Market Overview

The Singapore Aircraft Arresting System (AAS) market is valued at USD ~ million, driven by growing demands from both civil and military aviation sectors. The market size reflects the consistent need for safety systems that effectively mitigate runway overrun incidents at airports and airbases. Increasing air traffic, government safety regulations, and technological advancements in arresting systems fuel the market’s growth. Singapore, with its central position in Southeast Asia, hosts several high-traffic airports, making it a key player in the regional AAS market.

The Singapore Aircraft Arresting System market is predominantly driven by the city-state’s position as a major international aviation hub. Singapore’s Changi Airport, consistently ranked as one of the busiest airports in the world, places significant demand on high-performance arresting systems to enhance runway safety. The country’s stringent aviation safety regulations and investments in airport infrastructure further bolster the demand for AAS. Other regional players include Malaysia and Indonesia, where growing air traffic and modernizing airports align with similar safety requirements, contributing to the market’s regional prominence.

Market Segmentation

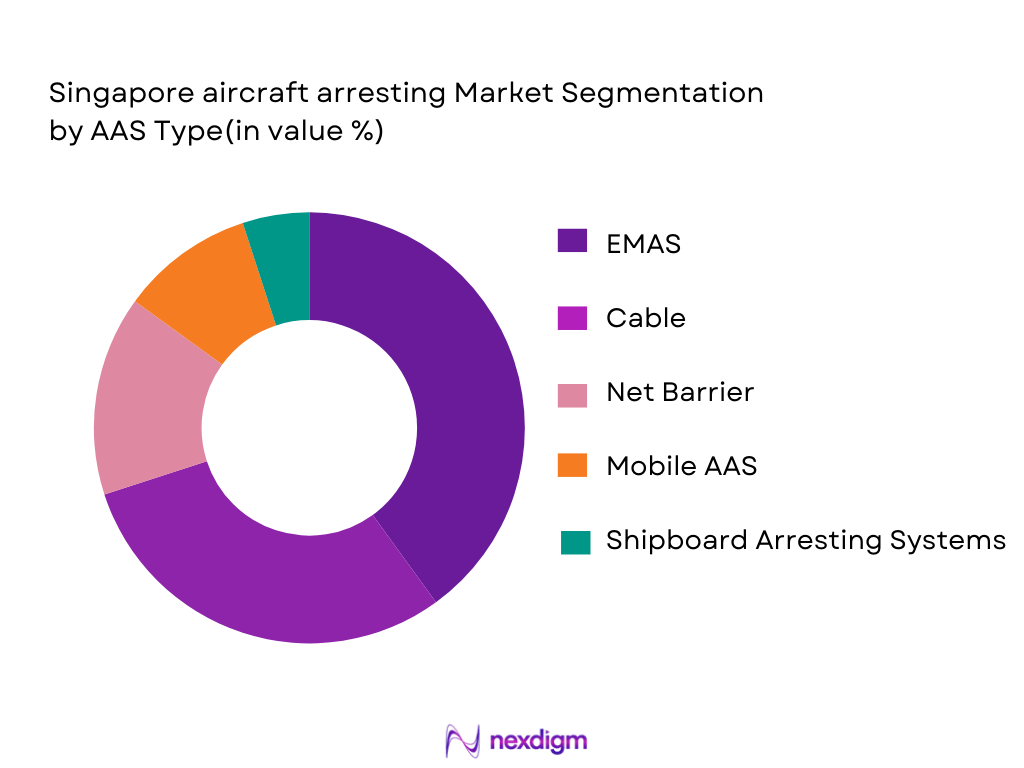

By AAS Type

The AAS market in Singapore is segmented by product types, including EMAS, cable, net barriers, mobile AAS, and shipboard arresting systems. Among these, the EMAS segment leads due to its widespread adoption in airports worldwide for its ability to absorb high levels of kinetic energy in minimal space, critical in preventing aircraft overrun incidents. The Cable system is also gaining traction due to its quick deployment capabilities, often used in military airbases.

