Market Overview

The Singapore Aircraft Antenna Market is valued at approximately USD ~ million in 2025, with projections indicating steady growth in the coming years. This market growth is primarily driven by the increasing demand for advanced communication systems in both commercial and military aviation sectors. Additionally, advancements in antenna technologies like SATCOM, VHF/UHF, and phased array systems, combined with the rapid modernization of aircraft fleets, play a key role in expanding market size. The introduction of high-bandwidth antenna systems, particularly for satellite communications, is expected to drive further growth, enhancing in-flight connectivity and operational efficiencies. Increasing aviation traffic and the rise of UAV technologies are also contributing factors to the market’s expansion.

The Singapore Aircraft Antenna Market is dominated by cities like Singapore City, which serves as a critical hub for the aerospace industry in Asia. The city benefits from its strategic location, access to key trade routes, and a highly developed aerospace ecosystem that attracts both global players and innovative startups. Singapore’s robust regulatory framework and its position as a regional leader in defense and commercial aviation further solidify its dominance in the market. Other key countries include Japan and South Korea, where advancements in both commercial and military aviation technologies bolster the demand for high-performance antenna systems. Singapore, due to its strategic importance, continues to lead as the primary market within the Southeast Asian region.

Market Segmentation

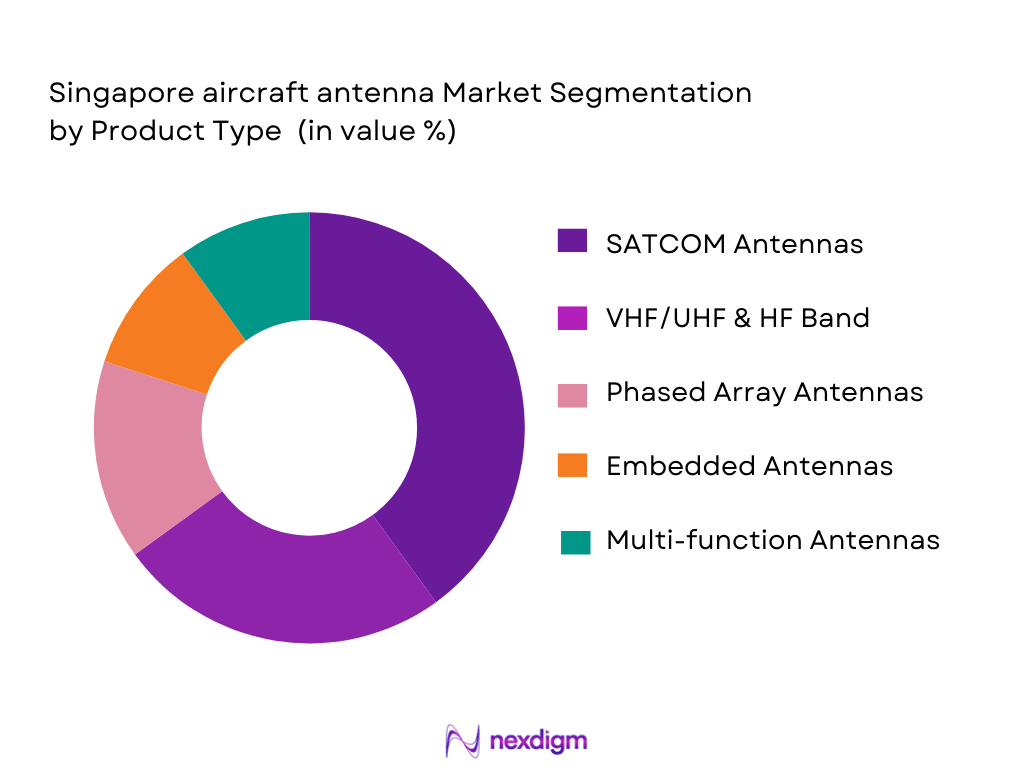

By Product Type

The Singapore Aircraft Antenna market is primarily segmented by product type into SATCOM antennas, VHF/UHF & HF band antennas, phased array antennas, embedded antennas, and multi-function antennas. SATCOM antennas currently hold the dominant share in the market, driven by the high demand for in-flight connectivity solutions across commercial and military platforms. These antennas provide critical communication links to satellites, enabling high-bandwidth services essential for modern aviation needs. SATCOM systems are used extensively in both large aircraft for long-distance flights and smaller aircraft for operational communications. Their dominance is propelled by airlines and defense entities requiring high-speed data transmission for navigation, communications, and entertainment systems.

