmarsat, Honeywell, and Collins Aerospace leading the charge in technological innovation and market penetration. The presence of these global players, combined with local companies, creates a robust competitive environment that continues to drive advancements in the market.

| Company | Establishment Year | Headquarters | Key Products | Technology Focus | Service Type | Target Market |

| Inmarsat | 1979 | London, UK | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | Charlotte, NC, USA | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, NC, USA | ~ | ~ | ~ | ~ |

| Viasat | 1986 | Carlsbad, CA, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

Singapore Airborne SATCOM Market Analysis

Growth Drivers

Urbanization

Urbanization is a key driver for the Singapore Airborne SATCOM market as the demand for air travel and in-flight connectivity increases with a growing urban population. As of 2025, Singapore’s urban population is estimated to be over ~ million, with rapid growth in passenger traffic, projected to exceed ~ million. Rapid urbanization is also spurred by infrastructural developments in cities and growing international connectivity. With greater disposable income and an increase in business and leisure travel, Singapore’s urbanization supports the increasing need for advanced satellite communications in aviation, particularly in commercial aircraft for both passenger and operational needs.

Industrialization

Industrialization plays a significant role in the demand for airborne SATCOM solutions, especially in defense and logistics sectors. In Singapore, the manufacturing industry contributes to about ~ % of GDP, with key sectors such as electronics and aerospace manufacturing seeing continuous growth. The expansion of these industries increases the reliance on secure, efficient communications, particularly for defense and logistics operations that rely on real-time data transmission for operational excellence. The industrial growth and continuous development of the aerospace sector, with the government’s support, strengthen the need for advanced satellite communication systems. Source: Singapore Ministry of Trade and Industry

Restraints

High Initial Costs

The high initial costs of deploying Airborne SATCOM systems are a significant restraint for market growth. The price of satellite communication equipment for aircraft, including terminal devices and ground infrastructure, can be substantial, with some advanced systems costing millions of dollars. The cost of installing such systems is often prohibitive for smaller airlines and operators, limiting the widespread adoption of satellite communication systems in the aviation industry. With airline operating costs continuing to rise, the investment in SATCOM technology is a financial hurdle, despite the growing demand for connectivity. Source: International Air Transport Association (IATA).

Technical Challenges

Technical challenges, particularly in the areas of signal interference, bandwidth limitations, and latency, remain a significant barrier for the Airborne SATCOM market. With growing air traffic, maintaining a stable and high-quality signal while minimizing latency is a constant challenge. The transition from traditional geostationary satellites to Low Earth Orbit (LEO) satellites has brought new complexities in terms of integration and service continuity across global regions. Moreover, integration issues with existing aircraft systems and compliance with evolving aviation regulations make it harder to implement seamless SATCOM systems.

Opportunities

Technological Advancements

Technological advancements in satellite systems present a major opportunity for the growth of the Airborne SATCOM market. The development and deployment of High Throughput Satellites (HTS), Low Earth Orbit (LEO) satellites, and Software-Defined Radios (SDRs) are enhancing the performance, bandwidth, and coverage of airborne SATCOM systems. In 2025, the launch of new HTS by major satellite operators significantly boosted global connectivity and will continue to support high-demand aviation markets like Singapore. The potential for LEO satellites to offer lower latency and better connectivity opens up new markets, especially in regions with limited infrastructure. Source: European Space Agency (ESA)

International Collaborations

International collaborations in satellite communications are a promising opportunity for the Singapore Airborne SATCOM market. Singapore’s strategic location as a global aviation hub and its strong ties with other countries in the ASEAN region create opportunities for joint ventures and collaborative satellite communication initiatives. Partnerships with global satellite operators, such as the collaboration between SES Networks and Thales for airborne solutions, are expected to enhance satellite coverage and connectivity solutions across Asia-Pacific. As international air travel continues to grow, such collaborations will be pivotal in expanding the market’s reach and improving connectivity infrastructure.

Future Outlook

The Singapore Airborne SATCOM market is expected to continue its strong growth trajectory over the next five years, driven by technological innovations in satellite communication and the ever‑increasing demand for high‑speed, secure in‑flight connectivity. As Singapore solidifies its position as a global aviation hub, the demand for advanced SATCOM solutions will escalate, particularly in the commercial and defense sectors. The rise of low Earth orbit (LEO) satellites, offering enhanced connectivity at lower latency, is also expected to contribute to the market’s future growth. With emerging opportunities in the UAV and defense sectors, the market is poised for significant advancements.

