Market Overview

The Singapore Aircraft Braking Systems market is valued at USD ~ million in 2024, driven by robust demand for advanced braking systems from both commercial and military aviation sectors. The market growth is propelled by the continuous advancement in aircraft braking technologies, particularly the increasing adoption of carbon brake systems and the growing trend of lightweight, eco-friendly materials. The aerospace sector’s push for more efficient and high-performance braking systems that support longer aircraft life and better fuel efficiency has further amplified market growth.

Singapore is one of the dominant countries in the Asia-Pacific region for aircraft braking systems due to its strategic position as a key aviation hub. The country’s well-developed aerospace industry, supported by significant infrastructure investments, such as Changi Airport, has cemented its status as a leader in aviation. Additionally, the presence of major aerospace manufacturers and a focus on research and development (R&D) have made Singapore a prime location for the growth of the aircraft braking systems market, further boosted by its highly efficient supply chain and regulatory support.

Market Segmentation

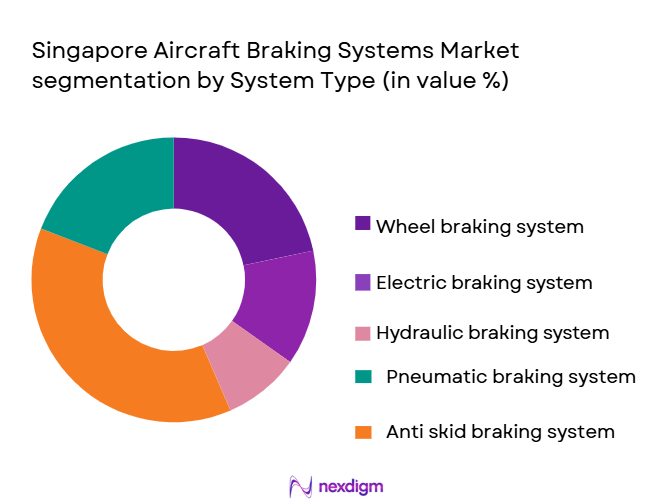

By System Type

The Singapore Aircraft Braking Systems market is segmented by system type into carbon brake systems, steel brake systems, electronic braking systems, anti-lock braking systems (ABS), and brake-by-wire systems. Among these, carbon brake systems dominate the market share in 2024. This is primarily due to the increasing demand from commercial aircraft operators who prioritize fuel efficiency and lower operational costs. Carbon brakes offer superior performance in terms of heat dissipation and lightweight design, making them the preferred choice for larger, high-performance aircraft. The consistent growth in air travel and the corresponding increase in aircraft fleet sizes are further driving the demand for these advanced braking systems.

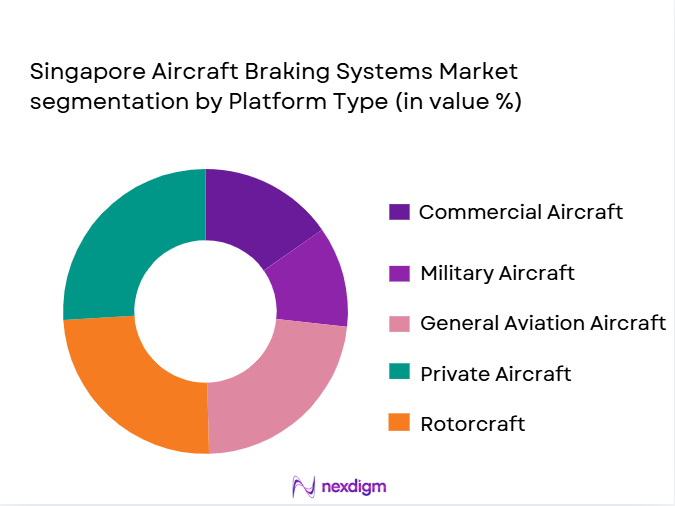

By Platform Type

The market is also segmented by platform type into commercial aircraft, military aircraft, regional aircraft, business jets, and unmanned aerial vehicles (UAVs). Commercial aircraft have the dominant share in 2024 due to the continued expansion of global passenger air traffic. The growth of low-cost carriers and the increasing number of flights are fueling demand for efficient braking systems for large commercial fleets. The trend toward higher fuel efficiency and reduced maintenance costs has further bolstered the demand for advanced braking solutions in commercial aircraft, with companies investing in next-gen braking systems to meet stringent safety and efficiency standards.