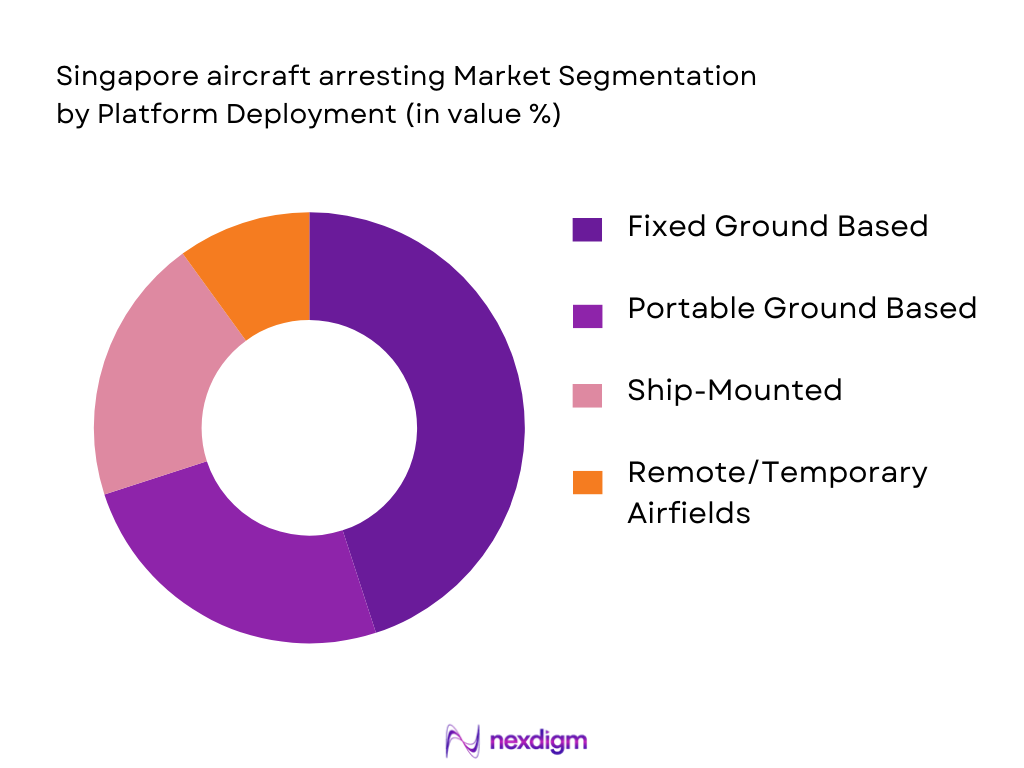

By Platform Deployment

AAS in Singapore is used across different platform types, including fixed ground-based systems, portable ground-based systems, ship-mounted systems, and remote/temporary airfields. Fixed ground-based systems dominate due to their application in major international airports, including Changi, which requires permanent and highly reliable arresting solutions.

Competitive Landscape

The Singapore Aircraft Arresting System market is characterized by significant competition among global and regional players. The key competitors include global brands that specialize in providing advanced safety solutions for airports and military airbases. Local providers are also gaining traction by offering more tailored solutions for Singapore’s specific needs. The consolidation of the market is driven by technological advancements, especially in EMAS and electromagnetic systems, along with growing collaboration between government and private players for defense and airport safety solutions.

| Company | Established Year | Headquarters | Technology Maturity | Market Presence | Product Portfolio | R&D Investment |

| Safran Arresting Systems | 2014 | France | ~ | ~ | ~ | ~ |

| General Electric | 1892 | USA | ~ | ~ | ~ | ~ |

| WireCo WorldGroup | 1960 | USA | ~ | ~ | ~ | ~ |

| RunwaySafe | 2015 | Sweden | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | France | ~ | ~ | ~ | ~ |

Singapore Aircraft Arresting System Market Analysis

Growth Drivers

Urbanization

Singapore’s urban population accounted for approximately ~ % of its total population, reflecting a highly urbanized economy where infrastructure development is continuous and intense. Urbanization data from the World Bank confirms Singapore’s urban population share remains near complete, supporting large‑scale investments in aviation infrastructure including airport safety systems. This high degree of urbanization correlates with increasing passenger throughput at Changi Airport, where ~ million passenger movements occurred, an increase of over ~% compared to the prior year, indicating sustained urban mobility and demand for aviation services. Such dense and growing urban environments intensify runway utilization and emphasize the need for robust aircraft arresting systems to manage operational traffic in limited space. Enhancements in arresting system deployment ensure optimized runway safety under conditions of high flight frequency, which is a direct outcome of dense urban demand for air travel. The number of ~ aircraft movements recorded at Changi further demonstrates this intensive usage. These figures highlight how Singapore’s near‑total urban population concentration drives airport operations and supports the need for advanced aircraft arresting system technologies to uphold safety and operational efficiency.