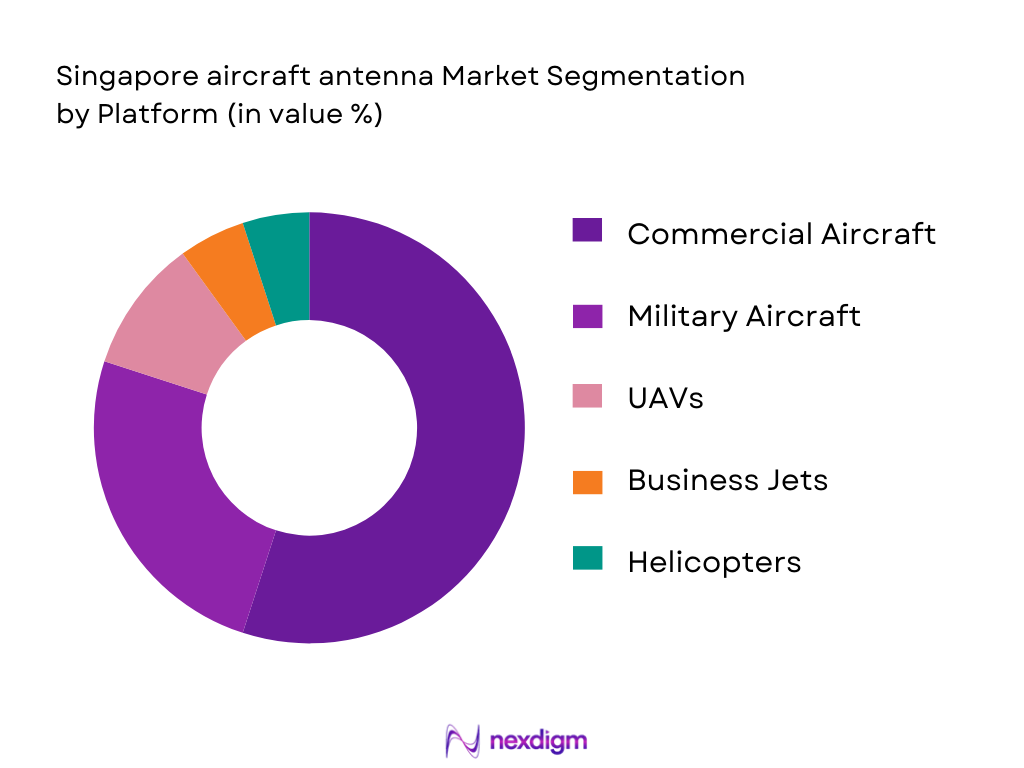

By Platform

The market is segmented by platform, which includes commercial aircraft, military aircraft, business jets, UAVs (Unmanned Aerial Vehicles), and helicopters. The commercial aircraft platform dominates the market due to the growing demand for in-flight connectivity, primarily for passenger services. Commercial aircraft require advanced communication systems that ensure global connectivity for both passengers and operational communication needs. As the number of long-haul flights continues to increase, the demand for satellite communication antennas, particularly for SATCOM systems, has risen sharply. The military platform, while not as large as commercial aircraft, still represents a significant market share, driven by advanced communications needs in defense applications.

