Market Overview

The Singapore Aircraft Auxiliary Power Unit (APU) market is projected to grow significantly in the coming years, driven by increased air traffic and the growing demand for MRO (Maintenance, Repair, and Overhaul) services for aviation equipment. In 2024, the market is valued at approximately USD ~ million. The APU market in Singapore has gained prominence due to the country’s strategic position as a global aviation hub and its advanced aviation infrastructure. Growth drivers include rising passenger traffic, a growing fleet of aircraft, and the demand for efficient, energy-saving auxiliary power units, which offer increased operational efficiency and lower fuel consumption for airlines. Furthermore, innovations in electric and hybrid APUs are expected to propel the market further as aviation companies focus on reducing emissions and operating costs.

Singapore stands as a dominant player in the APU market, leveraging its highly developed aviation sector. The country has a robust fleet of commercial and military aircraft and is home to several major aerospace companies and MRO facilities, including Singapore Technologies Aerospace. The country’s dominance in the market can be attributed to its strategic location in Southeast Asia, facilitating strong air travel and cargo activity, which increases the demand for efficient APUs. Additionally, Singapore’s advanced regulatory standards and investment in aviation technologies, along with the establishment of major maintenance and repair facilities, make it a central hub for APUs in the Asia-Pacific region.

Market Segmentation

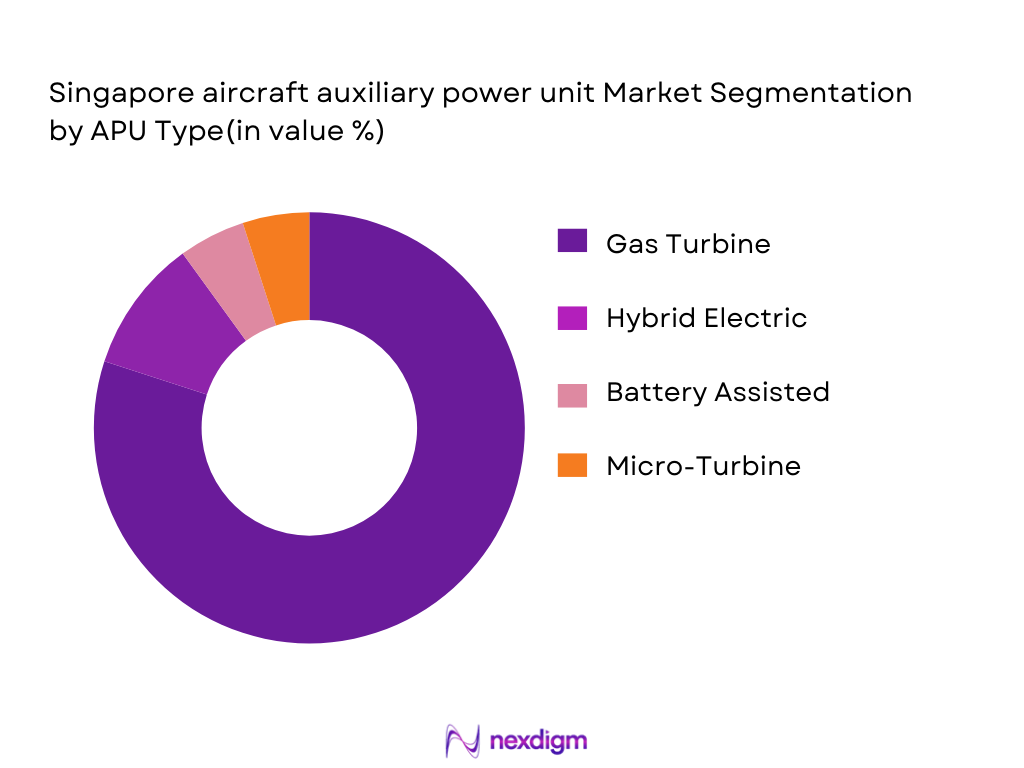

By APU Type

The Singapore Aircraft APU market is segmented by APU type into Gas Turbine, Hybrid Electric, Battery Assisted, and Micro-Turbine APUs. Gas turbine APUs have been dominating the market in Singapore due to their extensive use in commercial and military aircraft. Their proven reliability and ability to provide consistent power to aircraft systems, especially in larger, long-haul aircraft, make them the most widely adopted APU type in the region. While hybrid and electric APUs are emerging technologies aimed at reducing environmental impact and fuel consumption, their adoption is still in the nascent stage compared to traditional gas turbines, which remain the preferred choice.