Industrialization

Singapore’s aviation and aerospace sectors are integral to its industrial ecosystem, supported by strong national GDP and trade performance. In 2024, Singapore’s GDP reached USD ~ billion, with a GDP per capita of USD ~ , signaling robust economic capacity to invest in technologically advanced infrastructure and aviation safety systems. The aviation sector itself significantly contributes to the economy; ~ individuals are employed directly in aviation, generating USD ~ billion in economic output, which represents ~ % of Singapore’s total GDP. Additional value from the aviation supply chain contributes up to USD ~ billion in GDP through indirect channels including tourism and logistics. Singapore’s industrial strategy emphasizes high‑value sectors such as aviation safety technologies, which aligns with investments in aircraft arresting systems that prevent runway overruns and maintain operational continuity. These systems support industrialization by enabling modern airfield operations that serve as gateways for import‑export, business travel, and logistics flows critical to Singapore’s economy. The high level of industrial output and capacity for advanced system integration reinforces Singapore’s position as a regional hub for aerospace and airport safety equipment deployment, underpinning growth in aircraft arresting system adoption.

Restraints

High Initial Costs

One notable restraint for the Singapore Aircraft Arresting System market is the high upfront capital expenditure associated with procurement and installation. Advanced arresting systems – particularly engineered materials arresting systems (EMAS), electromagnetic arresting gear, and sensor‑integrated platforms – require substantial upfront investment of specialized materials, engineering design, and runway integration resources. Although global market estimates place the total aircraft arresting system market value near USD ~ million in 2024, the majority of this expenditure is concentrated in high‑cost regions with intensive infrastructure standards similar to Singapore’s. These specialized systems demand custom engineering, compliance with stringent aviation safety requirements, and certification processes that require significant budget allocation from both civil and military stakeholders. Singapore’s aviation sector is characterized by state‑of‑the‑art standards at major facilities such as Changi Airport, which handled ~ million passengers and ~ aircraft movements in 2024, highlighting intense use pressure for infrastructure reliability. However, high initial investment requirements can delay retrofits or upgrades of existing systems if prioritized against other capital needs like terminal expansion, runway extensions, or digital air traffic control technologies. This means that while safety priorities are essential, budgetary constraints within capital planning cycles can restrain the pace of aircraft arresting system deployment, particularly for smaller operators or secondary airfields with limited funding capabilities.

Technical Challenges

Technical complexity represents a key restraint for the Singapore Aircraft Arresting System market as systems must integrate with high‑precision airport operations and meet strict safety regulations. Arresting systems such as EMAS beds or electromagnetic gear require sophisticated calibration to ensure consistent performance across varied aircraft weights and landing speeds. These technical requirements include compatibility with advanced sensor technologies, real‑time monitoring systems, and robust fail‑safe operations for preventing runway overrun incidents. Singapore’s aviation layout – exemplified by ~ million passengers and nearly ~ million tonnes of airfreight throughput at Changi Airport – highlights the complexity inherent in integrating new systems within active runways. Such complexity can lead to extended commissioning phases and require multi‑disciplinary engineering teams to align system specifications with airport operational schedules, thereby increasing project lead times and specialized workforce reliance. Additionally, variability in aircraft types and landing gear configurations at major hubs poses calibration and reliability challenges for arresting systems. This technical intricacy demands thorough testing, ongoing maintenance frameworks, and continuous innovation to align with aviation safety norms, which can constrain the speed of technology deployment across the market.

