Market Overview

The India Aircraft Actuators Market is valued at approximately USD ~ million in 2024, driven primarily by the rapid expansion of the country’s aviation and defense sectors. The demand for more efficient and reliable aircraft components is pushing forward advancements in actuator technology. The growth is supported by both domestic and international aviation growth, defense spending, and an increasing focus on aircraft performance and safety. The market’s trajectory is further influenced by India’s efforts to modernize its air force and expand commercial aviation fleets, which enhances demand for advanced actuation systems.

In India, cities like Bengaluru, Hyderabad, and New Delhi dominate the aircraft actuators market due to the presence of key defense and aerospace manufacturers such as Hindustan Aeronautics Limited (HAL), as well as a growing network of international aerospace OEMs. Bengaluru stands out as the aerospace hub, housing numerous R&D centers and manufacturing units, thereby playing a pivotal role in the supply chain of aircraft actuators. These cities are central to the country’s military modernization and commercial aviation expansion, positioning them as key players in driving market demand.

Market Segmentation

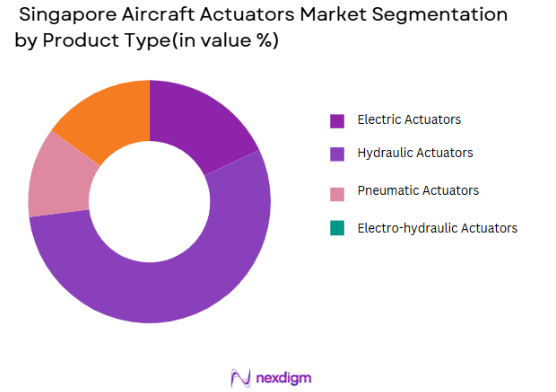

By Product Type

The India Aircraft Actuators Market is segmented by product type into electric actuators, hydraulic actuators, pneumatic actuators, and electro-hydraulic actuators. Among these, hydraulic actuators have the dominant market share in 2024. This dominance is largely due to their long-standing use in commercial and military aviation for flight control, landing gear, and other critical systems. Hydraulic actuators offer superior power-to-weight ratios, making them ideal for heavy-duty applications in aircraft, especially in high-stress environments like military operations. Additionally, hydraulic systems continue to evolve with more energy-efficient and durable designs, making them a preferred choice for both new builds and retrofits in existing fleets.

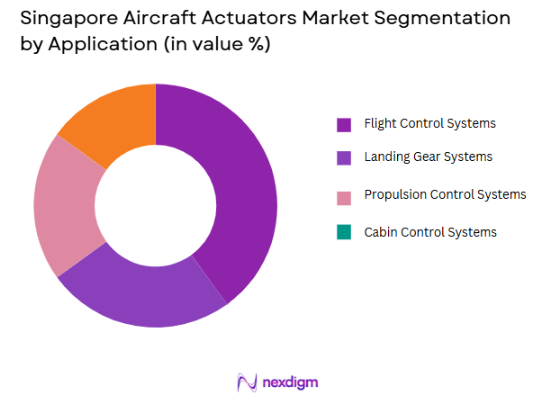

By Application

In terms of application, the India Aircraft Actuators Market is segmented into flight control systems, landing gear systems, propulsion control, and cabin control systems. Flight control systems have a dominant market share in 2024. This is due to the critical role actuators play in controlling the aircraft’s flight surfaces, which are essential for maintaining flight stability and maneuverability. Both commercial and military aircraft rely heavily on actuators for flight control, and the increasing demand for new aircrafts as well as retrofitting of older models ensures a continuous need for advanced flight control actuators. This segment is expected to see further growth with the increase in automation and demand for precision engineering in aviation systems.

Competitive Landscape

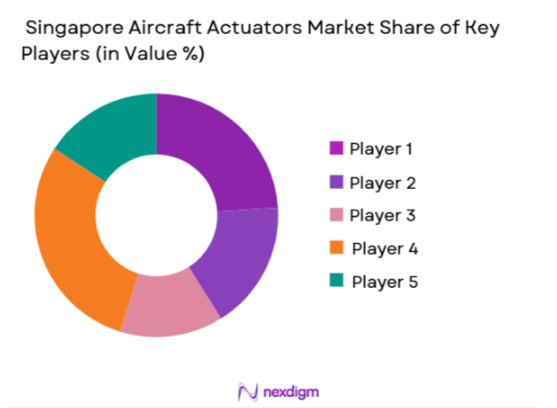

The India Aircraft Actuators Market is dominated by a few major players, including both international and domestic manufacturers. Key players such as Honeywell, Moog, and Parker Hannifin maintain a strong foothold in the market due to their global presence, advanced technology, and established customer bases. Local companies such as Hindustan Aeronautics Limited (HAL) also play a significant role, particularly in the defense sector, benefiting from government contracts and the “Make in India” initiative.