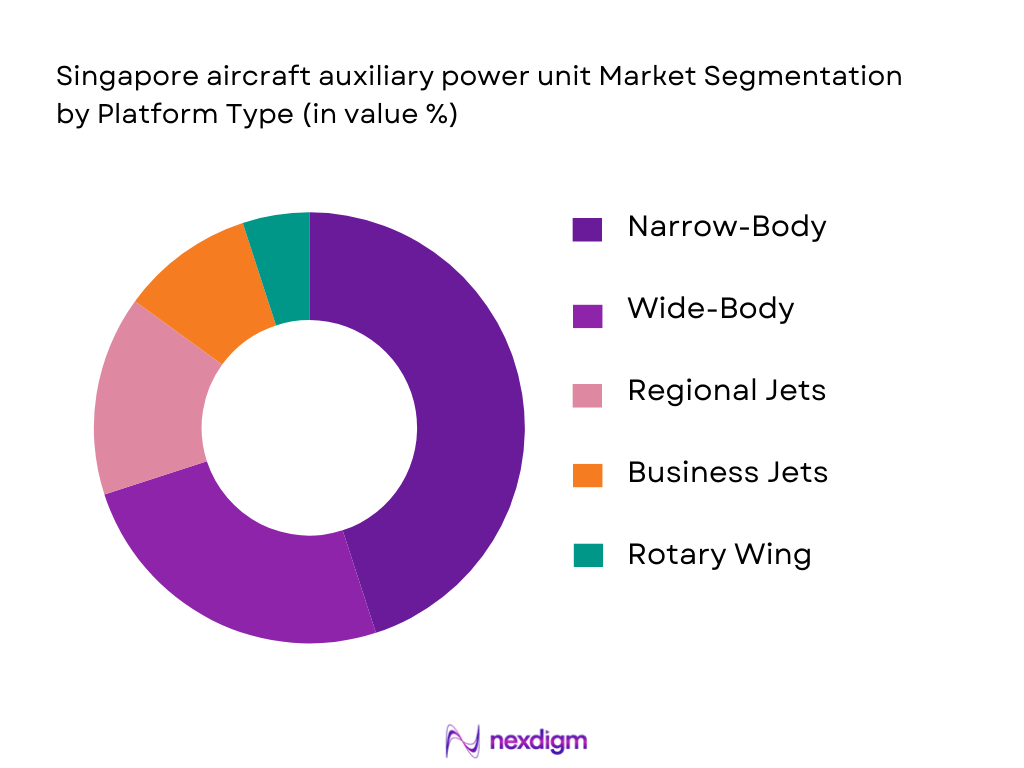

By Platform Type

The market segmentation by platform type includes narrow-body aircraft, wide-body aircraft, regional jets, business jets, and rotary wing aircraft. Narrow-body aircraft have the largest market share in Singapore due to the high volume of short and medium-haul flights operated within the region. The narrow-body aircraft segment benefits from the demand for frequent commercial flights and cost-effective operations, which require efficient auxiliary power systems. Wide-body aircraft, although fewer in number, require APUs to handle long-haul operations and high passenger capacity, contributing to a significant share in the market as well.

Competitive Landscape

The Singapore Aircraft APU market is highly competitive, with several global players competing to dominate the market. Major players include industry giants such as Honeywell Aerospace, Rolls-Royce, and Safran Power Units. These companies bring advanced technologies and a vast service network to meet the growing demand for APUs across commercial, military, and business aviation sectors. Singapore’s competitive advantage lies in its well-established aerospace sector, providing a fertile ground for these players to maintain their dominance in the region.

| Company | Establishment Year | Headquarters | Product Portfolio | Technological Capability | Market Share | Regional Footprint |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | United Kingdom | ~ | ~ | ~ | ~ |

| Safran Power Units | 2005 | France | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Germany | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1932 | United States | ~ | ~ | ~ | ~ |

Singapore Aircraft Auxiliary Power Unit (APU) Market Analysis

Growth Drivers

Urbanization

Singapore’s urban population reached approximately ~ rising from ~ a notable increase of ~ % year‑on‑year, reflecting continued densification of the city‑state. This high rate of urbanization, representing nearly ~ % of the population living in urban areas under UN estimates, supports sustained growth in aviation demand through expanded passenger and cargo throughput. Urbanization elevates domestic and international travel requirements, directly increasing aircraft movements — including take‑offs, landings, and ground operations where Auxiliary Power Units (APUs) are essential. APU usage grows in tandem with increased flight rotations and airport throughput.

