Market Overview

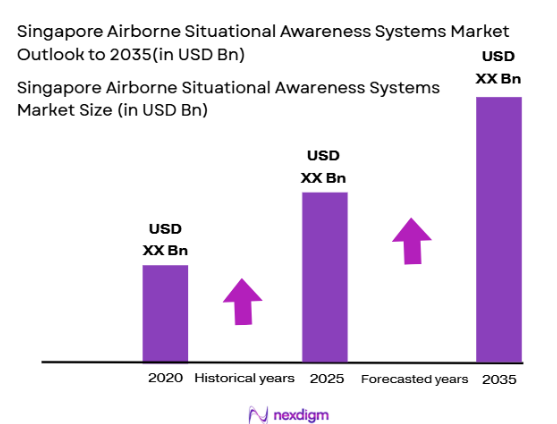

The Singapore Airborne Situational Awareness Systems market is valued at USD ~billion in 2024. The market has been significantly driven by technological advancements in radar, sensor integration, and real-time data analytics. Moreover, government initiatives to modernize defense systems and the increasing demand for surveillance technologies in both military and civil aviation are contributing to the market’s expansion. Investments in UAVs and other advanced platforms have further accelerated market growth.

Singapore is at the forefront of the Airborne Situational Awareness Systems market due to its strategic location and strong military presence. The city-state’s significant investments in defense technology and robust aviation industry contribute to its dominance. Additionally, neighboring countries such as Malaysia and Indonesia are becoming key markets as they look to modernize their defense systems and enhance airspace security, fostering a regional demand for advanced airborne situational awareness solutions.

Market Segmentation

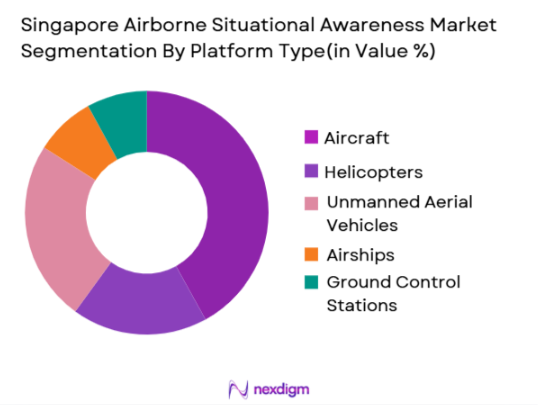

By Platform Type:

The Singapore Airborne Situational Awareness Systems market is segmented by platform type into aircraft, helicopters, unmanned aerial vehicles (UAVs), airships, and ground control stations. Aircraft is the dominant segment in the market, primarily due to the growing demand for situational awareness systems in military and commercial aviation. Aircraft, including fighter jets, surveillance planes, and transport aircraft, require high-end situational awareness technologies such as radar systems, infrared sensors, and data fusion systems to ensure efficient operations in complex environments. These systems are integrated into the operational backbone of air forces and government surveillance operations, contributing to the significant share of aircraft in this market.

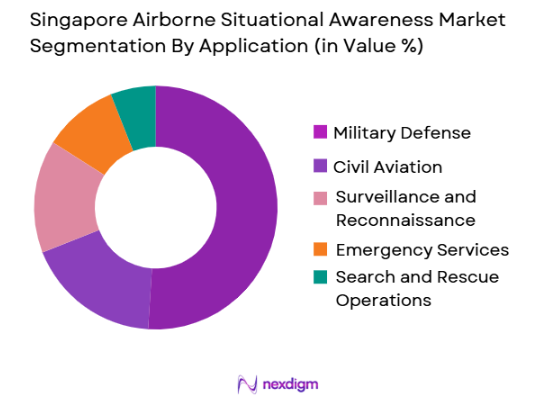

By Application:

The market is segmented by application into military defense, civil aviation, surveillance and reconnaissance, emergency services, and search and rescue (SAR) operations. Military defense is the leading segment, driven by the increasing need for real-time situational awareness systems in defense platforms such as fighter jets, bombers, and surveillance drones. These systems are crucial for enhancing operational effectiveness in combat scenarios, providing real-time intelligence, and facilitating precise decision-making. With the growing defense budgets and military modernization in Asia-Pacific, the demand for situational awareness systems in defense applications continues to rise.