Opportunities

Technological Advancements

The Singapore Aircraft Arresting System market stands to benefit significantly from ongoing advancements in arresting technology and safety automation. With global emphasis on airport safety and precision operations increasing, innovative solutions such as IoT‑enabled arresting systems, AI‑based predictive maintenance tools, and materials engineered for higher kinetic energy absorption are becoming more accessible. Recent industry reports indicate that the global aircraft arresting system market had broad adoption of cable and advanced arresting mechanisms, reflecting technological diversification. The expansion of smart systems that incorporate sensor networks to continuously monitor performance improves uptime and reduces unplanned maintenance, aligning with Singapore’s aviation excellence standards. Singapore’s high internet penetration (~ % of population using the internet according to World Bank data) supports deployment of digitally connected systems for real‑time diagnostics and performance analytics, leading to increased operational reliability and predictive failure prevention. This creates opportunities for suppliers to integrate digital solutions that enhance safety performance while offering airport operators enhanced metrics for runway risk reduction. Furthermore, emerging lightweight composite materials can improve system responsiveness without significantly increasing structural burden on runways, expanding the usability of arresting systems to diverse operational environments including smaller airfields and military installations.

International Collaborations

Strategic international partnerships present a strong opportunity for the Singapore Aircraft Arresting System market. Singapore’s aviation sector is deeply interconnected with global aviation networks, as evidenced by Changi Airport’s ranking among the world’s busiest international airports with ~ reported international passengers in 2024, as per global airport rankings. These strong international linkages support knowledge exchange, technology transfer, and collaborative research with advanced aviation safety solution providers from around the world. Collaborative ventures can promote localized research & development centers, enhance workforce training in sophisticated arresting system maintenance, and attract global OEMs to participate in Singapore’s airport modernization projects. Singapore’s central geographic position in Southeast Asia also makes it a strategic gateway for distributing advanced arresting system technologies across the ASEAN region, fostering hub‑based logistics partnerships with neighboring countries such as Malaysia and Indonesia, where airport expansions continue. Aligning with global safety standard bodies and jointly developing best‑practice guidelines for system interoperability can further strengthen Singapore’s role as a testbed for next‑gen arresting solutions.

Future Outlook

Over the next five years, the Singapore Aircraft Arresting System market is expected to experience robust growth. This growth will be driven by government regulations, increasing airport modernization projects, and rising aviation traffic. Technological innovations, especially in electromagnetic and smart systems, will play a pivotal role in shaping the future of arresting systems. A heightened focus on runway safety and emergency management will further enhance the demand for advanced arresting gear across commercial airports and military airbases.

Major Players in the Market

- Safran Arresting Systems

- General Electric

- WireCo WorldGroup

- RunwaySafe

- Zodiac Aerospace

- General Atomics

- Aries Test Systems & Instrumentation

- Hensoldt AG

- Raytheon Technologies

- Honeywell Aerospace

- Thales Group

- Leonardo S.p.A.

- Cargill

- Atech Inc.

- Curtiss-Wright Corp.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore, Ministry of Defense – Singapore)

- Military and Airforce Procurement Departments

- Airport Authorities and Operators

- Civil Aviation Equipment Manufacturers

- Aviation Infrastructure Developers

- OEMs of Aircraft Arresting Systems

- Airport Safety & Operations Managers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire ecosystem of the Singapore Aircraft Arresting System market, identifying critical players and relevant safety standards. Secondary data and market reports will be employed to understand key trends affecting the market. We aim to focus on systems integration, procurement patterns, and demand-supply analysis across various platforms.

Step 2: Market Analysis and Construction

This phase involves collecting historical data, examining current usage patterns, and analyzing operational demands. Key segments, including product types, regions, and end-users, will be examined for growth potential. Our analysis includes insights from airports, military, and defense sectors to create a holistic market estimate.

Step 3: Hypothesis Validation and Expert Consultation

We will consult industry experts from various segments such as airport authorities, defense ministries, and AAS manufacturers to validate our hypotheses. The insights gathered will allow us to refine and adjust our estimates for market growth, trends, and technological innovations.

Step 4: Research Synthesis and Final Output

Following consultation, we will synthesize the data, incorporating the insights into a final report. Primary research, particularly interviews with stakeholders, will provide the basis for refining data and creating actionable conclusions for businesses looking to expand in this market.

