Market Overview

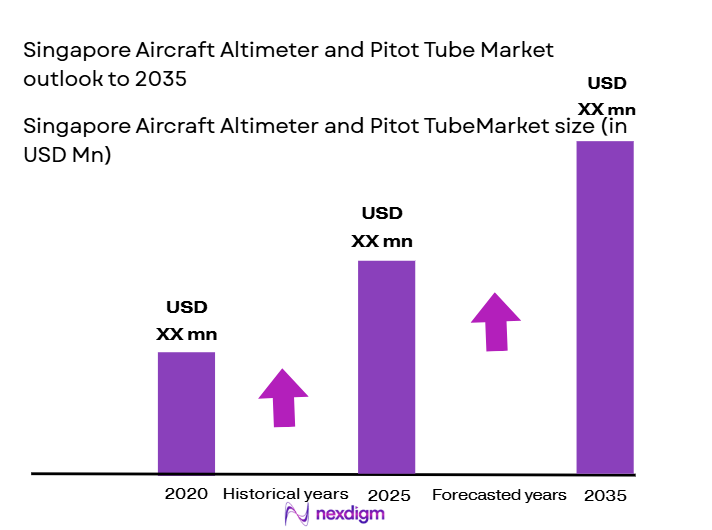

The Singapore aircraft altimeter and pitot tube market is valued at USD ~ million in 2023. The market has been primarily driven by the continuous growth of the aviation industry, including increasing demand for both commercial and military aircraft. As global air travel rebounds, the demand for precision flight instruments, such as altimeters and pitot tubes, has surged. Additionally, technological advancements and the integration of digital systems into aircraft instruments are fueling market growth. The Singapore market benefits from strong investments in aviation safety and modernization, creating a steady growth trajectory.

Singapore, as a major aviation hub in Southeast Asia, dominates the aircraft altimeter and pitot tube market. The country’s strategic geographical location facilitates its robust air traffic, positioning it as a key player in the aviation sector. The demand in Singapore is further amplified by its government’s commitment to air travel safety and infrastructure development. Other key players in the region include Malaysia and Indonesia, where increasing air traffic and military investment in aerospace technology are significant drivers. These regions’ growing aviation industries further cement Southeast Asia’s prominence in the global market.

Market Segmentation

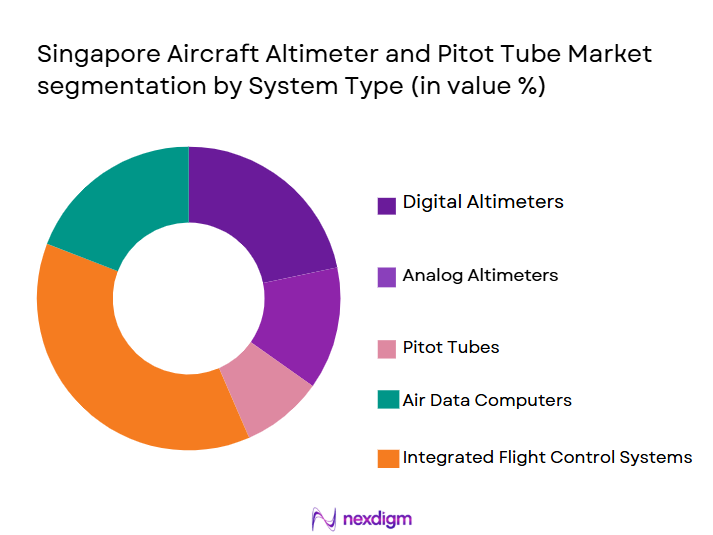

By System Type

The Singapore aircraft altimeter and pitot tube market is segmented by system type, which includes analog altimeters, digital altimeters, pitot tubes, radar altimeters, and hybrid altimeter systems. Among these, digital altimeters have a dominant share of the market due to their precision, reliability, and integration with modern aircraft systems. Digital altimeters provide real-time, highly accurate readings, making them ideal for advanced aircraft systems, including military, commercial, and private aviation. Furthermore, digital altimeters offer enhanced capabilities for complex flight management systems, which is driving their widespread adoption in new aircraft models.