Competitive Landscape

The Singapore Aircraft Braking Systems market is dominated by a few key players that drive innovation and set industry standards. Companies like Honeywell Aerospace, Safran, and UTC Aerospace Systems lead the market with their advanced technologies and comprehensive service offerings. These firms have leveraged their technological expertise, global presence, and robust supply chain capabilities to capture a significant share of the market. The market landscape also includes smaller, specialized players who focus on niche solutions for specific aircraft segments.

| Company Name | Establishment Year | Headquarters | Technology Innovation | Market Reach | R&D Investment | Product Portfolio | Customer Base | Partnerships | Sustainability Efforts |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| UTC Aerospace Systems | 1934 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1949 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Braking Systems Market Dynamics

Growth Drivers

Growing demand for advanced braking systems in commercial aircraft

The demand for advanced braking systems in commercial aircraft is driven by the continuous expansion of the global aviation industry. In 2024, the International Air Transport Association (IATA) forecasts that global passenger traffic will reach ~ billion, an increase from ~ billion in 2023, reflecting a growing need for modern aircraft that require advanced braking systems. As commercial airlines are focusing on increasing operational efficiency and reducing downtime, braking systems that offer durability and high performance are essential. The rise in the number of new aircraft deliveries—expected to reach ~ units annually by 2026—further intensifies the demand for cutting-edge braking technology to ensure safety, reliability, and fuel efficiency.

Increasing focus on aircraft weight reduction to improve fuel efficiency

As part of global efforts to reduce carbon emissions and improve fuel efficiency, aircraft manufacturers and airlines are increasingly focusing on reducing the weight of their fleets. In 2024, the global aviation sector is expected to face increasing regulatory pressure from governments and environmental bodies to minimize its carbon footprint, with the International Civil Aviation Organization (ICAO) introducing stricter emission regulations. This trend drives the demand for lightweight aircraft components, including braking systems, which offer better fuel efficiency. For example, the weight reduction trend in aircraft design has led to the adoption of carbon brake systems, which provide significant weight savings compared to steel brakes, thereby improving fuel economy. In 2024, aviation fuel prices are expected to remain at higher levels, incentivizing airlines to invest in such lightweight technologies to reduce operational costs.

Market Challenges

High initial cost of advanced braking systems

The high upfront cost of advanced braking systems, particularly carbon brakes and electronic braking systems, remains a significant challenge for the aircraft braking systems market. While these systems offer long-term operational savings, the initial investment is substantial, especially for airlines operating on tight budgets. In 2024, the price of carbon brakes is projected to be higher than that of steel brakes, often exceeding USD ~ per aircraft. With the average fleet size of commercial airlines growing steadily (for example, the global commercial fleet is expected to exceed ~ by 2026), airlines must carefully evaluate the financial viability of such investments. Additionally, the integration of these advanced systems into existing fleets requires extensive modifications, further adding to the cost burden.

Complexities in system integration and maintenance

As aircraft systems become more complex, integrating advanced braking technologies into existing fleets becomes increasingly challenging. Electronic braking systems and carbon brake systems require sophisticated installation processes and training for maintenance crews. In 2024, the transition to new braking systems involves compatibility checks, integration of new sensors and electronics, and updating maintenance protocols, which can be costly and time-consuming. For example, retrofitting older aircraft with electronic braking systems can take up to several months, reducing aircraft availability and increasing maintenance costs. Moreover, maintaining these systems requires specialized knowledge and tools, which may not be readily available in all regions, thus hindering their widespread adoption in certain markets

Market Opportunities

Adoption of carbon brakes in commercial aircraft

The adoption of carbon brake systems in commercial aircraft presents a significant market opportunity due to their benefits in terms of weight reduction, improved performance, and cost-efficiency over the long term. In 2024, the aviation industry is focusing on increasing the adoption of carbon brakes in response to growing concerns about fuel efficiency and environmental sustainability. Carbon brakes offer weight reductions of up to ~% per aircraft compared to steel brakes, which translates into fuel savings. The global aviation industry, which is expected to operate more than ~ commercial aircraft by 2026, is increasingly investing in carbon brakes as part of their fleet modernization efforts. This shift is expected to continue as airlines seek to meet both fuel efficiency targets and environmental regulations.