- Executive Summary

- Research Methodology (Market Definitions & Singapore AAS Scope, Abbreviations (AAS, EMAS, MAAS, ARR, ARPI), Singapore Market Sizing Logic (Value & Volume), Primary & Secondary Data Sources, Qualitative & Quantitative Integration Method, In‑Country Industry Interviews & Validation, Data Integrity, Limitations & Risk Controls )

- AAS Functionality & Safety Imperatives

- Singapore Market Context & Aviation Infrastructure

- Global Benchmarking (AAS Sizing Model)

- Market Genesis, Evolution & Adoption Path

- Historical Deployment Trends

- Operational Use in Singapore Airbases & Airport

- Growth Drivers

National Aviation Safety Mandates (Runway Safety Index)

Higher Military Readiness & Base Modernization

Civil Aviation Growth & Overrun Incident Reduction Mandates

Technology Adoption (AI‑enabled predictive maintenance) - Market Challenges

Installation Footprint & Airport Real Estate Constraints

High CapEx and Lifecycle Maintenance Costs

Integration Complexity with Legacy Airfield Systems - Market Opportunities

Next‑Gen EMAS Deployment at Regional Airports

Digital Maintenance & IoT Systems for Performance Uptime

Singapore as AAS Integration Hub for ASEAN - Market Trends

Shift to Electromagnetic & AAG Systems

Modular Portable Deployments in Military Exercises

Localized Service & Support Ecosystem

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By AAS Type (In Value %)

EMAS (Engineered Materials Arresting System)

Cable

Net Barrier

Mobile AAS

Shipboard Arresting Systems

- By Platform Deployment (In Value %)

Fixed Ground Based

Portable Ground Based

Ship‑Mounted

Remote/Temporary Airfields

- By End User (In Value %)

Military Airbase

Commercial Airports

Naval Carriers

Regional Civil Operators

- By System Type (In Value %)

Advanced Arresting Gear (AAG)

Traditional Hydraulic

Electromagnetic

Sensor Integrated Smart Arresting

Predictive Analytics Score

IoT‑Enabled Systems

Operational Uptime Index

Legacy Mechanical Systems

- Market Share — Singapore & Regional

- Cross‑Comparison Parameters (Arresting System Product Portfolio (Coverage Score), Technology Maturity & R&D Intensity, Reliability Uptime & Mean Time Between Failures, Local Support & Aftermarket Penetration, Compliance & Safety Certification Levels, Installation & Integration Capabilities, Price Competitiveness (Total Cost of Ownership), Strategic Partnerships & Defense Contracts )

- SWOT Analysis of Major Competitors

- Pricing & Total Cost Benchmarking by SKU & Configuration

- Detailed Company Profiles

Atech Inc. (Cable & Portable Systems)

Curtiss‑Wright Corp. (Integrated Fixed & Ship Systems)

General Atomics (Advanced Arresting Gear Systems)

Escribano Mechanical & Engineering S.L. (Heavy Duty Systems)

Foster‑Miller, Inc. (EMAS Innovation)

Scama AB (Net Barrier Systems)

WireCo WorldGroup (High‑Strength Cable Systems)

Victorian Balata Belting Co. (Energy Absorption Materials)

Aries Test Systems & Instrumentation (Test & Compliance Tools)

RunwaySafe (Rapid Install EMAS)

Hensoldt AG (Sensor & Smart System Integrations)

Thales Group (System Automation & Analytics)

Honeywell Aerospace (Avionics & Integrated Safety Platforms)

Raytheon Technologies (Defense & Naval Systems)

Safran Arresting Systems Division (Aircraft Carrier AAS)

- Demand Quantification by Segment

- Military Airbases (Runway Safety & Quick Reaction Capability)

- Commercial Airports (Sustainability & Passenger Safety)

- Naval Application (Aviation Carrier Ops Index)

- Procurement Lifecycle Mapping

- Budget Allocations & Project Approval Timelines

- RFP to Award Cycle (Defense vs Civil)

- Pain Points, Buyer Needs & Decision Drivers

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035