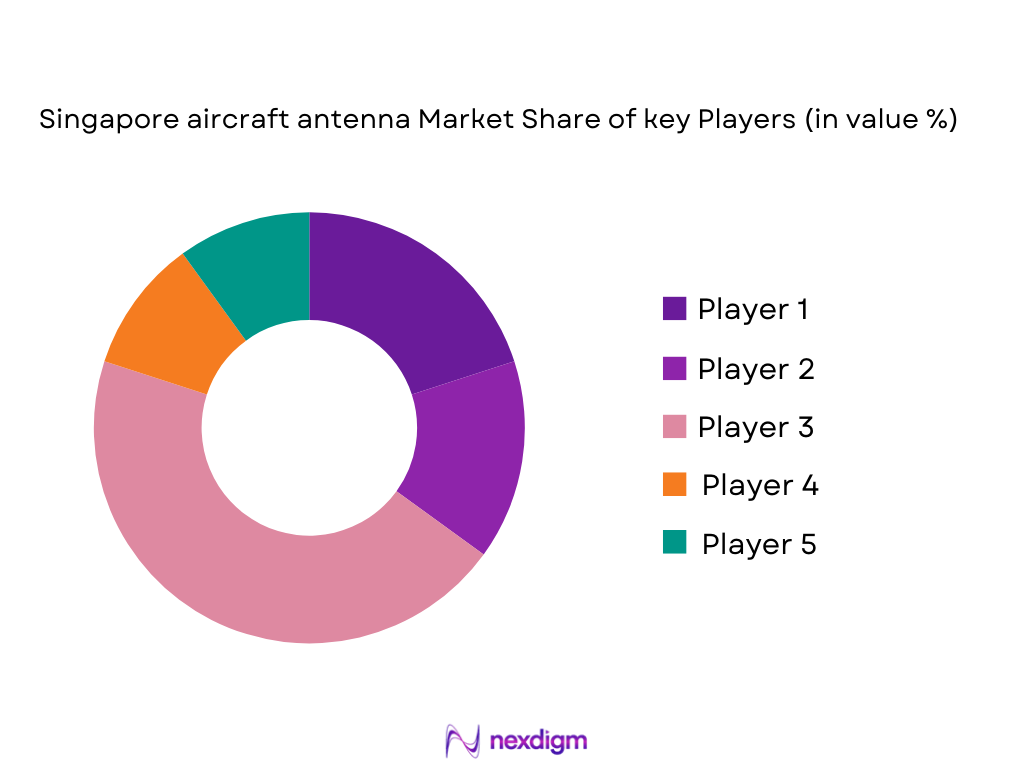

Competitive Landscape

The Singapore Aircraft Antenna Market is highly competitive, with a mix of local and international players operating in the space. Companies like Cobham Limited, L3Harris Technologies, and Amphenol Corporation dominate the market, offering a wide range of antenna solutions. These companies maintain strong market positions by leveraging advanced technologies, global supply chains, and extensive experience in the aerospace and defense sectors. The market also sees active participation from local firms in Singapore, such as ST Engineering, which provides specialized communication solutions tailored for both military and commercial aircraft. The competition is intensified by the constant technological innovations and the demand for high-performance communication systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Annual Revenue | Product Portfolio | Global Reach |

| Cobham Limited | 1934 | UK | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2002 | USA | ~ | ~ | ~ | ~ |

| Amphenol Corporation | 1932 | USA | ~ | ~ | ~ | ~ |

| ST Engineering | 1967 | Singapore | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen ASA | 1814 | Norway | ~ | ~ | ~ | ~ |

Singapore Aircraft Antenna Market Analysis

Growth Drivers

Urbanization

Singapore’s rapid urbanization is a foundational driver for the aircraft antenna market, reinforcing aviation infrastructure and communication needs. With a total population of ~, Singapore exhibits a high urban population concentration nearing ~ %, while annual urban population growth was approximately ~ % in 2025, reflective of sustained urban expansion and mobility demand.

This urban concentration accelerates demand for reliable air transport services, placing pressure on airports like Changi Airport, which processed ~ million passengers and ~ aircraft movements in 2025, making it essential for advanced antenna systems to support voice, data, and SATCOM usage.

Urbanization also heightens the need for seamless aviation connectivity, necessitating robust antenna technologies to support passenger communications, air traffic management, and IoT‑enabled airport operations.

Industrialization

Industrialization in Singapore underscores strong aerospace, advanced manufacturing, and high‑technology integration, which benefits the aircraft antenna landscape by demanding sophisticated communication systems. Singapore’s manufacturing output totaled approximately ~ billion in total output and ~ billion in value added in 2025, signaling robust industrial capacity that supports complex aerospace components and networking technologies.

The broader electronics and ICT sectors are also influential, with the ICT market contributing ~ % of GDP in 2025 and continued investment into digital infrastructure, such as ~ billion allocated to the National Productivity Fund in 2025 to elevate innovation in enterprise technology.

Industrialization facilitates the adoption of advanced aircraft communication and antenna systems—integral for precision navigation, sensor integration, and SATCOM connectivity—by bolstering technological readiness and manufacturing prowess within the aviation ecosystem.

Restraints

High Initial Costs

High upfront costs associated with advanced aircraft antenna systems pose a significant restraint on market growth, especially for operators integrating cutting‑edge technologies requiring substantial capital expenditure. Components such as SATCOM arrays and phased array antennas involve precise engineering and specialized materials, resulting in upfront procurement expenses that can exceed industry averages for traditional avionics subsystems. Singapore’s advanced economy—with GDP at approximately USD ~ billion and GDP per capita of USD ~ in 2025—supports substantial technological investment, yet high production and integration costs still challenge smaller operators or regional aviation enterprises.

Additionally, Singapore’s strategic emphasis on advanced infrastructure increases expectations for premium communication systems, further driving upfront cost hurdles for adopting state‑of‑the‑art antenna technologies across fleets and ground support facilities.

Technical Challenges

The aircraft antenna market encounters technical challenges that can hinder seamless integration and performance optimization within complex avionics and air traffic ecosystems. As aircraft antenna systems must comply with stringent aviation safety and communication standards, technical complexities arise in achieving integration with diverse onboard systems, spectrum allocation, and interference mitigation.