Industrialization

Singapore’s economy is heavily industrialized with a significant services and aerospace component. In 2024, national GDP reached USD ~ billion with a GDP per capita of USD ~, reflecting high productivity and strong economic activity. This industrial capacity supports advanced MRO (Maintenance, Repair & Overhaul) infrastructure and aerospace manufacturing capabilities, critical for servicing APUs and related aircraft systems. High industrial output correlates with expanded aerospace facilities, logistics operations, and technical workforce availability — enhancing Singapore’s appeal as a regional hub for APU maintenance and deployment. The growth in flight activity and cargo handling at Changi, which served over ~ million passengers in 2024, underscores the demand for robust industrial aviation support services including APU operations.

Restraints

High Initial Costs

Advanced Aircraft Auxiliary Power Units, especially modern hybrid or emissions‑compliant models, involve significant upfront capital investment that can restrict adoption within airline fleets and MRO providers. Although macroeconomic data do not directly price APUs, the GDP per capita of USD ~ and Singapore’s advanced technological cost environment indicate a high baseline cost of industrial equipment acquisition and skilled labor. High initial expenses in aerospace equipment procurement, infrastructure upgrades, and certification processes can slow down the replacement and modernization cycle for APUs, particularly for smaller operators balancing aircraft costs. This capital intensity is compounded by Singapore’s high cost of living and operating environment, which is one of the most expensive globally for industrial space and technical services.

Technical Challenges

Deploying next‑generation APU technologies — including hybrid and microturbine systems — requires technical expertise and regulatory approvals, which can constrain rapid adoption. Singapore’s aviation standards are among the strictest globally, requiring extensive validation for new aerospace systems. The Civil Aviation Authority of Singapore’s detailed certification regime mandates rigorous testing, documentation, and compliance before advanced APU systems can be widely deployed, particularly where electrical integration with aircraft systems is concerned. While Changi Airport reported ~ aircraft movements in 2024, an increase, this volume also places higher demands on technical capabilities in maintenance operations that may not always be readily scalable without targeted investments in specialized workforce training and certification processes.

Opportunities

Technological Advancements

Advances in aviation power systems, including electric and hybrid APU technologies, present a key opportunity for Singapore’s aerospace market. While Singapore does not yet produce comprehensive national data on APU tech adoption, the country’s high GDP per capita and advanced industrial ecosystem enable investment in research and cutting‑edge aerospace technologies. Singapore’s aviation sector is positioned to benefit from modern predictive maintenance tools, IoT‑enabled performance monitoring systems, and electrified power units that reduce fuel burn during ground operations — critical given Changi Airport’s ~ million passenger movements and over ~ million tonnes of cargo processed in 2024. As airlines and MRO providers seek to minimize operational downtime and extend component lifespans, technological APU advances offer tangible lifecycle improvements.

International Collaborations

Singapore’s strategic position as a global aviation hub facilitating connections to over ~ cities worldwide with more than ~ weekly flights enhance opportunities for foreign partnerships in aerospace systems and APU services. Such international collaborations — between Singapore‑based aerospace firms and global companies — enable knowledge transfer, co‑development of advanced APU technologies, and stronger integration into global supply chains for aircraft components and support services. These partnerships also leverage Changi’s status as one of the busiest international airports by passenger traffic, providing a platform for operational pilots, field trials, and service validation across diverse aircraft types. International collaboration further aligns with Singapore’s broader economic development strategies, expanding industrial competencies and workforce skills in high‑value aerospace sectors.

Future Outlook

Over the next five years, the Singapore Aircraft APU market is expected to witness steady growth, driven by advancements in aviation technologies and the increasing emphasis on sustainability. The rising demand for fuel-efficient and environmentally friendly APUs, coupled with ongoing developments in hybrid and electric APU systems, will contribute significantly to the market’s expansion. Furthermore, as the aviation industry recovers from the impacts of the global pandemic, the need for efficient and reliable APUs will increase, reinforcing the market’s long-term growth trajectory.

Major Players in the Market

- Honeywell Aerospace

- Rolls-Royce

- Safran Power Units

- MTU Aero Engines

- Collins Aerospace

- United Technologies Corporation (UTC)

- General Electric (GE) Aviation

- Pratt & Whitney

- IAE (International Aero Engines)

- Liebherr Aerospace

- Lufthansa Technik

- Aviall Services, Inc.