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Focus | Market Reach | Key Partnerships |

| Honeywell International | 1906 | United States | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | United States | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | United States | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited (HAL) | 1940 | India | ~ | ~ | ~ | ~ |

| Safran SA | 2005 | France | ~ | ~ | ~ | ~ |

Singapore Aircraft Actuators Market Analysis

Growth Drivers

Urbanization

Urbanization in Singapore is steadily contributing to the growth of the aircraft actuators market, driven by the expansion of urban areas and increased demand for air travel. In 2024, the country’s urban population is projected to be over ~million, which significantly impacts the growth of the aviation sector, driving up demand for efficient aircraft systems. The country’s strong urban development leads to greater demand for both domestic and international air travel, directly influencing the need for advanced actuators in modern aircraft. Furthermore, Singapore’s status as a regional hub for aviation and logistics amplifies the demand for sophisticated aircraft technologies, including actuators.

Industrialization

The industrialization of Singapore, particularly within its aerospace and defense sectors, contributes significantly to the demand for aircraft actuators. Singapore’s aerospace industry is one of the largest in the region, with significant contributions from key players in manufacturing, MRO (maintenance, repair, and overhaul), and research. The country’s industrial output is projected to rise by ~% in 2024, and the aerospace sector continues to receive substantial investments. As part of this growth, demand for aircraft actuators is expected to increase due to their critical role in ensuring the functionality of advanced aerospace systems, making the market for actuators a key area of focus.

Restraints

High Initial Costs

The high initial costs of aircraft actuators pose a significant challenge to the growth of the market. With the increasing complexity of actuator systems, the cost of procurement and installation continues to rise. In 2024, the average cost of advanced actuators is estimated to be significantly higher compared to older technologies. For instance, electric actuators, while offering efficiency benefits, come with higher upfront costs due to their complex technology. Additionally, regulatory compliance requirements and the need for customization for specific aircraft types add to the cost. This financial burden impacts both small and large aircraft manufacturers and can hinder the widespread adoption of newer actuator technologies.

Technical Challenges

The technical challenges associated with aircraft actuators, particularly in terms of integration and system reliability, continue to be a restraint in the market. In 2024, the increasing complexity of aircraft designs, especially with hybrid and electric aircraft, demands actuators that are more sophisticated and reliable. However, the integration of these actuators into various aircraft systems can be complicated, requiring extensive testing, modifications, and regulatory approvals. These technical difficulties not only delay the deployment of new actuators but also contribute to the overall costs of production, which can be a significant barrier for manufacturers and airlines.

Opportunities

Technological Advancements

Technological advancements in actuator systems present a significant opportunity for market growth. The shift towards electric and hybrid-electric actuators is revolutionizing the aircraft industry. These systems are more energy-efficient, lightweight, and environmentally friendly compared to traditional hydraulic actuators. With the Singaporean government’s focus on sustainability and energy efficiency, the demand for these innovative actuator technologies is expected to grow. Furthermore, the introduction of smarter actuators, capable of real-time monitoring and predictive maintenance, is opening up new possibilities for aircraft optimization and cost reduction. The current technological evolution in actuator design is set to drive future market growth.

International Collaborations

Singapore’s strategic international collaborations in the aerospace sector provide a significant opportunity for the aircraft actuators market. Singapore’s role as a hub for aviation in Asia and its strategic partnerships with global aerospace companies like Boeing, Airbus, and Lockheed Martin have fostered growth in local manufacturing capabilities. These collaborations enhance knowledge exchange, promote advanced technology integration, and provide local players with access to global markets. As these partnerships expand, demand for advanced actuators is expected to grow, particularly in military and commercial aviation sectors.

Future Outlook

Over the next decade, the India Aircraft Actuators Market is expected to experience significant growth driven by India’s expanding aviation sector and defense modernization initiatives. Technological advancements in actuator systems, particularly in electric and hybrid-electric actuators, will further fuel market development. Additionally, the “Make in India” program and the increasing demand for military and commercial aircraft will continue to support the domestic manufacturing of actuators. As the aviation industry adapts to more sustainable technologies and higher operational demands, the market is poised to see a steady compound annual growth rate (CAGR) of approximately ~% between 2026 and 2035.

Major Players in the Market

- Honeywell International

- Moog Inc.

- Parker Hannifin

- Eaton Corporation

- Rockwell Collins

- Safran SA

- Curtiss-Wright Corporation

- GE Aviation

- Liebherr Aerospace

- Thales Group

- Boeing

- Lockheed Martin

- Hindustan Aeronautics Limited

- Tata Advanced Systems

- Adani Defence & Aerospace

Key Target Audience

- Aerospace Manufacturers

- Defense Ministries and Agencies

- Aircraft OEMs

- Government and Regulatory Bodies

- Aerospace Component Suppliers

- Maintenance, Repair, and Overhaul Providers

- Investments and Venture Capitalist Firms

- Military Aviation and Air Force Divisions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key market variables that influence the demand for aircraft actuators in India. This includes studying technological trends, regulatory frameworks, and market drivers like defense spending and commercial aviation growth. Information is gathered through secondary sources, including industry reports, government publications, and interviews with key industry stakeholders.