For example, efficient synchronization with air traffic control, SATCOM networks, and ADS‑B broadcast protocols requires precise engineering and testing, which can extend development cycles and necessitate high‑expertise engineering resources.

Singapore’s aviation infrastructure—exemplified by Changi Airport’s ~ million tons of air freight and ~ aircraft movements in 2025—demands precision and reliability in communication systems, where suboptimal antenna performance can disrupt operations.

These technical challenges slow adoption among end users who may lack the internal capacity to manage complex system qualification and certification processes, thereby restraining broader market uptake.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the Singapore Aircraft Antenna market by enabling more efficient, resilient, and integrated communication systems tailored for modern aviation needs. Continued innovation in SATCOMs, phased array antennas, and integrated multi‑function communication systems enhances real‑time data transmission, navigation precision, and connectivity across aircraft platforms.

Singapore’s emphasis on digital transformation, evidenced by substantial ICT investment—including a US ~ billion top‑up to the National Productivity Fund in 2025—creates an enabling environment for adopting advanced aerospace communication technologies. In addition, Singapore’s innovation ecosystem is supported by rankings in global innovation indices, where the country is positioned among top economies for input capability, reflecting a conducive environment for R&D.

As aviation becomes increasingly data‑centric, the demand for high‑performance antenna systems that integrate with next‑generation infrastructures—such as 5G backhaul and advanced SATCOM—is poised to grow, offering opportunities to capture value in both commercial and defense segments.

International Collaborations

International collaborations offer a considerable opportunity to expand Singapore’s aircraft antenna market by fostering cross‑border innovation, technology transfer, and joint ventures between global aerospace leaders and local enterprises. Singapore’s strategic position as a connectivity hub in Southeast Asia, with Changi Airport handling ~ million passengers and nearly ~ million tons of air freight in 2025, positions it as an attractive partner for multinational aerospace and communication technology firms.

Bilateral agreements and collaborative R&D with aerospace giants enhance technical competence and product development capabilities, enabling Singaporean stakeholders to integrate global best practices and standards into aircraft antenna technologies.

Further, associations with international aviation events like the Singapore Airshow—where governments, defense delegations, and global corporations converge—provide platforms for forging partnerships and expanding market reach.

Such collaborations can accelerate the adoption of high‑performance antennas, elevate local manufacturing and testing capacities, and stimulate export opportunities, making this a pivotal growth‑oriented avenue for market participants.

Future Outlook

Over the next 5 years, the Singapore Aircraft Antenna Market is expected to show significant growth. Key drivers include the continuous expansion of commercial aviation, increasing demand for satellite connectivity in defense applications, and the rise in UAV usage. As global airlines and defense agencies upgrade their aircraft to include state-of-the-art communication systems, the market for high-performance antennas, particularly SATCOM systems, will experience steady growth. Innovations in multi-function antennas and phased array systems are also expected to revolutionize communication technologies in aviation, further boosting the demand.

Major Players in the Market

- Cobham Limited

- L3Harris Technologies

- Amphenol Corporation

- ST Engineering

- Kongsberg Gruppen ASA

- Honeywell International

- Garmin Ltd.

- Rohde & Schwarz

- Thales Group

- Viasat Inc.

- TE Connectivity Ltd.

- Antenova Ltd.

- Avionics Services

- Ball Aerospace

- TTM Technologies

Key Target Audience

- Aerospace OEMs

- Defense Contractors (e.g., Singapore Ministry of Defense)

- Military Aviation Units (e.g., Singapore Air Force)

- UAV Manufacturers

- Satellite Service Providers

- Investments and Venture Capitalist Firms

- Aircraft Fleet Operators

- Government and Regulatory Bodies (e.g., Civil Aviation Authority of Singapore)

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the critical variables that influence the market, including technology adoption rates, regulatory requirements, and regional demand. We gather information from a mix of secondary data sources such as industry reports and proprietary databases, alongside consultations with key players in the aerospace and defense sectors.

Step 2: Market Analysis and Construction

We analyze historical and current market data to construct a comprehensive picture of the market size, segmentation, and growth trends. This involves calculating revenue, unit sales, and average pricing across various product types and platforms, as well as reviewing customer preferences and technological advancements.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations with industry leaders, including aerospace engineers, aviation authorities, and defense contractors. This step ensures that the insights we gather are grounded in real-world market dynamics.

Step 4: Research Synthesis and Final Output

We finalize our analysis by synthesizing the data obtained from various sources, including detailed interviews with key stakeholders. This allows us to provide an accurate and reliable forecast, which is cross-referenced with industry standards and benchmarks.