Development of smart braking systems for military applications

The military aviation sector offers substantial opportunities for the development and adoption of smart braking systems, which can enhance the operational capabilities of military aircraft. In 2024, the global military aviation market is expected to reach USD ~ billion, with a portion of this investment dedicated to the modernization of military aircraft fleets. Smart braking systems offer features like automated diagnostics, predictive maintenance, and integration with other aircraft systems, providing enhanced safety and reliability for military operations. As defense budgets grow globally, particularly in regions like Asia-Pacific, there is a rising demand for technologically advanced military aircraft components, including braking systems that meet the rigorous performance standards required by military operations.

Future Outlook

Over the next 5 years, the Singapore Aircraft Braking Systems market is expected to experience moderate growth, driven by increasing demand for more efficient and sustainable braking solutions. This growth will be propelled by advancements in electronic and carbon braking technologies, the rising demand for military aircraft upgrades, and the overall expansion of global aviation. Government initiatives to promote sustainable aviation technologies, coupled with the growing emphasis on reducing aircraft weight for better fuel efficiency, will significantly contribute to the market’s growth trajectory.

Major Players

- Honeywell Aerospace

- Safran

- UTC Aerospace Systems

- Liebherr Aerospace

- Parker Hannifin

- Rockwell Collins

- Eaton Corporation

- Meggitt

- Collins Aerospace

- Goodrich Aerospace

- Sundaram Brake Linings

- Indian Aviation Enterprises

- Xerox Aerospace

- Regal Beloit Corporation

- Crane Aerospace & Electronics

Key Target Audience

- Aircraft Manufacturers

- Airlines and Fleet Operators

- Military Aviation Authorities (e.g., Ministry of Defence, Singapore)

- Maintenance, Repair & Overhaul (MRO) Providers

- Government and Regulatory Bodies (e.g., Civil Aviation Authority of Singapore)

- Investment and Venture Capitalist Firms

- Aerospace Component Suppliers

- Aircraft Parts Procurement Agencies

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map to identify key stakeholders such as manufacturers, suppliers, and regulatory bodies. Extensive desk research is conducted using secondary and proprietary data sources to define critical variables affecting the market.

Step 2: Market Analysis and Construction

In this phase, historical data for the Singapore Aircraft Braking Systems market is compiled and analyzed. This includes examining market penetration rates, supply-demand dynamics, and consumer preferences. The goal is to quantify the revenue impact of these variables and forecast future market growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through consultations with industry experts. These will include telephonic interviews and surveys with key market players, providing real-time insights into market conditions, challenges, and opportunities.

Step 4: Research Synthesis and Final Output

The final output will involve synthesizing data collected from various sources, including direct engagements with manufacturers, and comparing market trends and forecasts. This will ensure the accuracy and reliability of the final analysis, reflecting real-world dynamics in the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for advanced braking systems in commercial aircraft

Increasing focus on aircraft weight reduction to improve fuel efficiency

Advancements in electronic braking systems technology - Market Challenges

High initial cost of advanced braking systems

Complexities in system integration and maintenance

Regulatory challenges in different jurisdictions - Market Opportunities

Adoption of carbon brakes in commercial aircraft

Development of smart braking systems for military applications

Rising demand for lightweight materials in aircraft components - Trends

Emerging trend of electric and hybrid aircraft braking systems

Increased investment in R&D for next-generation braking technologies

Shift towards eco-friendly and sustainable braking materials

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Carbon Brake Systems

Steel Brake Systems

Electronic Braking Systems

Anti-lock Braking Systems (ABS)

Brake-by-wire Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Regional Aircraft

Business Jets

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Retrofit

Aftermarket

Upgrades

Custom Fitments - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

Maintenance Repair Organizations (MROs)

Military Aviation

Freight Carriers - By Procurement Channel (In Value%)

Direct Purchases from OEMs

Third-Party Distributors

Online Procurement Platforms

Bidding & Government Tenders

Service Agreements

- Market Share Analysis

- CrossComparison Parameters

(Technology, Product Quality, Cost Structure, Brand Presence, Service Network) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Boeing

Honeywell Aerospace

Safran

Liebherr Aerospace

UTC Aerospace Systems

Rockwell Collins

Parker Hannifin

Eaton Corporation

Meggitt

Collins Aerospace

Goodrich Aerospace

Sundaram Brake Linings

Indian Aviation Enterprises

Xerox Aerospace

Regal Beloit Corporation

- Airlines seeking improved operational efficiency and fuel savings

- Aircraft manufacturers focusing on lightweight and high-performance systems

- Military sectors investing in robust and reliable braking systems for tactical aircraft

- MROs focusing on cost-effective braking system maintenance solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035