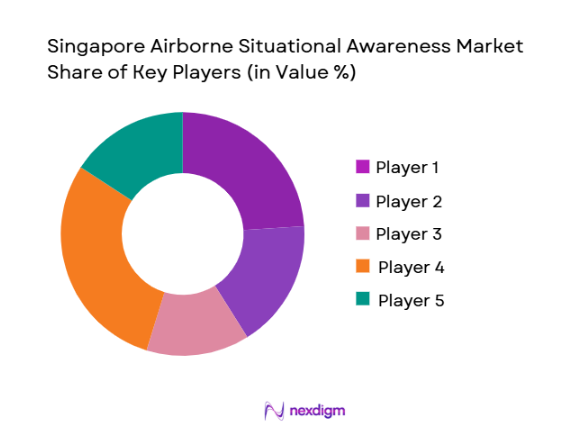

Competitive Landscape

The Singapore Airborne Situational Awareness Systems market is consolidated, with a few key players dominating the sector. Leading companies like Thales Group, Lockheed Martin, and Leonardo S.p.A. have established strong market presence, leveraging advanced technology and strong government contracts. These companies provide a wide range of airborne situational awareness systems that cater to both military and commercial aviation needs. Their extensive portfolios, coupled with strategic partnerships with defense ministries and agencies, position them as leaders in this market.

| Company | Establishment Year | Headquarters | Key Parameter 1 | Key Parameter 2 | Key Parameter 3 | Key Parameter 4 | Key Parameter 5 | Key Parameter 6 |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Airborne Situational Awareness Systems Market Analysis

Singapore Airborne Situational Awareness Systems Market Analysis

Growth Drivers

Urbanization

Urbanization in Singapore continues to drive the demand for advanced airborne situational awareness systems. The urban population in Singapore reached ~% in 2025, with over ~ million people living in the country. The high density of people and infrastructure in urban areas increases the need for enhanced air traffic management and surveillance systems, especially to manage safety in increasingly crowded airspace. Moreover, Singapore’s growing air traffic, particularly through Changi Airport, one of the busiest in Southeast Asia, creates demand for advanced surveillance and situational awareness technology. These urbanization trends contribute to the increasing adoption of airborne situational awareness solutions.

Industrialization

Industrialization in Singapore plays a pivotal role in driving the demand for airborne situational awareness systems, particularly within the defense and logistics sectors. The country is home to a well-developed aerospace and defense industry, contributing ~% of GDP in 2025, with significant investments in defense technology. The growing industrial infrastructure around ports, airfields, and key military assets has led to increased demand for situational awareness systems to ensure airspace security, particularly in surveillance and reconnaissance applications. The expanding air logistics industry further emphasizes the need for precise and reliable airborne situational awareness technologies to monitor critical airspace.

Restraints

High Initial Costs

The high initial costs associated with airborne situational awareness systems are a significant restraint for widespread adoption in Singapore. Advanced systems, such as radar and sensor technologies, require substantial investments in infrastructure and ongoing maintenance. In 2025, the cost of implementing comprehensive surveillance systems was reported to exceed SGD ~ million for large-scale deployment. These high capital expenditures make it challenging for smaller stakeholders, particularly in the commercial sector, to afford these advanced systems. The Singaporean government and large corporations often bear the burden of these costs, but smaller entities face barriers in adopting cutting-edge technologies.

Technical Challenges

Technical challenges, particularly in terms of system integration and data accuracy, continue to hinder the implementation of airborne situational awareness systems in Singapore. The need for seamless integration of radar systems, communication networks, and data analysis tools into existing air traffic management infrastructure is complex. In 2025, the Civil Aviation Authority of Singapore highlighted challenges related to upgrading legacy systems and ensuring interoperability with new technologies. Additionally, the high volume of air traffic and diverse operating environments across commercial, military, and private sectors in Singapore contribute to the complexity of maintaining these systems effectively.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the airborne situational awareness systems market in Singapore. The integration of artificial intelligence (AI) and machine learning (ML) into radar and sensor technologies has the potential to greatly enhance the capabilities of these systems. In 2025, the Singapore government launched a national initiative to advance AI and ML technologies across various sectors, including aerospace and defense. The use of AI-powered systems enables real-time data analysis and faster decision-making, which improves situational awareness for both defense and commercial aviation sectors. The ongoing technological advancements will continue to fuel the demand for these systems in the coming years.

International Collaborations

International collaborations represent a significant opportunity for growth in Singapore’s airborne situational awareness systems market. In 2025, Singapore signed multiple defense cooperation agreements with countries like the United States, Australia, and Japan to enhance its air surveillance capabilities. These agreements foster the exchange of technology and best practices in airborne surveillance. The collaboration with international defense contractors and aerospace companies allows Singapore to access cutting-edge technologies, which will improve its air traffic management systems. These partnerships are critical in advancing Singapore’s position as a regional leader in air safety and situational awareness.