- Executive Summary

- Research Methodology (Market Definitions and Technical Standards, Abbreviations, Primary vs Secondary Research Approach, Forecasting Model (CAGR & TAM/SAM/SOM), Data Quality Assurance, Limitations)

- Singapore Aircraft Antenna Market Synopsis

- Key Technologies in Antenna Systems (SATCOM, VHF/UHF, Phased Array)

- Singapore’s Aerospace Ecosystem (MRO, OEMs, Defense Integration)

- Role of National Policy & Regulatory Standards (Transport & Defense Bodies)

- Singapore Airshow & Aerospace Trade Influence on Local Market Growth

- Value Chain & Supply Chain Analysis

- Tier‑1 to Tier‑3 Supplier Mapping

- Component Level Cost Structure (Materials, RF Modules, Integration)

- Logistics, Import/Export Dynamics & Free‑Trade Zones

- Market Drivers

Increasing In‑Flight Connectivity Demand (SATCOM & Broadband)

Fleet Modernization & Retrofit Cycles

UAV/Defense Communication Needs

Regional Air Traffic Growth (Asia‑Pacific Demand)

Adoption of 5G & Next‑Gen Communication Standards - Market Restraints & Challenges

Supply Chain Disruptions & Component Scarcity

High Certification & Regulatory Barriers

Competitive Pricing Pressure from OEMs

Integration Complexity with Avionics Architecture - Market Opportunities & Trends

AI‑Enabled Smart Antenna Systems

Lightweight Materials & Nanotechnology Adoption

Integration with Satellite Broadband & IoT Systems

MRO Partnerships for Aftermarket Growth - Regulatory & Compliance Framework

Aviation Communication Standards

Civil Aviation Authority Compliance

Military & Dual‑Use Trade Regulations

Certification Requirements for Antenna Systems

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Product Type (In Value %)

SATCOM Antennas (High‑Throughput & LEO/Geostationary)

VHF/UHF & HF Bands Antennas

Phased Array / Beamforming Antennas

Embedded & Conformal Antennas

Multi‑Function Antennas (Comms + Navigation + ADS‑B)

- By Platform (In Value %)

Commercial Aircraft

Military Aircraft & Defense Platforms

Business / VIP Jets

Unmanned Aerial Vehicles (UAV/drones)

Helicopters & EVTOL Platforms

- By Frequency Band (In Value %)

L‑Band

S‑Band

C‑Band

X‑Band

Ku/Ka‑Band

- By End Use (In Value %)

OEM Integrations

Aftermarket Retrofits/Upgrades

Maintenance, Repair & Overhaul (MRO)

- By Installation Type (In Value %)

Fuselage Mounted

Tail/Nose Mounted

Wing/Specialty Mounting

- Market Share Analysis (By Value & Volume Contributions)

- Competitive Benchmarking

- Cross Comparison Parameters (Company Overview, Product Portfolio & Tech Focus (SATCOM, Phased Array, VHF/UHF, Ku/Ka Functionalities), R&D Spend & Innovation Index, Revenue & Growth Dynamics, Singapore/Asia‑Pacific Presence & Footprint, Partnership & Strategic Alliances, Distribution & Service Capabilities, Aftermarket Support Infrastructure, Certifications & Compliance Credentials, Customer Segment Focus & Win‑Rate Indicators)

Detailed Intelligence on Market Participants

Cobham Limited – Aero Comms & SATCOM Antennas

L3Harris Technologies – Military Grade Antenna Systems

Amphenol Corporation – Integrated Avionics Antenna Portfolios

TE Connectivity Ltd. – RF & Aerospace Connectivity Solutions

Thales Group – Navigation & SATCOM Products

Honeywell International Inc. – Aerospace Communication Platforms

Kongsberg Gruppen ASA – Defense Comms & Navigation

Viasat Inc. – High‑Bandwidth SATCOM Solutions

Rohde & Schwarz GmbH & Co KG – RF Test & Antenna Systems

Antenova Ltd. – Embedded Antenna Solutions

Cobham Antenna Systems Singapore – Local Integration Hub

Gogo Inc. (subsidiary) – Inflight Connectivity Systems

Garmin International (Aero Avionics)

Panasonic Avionics Corporation – Connected Aircraft Platforms

Experimental Aircraft Solutions

- Maintenance, repair, and overhaul (MRO) service providers

- Air navigation service providers

- Aircraft manufacturers (OEMs)

- Unmanned aerial vehicle (UAV) operators

- Helicopter service providers

- Aerospace research and training institutions

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035