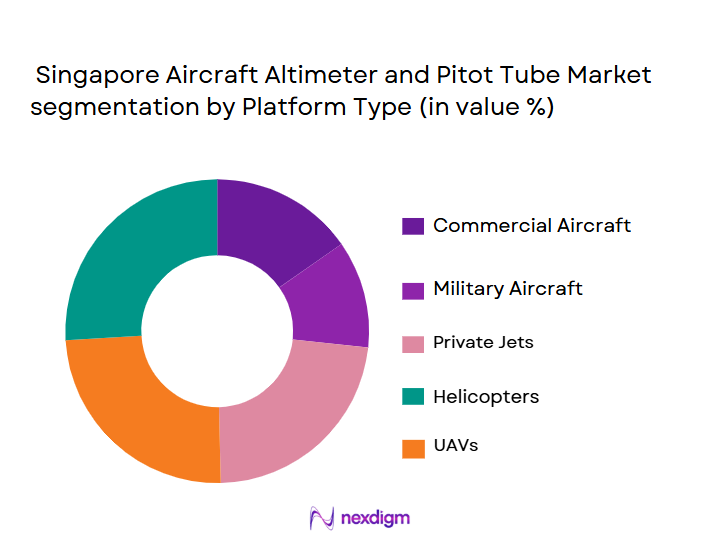

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, private aircraft, military aircraft, helicopters, and unmanned aerial vehicles (UAVs). Commercial aircraft hold the largest share of the market. The rapid growth in air travel, particularly post-pandemic, has led to a steady increase in the production and procurement of commercial aircraft. Airlines worldwide are equipping their fleets with the latest navigation and flight management technologies, including advanced altimeters and pitot tubes. This surge in commercial aviation operations is expected to continue, driving the dominance of this sub-segment in the market.

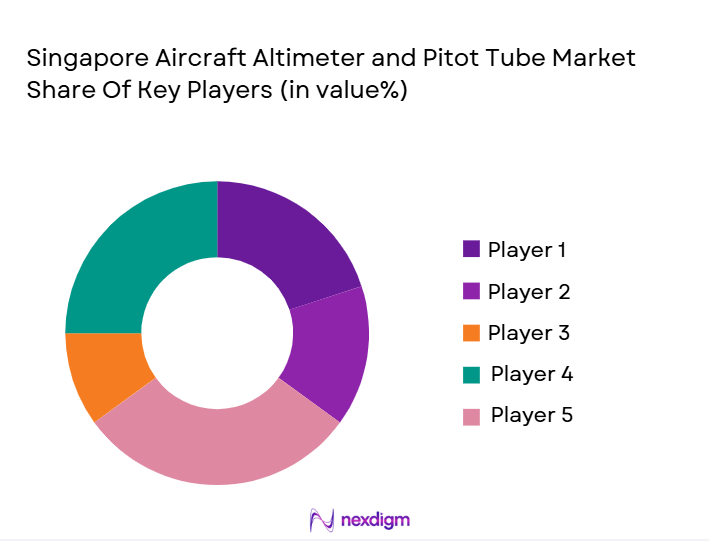

Competitive Landscape

The Singapore aircraft altimeter and pitot tube market is dominated by a few key players, including global aerospace manufacturers and regional suppliers. Companies such as Honeywell Aerospace and Collins Aerospace are major contributors to the market, given their advanced technology, strong industry presence, and wide product portfolios. These players are strategically positioned due to their historical expertise in avionics and aircraft components.

| Company Name | Year Established | Headquarters | Technology Innovation | Market Presence | Product Portfolio | R&D Investment |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1935 | United States | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Safran Electronics | 2005 | France | ~ | ~ | ~ | ~ |

| Ametek Inc. | 1930 | United States | ~ | ~ | ~ | ~ |

Singapore aircraft altimeter and pitot tube Market Dynamics

Growth Drivers

Rising Air Traffic and Demand for Aircraft

As air traffic in Singapore continues to rise, driven by both passenger and cargo flights, the demand for advanced aircraft systems, including altimeters and pitot tubes, increases. The growing need for more efficient and safe aviation operations fuels the market for these critical components, as airlines upgrade their fleets to meet higher operational standards.

Advances in Aircraft Safety and Performance Technologies

The continuous advancements in aircraft safety and performance technologies are driving the need for more precise and reliable altimeter and pitot tube systems. These systems are essential for ensuring accurate altitude measurement and airspeed monitoring, which are crucial for both safety and operational efficiency in modern aircraft.

Market Challenges

High Maintenance Costs of Advanced Systems

The high maintenance costs associated with advanced altimeter and pitot tube systems can be a significant challenge for airlines. These systems require regular calibration, inspections, and maintenance, which can result in substantial operational expenses, particularly for smaller carriers with limited budgets.

Regulatory Hurdles and Certification Complexities

The regulatory requirements for the certification of aircraft components like altimeters and pitot tubes can be complex and time-consuming. Airlines and manufacturers must comply with strict aviation standards, which can delay the introduction of new technologies and add additional costs to the production and maintenance of these systems.