- AAR Corporation

- Satair Group

- Singapore Aerospace Manufacturing

Key Target Audience

- Airline Fleet Operators (Singapore Airlines, Scoot, AirAsia)

- Aircraft OEMs (Boeing, Airbus, Embraer, Bombardier)

- MRO Service Providers (Singapore Technologies Aerospace, Lufthansa Technik)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore, Ministry of Transport)

- Aviation Maintenance Contractors

- Aircraft Leasing Companies

- Military Aviation Authorities (Singapore Armed Forces, Ministry of Defence)

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying all major stakeholders in the Singapore Aircraft APU market. This is done through comprehensive desk research, utilizing secondary and proprietary data sources, including regulatory bodies, industry reports, and OEM databases.

Step 2: Market Analysis and Construction

Historical market data and current trends are analyzed to understand the market dynamics. This includes assessing the market penetration of APUs, segment contributions, and evaluating the financial performance of key players in the market.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market hypotheses through expert consultations with industry leaders, OEMs, and MRO service providers, using both structured interviews and computer-assisted telephone interviews (CATIs).

Step 4: Research Synthesis and Final Output

The final step includes synthesizing all gathered data and insights to generate a comprehensive, validated report on the Singapore Aircraft APU market. Interviews with key market players will further validate the information, ensuring a high level of accuracy.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions (APU Classification, Component Boundaries), Data Sources & Validation Framework (Singapore ANSP, CAAS, OEM Returns), Sizing Approach (Bottom‑Up: Installed APU Base MRO Spend), Top‑Down Forecast Calibration (Regional APAC Demand vs. Singapore Share), Primary Research Protocol (Expert Panels, Airline Fleet Directors, MRO Heads), Limitations & Sensitivity Checks)

- Role of APUs in Modern Aircraft (Ground Power, Pneumatic & Electrical Supply)

- Singapore as an APU Ecosystem Node (Hub Status: MRO, Overhaul, Test Beds)

- APU Value Chain & Supply Chain Analysis (Tier 1 Components, Aftermarket Services)

- Technology Adoption Map (Gas Turbine, Hybrid‑Electric APU Systems)

- Regulatory & Certification Landscape (CAAS APU Standards, Environmental Compliance)

- Singapore Market Business Cycle & Seasonal Demand Patterns

- Growth Drivers

Rise in Singapore Aircraft Movements & Fleet Base

Expansion of APU MRO Clusters (e.g., Seletar Park)

Adoption of Predictive Maintenance & AI‑Assisted Prognostics

- Market Restraints

High OEM Certification & Compliance Costs

Fleet Modernization Shifts & APU Replacement Lag

- Opportunities

Growth in Hybrid & Electrified APU Systems

APU Leasing & Pooling Models

Service Outsourcing Trends

- Market Trends

Predictive Analytics & Digital Twin Adoption

Fuel Efficiency & Emissions Reduction Initiatives

Component Modularization

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Platform Type (In Value %)

Narrow‑Body

Wide‑Body

Regional Jets

Business Jets

Rotary Wing

- By APU Type (In Value %)

Gas Turbine

Hybrid Electric

Battery Assisted

Micro‑Turbine

- By APU Application (In Value %)

Commercial Aviation

Military Aviation

Corporate Aviation

Unmanned Platforms

- By Deployment Channel (In Value %)

OEM Direct

Aftermarket OEM Service Centers

Independent MRO

APU Leasing

- By Service Model (In Value %)

On‑Wing Support

Line Maintenance

Deep Overhaul

Component Exchange

- Singapore APU Market Share – Top Competitors (Value & Units)

- Cross‑Comparison Parameters (Company Overview, Product / APU Platform Portfolio, Service Coverage (Global/Regional Footprint), Installed Base & Type Approvals, Revenue & Market Contributions, Service Network Density (Points of Presence), Technology Leadership & Patent Portfolios, Strategic Partnerships & MRO Alliances

- Competitor SWOT Analysis

- Cost & Pricing Benchmark – APO Units & MRO Labor

- Detailed Profiles of Major APU Market Players

Honeywell Aerospace

Pratt & Whitney (RTX)

Safran Power Units

Rolls‑Royce Holdings

MTU Aero Engines

Collins Aerospace

Boeing APU Systems

PBS Group

Elbit Systems

IAE (International Aero Engines)

Liebherr‑International

UTC Aerospace Systems

GE Aviation APU Units

APU Leasing & Exchange Consortium Asia

Singapore APU Services & MRO Ltd.

- Demand Forecast by Operator Type (LCCs, Flag Carriers, MROs)

- Procurement Cycles & Budget Allocation

- Pain‑Point Mapping (Lifecycle Costs, Uptime Targets)

- End‑User Decision Funnel (Fleet & Service Considerations)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035