Major Players in the Singapore Airborne SATCOM Market

- Inmarsat

- Honeywell

- Collins Aerospace

- Viasat

- Thales Group

- L3Harris Technologies

- General Dynamics Mission Systems

- Northrop Grumman

- ST Engineering

- Astronics

- Cobham Aerospace Communications

- Gilat Satellite Networks

- Iridium Communications

- SES Networks

- Intelsat

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore, Ministry of Defense Singapore)

- Aerospace OEMs (Airbus, Boeing)

- Satellite Communication Providers

- Commercial Airlines (Singapore Airlines, Scoot)

- Military Aviation Units

- Aerospace & Defense Contractors

- UAV Service Providers

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process is to develop a comprehensive market map, identifying the stakeholders in the Singapore Airborne SATCOM market. This includes manufacturers, satellite service providers, aviation authorities, and commercial airlines. Desk research from credible secondary sources forms the foundation for identifying key market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

We will analyze historical data to gauge the market penetration of SATCOM systems across different aviation segments, evaluating the demand for both hardware and bandwidth services. A bottom‑up approach will be adopted to estimate the market size based on the number of platforms equipped with SATCOM.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, hypotheses about the market’s future growth are tested through interviews with key experts, including aerospace engineers, airline executives, and defense industry leaders. These consultations will provide critical insights into the challenges faced by operators and future market trends.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing data from all sources, including interviews and market analyses, into a comprehensive report. Detailed profiles of major companies and a clear market forecast will be provided to give clients a complete view of the Singapore Airborne SATCOM market.

- Executive Summary

- Research Methodology (Market Definitions & Singapore Aviation Connectivity Assumptions, Abbreviation Matrix, Market Sizing & Forecasting Approach, Multi‑Source Data Validation (Gov, ICAO‑Reg, Operator Data), Airborne SATCOM Market KPIs (Installed Base, ARPU, Bandwidth Utilization), Primary Research (Airline Heads, Defense SATCOM Leads, Tier‑1 Integrators), Limitations)

- Definition and Scope

- Market Genesis and Singapore Connectivity Imperatives

- Strategic Role in National Aviation & Defense Communications

- Sector Life Cycle Mapping

- Value Chain & Supply Chain Analysis

- Growth Drivers

In‑flight Broadband Demand & Passenger Experience Metrics (Bandwidth per Seat, Uptime Targets)

Government & Defense Secure SATCOM Requirements

UAV/BVLOS Connectivity for ISR & Logistics

Multi‑Orbit Adoption (GEO/LEO/MEO Hybrid) [Network Integration Demand] - Market Restraints

Regulatory Spectrum Allocation & ICAO Coordination

Cost of Antenna Retrofits & Bandwidth ARPU Pressure - Market Opportunities

LEO/MEO Bandwidth Sourcing for Low‑Latency Connectivity

Software Defined Radios (SDR) & Flat‑Panel SATCOM Deployments - Market Trends

Integrated SATCOM + 5G/Onboard Connectivity Convergence

Commercial & Defense SATCOM Service Tier Innovation

Regulatory & Standards Environment

CAAS Licensing/NOC Requirements

Aviation & Cybersecurity Certification for SATCOM - Singapore Market SWOT

- Singapore Airborne SATCOM Ecosystem Stakeholders

- Porter’s Five Forces

- Strategic Outlook

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Installation Type (In Value %)

OEM Line‑Fit (Airframers)

Retrofit/Aftermarket (Fleet Upgrade)

Platform OEM Partnerships - By Platform Type (In Value %)

Commercial Fixed Wing

Business Jets

Government & Defense Aircraft

Helicopters

UAV/BVLOS Platforms - By Frequency Band (In Value %)

L‑Band (Resilient Link)

Ku‑Band (Broadband)

Ka‑Band (High Throughput)

Multi‑Band Configuration - By Component Type (In Value %)

SATCOM Terminals

Antennas & Radomes

Transceivers & Amplifiers

Modems/Routers

SDR Modules - By End‑User Sector (In Value %)

Commercial Aviation Connectivity

Government/Defense SATCOM

UAV/ISR Missions

Emergency Services & HEMS

- Market Share by Revenue & Units (Local Contracts + Service Revenues)

- Cross Comparison Parameters (Product/Terminal Portfolio Breadth (Bands Supported), Regional Service Footprint (Global Coverage), Secure SATCOM Capabilities (Encryption/Resilience), Network Performance Benchmarks (Latency, Throughput), Aftermarket Support & SLA Terms, Pricing Strategy & Contract Models, Local Partnerships/Integrator Engagements, Regulatory Compliance & Certification Leadership)

- Competitor SWOT

- Pricing & Service Tier Benchmark (Per Band, Per Service SLA)

- Detailed Company Profiles

Inmarsat (Global SATCOM Services, Aviation Broadband)

Honeywell International (JetWave & VersaWave SATCOM Platforms)

Collins Aerospace (Raytheon)

Viasat Inc.

L3Harris Technologies

Thales Group

Cobham Aerospace Communications

General Dynamics Mission Systems

BAE Systems SATCOM Solutions

Northrop Grumman SATCOM

Astronics Corporation

ASELSAN A.S.

Orbit Communications Systems Ltd.

ST Engineering (Aerospace Comms)

Local Systems Integrators & Resellers

- Operational Demand Metrics

- Budgeting & Procurement Criteria (CapEx/OpEx for Airlines & Government)

- Technical Requirements & Pain Points (Latency, QoS, Coverage)

- Decision‑Making Process — Airline & Defense Buyers

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035