Market Opportunities

Growing Adoption of Digital Altimeter Systems

The growing adoption of digital altimeter systems presents an opportunity for the market as they offer higher accuracy and greater reliability compared to traditional mechanical systems. These systems are becoming increasingly popular due to their integration with modern avionics, enhancing overall aircraft safety and performance.

Emerging Markets for UAVs and Military Aircraft

The rise of unmanned aerial vehicles (UAVs) and military aircraft markets presents new growth opportunities. As these sectors expand, there is an increasing demand for reliable altimeter and pitot tube systems to ensure accurate flight measurements, navigation, and performance monitoring, especially in more complex and challenging environments.

Future Outlook

Over the next decade, the Singapore aircraft altimeter and pitot tube market is expected to show significant growth driven by advancements in avionics technology, growing demand for safer flight systems, and the expansion of regional air traffic. Furthermore, increasing investments in military aviation and a rise in the procurement of new-generation commercial aircraft will contribute to the market’s development. As the aviation industry continues to innovate and focus on enhanced safety protocols, the demand for advanced altimeter and pitot tube systems is projected to rise.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- Safran Electronics

- Ametek Inc.

- Garmin Ltd.

- Moog Inc.

- Rockwell Collins

- Astronautics Corporation of America

- L3 Technologies

- Esterline Technologies

- Northrop Grumman

- General Electric

- Boeing

- Lockheed Martin

Key Target Audience

- Aircraft Manufacturers

- Aviation Safety Regulatory Bodies (e.g., Civil Aviation Authority of Singapore)

- Defense & Aerospace Contractors

- Military and Defense Organizations

- Commercial Airlines

- Private Jet Operators

- MRO (Maintenance, Repair, and Overhaul) Service Providers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and defining critical variables affecting the aircraft altimeter and pitot tube market in Singapore. This phase will combine both secondary research and proprietary databases to construct an ecosystem map of the market’s stakeholders, including manufacturers, suppliers, regulatory bodies, and end-users.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical market data to understand trends in market penetration, aircraft fleet growth, and the increasing integration of altimeter and pitot tube systems in new aircraft. This analysis will also include examining the factors driving demand, such as the modernization of aviation infrastructure and safety upgrades.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, we will engage in consultations with industry experts, including those from avionics manufacturers, regulatory bodies, and aerospace organizations. These insights will provide valuable real-world perspectives on market trends and potential future developments in the altimeter and pitot tube sectors.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing data from both secondary sources and primary interviews with industry players. This will be followed by refining the research outputs to ensure a comprehensive analysis of the Singapore aircraft altimeter and pitot tube market, including product segmentation, competitive landscape, and growth forecasts.

- Executive Summary

- Singapore Aircraft Altimeter and Pitot Tube Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising air traffic and demand for aircraft

Advances in aircraft safety and performance technologies

Increased demand for retrofit and MRO services - Market Challenges

High maintenance costs of advanced systems

Regulatory hurdles and certification complexities

Supply chain disruptions and component shortages - Market Opportunities

Growing adoption of digital altimeter systems

Emerging markets for UAVs and military aircraft

Technological advancements in pitot tube and altimeter systems - Trends

Integration of AI and IoT for predictive maintenance

Miniaturization and weight reduction in aircraft components

Move towards standardized aircraft safety systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Analog Altimeters

Digital Altimeters

Pitot Tubes

Radar Altimeters

Hybrid Altimeter Systems - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

Linefit

Retrofit

OEM (Original Equipment Manufacturer)

MRO (Maintenance, Repair, and Overhaul)

Aftermarket - By EndUser Segment (In Value%)

Commercial Airlines

Private Jet Operators

Military & Defense

Aerospace Manufacturers

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement from OEMs

Authorized Distributors

Third-Party Suppliers

Online Marketplaces

Government Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Product Innovation, Market Share, Geographic Presence, Technical Support & After-Sales Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility Strategic Alliances, Customer Base) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Collins Aerospace

Thales Group

Garmin Ltd.

Northrop Grumman

L3 Technologies

Rockwell Collins

Safran Electronics

Ametek Inc.

Moog Inc.

Esterline Technologies

Astronautics Corporation of America

Sensyne Health

Boeing

General Electric

- Growing demand for safer and more efficient aircraft operations

- Increasing military spending on defense aviation

- Rise in commercial aviation activities in Southeast Asia

- Rising demand for MRO services and component upgrades

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035