Step 2: Market Analysis and Construction

In this phase, historical market data from the past five years is analyzed to understand market trends, including demand fluctuations and growth patterns. We examine factors such as the number of aircraft deliveries, production rates, and technological innovations in actuator systems. This data helps in constructing a reliable market forecast.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with experts from both defense and aerospace sectors. Interviews with key personnel from aircraft manufacturers, suppliers, and MRO companies provide insights into operational challenges, procurement cycles, and future technology trends, which help refine the market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing insights gained from expert interviews and secondary research to generate a comprehensive market outlook. This includes analyzing competitor strategies, customer needs, technological advancements, and regulatory influences, ensuring the final report offers a complete and accurate market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Defence Procurement Cycle Mapping, Data Sources & Validation, Supply Chain Primary Interviews, Market Modelling & Forecasting Logic, Limitations, Validation with OEM and User Data)

- Definition and Scope

- Market Genesis & Policy Evolution

- Historical/Technological Timeline

- Aircraft Actuators Value Chain Analysis

- Regulatory & Standards Framework

- Technological Landscape in Actuator Systems

- Growth Drivers

Expansion of Aviation Fleet

Increasing Demand for Fuel-Efficient Aircraft Systems

Technological Advancements in Aircraft Actuation Systems

Government Initiatives & Defence Procurement - Market Challenges

High Initial Procurement & Lifecycle Costs

Maintenance and Spare Parts Management

Regulatory Compliance and Certification Challenges

Interoperability of Systems across Aircraft Types - Opportunities

Development of Lightweight & High-Efficiency Actuators

Growing Aerospace and Defence Exports

Advancements in Smart Actuators and AI Integration

Regional Growth in Aviation Sector - Technology & Innovation Trends

Digital Actuation Systems

Hybrid Actuation Technologies

Adoption of Autonomous Aircraft Actuators

Integration of AI and Predictive Maintenance Tools - Regulatory & Defence Standards

Safety & Certification Standards for Aircraft Actuators

Compliance with MoD / Civil Aviation Safety Regulations

International Standards for Actuation System Interoperability

- SWOT Analysis

- Porter’s Five Forces Analysis

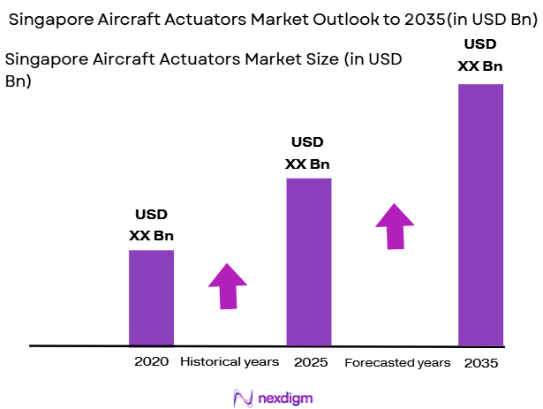

- By Value, 2020-2035

- By Volume, 2020-2035

- By Installed Base, 2020-2035

- By Average Price, 2020-2035

- By Actuator Type (In Value and Volume%)

Electric Actuators

Hydraulic Actuators

Pneumatic Actuators

Electro-hydraulic Actuators

Mechanical Actuators - By Aircraft Type (In Value and Volume%)

Commercial Aircraft

Military Aircraft

Unmanned Aerial Vehicles

Regional Aircraft

Business Jets - By End-User Industry (In Value and Volume%)

Aerospace

Defense

Maintenance, Repair & Overhaul

Research & Development - By Application (In Value and Volume%)

Flight Control Systems

Landing Gear Actuation

Propulsion Control

Cabin Control Systems

Stabilization and Control Actuators - By Integration Type (In Value and Volume%)

OEM New Platform Integrations

Retrofit / Upgrades

Aftermarket Support & Spares

- Market Share Analysis

- Cross Comparison Parameters(System Integration Capability, Global Contract / Supply Footprint, Platform Compatibility, R&D Intensity, Production & Maintenance Ecosystem, Aftermarket Support Network, Strategic Alliances & Offset Contributions, Regulatory Certifications & Compliance)

- SWOT Analysis of Major Competitors

Strengths, Weaknesses, Opportunities, Threats of Top Players in the Market

- Pricing analysis of major players

- Detailed Profiles of Major Companies

Honeywell International

Moog Inc.

Parker Hannifin

Eaton Corporation

Safran SA

Rockwell Collins

United Technologies Corporation

Curtiss-Wright Corporation

BAE Systems

Leonardo DRS

GE Aviation

Liebherr Aerospace

Thales Group

Sagem

Hindustan Aeronautics Limited

- Air Force Operational Demand and Mission Set

- Naval Aviation Requirements (Carrier Operations)

- Commercial Aviation Demand for Efficient Actuators

- MRO Requirements and Fleet Support

- Defence Acquisition Process & Decision Flow

- By Value, 2026-2035

- By Volume, 2026-2035

- By Technology Share, 2026-2035

- By Market Adoption and Growth Metrics, 2026-2035