Future Outlook

Over the next decade, the Singapore Airborne Situational Awareness Systems market is poised to witness significant growth. This will be driven by increasing demand from both defense and civil aviation sectors, coupled with advancements in sensor technology and artificial intelligence integration. The rise of unmanned aerial vehicles (UAVs) and autonomous systems in defense and surveillance applications will also contribute to this growth. Furthermore, government initiatives to bolster national defense capabilities and investments in air traffic control and security systems will continue to support the market’s expansion.

Major Players

- Thales Group

- Lockheed Martin

- Leonardo S.p.A.

- Raytheon Technologies

- Northrop Grumman

- BAE Systems

- Saab AB

- Collins Aerospace

- Airbus Defence and Space

- General Electric

- Rockwell Collins

- Elbit Systems

- Israel Aerospace Industries (IAI)

- L3 Technologies

- Curtiss-Wright

Key Target Audience

- Defense Ministries and Agencies

- Aviation Regulatory Authorities

- Airlines and Aircraft Operators

- Aerospace Manufacturers and OEMs

- Military Contractors and Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Surveillance and Security Organizations

Research Methodology

Step 1: Identification of Key Variables

The first step in our research methodology involves identifying and mapping the key variables influencing the Singapore Airborne Situational Awareness Systems market. This includes understanding industry trends, technology adoption, and government regulations. Data is gathered through secondary research, including government reports, industry publications, and proprietary databases.

Step 2: Market Analysis and Construction

Next, we analyze historical data and current market trends to construct the market landscape. This involves segmenting the market by platform type and application to determine key drivers, restraints, and opportunities. Market share by region and technology is also assessed to understand regional variations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth and potential disruptions are validated through expert consultations. Interviews with key industry players, including defense officials, aerospace manufacturers, and regulatory bodies, are conducted to refine the market data and validate assumptions.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data and insights gathered from all sources. In this step, we cross-verify information with market participants and finalize the analysis. The final output provides an accurate, comprehensive, and validated report on the Singapore Airborne Situational Awareness Systems market.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Regulatory Landscape

- Business Cycle and Adoption Timeline

- Growth Drivers

Increasing Demand for Advanced Surveillance Systems

Government Investments in Air Defense Systems

Integration of AI and Machine Learning in SA Systems

Technological Advancements in Radar and Sensor Technologies - Market Challenges

High Development and Maintenance Costs

Integration Challenges with Legacy Systems

Regulatory and Compliance Hurdles

Data Security and Privacy Issues in SA Systems - Market Trends

Miniaturization of Airborne Sensors

Increased Use of Multi-Sensor Fusion Techniques

Growing Focus on Predictive Maintenance

Move Towards All-in-One Integrated Situational Awareness Systems - Market Opportunities

Rising Demand for Unmanned Aerial Vehicles

Growing Adoption of Autonomous Systems in Aviation

Emerging Applications in Disaster Management and Monitoring

Potential for Commercial Airliners to Incorporate SA Systems - SWOT Analysis

- Porter’s Five Forces

Stakeholder Ecosystem

Competition Ecosystem

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Platform (In Value %)

Aircraft

Helicopters

Unmanned Aerial Vehicles (UAVs)

Airships

Ground Control Stations - By Application (In Value %)

Military Defense

Civil Aviation

Surveillance and Reconnaissance

Emergency Services

Search and Rescue (SAR) Operations - By Sensor Technology (In Value %)

Radar Systems

Electro-Optical/Infrared (EO/IR) Systems

Acoustic Sensors

LiDAR Systems

Synthetic Aperture Radar (SAR) Systems - By Region (In Value %)

Singapore

Southeast Asia Region

Rest of Asia-Pacific Region - By End-User (In Value %)

Government and Military

Commercial Aviation

Research Institutions

Aviation Services Providers

Private Enterprises

- Market Share Analysis

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Market Presence, Organizational Structure, Financials, Market Share by Segment, Technology Investment, Product/Service Differentiation, Supply Chain, Distribution Channels, R&D Capacity)

- SWOT Analysis of Major Players

- Pricing Analysis by Major Players

- Detailed Profiles of Major Companies

Thales Group

Lockheed Martin

Leonardo S.p.A.

Raytheon Technologies

Northrop Grumman

Airbus Defence and Space

BAE Systems

Saab AB

Collins Aerospace

General Electric

Rockwell Collins

Elbit Systems

Israel Aerospace Industries

L3 Technologies

Curtiss-Wright

- Market Demand and Utilization by Sector

- Government and Military Procurement Trends

- Regulatory and Compliance Requirements for End-Users

- Customer Needs, Desires, and Pain Point Analysis

- Decision-Making Process and Procurement Cycles

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035